How Argyle partners with OneBlinc to provide credit solutions for one of the most vulnerable groups in the U.S. workforce

OneBlinc is on a mission to help low-income federal workers who need a boost in their finances. Launched in 2018, the company saw the need for an alternative to high-interest predatory loans. They set out to create an affordable credit solution with an easy application process and a progressive underwriting model—one based on an expanded data set of each applicant’s income and employment, instead of on a single credit score. To fuel their mission, they turned to Argyle.

Measurable success

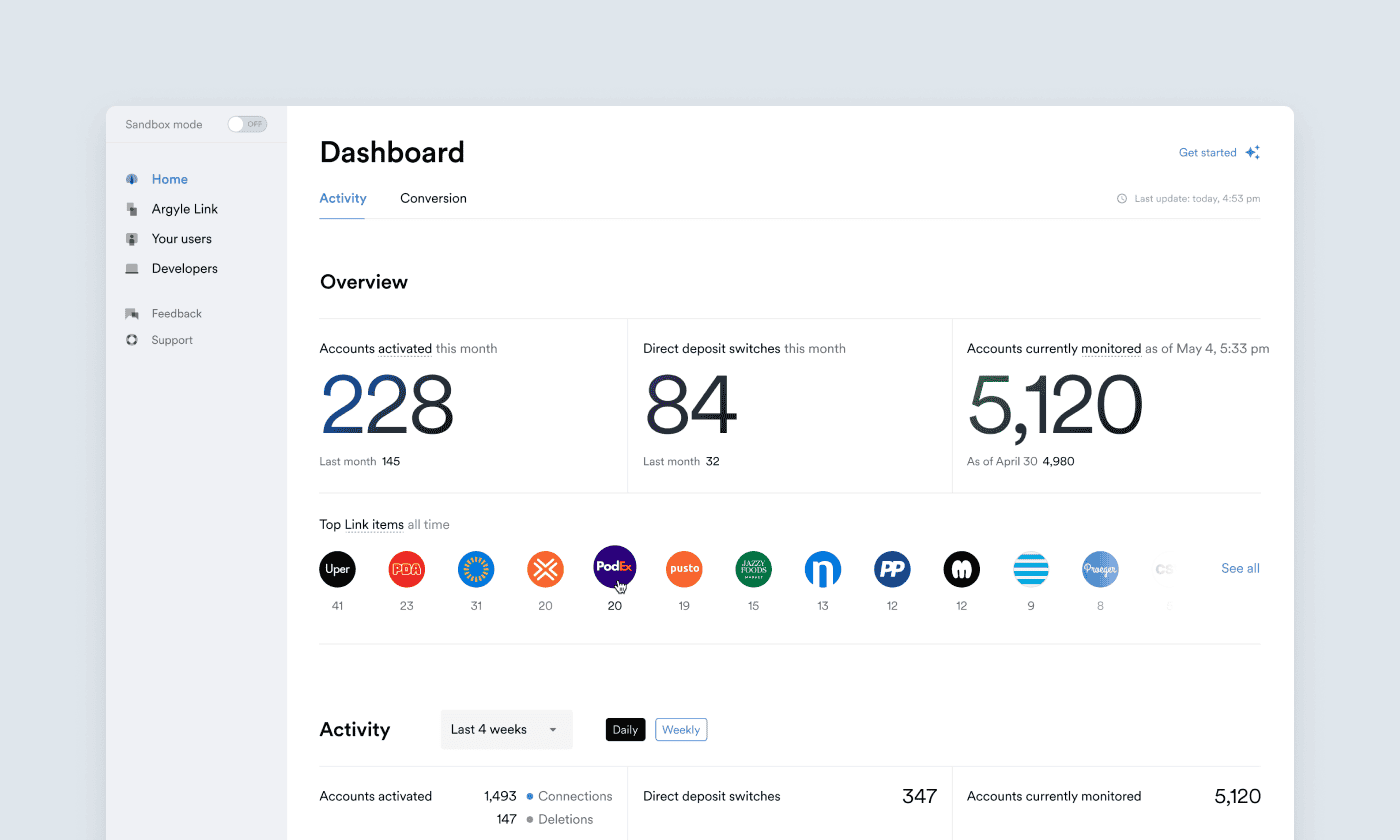

Since partnering with Argyle, OneBlinc has been able to largely automate the application and underwriting processes for their credit products. In as little as 10 minutes, a borrower can complete an application that would ordinarily take 20 hours over several days. Argyle’s automation process also eliminates the need for OneBlinc’s underwriting team to review numerous documents, saving them at least 1,000 hours of work each month.

The background

Cash-strapped, time-poor, and stuck with a low credit score

According to the American Federation of Government Employees, tens of thousands of federal employees currently earn roughly 22% less than their counterparts in the private sector. These federal workers have no financial buffer to help with unexpected expenses and are strapped for time because of their busy schedule. Their credit scores are often too low to qualify them for a competitive-interest loan, making them vulnerable to predatory lenders and a no-win cycle of escalating debt.“Imagine a single parent working for the USPS. She doesn’t want to have to choose between putting gas in her car, buying school supplies for her kids, or paying the rent,” explains Gustavo Tamborlim Simões, chief technology officer at OneBlinc. “By the time she ends her shift, makes dinner, checks her children’s homework, and puts them to bed, she has just a handful of minutes to sort out her finances.”

