With Argyle, B9 sees faster direct deposit switching, higher conversion rates, and stronger data

Financial wellness platform B9 offers on-demand cash solutions, including early payroll access for every kind of worker. To fund services and get clients quick access to earnings, it needed an efficient way to switch direct deposits to a B9 account—faster than the three days often required with banking-based and manual processes. That’s where Argyle’s real-time payroll and employment data comes in.

Measurable success

70-80% Conversion

Since partnering with Argyle, a large majority of B9’s clients have been able to seamlessly switch their direct deposits to a B9 account and instantly unlock financial access.

The background: early payroll access for migrants, by migrants

Unbanked and underbanked communities—including many migrant workers typically neglected by financial institutions—are often targeted by predatory lenders, perpetuating patterns of inequity. That’s why B9 set out to create a tech-forward cash access platform that could better meet their needs.“We realized there’s a huge appetite for on-demand, emergency coverage,” said José Robles, B9 co-founder and head of operations. “Our clients have a hard time accessing fair loans, even for $50 if their car breaks down. We’re all migrants ourselves, so we understand the market, we understand the demographic, and we believe we’re more equipped to build a viable solution.”

Power over paychecks

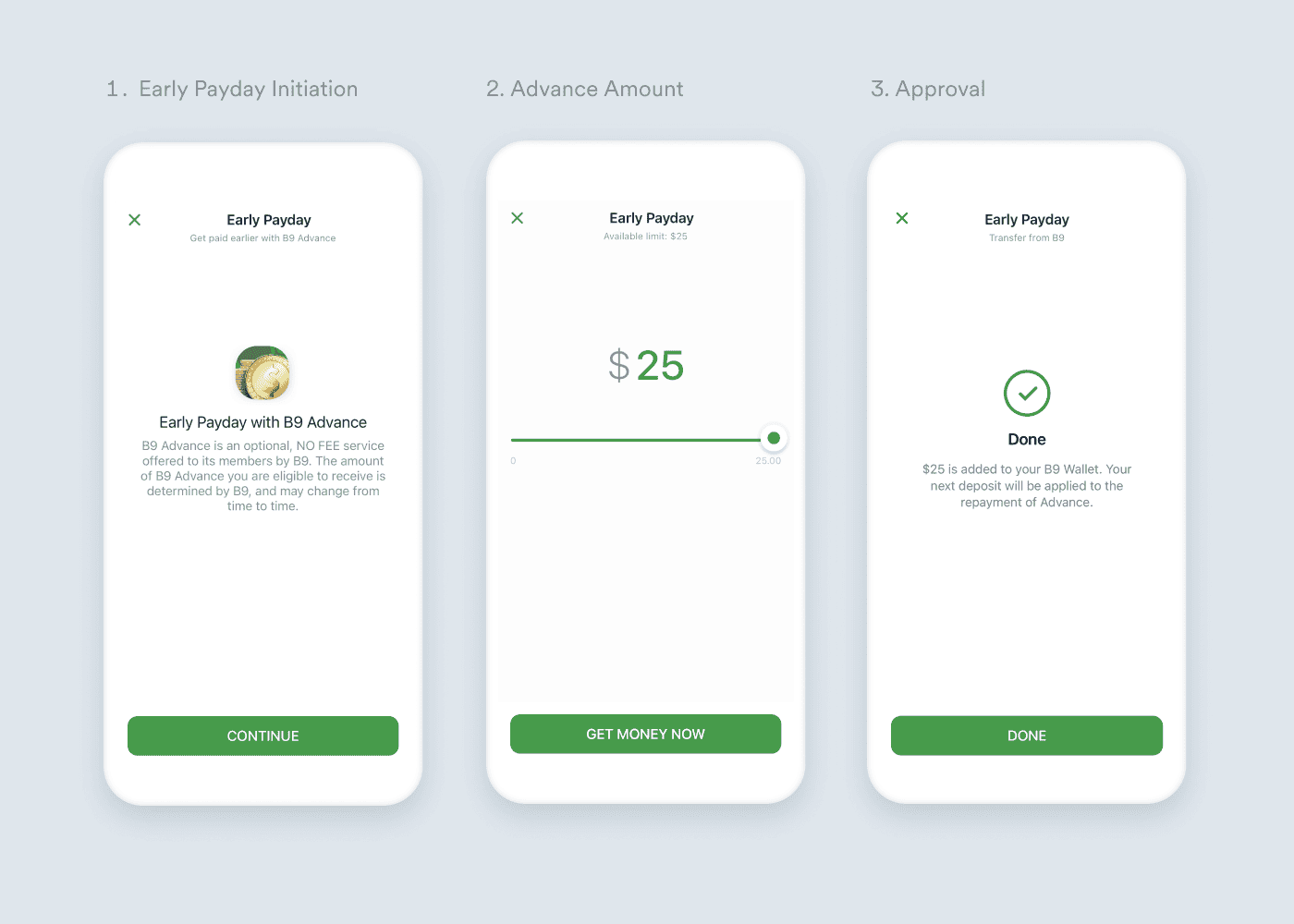

B9 lets workers decide when they receive their paycheck, up to 15 days in advance. Once a client downloads the B9 app, registers their credentials, and sets up an account, they can choose from a suite of helpful products, with no social security number or credit history required. And business is growing fast. Having been on the open market just a few months, B9 is on track to reach 100,000 clients by the end of the year.

The problem: slow setup with stalled rewards

As a mobile-only platform, B9 needs an intuitive way to switch direct deposits. It’s not only what enables clients to fund their B9 account, begin using their B9-issued debit card, and unlock cash on demand—it’s what allows B9 to earn revenue and provide those services in the first place. Initially, B9 switched direct deposits through a client’s bank account, a process requiring multiple steps, transactional costs, and one to three business days to complete. But workers seeking early pay don’t need an advance in three days; they need one now. And those without a bank account—a significant segment of B9’s clientele—get left behind.

“From the get-go, we knew that direct deposit switching is front and center for us as a key performance metric,” said Robles. “We soon realized banking data wasn’t the connection we were looking for, and we had to proactively source a better solution.”

That’s when B9 discovered Argyle’s real-time payroll data.“If you compare banking and payroll data in our industry, payroll is by far the most valuable,” said Robles. “So we reached out to Argyle and got the conversation going.”

