Argyle’s enhanced deposit switching flows include new features for adding, adjusting, and removing pay allocations.

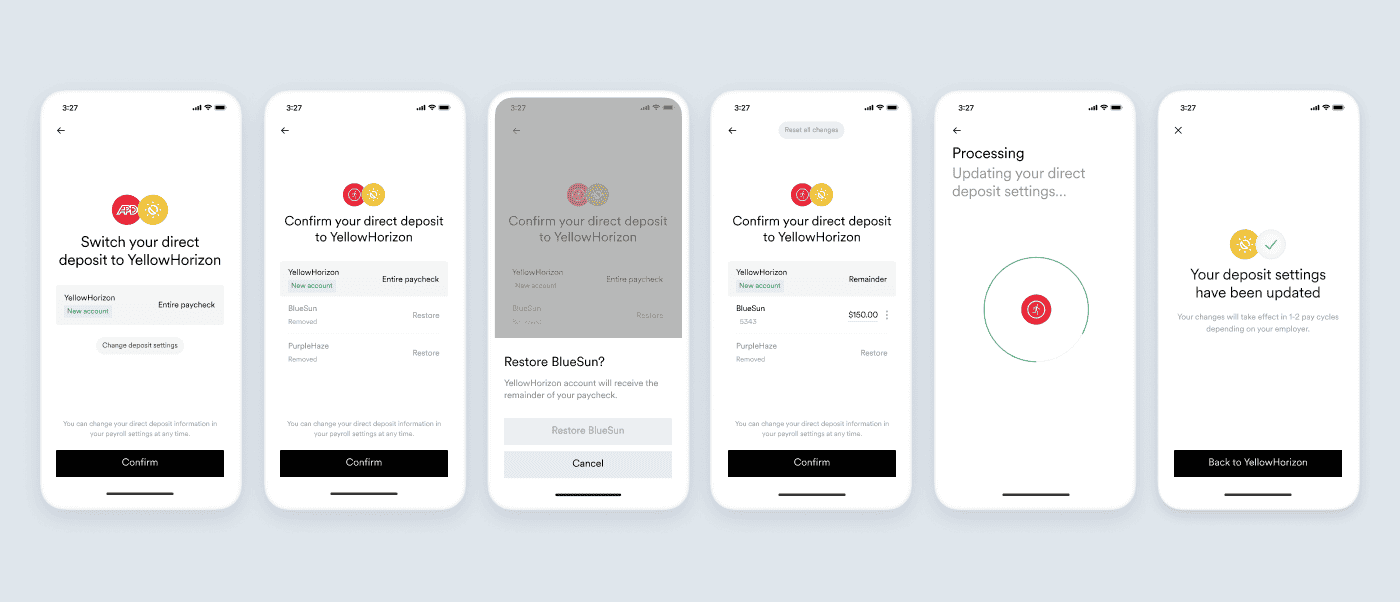

Since launching our direct deposit switching flow via Argyle Link, it has allowed users to connect to their payroll platform and change their paycheck distributions without ever leaving your app. That means, depending on your industry, it can help you seamlessly achieve primary account status or unlock services like paycheck-linked lending for your users—all with their informed consent. Now, we’re making it even better. With Argyle Link 4.7, we’re introducing a simpler, more intuitive deposit switching flow to drive even greater user engagement and conversion rates. Most importantly, we’ve added new features to help you manage the entire direct deposit lifecycle through your platform, including adding, adjusting, and removing pay allocations. Let’s walk through each update and explore the benefits our enhanced flows have to offer.

What we’re solving

For users, switching direct deposit settings can be a long and painful process. It typically involves manually tracking down details and submitting paper forms for each account they’re looking to fund, making it highly likely they’ll drop off somewhere along the customer journey. Argyle Link has revolutionized this ordeal, making it easy for users to instantly update their pay allocations with just a few clicks. But there’s always room to grow—especially when it comes to optimizing user experience. Since day one, we’ve listened to our customers’ feedback and identified new ways to eliminate friction from deposit switching. And with Link 4.7, we’ve put these lessons into action.

