How Juno 30x direct deposit acquisition with Argyle

Juno offers high-yield checking accounts, including the option to set up a direct deposit and receive part or all of your cash paycheck in cryptocurrency (BTC, ETH, and USDC) in any wallet of your choice. After months of working with another direct deposit switching provider, the company leaders knew it needed a new partner—a company which had the same high-performance goals and care for the customer service and user experience as Juno. That’s when they found Argyle.

Measurable successes

30x conversion

Prior to transitioning to Argyle, conversion was 1%. But since implementing Argyle, Juno sees an industry leading 30 to 40% conversion in direct deposit switching.

10/10 customer experience

Juno has not only been happy with their Argyle experience, they look to it as an example as they build out its customer experience team.

The background

A checking account to get paid in crypto

Launched in 2020, Juno originally catered to high-earning immigrants with a sleek metal debit card offering 5% cashback (with selected merchants) and a higher bonus rate, with the ability to execute international money transfers from the same account. However, as the company grew, they saw the untapped potential in being a cryptocurrency-enabled bank that helped those new to the space get involved. “Before Juno, the team had built Nuo Protocol in 2019, one of the earliest DeFi margin lending and trading protocols,” said Ankit Pandey, Associate Product Manager at Juno. While the traditional onramps for investing in cryptocurrency have been done through on-demand ACH and debit or credit card transactions, the team at Juno believes the next iteration of on-ramping will be converting directly from payroll, requiring just a one-time setup that continues in perpetuity. Currently, there isn’t a compliant way for employers to pay their employees with cryptocurrency, and employers must pay in USD. That is where Juno comes in. It offers users a compliant method to accept a portion or all of their paychecks in cryptocurrency. Juno is a fully functional bank account insured by FDIC and continues to offer its debit card and money transfer services while exploring new avenues.

The problem

Direct deposit switching needed to become a priority for Juno

Like all neobanks, Juno was focused on becoming the primary banking solution for its clients. It needed to not only stand out for having great benefits for users, but also for being a quick and easy banking solution. But when the company was just starting out, they weren’t 100% sure what they needed in a direct deposit platform to facilitate this goal. “We did not have much experience as to what we needed to build,” said Pandey. “So at that point of time, we were using a different direct deposit solution.” However, as the company attracted attention after launching its paycheck in crypto product, improving the direct deposit experience quickly became a priority for the company.

“At that time, our conversion rates were somewhere around 1%, which was not really what we expected.”

Juno started the search for a partner that could offer a direct deposit solution that could be seamlessly folded into its checking account experience, meet compliance requirements, while also facilitating quick deposit switches.

The solution

A turn-key experience with superior customer support

After meeting with the Argyle team and reviewing the extensive documentation library, Pandey knew this solution was going to address the growing needs of the company and its users. As implementation got started, the Argyle support team proved to be a critical asset as well. “We’ve never had an occasion where we even had to wait for more than 10 minutes when we raised a query,” said Pandey. “It was super quick and one of the best experiences I had while integrating a third-party API into our product so far.”

