how it works

Linking a loan to a paycheck is fast and easy

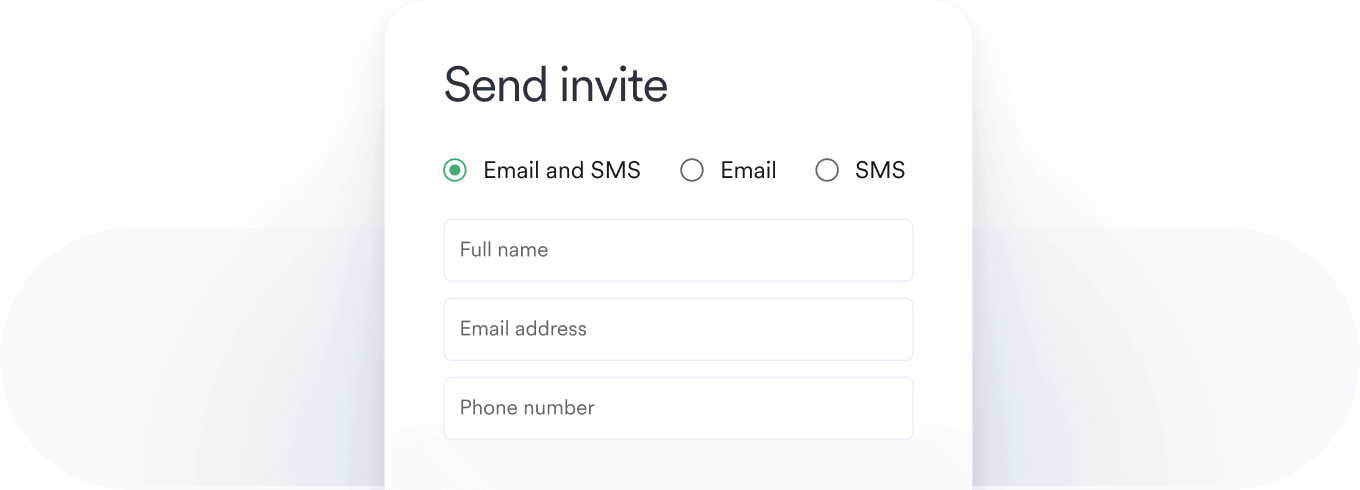

Argyle sends your borrower an invitation to connect.

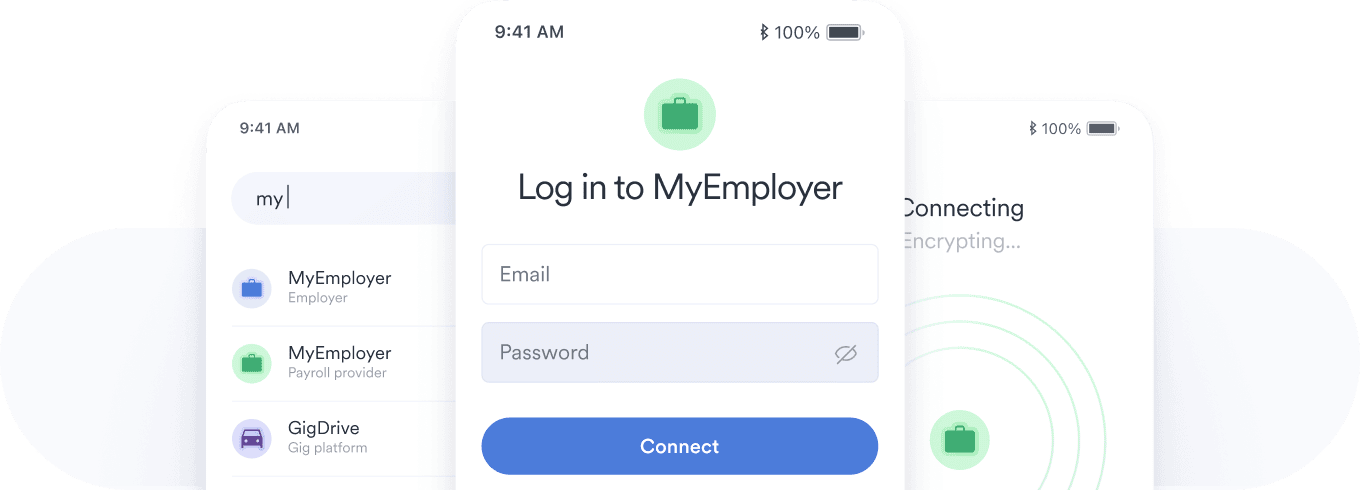

Your borrower completes a quick payroll connection flow.

