Whether you’re buying your first home or starting your dream job, Argyle helps you easily share your income and employment data directly with lenders, insurers, background screeners, and other service providers—so you can quickly advance your application.

who is argyle

Argyle simplifies your

financial experiences

Argyle automates data sharing, so you never have to track down a paystub or fill out endless forms to verify your income and employment.

Log in to your payroll account, and instantly share data with the service providers you authorize, so they won’t need to contact you for updates.

You decide which accounts you share, which service providers you share them with, and for how long—and you can withdraw access at any time.

Argyle complies with the highest privacy and security standards, and we undergo regular, rigorous audits to ensure your data is safe.

why argyle

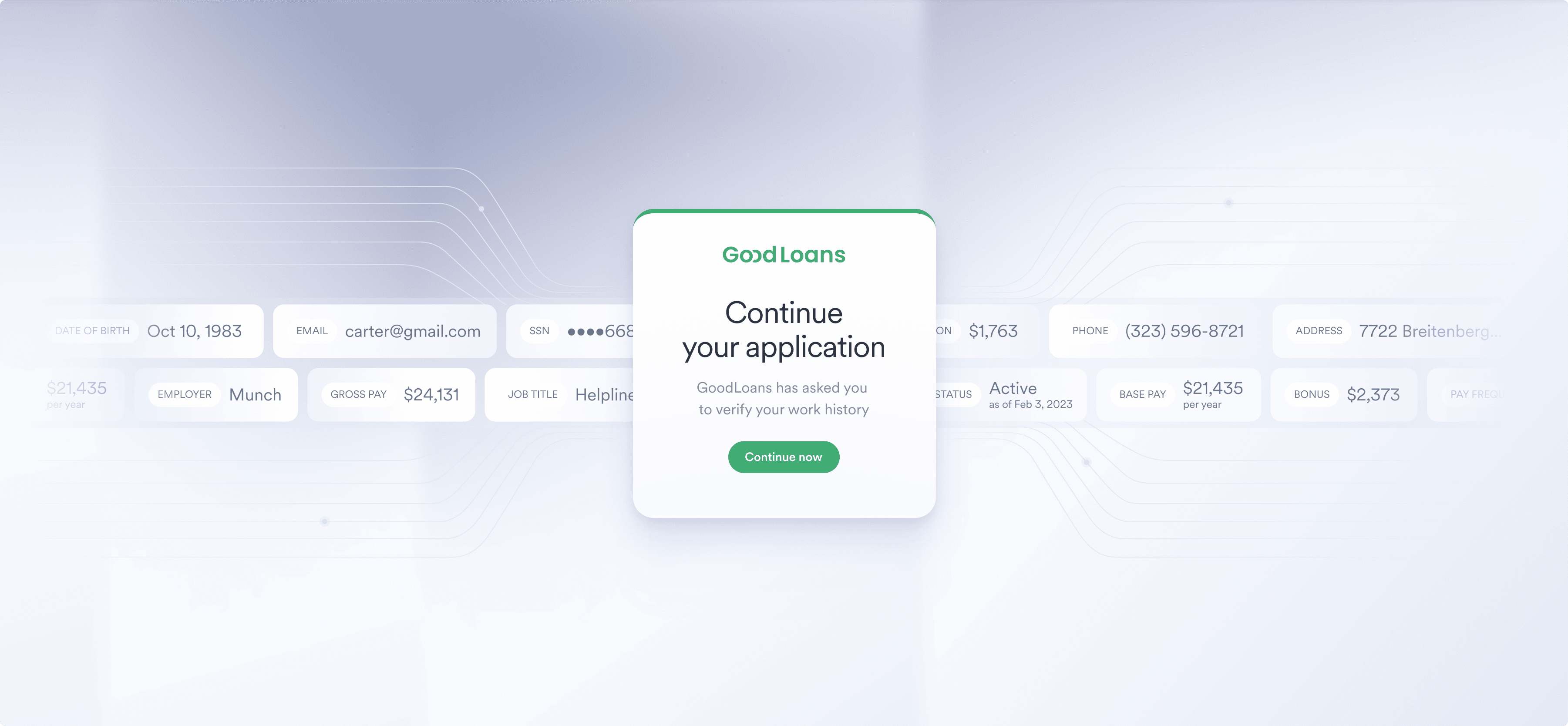

Faster, safer, and easier verifications with Argyle Passport

You do enough to earn your income. You shouldn’t have to jump through hoops to prove it.

