how it works

Switching a direct deposit is fast and entirely digital

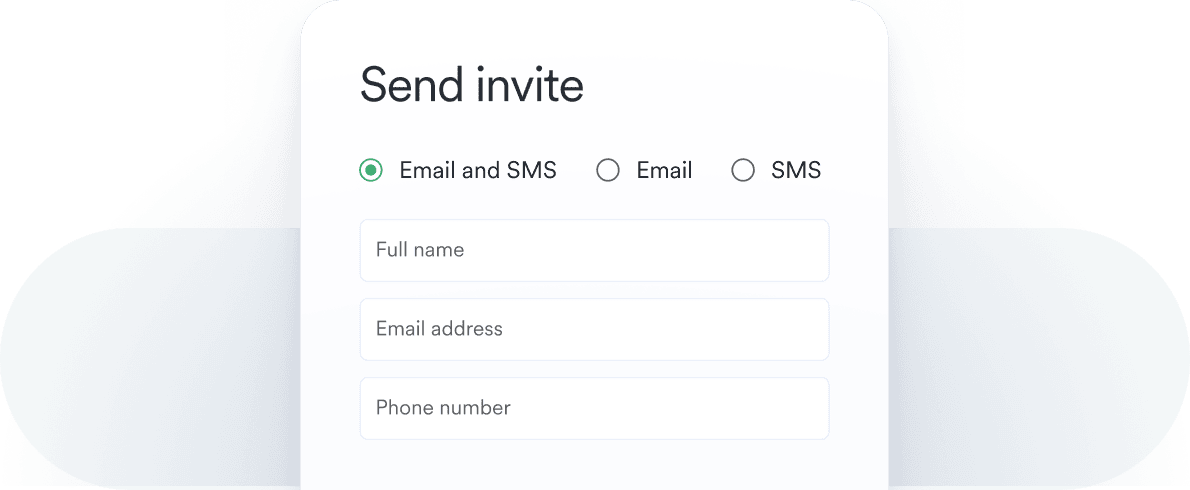

Argyle sends your customer an invitation to connect

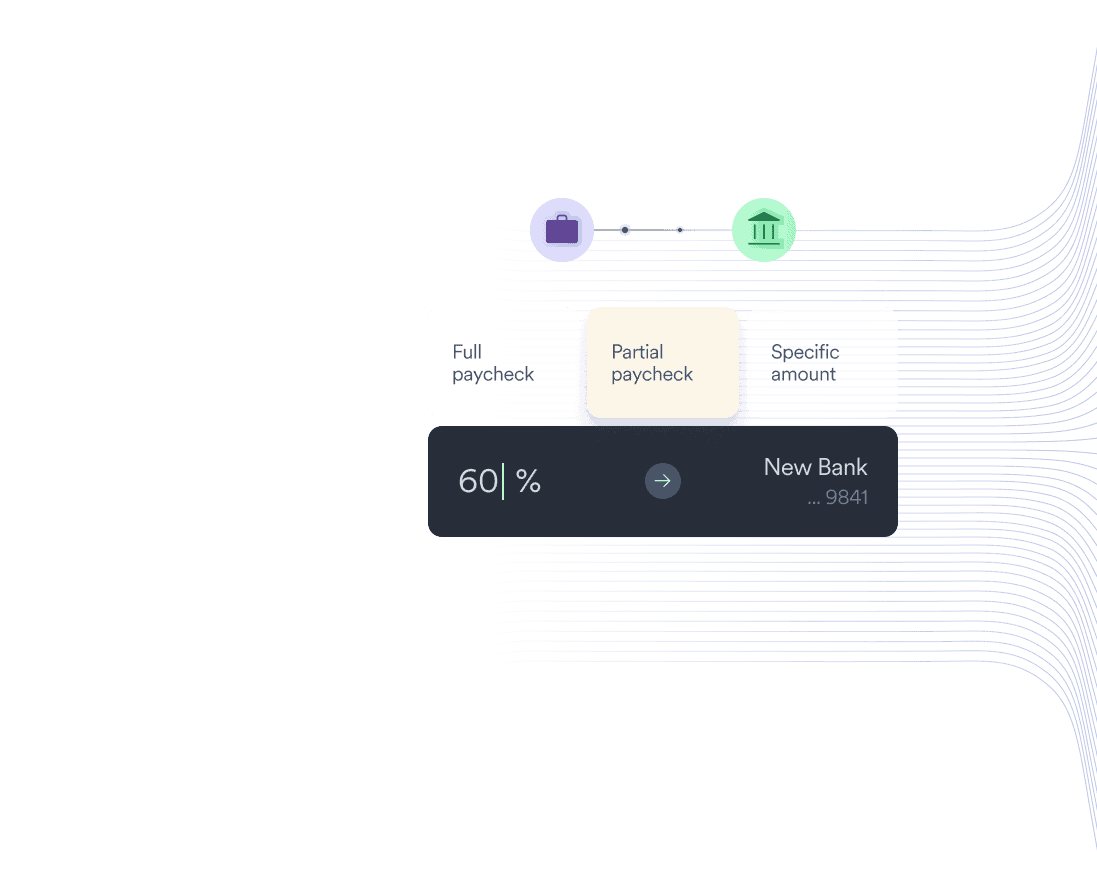

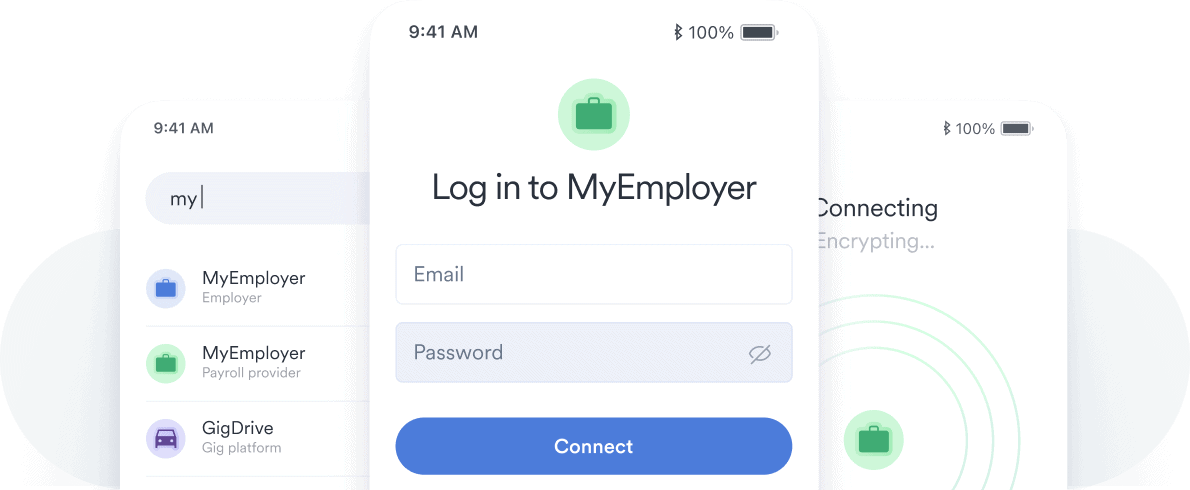

They complete a quick payroll connection flow