Argyle establishes a direct link to their payroll records.

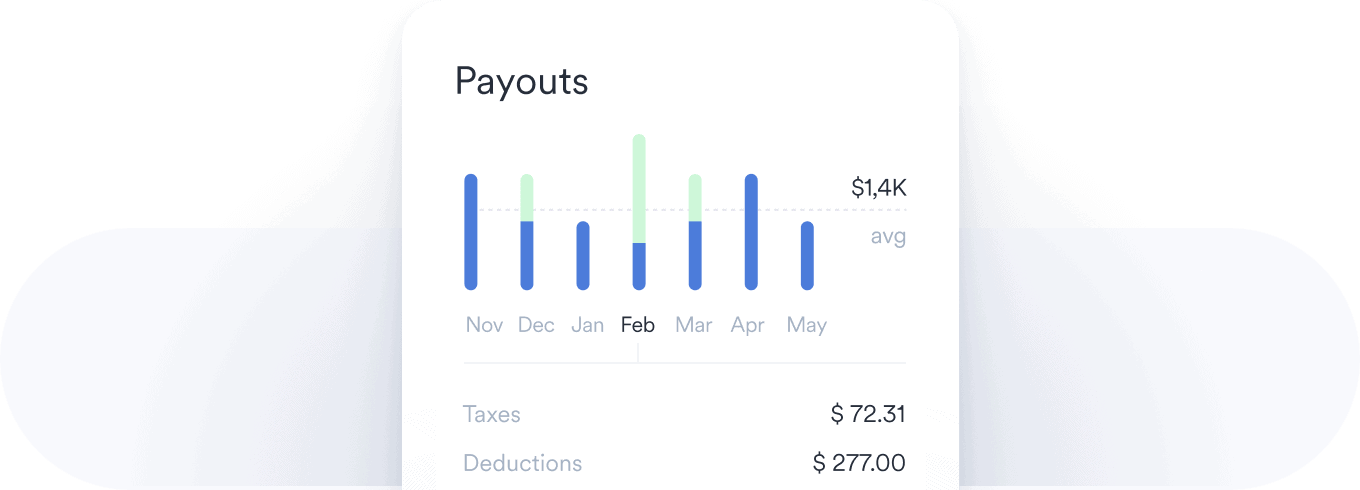

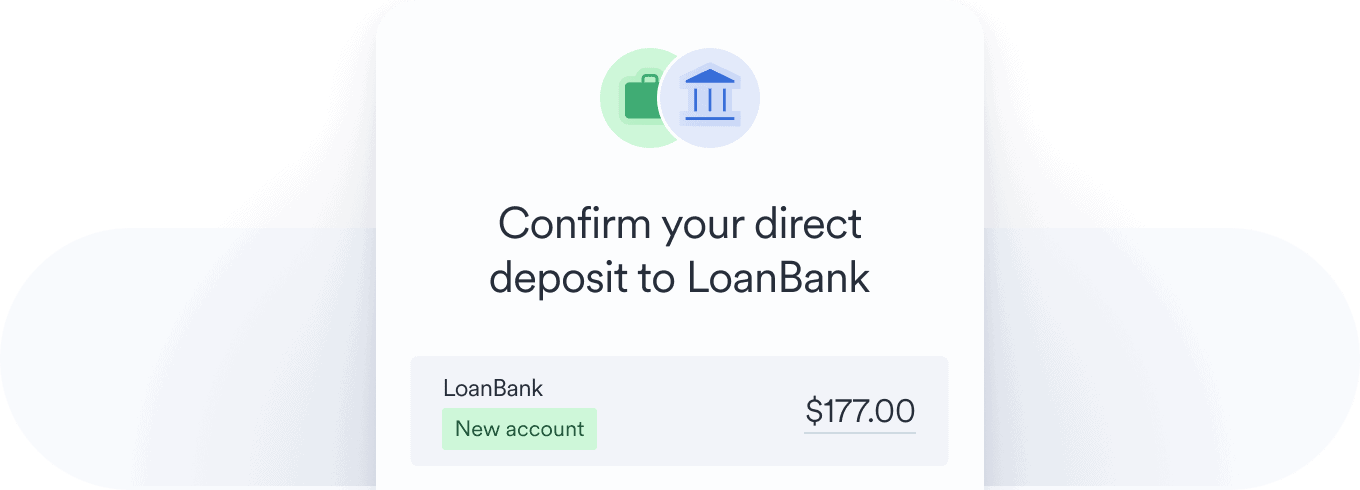