Argyle serves as a trusted intermediary, helping you seamlessly share the income and employment data you’d be providing anyway.

Explore Argyle Passport

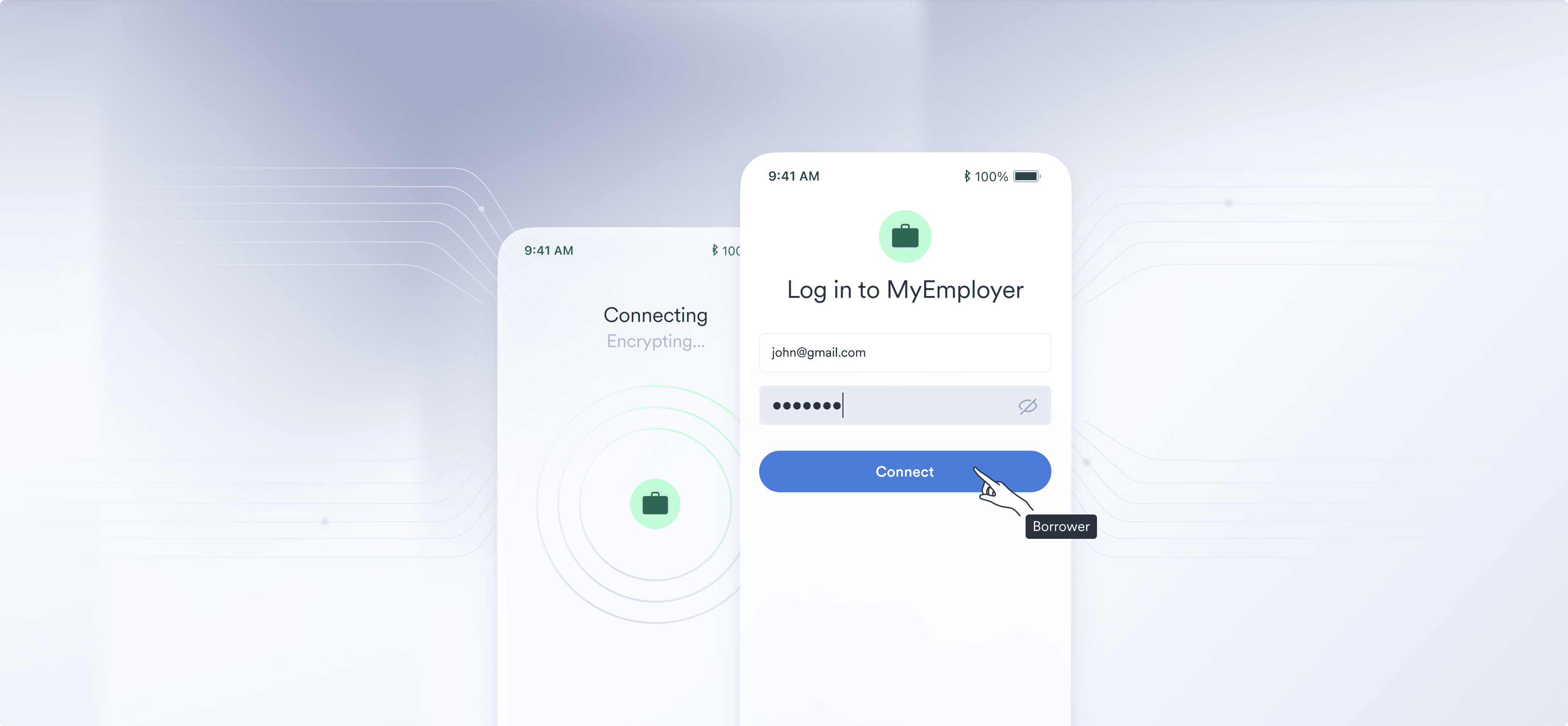

how it works

Connecting your employer or

payroll provider is fast and easy

