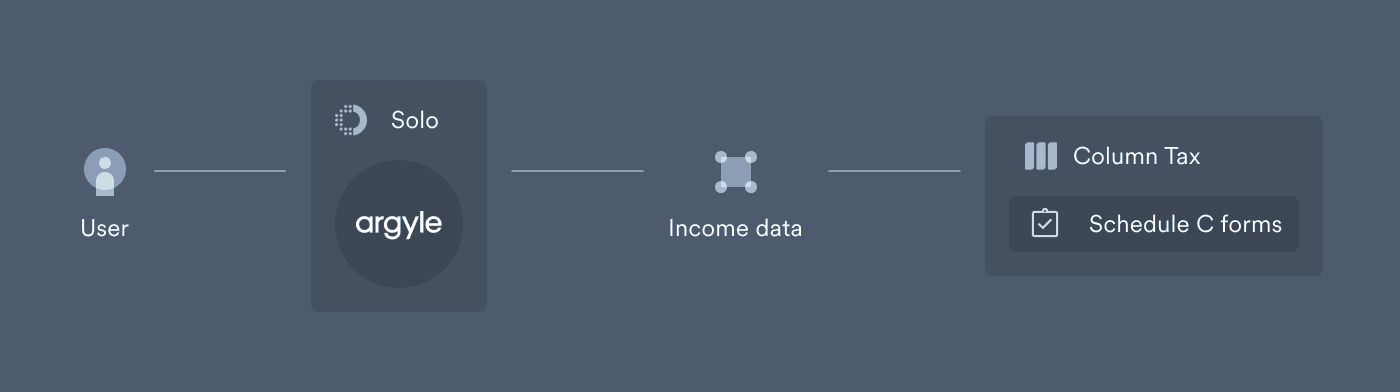

With Argyle, Solo and Column Tax simplify finances and tax filing for gig workers with Argyle’s real-time income and employment data.

Column Tax is a next-level, IRS-authorized tax filing solution. The embeddable software makes it easy for banking apps and fintechs—particularly those serving gig workers and the self-employed, like Solo—to offer their customers seamless tax experiences.