How it works

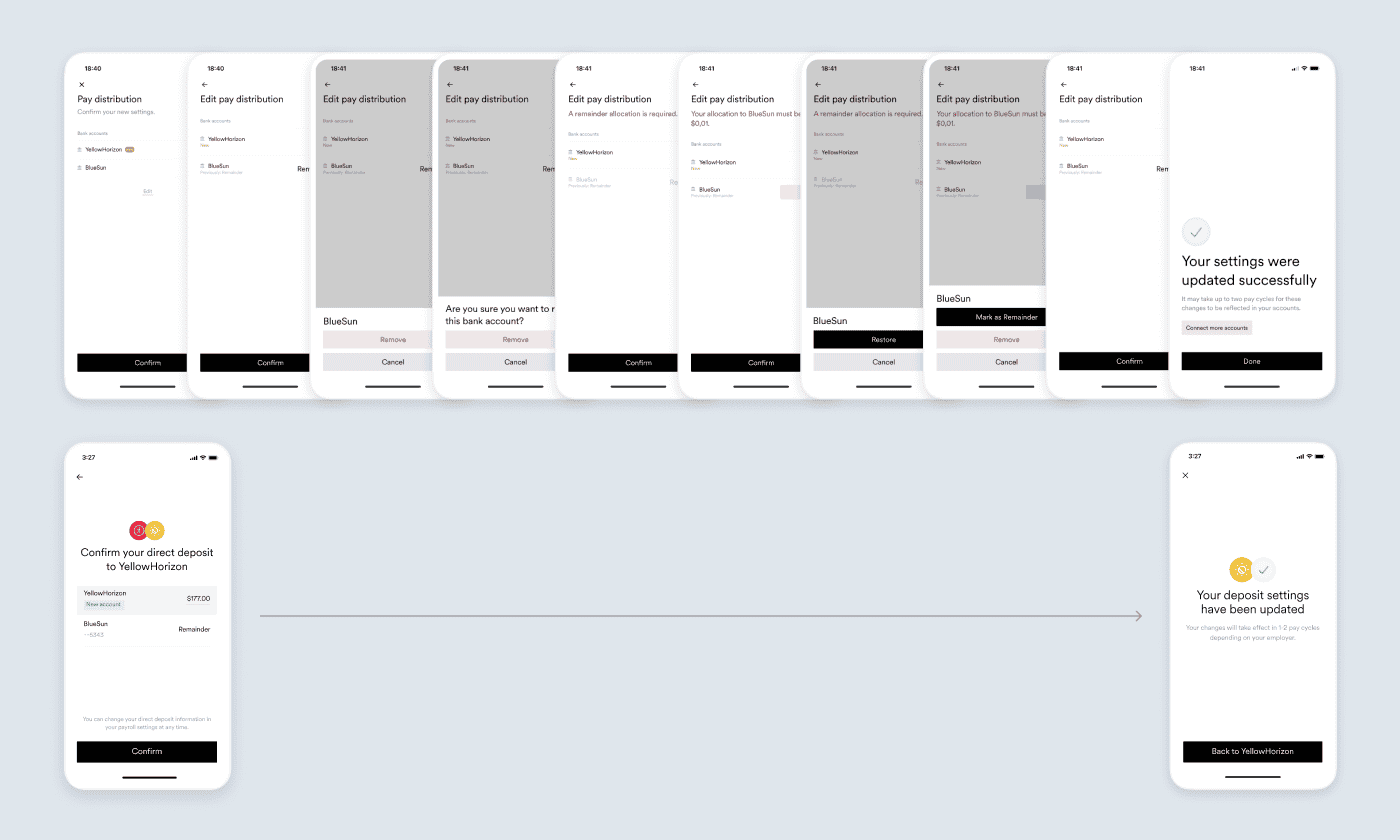

We built six new features into our deposit switching flows; all focused on elevating the user experience while refining each part of the direct deposit lifecycle. These include:

1. A new switching flow for entire paychecks

This straightforward, one-step flow offers an intuitive design and clear instructions that guide users as they confirm a new pay allocation and switch their full deposit to your account. Critical information—like the user’s account number, the financial institution, and the amount to be allocated—is easily accessible, and users are notified upfront that they can change direct deposit details in their payroll settings at any time.

2. Flexible settings for new pay allocations

Now, you can suggest that users deposit their entire paycheck with your platform while still allowing them to opt for a lower amount or to restore standing allocations—like for a paycheck-linked mortgage or other loan repayments.