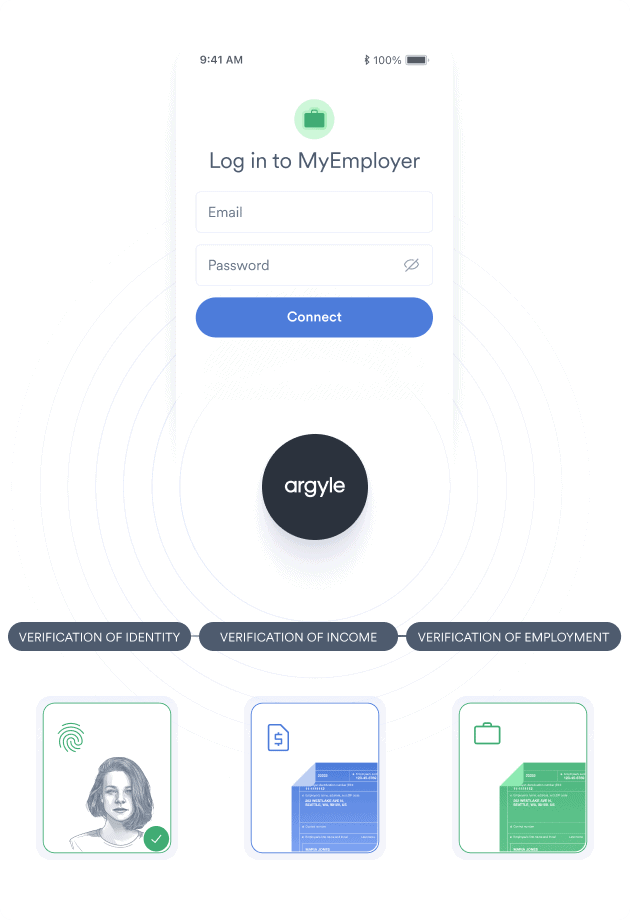

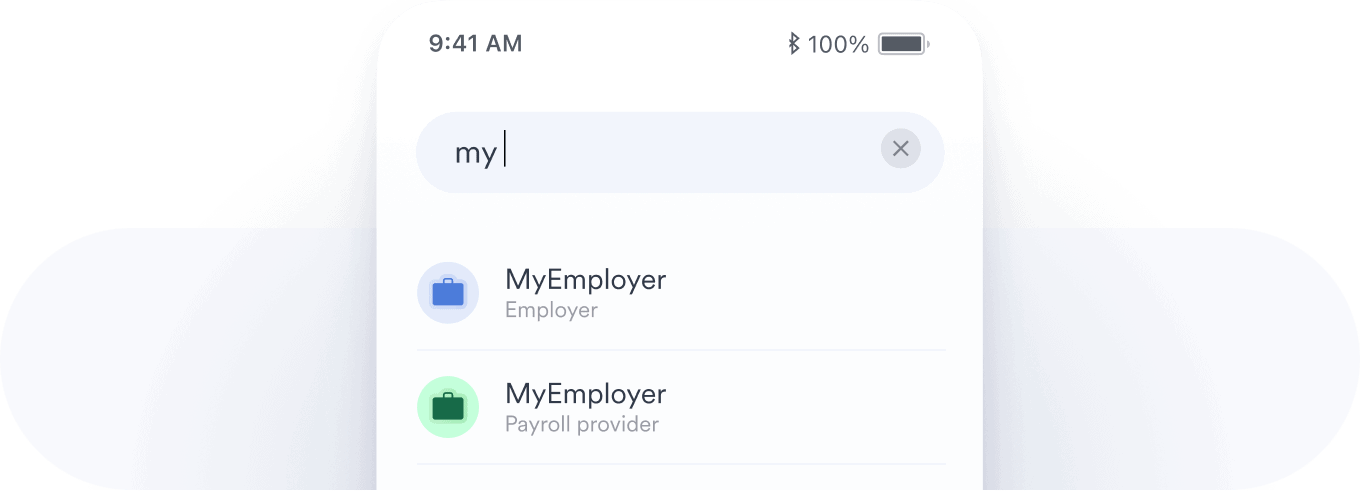

Select your employer or payroll provider from Argyle’s comprehensive network. (If your service provider already has this information, you skip this step!)

