Argyle is sunsetting paper paystubs and scanned PDFs for an automated, standardized alternative.

Paystubs have historically been the common denominator when it comes to verifying income for a loan or mortgage—and for good reason. They bring important information like personal details, base pay, gross earnings, deductions, contributions, and tax withholdings together on a single sheet of paper.

But, frankly, paystubs are also a bureaucratic pain. You have to request them, wait for your customer to retrieve, scan, and send them, and then restructure selected data that’s been formatted in many different ways by many different providers.

That’s why we’re introducing digital paystubs—a modern alternative that’s compatible with the way lenders use paper paystubs and PDFs today. Digital versions carry the same critical data in a comprehensive, itemized list, without all the hassles and errors that come from manual workflows and third-party OCR services.

Ask any other income data provider: can they provide you with the exact digital equivalent of a traditional paystub, with all the same data? No. But now, Argyle can.

Below, we take a closer look at what this new feature solves, how it works, and why it will transform your income verifications for the better.

What we’re solving

To meet regulatory compliance requirements, lenders and mortgage processors need detailed tax withholdings and gross and net pay information that can only be found on a paystub.

But manually sorting through and entering data from paper documents and scanned PDFs—or paying a third-party OCR processor—can have several negative business consequences. These include:

Wasted time and resources: Whether someone from your team is manually entering paystub data or scanning and sending documents to a third-party processor, they’re using up hours and effort that could be spent on your core products and services.

Human (and OCR) error: People make mistakes—and so do machines—especially when a paystub’s image quality is poor. Even the best OCR systems only promise accuracy up to about 99%, and those little errors (that you’re still paying for) can have a big impact on lending decisions and the overall trajectory of your business.

Inconsistent data structures: Paystubs come in all sorts of different shapes, sizes, and formats, and getting income data into a standardized, usable form often means juggling multiple vendors and API schemas or trying to untangle the data structures yourself.

Poor borrower experience: When you ask for a paystub, your customer has to log in to their payroll platform (or search through their mail), scan or download a paystub file, and then upload it to your system—leading many to simply give up.

