How Better Financial Uses Argyle to Streamline Account Funding via Direct Deposit Switching

Better Financial is a mission-driven financial services provider that offers users the World’s 1st Community Safety Net™ for unforeseen expenses. To monitor users’ cash flow, speed up direct deposit switches, and amass a reserve fund for when setbacks arise, they needed a faster, easier way to connect to employer payroll data. To meet those goals, they turned to Argyle.

Measurable successes

Weeks saved

With Argyle, Better Financial can ditch the slow, tedious paperwork they once used to initiate direct deposit switches and activate them instantly.

Real-time status alerts

If a user stops earning income or drops off their platform, Better Financial doesn’t have to wait to find out—Argyle notifies them right away through webhooks.

The background

A financial shock

When Saumik Tiwari was hospitalized with a rugby injury in 2018, he ended up with a medical bill that wasn’t covered by his health insurance. When he couldn’t afford the charge, it resulted in long-term damage to his credit score. He soon learned he wasn’t alone. That year, 60% of U.S. residents suffered some form of monetary shock. That’s why Saumik—along with his brother Kaushik—founded Better Financial to account for the unexpected.

A community safety net

Better Financial is designed as a checking account with an added layer of protection. Every time a user makes a transaction on their debit card, a small percentage goes into a community pool. Once users enable their direct deposit and meet a minimum level of banking activity, they gain access to that pool, which includes no-cost insurance and cash advances for sudden hardships like an accident, prolonged illness, or pay cut. For Kaushik, this helps users avoid entering a potentially damaging cycle of debt.

“You should only have to take on debt when it adds to your future. In any other case, it’s just not right.”

The problem

Paperwork pain points

Acquiring direct deposits is crucial for banks, as they’re a key indicator of a user’s primary account and have a huge impact on spending, engagement, and retention. This is especially important for Better Financial, because they rely on user transactions to fund their community pool through interchange fees.“Being the primary bank account is the biggest prize in this space, and getting the direct deposit is critical to keeping our benefits alive. Our business can’t exist without it.”Before Argyle, rerouting a user’s paychecks for direct deposit involved a drawn-out, high-friction process, resulting in user drop-offs.

“We had to send paper forms to employers for direct deposit switching. It would take a week or two to set up an account, and we had to manually keep track of the money coming in. It was a terrible experience for whoever had to do it.”

The Tiwari brothers knew there had to be a better way. They began searching for a product that would automate account funding via direct deposit switching.