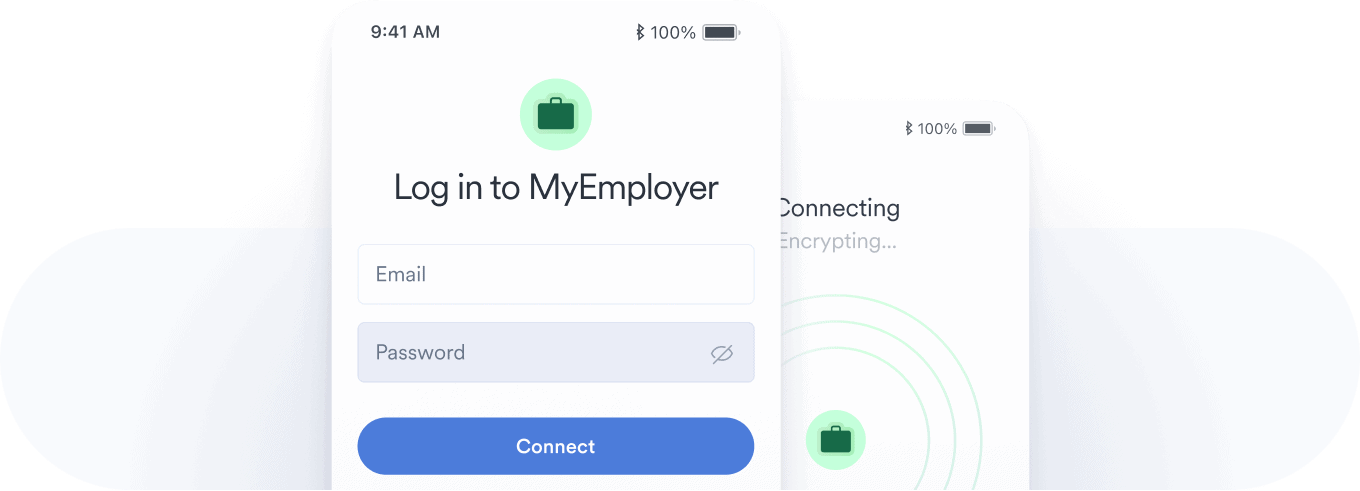

Log in to your employer or payroll account using your existing username and password.

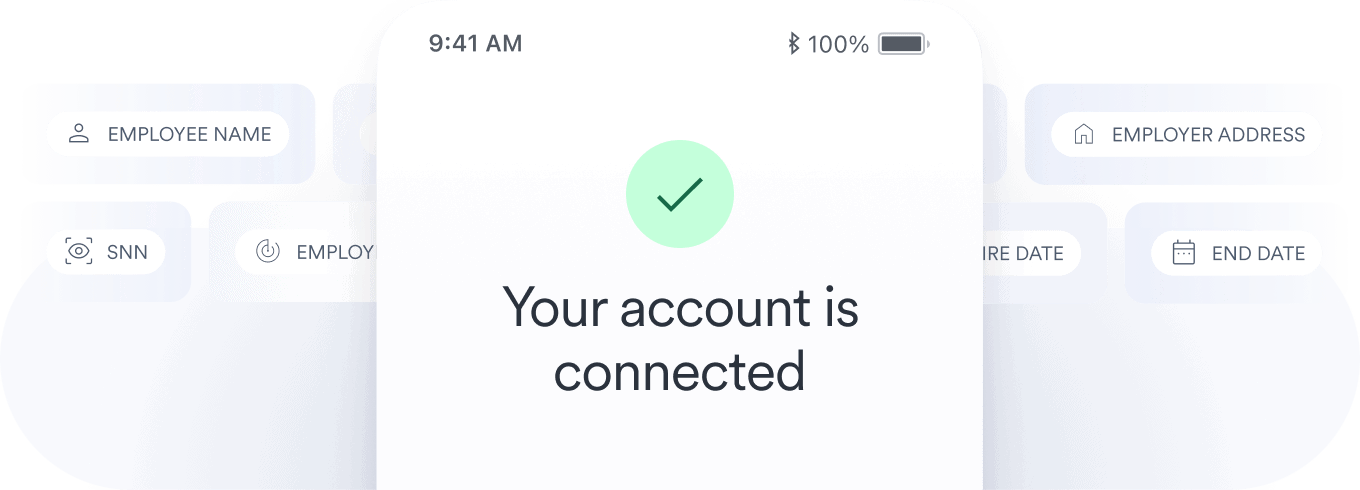

Argyle’s secure technology takes over, retrieving your data in a matter of seconds.

We’re modernizing financial

servicing—and we’re doing it

with your permission

Long story short, traditional income and employment verifications are inefficient, and they get in the way of consumers’ and service providers’ goals. We know we can do better.