Argyle establishes a direct link to their payroll records

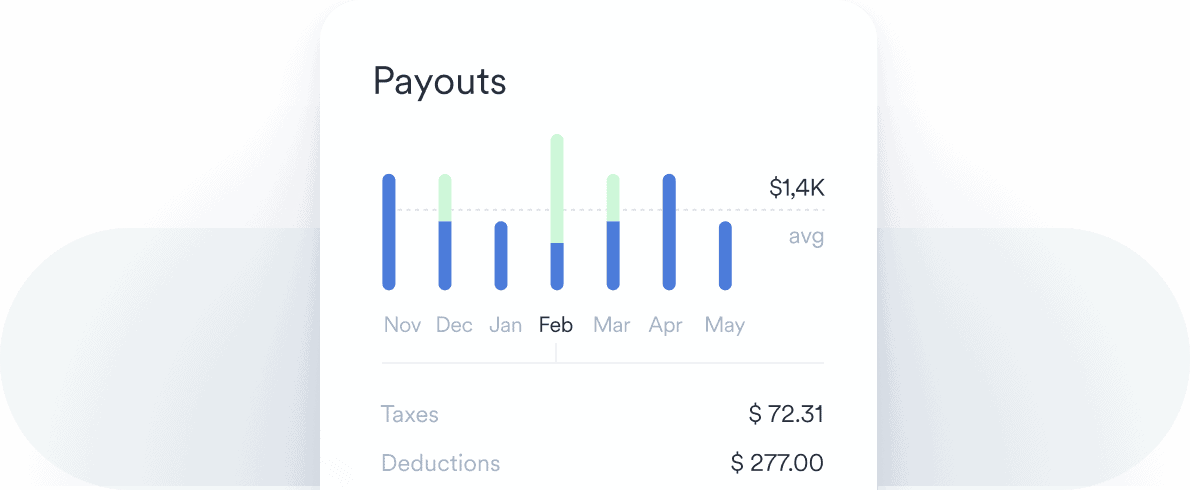

They redirect their paychecks to a designated banking account

benefits

The benefits extend to your

bottom line

Argyle makes deposit switching easy, which prevents drop-offs and fosters customer loyalty.