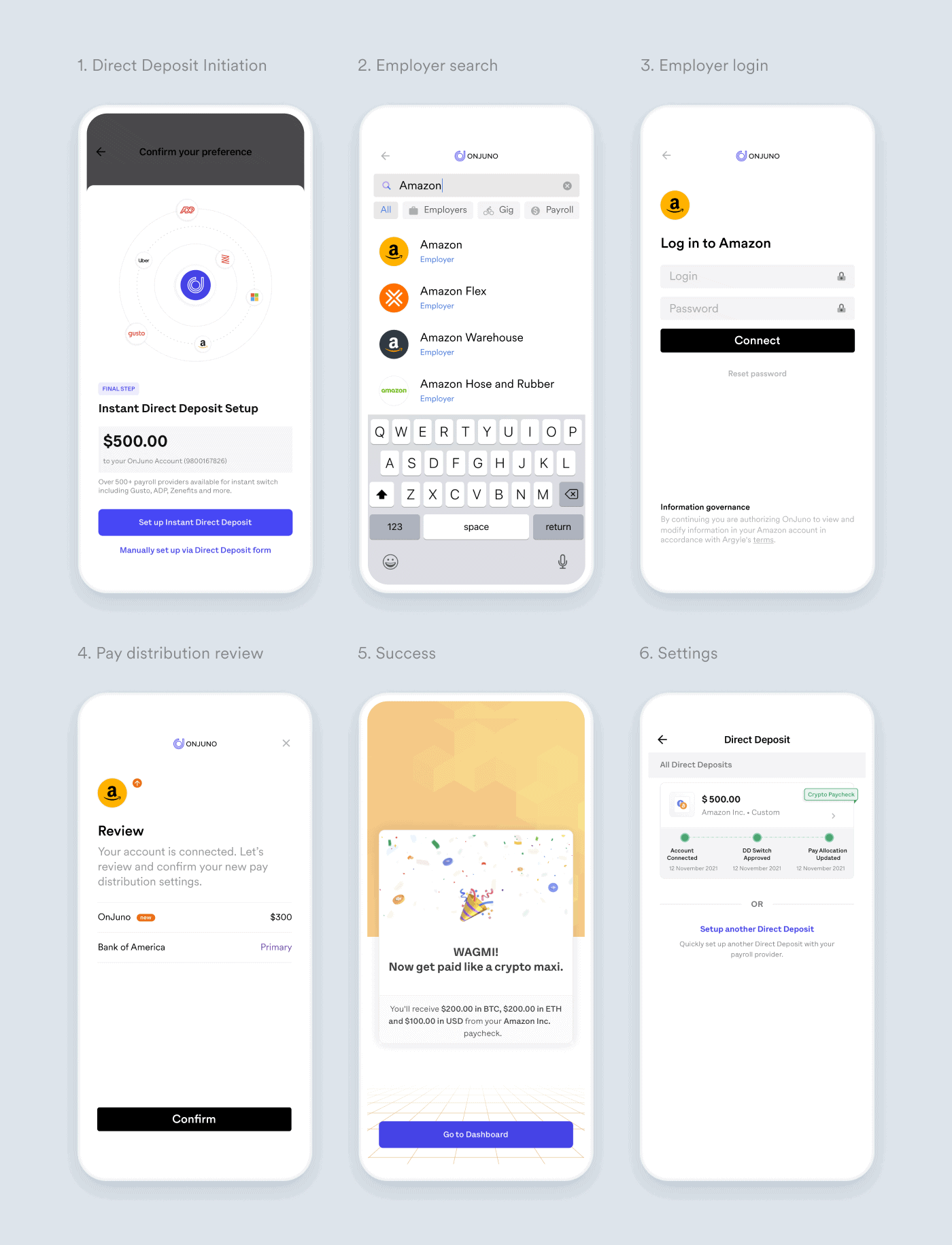

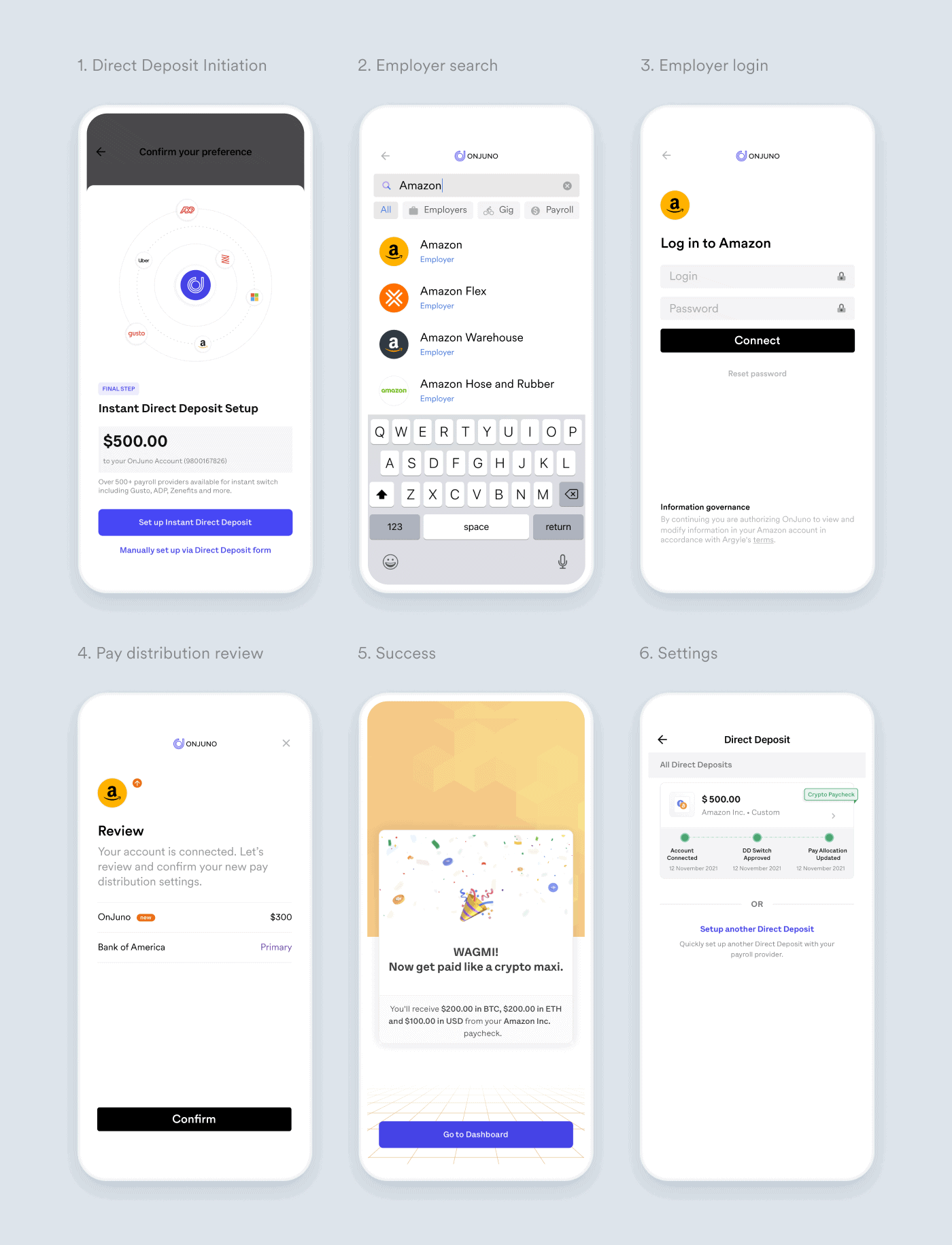

Continuous access enables users to easily increase direct deposit amounts

Users connect directly to their employer or payroll account through Juno and authorize a direct deposit switch with just a few clicks—saving the user and neobank serious time without sacrificing confidence. Trust is the name of the game for the Juno team, as they know that if the user has a positive experience during onboarding they are much more likely to use the full suite of services it offers.

”Having access to Argyle’s direct deposit switching solution, ensures that more users deposit their salaries into Juno, which takes us closer to the goal of converting Juno to a primary banking account for our users.”

The results

30x improvement in conversions

While Juno had a direct deposit solution in place, it was not helping the company convert more users. “Conversion earlier was 1%. But now, with Argyle, we see 30 to 40% conversion. And by 30 to 40%, I mean, right from submitting the credentials of a login page to finally allocating a certain part of salary.” This huge jump gives Juno a much larger pool of users to work with and offer further product offerings to.

Established the client’s trust

“Implementation was a 10 out of 10 experience,” said Pandey. “With other vendors, we might get a response within 24 hrs and then there’s a constant back and forth. With Argyle, someone will ping us right away regardless of the time.”He points to the extensive documentation as a reason to sign with Argyle as a solution, and now follows the change log and Argyle’s Blog for API and product updates that will help his team do even more with our solution. More than the resources offered, Pandey cited the positive working relationship he has with the Argyle team.

“There are two days I look forward to. One is Friday for the weekend. The second is Tuesdays for the Argyle meeting. I’m excited and pumped to ideate on things with the whole team.“

The future

Expanding beyond direct deposit switching

Juno launched its cryptocurrency checking account in October 2021, but thinks there are many more avenues to explore in this space. “Steadily we’ll be offering many more options to the user so that they can engage with the whole cryptocurrency landscape,” said Pandey. As Juno scales its existing products, and looks for new solutions to increase its top-of-funnel and user retention, the team knows they can always turn to the Client Success team at Argyle to brainstorm solutions. “I’m really excited with how things have shaped up so far, and equally excited for how things will shape in the future.”