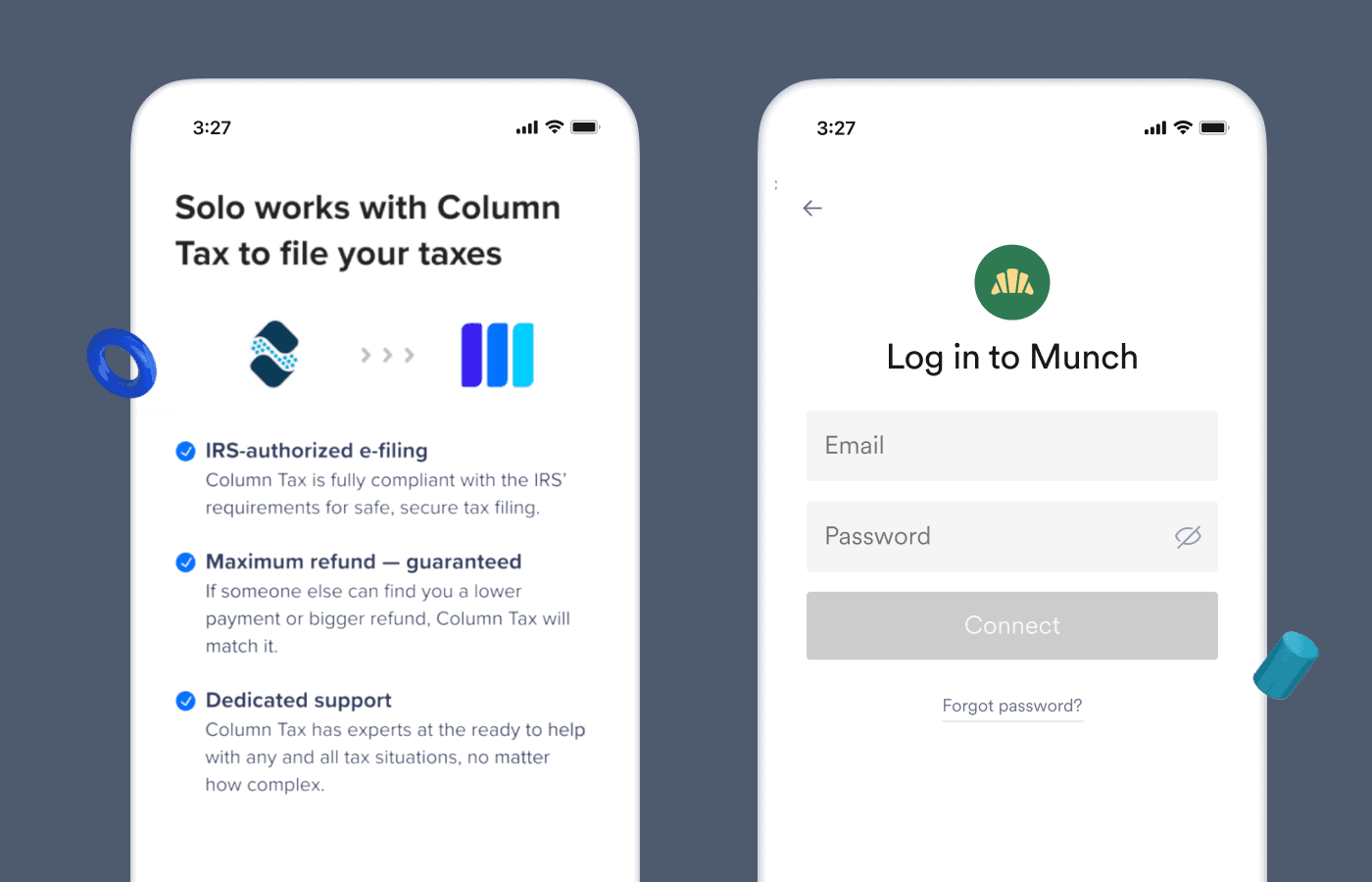

Solo is a business app and financial hub for gig workers, enabling them to track their earnings, deductible expenses, mileage, and more through a single, intuitive dashboard. By integrating with Column Tax, Solo allows workers to automatically fill and file their tax forms with just a few clicks.

Powering the process behind the scenes is Argyle’s real-time income and employment data.

Challenge

Financial platforms like Column Tax and Solo face steep hurdles when it comes to helping gig workers manage their cash flow—especially during tax season. That’s because gig workers often have multiple sources of income: driving for Uber one day and delivering for Grubhub the next, while also working a full- or part-time job. Key documents like paystubs and mileage reports are difficult to track down, as they’re spread across different platforms, and aggregating them all at tax time can be a highly manual and stressful process.

Solution

With Argyle, gig workers can connect their gig platform(s) directly to the Solo app when they sign up for an account, giving Solo ongoing visibility into shift-level details like income, hours, and miles. That means gig workers’ wages can be tracked and categorized in real time and weighed against expenses, allowing them to effortlessly manage their finances year-round. When tax season comes along, Solo syncs this data to Column Tax, so Schedule C forms can be automatically populated with verified information and every possible deduction for maximum accuracy and returns.

Outcome

From 25 hours to a single session: With Argyle’s real-time income and employment data, Solo and Column Tax can automate the tax process for gig workers, allowing them to file in a single session and reducing their time investment from an average of 25 hours each year to just two.

Up to $1,000 net benefit: Argyle offers Solo and Column Tax an instant, granular view of income and employment activity, so workers can avoid pricey, upsold tax products, save up to $530 in preparation costs, and optimize their deductions for the maximum refund.

100% accuracy guaranteed: With Argyle’s direct payroll connections, Solo and Column Tax can stream verified income and employment data straight from the source, allowing workers to avoid common data entry mistakes and file exceptionally accurate returns.

The number one thing we hear from gig workers is how stressful their taxes are. A lot of that has to do with siloed data they have to track down, compile, and re-enter themselves, leading to lost time and money. We’ve seen people miss a single decimal point and end up owing much more than they should. By working with integrated platforms like Argyle and Solo, we can connect directly to our customers’ gig platforms, instantly pull verified financial data, and automate tax filing from end to end.