The solution

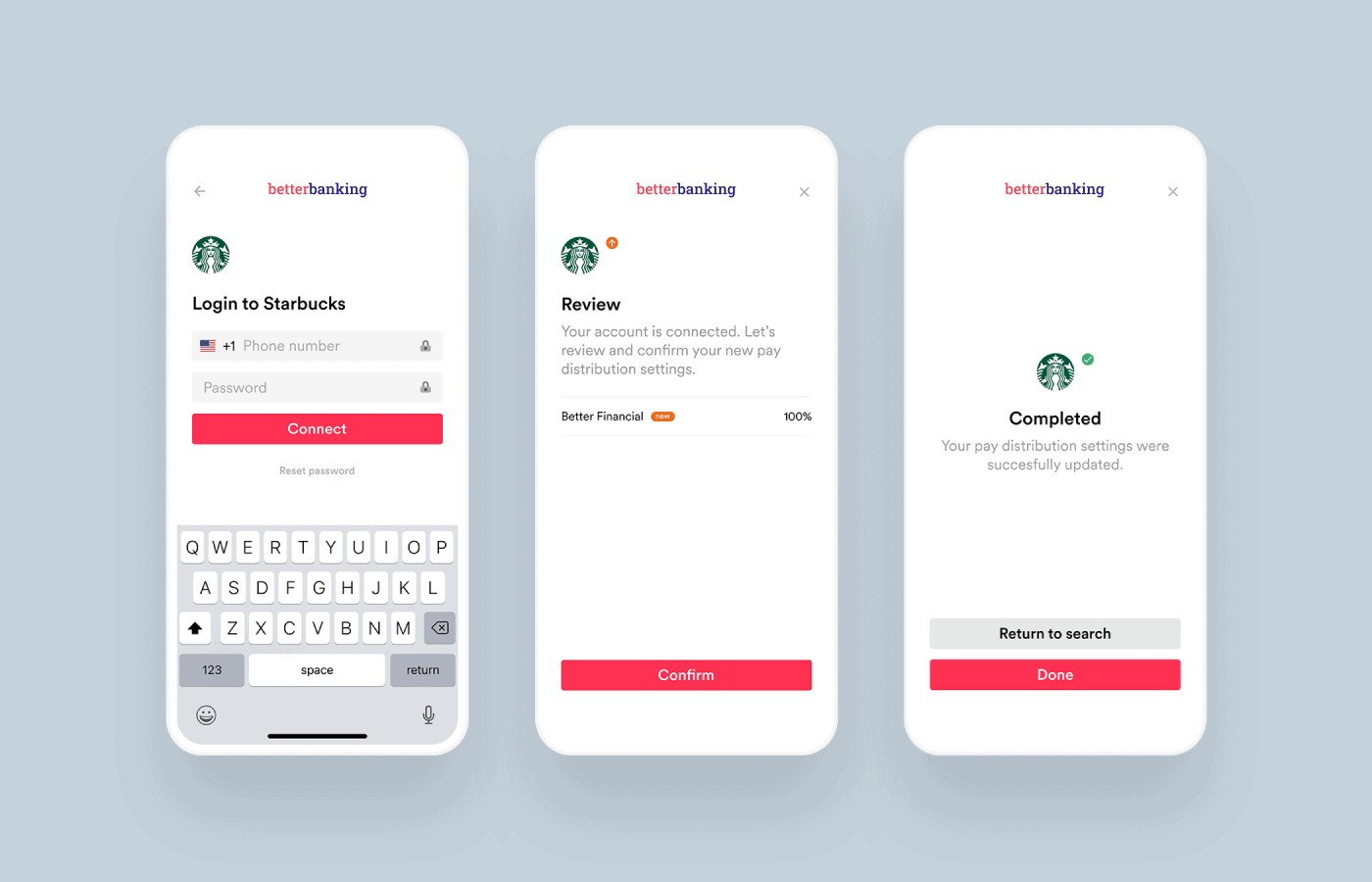

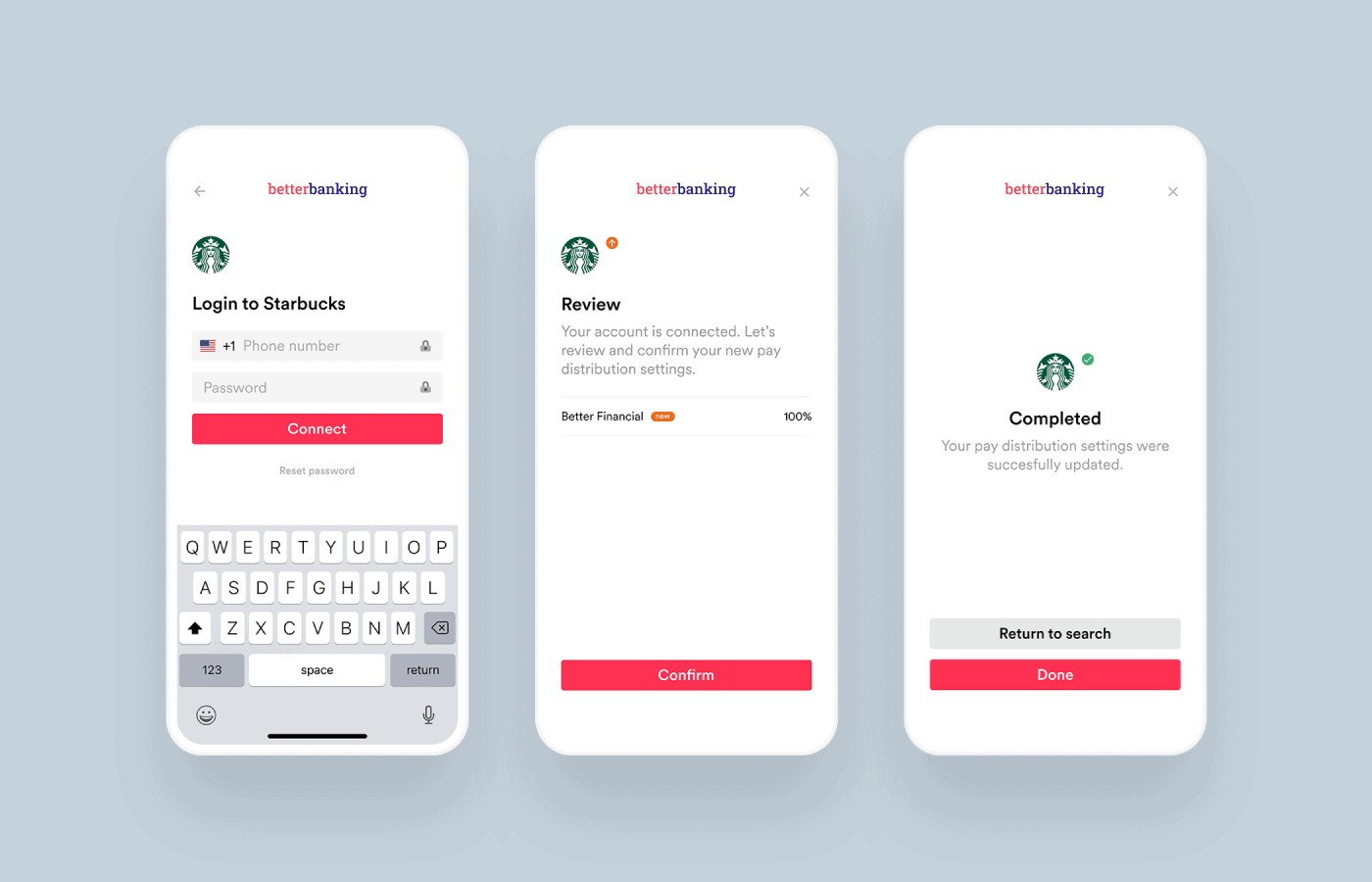

Smooth onboarding with automated direct deposits

Argyle immediately stood out among the competition. Now with Argyle, users connect directly to their employer or payroll account through the Better Financial app and authorize a direct deposit switch with just a few clicks. This makes setup a breeze for the bank and its users.“Argyle offered the perfect product,” said Kaushik. “Their direct-deposit solution is the most well-developed on the market, and they provide us with real-time transparency into employment and income.”

Superior data coverage

Better still, Argyle offers the broadest network of employers and payroll platforms on the market—including labor segments like independent, federal, and gig workers not covered by other services—so none of Better Financial’s users are left out.

”Argyle’s data coverage is amazing. We haven’t had any complaints from users about not being able to locate their employer or payroll provider, which was our biggest concern going into this kind of service.”

The results

Time (and worry) saved

Argyle’s instant, automated direct-deposit switches bring weeks of processing time down to zero, and it means users in need can quickly get the help they’re looking for.“Since integrating with Argyle, direct-deposit switches have been seamless,” said Saumik. “Activating an account and instantly accessing the Community Safety Net is a priority for our clients, and we’re able to do it because of Argyle.”

Real-time webhook notifications

Argyle’s webook technology also alerts Better Financial right away if a user’s data or status changes. If a user is missing work or losing pay, for example, Argyle lets Better Financial know, so they can react accordingly.“We then send a push notification to the user,” said Kaushik. “Like, ‘We noticed a drop in income last week. What happened?’ Based on the information they provide, we offer a cash advance or initiate an insurance claim.”Recognizing when someone might be in distress allows Better Financial to proactively extend help when users need it most, which is central to their mission.