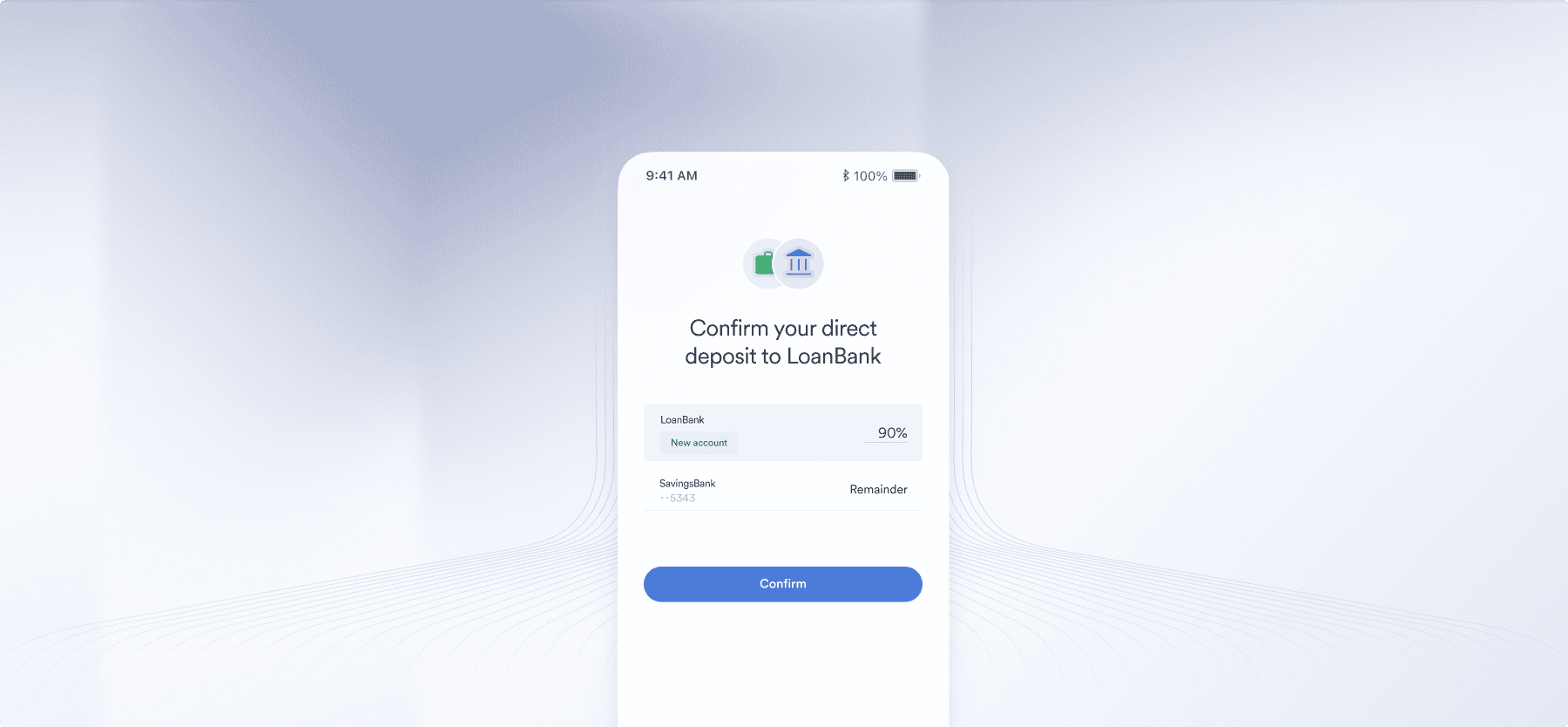

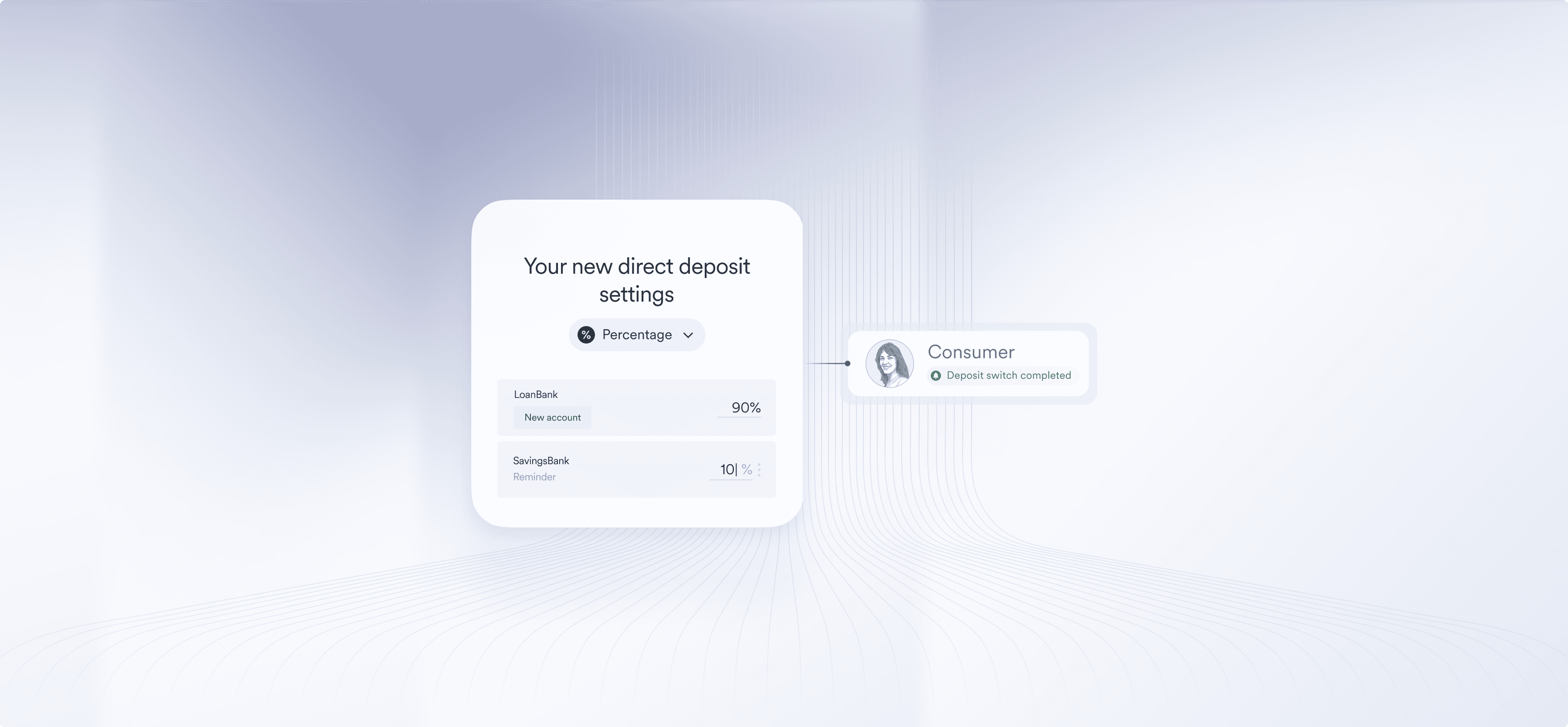

Your borrower allocates an amount or percent of their paycheck.

You are repaid predictably and alerted if anything changes.

benefits

Experience the benefits of

paycheck-linked lending

Argyle makes setting up a paycheck distribution a breeze.