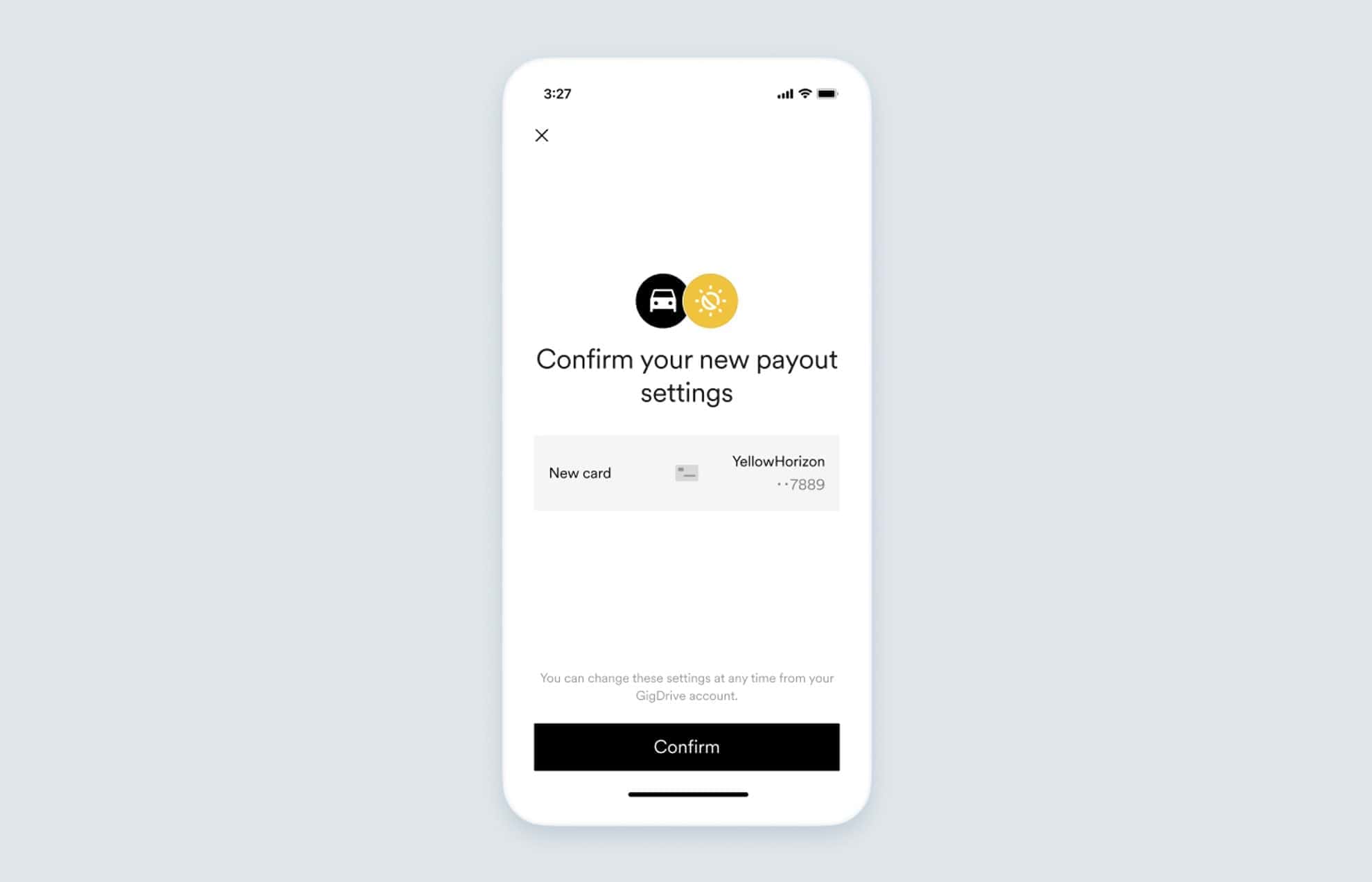

3. Debit card payout switching

Users can adjust payouts and allocations that are serviced through debit card rails. Link 4.7 allows for debit card payouts to easily be switched to any debit card (not just gig or platform-issued cards).