Of course, if you want the long story, we’re happy to tell it:

your data

Your income data rightfully

belongs to you

At Argyle, we believe in consumer-permissioned data sharing. That means we only access your data with your fully informed consent, and we never sell it to anyone.

What’s more, we charge your service provider—never you—to connect your accounts, so your interactions with Argyle don’t come with any cost.

See our approachIt’s easy to opt out

You can stop sharing your income and employment data at any time (or contact our team, and we’ll do it for you).

Step 1

Navigate to the same Argyle connection flow you previously used to connect your account through your service provider.

Step 2

Click on your linked account(s).

Step 3

Adjust or remove the connection.

You can also delete your existing data by filling out this request form:

Delete data request formWant to learn more about how Argyle works and how you can control your data?

Visit our Trust Center to review our user terms and security measures—or read through our frequently asked questions for further details.

Visit Trust Center

Answers to your frequently asked questions

What is Argyle?

Argyle is an income and employment verification platform.

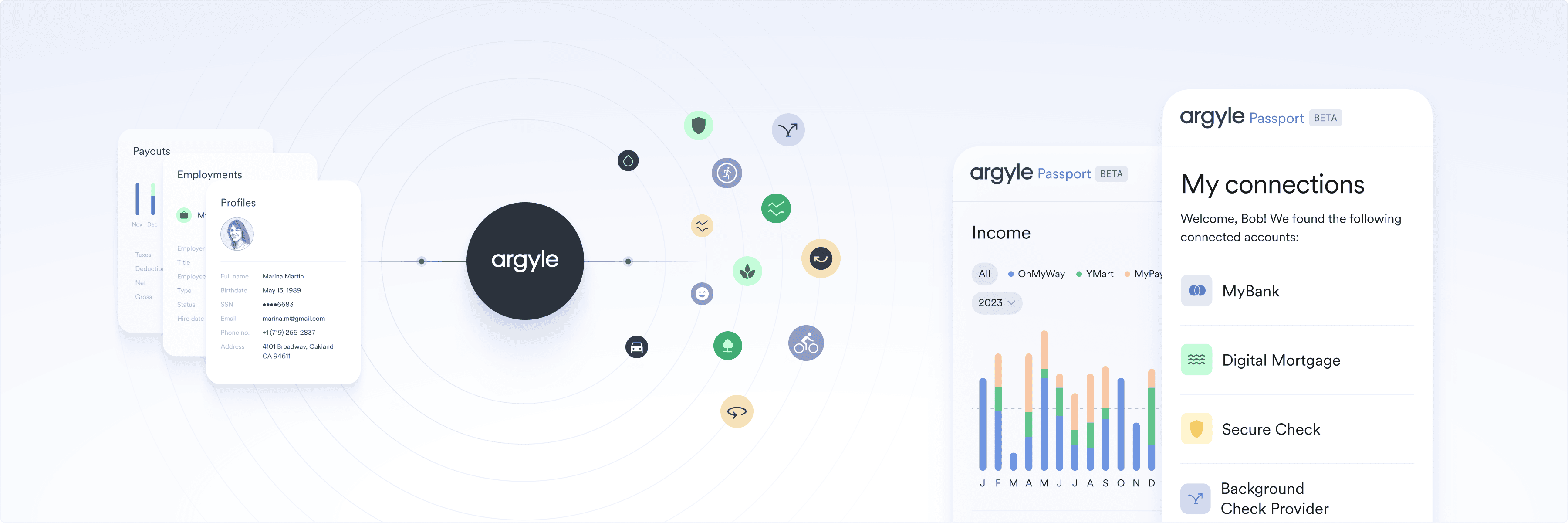

We offer a simple, secure, and fully automated way for you to share your income and employment data with a lender, property management company, potential employer, or other service provider you have authorized to receive your information. We do this by allowing you to connect your service provider directly to your employer or payroll provider account, so they can pull your data straight from the source.

That means, instead of tracking down, scanning, and manually submitting required documents like paystubs and tax forms, you can complete your application quickly and with just a few clicks.

What types of verifications does Argyle provide?

Argyle provides income and employment verifications. That means we help you share your employment status and earnings activity with a lender, property management company, potential employer, or other authorized service provider to confirm your eligibility for services such as a personal loan, mortgage, or housing rental.

How does Argyle work?