The solution: seamless onboarding with inclusive service

With Argyle, clients connect their B9 account directly to their employer or payroll provider and switch direct deposits without ever leaving the B9 app. It’s a seamless, two-step process—and it takes minutes, not days.B9 currently offers Argyle’s payroll service alongside others involving banking data or paper forms. But for B9’s head of product, Alexander Isaev, Argyle is by far the fastest method with the best user experience.

“Payroll switching through Argyle is convenient and user-friendly, with no intermediate steps or additional costs,” said Isaev. “In the end, it’s a much more practical solution.”

Now, B9 can onboard clients and offer cash solutions right away. And, better yet, every type of worker can benefit.

The result: instant access

Argyle’s comprehensive payroll data provides greater visibility into each client, enabling B9 to approve requests quickly and confidently. From B9’s perspective, this instant access is what most differentiates their platform in the marketplace.

“Argyle gives us a holistic view of a client’s income and employment, which empowers us to take on risk,” said Isaev. “It’s a unique market proposition. I don’t know of any other payment service that can offer a salary advance immediately after a client is onboarded—and it’s only possible because of Argyle.”

Higher conversion

Since integrating with Argyle, B9 has seen a notable uptick in conversion, with 70 to 80% of clients streamlining direct deposit switches through their payroll account. This is especially true of gig employees working in nontraditional jobs, who form a crucial client segment. “Argyle’s solution is very popular among gig workers on platforms like Uber Eats, and it gives us a better understanding of how to promote our product among that audience,” said Robles. What’s more, because of Argyle’s broad coverage, very few workers fall through the cracks. For Robles, that means B9 can reach and help even more members of the community.“ We don’t have many clients who can’t find an employer through Argyle,” he said. “It’s just not a pain point.”

Stronger data

As Isaev explained, Argyle’s continuous, real-time data and over 140 endpoints allow B9 to form deeper, more insightful relationships with clients.

“From an analytics perspective, Argyle has a huge data package,” he said. “It enables us to track client behavior and improve the funnel between initial authorization and final payment allocation. With this tool, we can boost conversion month over month and identify the best way to reach each type of client, which is key to our success. It’s really cool stuff.”

For Robles, having Argyle at their back—and knowing that a large percentage of clients will easily convert through Argyle’s platform—has given B9 the confidence needed to scale. “Argyle’s representatives are incredibly responsive when there’s a need for hand-holding,” he said. “They’ve always been there for us. We’re in the people business, and Argyle’s team has really come through—not to mention the product itself.”