More conversions brings higher volumes of steady payroll deposits.

When customers deposit more assets with your bank, they’re more likely to use additional products.

benefits

Leverage Argyle’s market-leading features

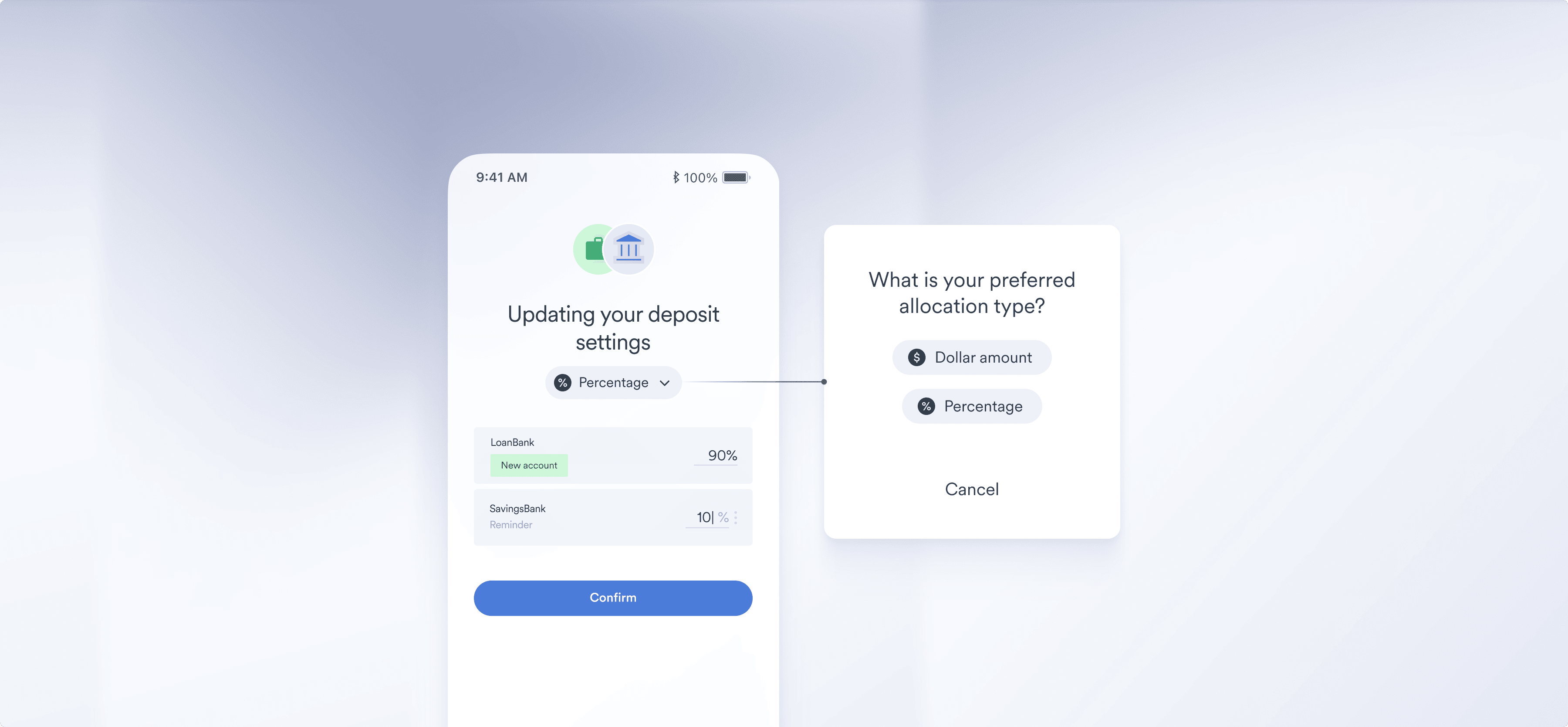

Your customers can redirect their paycheck in whole or in part for ultimate flexibility.