Argyle connects authorized service providers to your employer or payroll provider platform using API technology, so they can retrieve your income and employment data straight from the source. You can think of it like a secure pipeline that moves data directly from your payroll account into your provider’s records—instead of requiring you to prove your income and employment status by manually submitting paystubs and tax forms.

This not only saves you significant time and effort, it means your service provider can work with accurate, up-to-date insights, so they can quickly process your application.

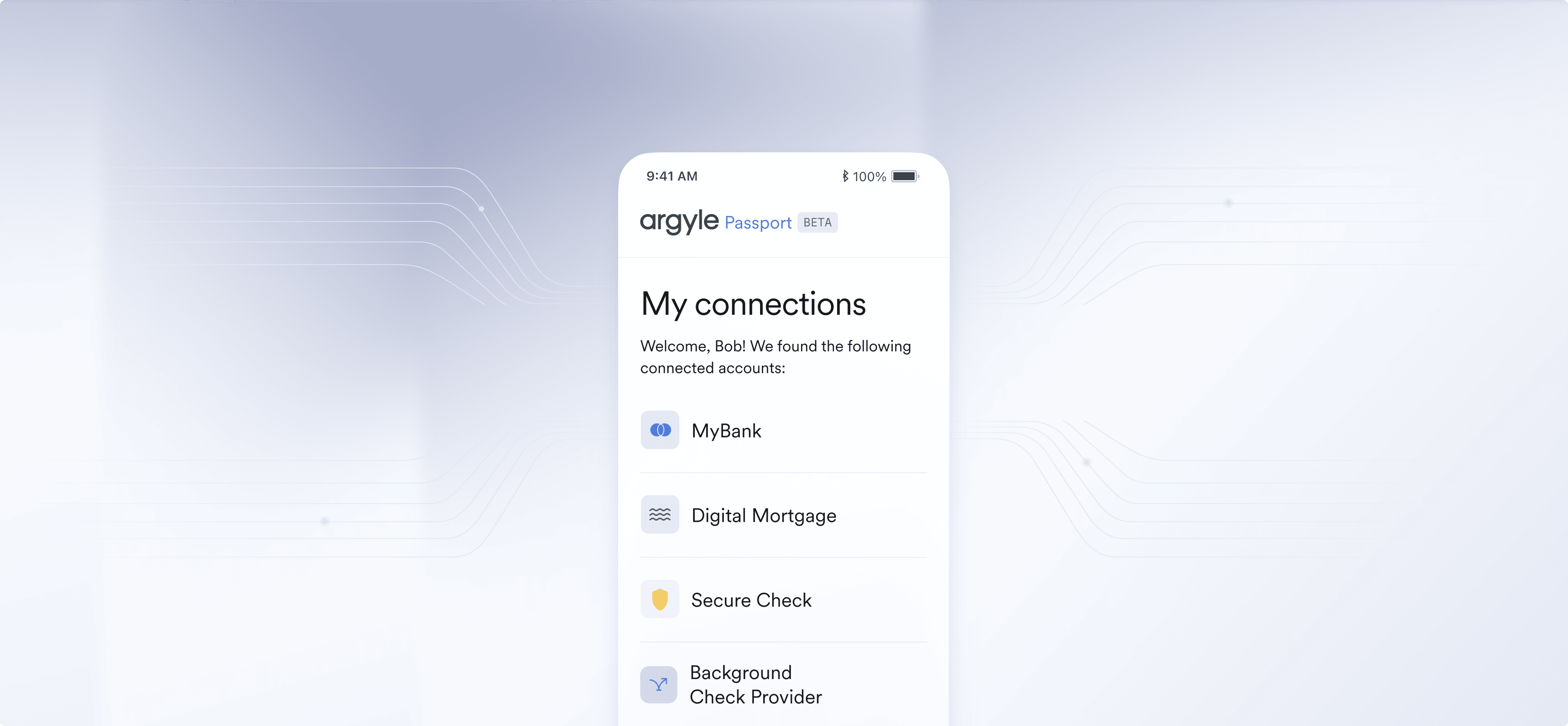

What is Argyle Passport?

Argyle Passport is your personal control center where you can manage every payroll connection you establish through Argyle. You can view all of your connected accounts, see a breakdown of your income and employment data, and adjust your connection settings all from a simple, accessible dashboard.

Argyle is fully consumer-permissioned—meaning you have full control over who sees your data, what details they can view, and for how long. You can also revoke access to your data at any time.

To learn more or access your account, visit our Argyle Passport page.