Argyle helps ensure payments are made on time, de-risking your portfolio.

features

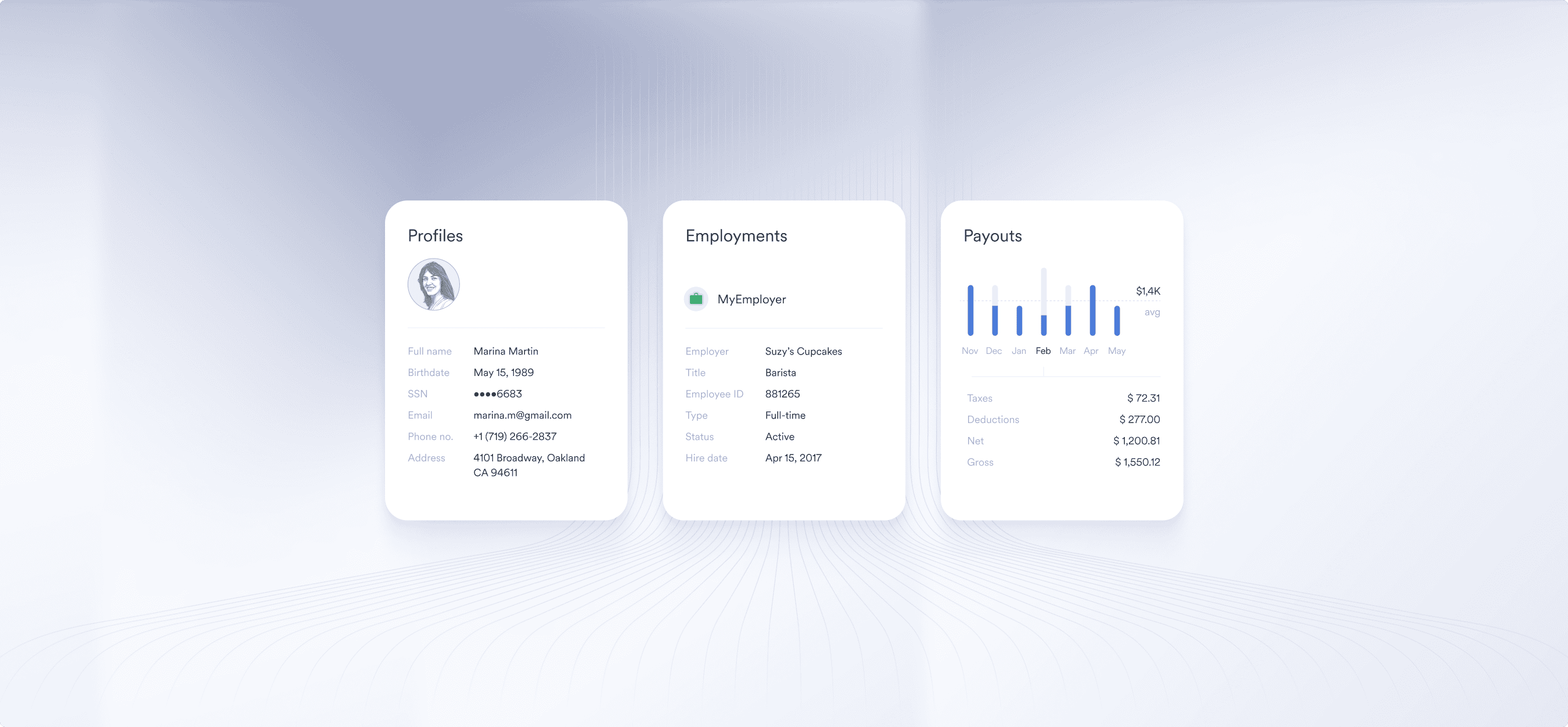

Leverage Argyle’s market-leading features

Borrowers can set up distributions as a percentage of their paycheck or a specific value.

Receive an alert when a borrower makes a change to their distribution.

Monitor borrowers’ income and employment status, so you can service loans appropriately.

why Argyle

Performance you can trust

Broader coverage

More conversions

Better outcomes

Answers to your frequently asked questions

What is paycheck-linked lending?

Paycheck-linked lending refers to the practice of securing loan repayment directly from a borrower’s paycheck. With paycheck-linked lending, payments for a loan are automatically withdrawn from the borrower’s paycheck on a regular basis. Compared to traditional ACH debits, paycheck-linked lending reduces the chance of delinquency and default.

INDUSTRY SOLUTIONS

Learn how peers in your

industry are using Argyle

Try our Paycheck-Linked Lending solution

We can get you started as soon as today. No commitment required.

Contact sales