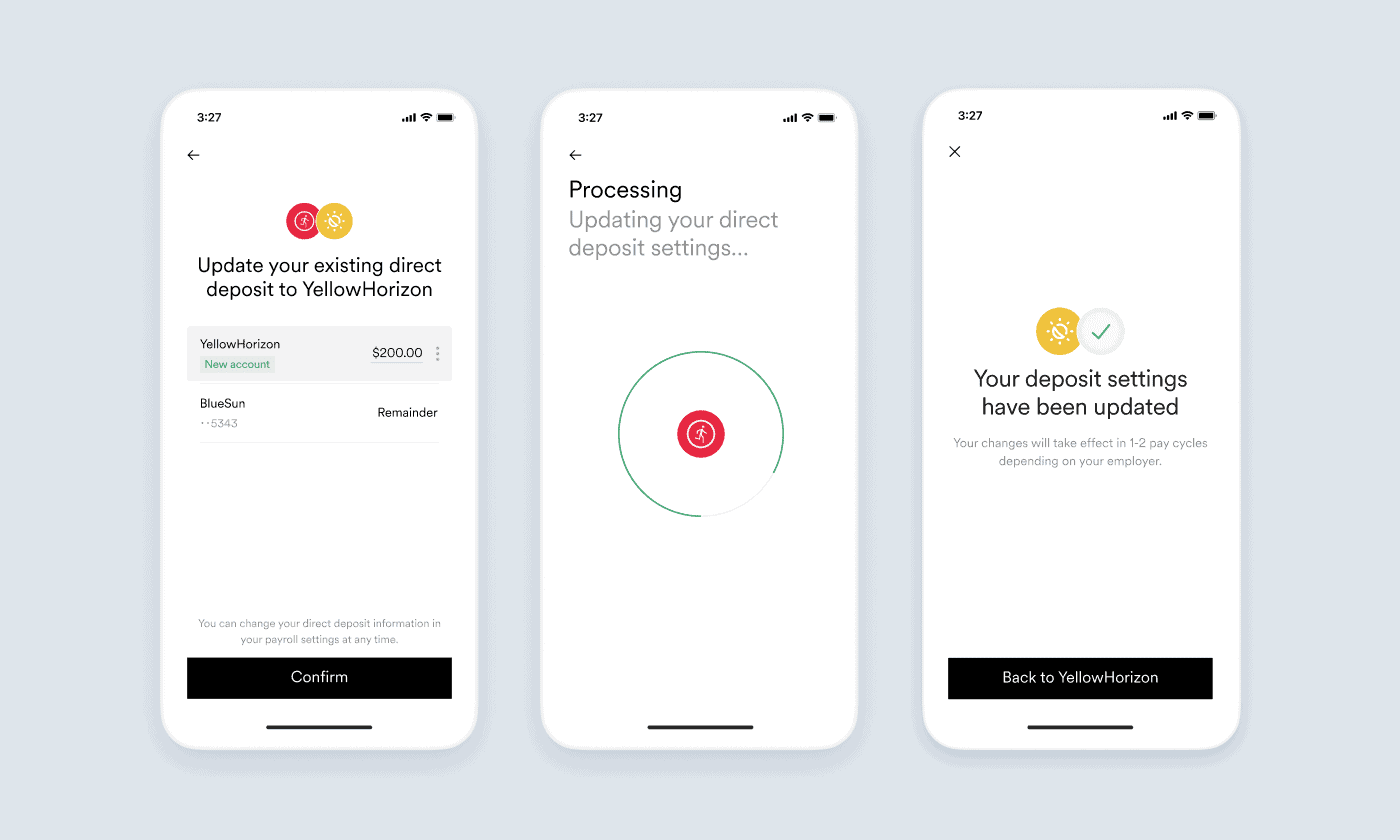

4. Less friction when editing deposit settings

We’ve reduced the number of steps it takes to edit a direct deposit from 10 to two—simplifying the process and limiting opportunities for user dropoff and human error.

5. A clearer way to define the allocation type

We now let users select the type of pay allocation—either a specific dollar amount or a percentage of each incoming paycheck—before they enter their deposit switching details, allowing this initial choice to shape the rest of the flow.

6. A new flow for adjusting pay allocations

Rather than treating any update as a new pay allocation, we’ve introduced a separate flow that enables users to adjust an existing allocation—a critical step for services like refinancing.