The problem

Burdening the customer with a manual process

When OneBlinc launched, its paycheck-linked loan application process and pay distribution setup were largely manual. A customer had to leave the OneBlinc platform to log in to their payroll account, gather paystubs, authorize a payroll distribution, take screenshots, and then return to OneBlinc to upload their documentation. This resulted in a time-consuming, hit-or-miss process. More often than not, a customer shared images of incomplete or incorrect information.

Feeling overwhelmed when underwriting

At the other end of the process, OneBlinc’s underwriting team typically took an hour or more to sift through each application. Because they were reviewing a monthly average of a thousand applications, this means they were losing 1,000 hours of productivity. Much of this time was spent going back and forth with the applicant to make sure the right documentation was being shared.

The solution

A faster track to fair funding

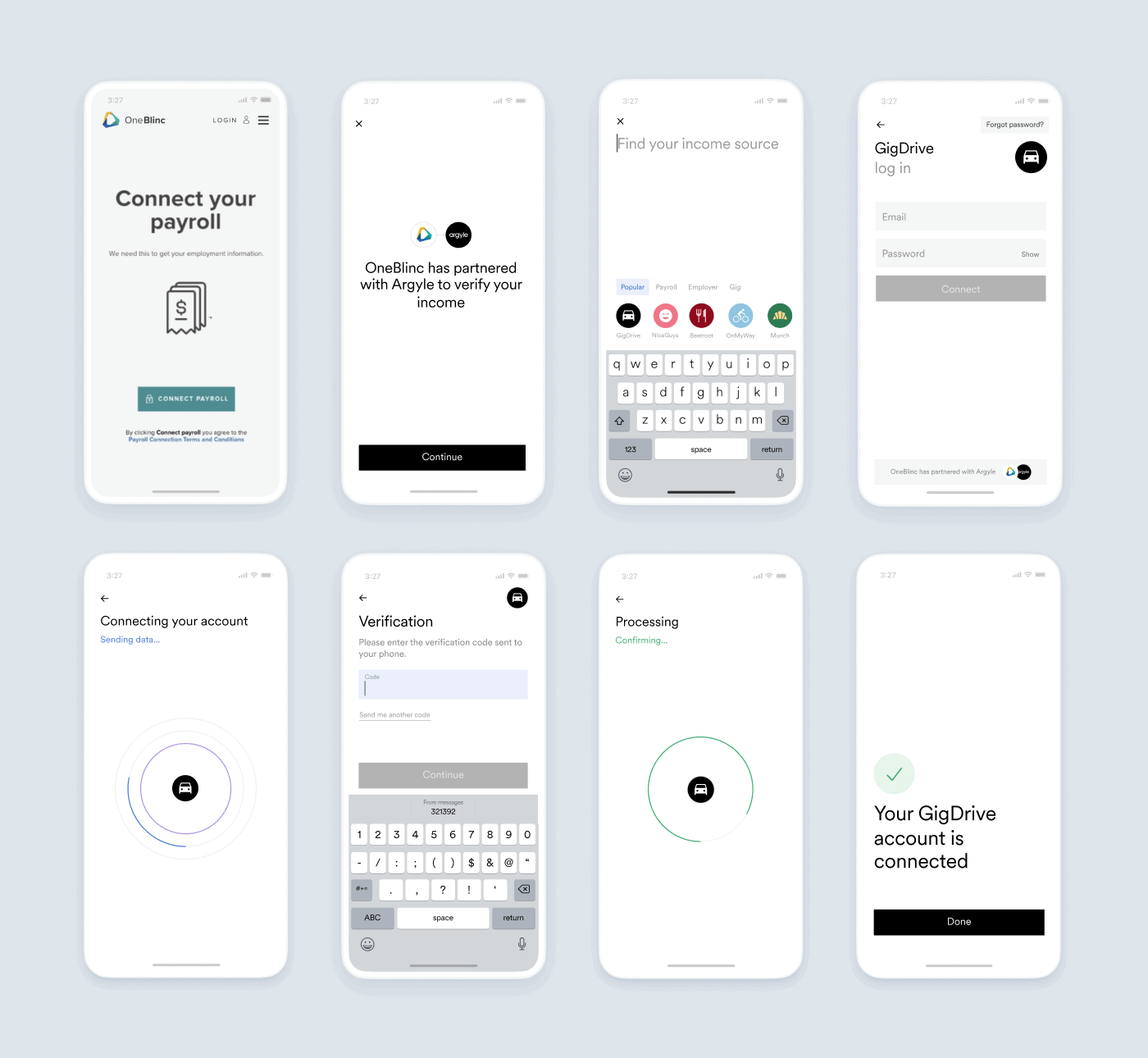

When OneBlinc joined forces with Argyle in early 2021, the new collaboration had an immediate, positive impact. Just as OneBlinc’s customers needed a faster and better way to solve their latest financial challenge, the company needed an agile and accurate way to deliver the right solution. Argyle was the game-changer.Thanks to Argyle, tedious, error-prone manual entry and screenshot uploads are a thing of OneBlinc’s past. Instead, Argyle’s front-end modal prompts applicants to connect their payroll account with a single authentication at the top of OneBlinc’s signup flow. Within moments, the link is established, and Argyle retrieves the historic and real-time data OneBlinc needs to verify income and employment and fuel its credit-decisioning model. Once approved, applicants can also use the payroll connection they established to set up automatic loan repayments. It’s a quick, frictionless process that drastically reduces borrowers’ default risk.

“In Florida, there are more predatory lenders than there are McDonald’s and Burger Kings combined, If a person gets stressed, they’re tempted to walk to the nearest predatory lender, only to wind up in debt for years. OneBlinc’s solution needs to be easier than just crossing the street—and Argyle makes that possible.”