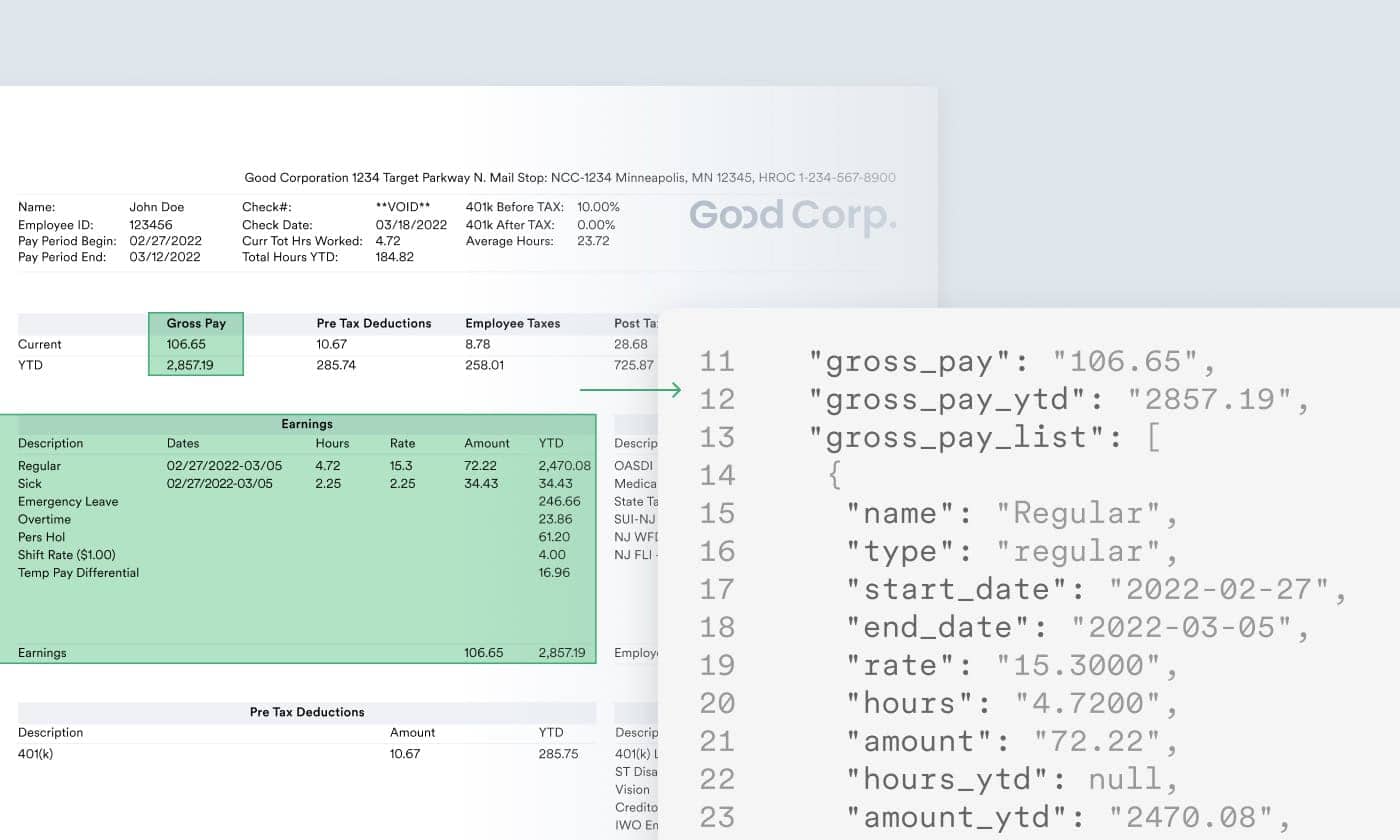

With Argyle’s auto-filled, digital paystub, your customers can connect programmatically to their payroll provider and stream itemized income data straight from the source to our standardized form, making the entire verification process efficient, accurate, and effortless.

How it works

The best part about Argyle’s new digital paystub feature? It introduces zero friction to our platform.

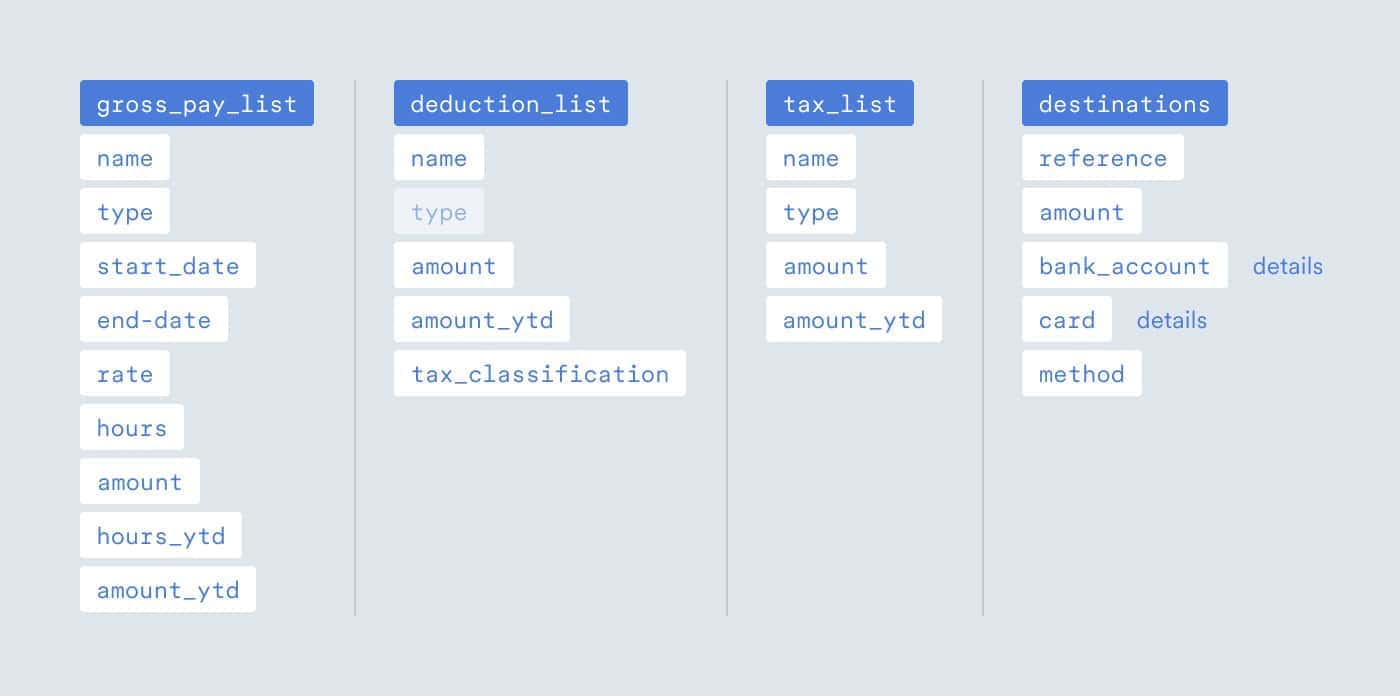

You’ll enjoy the same seamless experience you always have when retrieving customers’ income via Argyle, but now you’ll receive a richer dataset providing a complete breakdown of every line item on their paystub. And for those instances when you need a copy directly from payroll, we include a PDF attachment of the original paystub with every standardized version.

As of this posting, Argyle’s digital paystub is compatible with over 60% of our services, and we’ll be rolling it out to 80% coverage by the end of October and 100% coverage by the end of the year.

Why you’ll love it

No one loves the inconvenience of chasing down, processing, and interpreting static, irregular paystubs. With Argyle’s new digital alternative, the same data (and more) is collected for you and auto-populated into a standardized, easy-to-read table with the click of a button.

Check it out

The new digital paystub fields can be accessed via the /payouts endpoint of the Argyle API, as well as in Argyle Console. Jump into our docs to explore the entire set of available data fields. You can also reach out to your account manager or contact one of Argyle’s data experts to learn more about how we’re sunsetting traditional paystubs for a better, digital alternative.

If you’re ready to see our modern paystubs in action, sign up for a free account, and test them out for yourself.