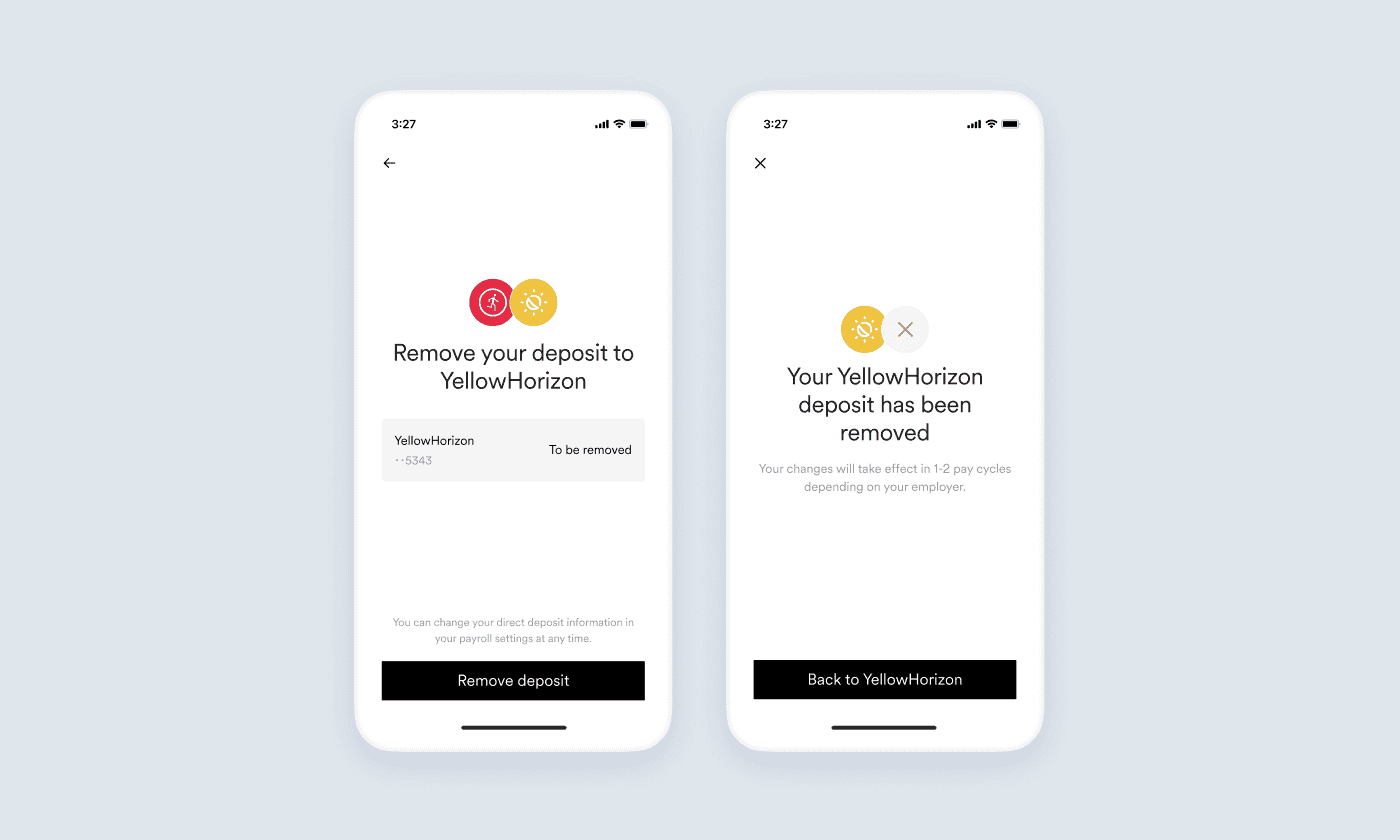

7. A new, differentiated flow for removing pay allocations

Similarly, we’ve added a smooth flow that lets you prompt users to remove an existing pay allocation—for instance, if a paycheck-linked loan has been covered. All it takes is a tap. Thanks to Argyle’s continuous data access and webhook alerts, you’ll also be notified instantly of any significant changes—like a direct deposit adjustment you did not initiate. That means, even after a user has added or edited a pay allocation, you’ll be able to monitor their connection in real-time and identify opportunities to tailor your solutions and boost lifetime value.

Why you’ll love it

We’ve kept the best parts of our direct deposit flow but streamlined the content and design to amplify the user experience—while adding dynamic new flows that help you manage the direct deposit lifecycle from end to end.

Ready to build with enhanced direct deposit switching?

Reach out to the Argyle sales team to learn more about our new deposit switching flows—or jump into our docs to see how they work.