Built-in fraud detection

Argyle’s real-time data also means Better Financial can ensure benefits are going to the right recipients.“If a user claims they’re injured, but they’re out working at Target, we find that out through Argyle’s payroll data,” said Saumik. “Argyle also tells us if somebody shifts their deposits from our platform. We can then swiftly cancel services, so there’s no possibility of fraud.”

The future

Simple, hands-off service

Moving forward, Better Financial knows Argyle’s service will continue to run like a well-oiled machine.

“Our integration with Argyle basically drives itself,” said Kaushik. “I don’t have to get involved. We have five Argyle engineers supporting us, and everything is white-glove service.”

”Our integration with Argyle basically drives itself. I don’t have to get involved. We have five Argyle engineers supporting us, and everything is white-glove service.”

This gives the Tiwari brothers and the entire Better Financial team time to scale the company, build new products, and imagine a much bigger future.

An eye toward growth

For Kaushik, working with Argyle opens an infinite number of possibilities for Better Financial.“Our goal is to be a financial supermarket—like the Costco of finance,” he said. “We already have insurance, but are adding lending, advance paychecks, and other investment products. With Argyle’s direct-deposit and spending-level data, we can connect to users in a much more present way. As we mature, I know we’ll find dynamic new uses for this partnership.”To read more about the partnership between Argyle and Better Financial, check out press release here.