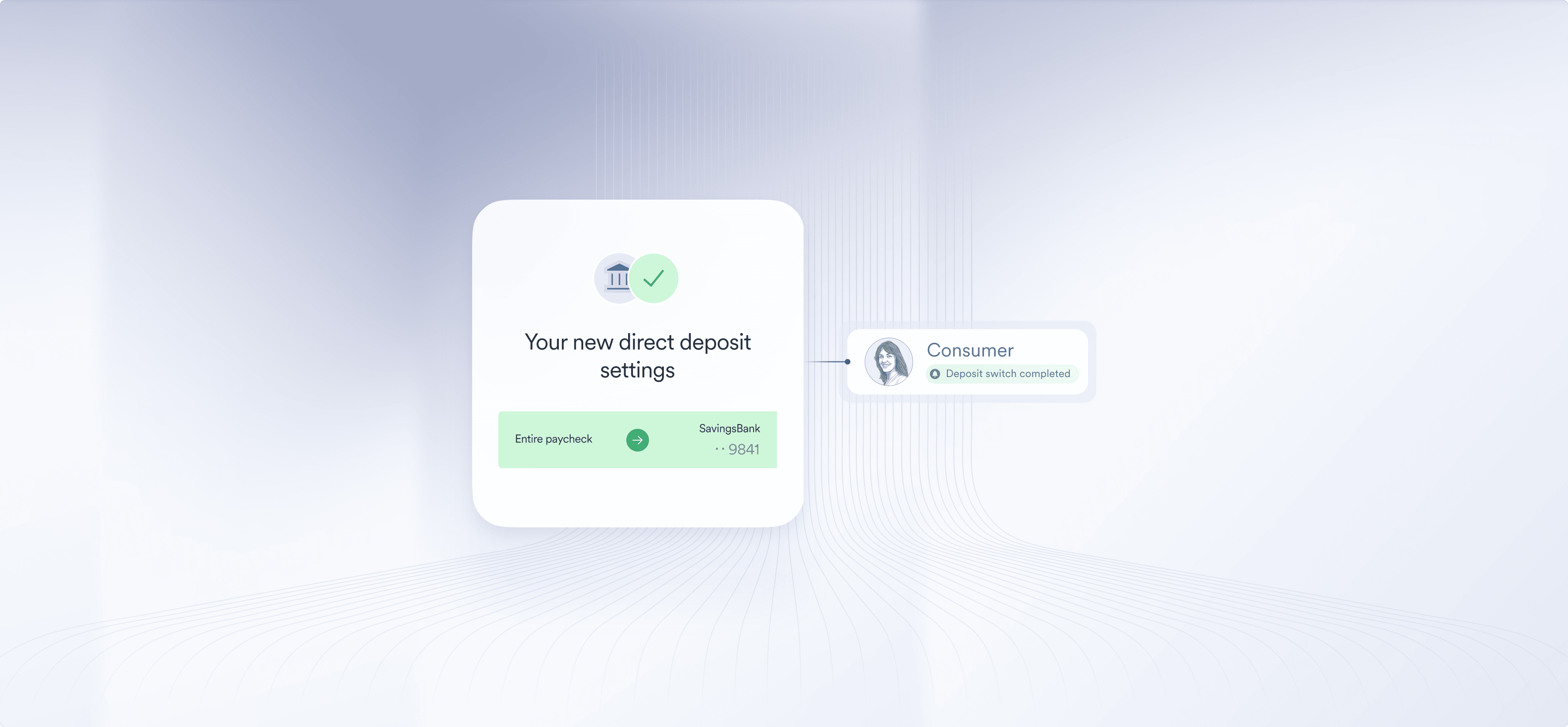

We’ll alert you when your customers complete their deposit switch or change their allocation.

why Argyle

Performance you can trust

Broader coverage

More conversions

Better outcomes

Answers to your frequently asked questions

What is deposit switching?

Deposit switching is the process a banking customer goes through to redistribute their paycheck from one financial institution to another. Traditionally, this process requires filling out forms that can take days or weeks to process. Argyle’s Deposit Switching solution makes the process entirely digital.

INDUSTRY SOLUTIONS

Learn how peers in your industry are using Argyle

Try our Deposit Switching solution

We can get you started today. No commitment required.

Contact sales