See how Argyle’s payroll connections, direct deposit switching, and paycheck-linked lending capabilities work IRL with an end-to-end loan application demo

If you’ve been following Argyle’s updates, you’ve likely heard about or even tried our Sample Apps—a set of interactive templates that help you build quickly with curated documentation that can be dropped right into your platform.

So far, we’ve introduced sample apps for Banking and Earned-Wage Access, as well as an inline Employer Search feature that normalizes data inputs, and an Income Visualizer dashboarding tool that allows users to view and analyze their income through customizable charts and displays.

Now, we’ve added a Loan App to the mix that takes you through the basics of a simulated loan application—including options for paycheck-linked lending (PLL)—and demonstrates where and how Argyle’s solutions fit in to simplify the flow.

Read on to learn what our new Loan App does, how it works, and how you can use it to inform and enhance your next build.

What we’re solving

Argyle supports many different components of an online loan application, including:

Real-time income verifications through direct, programmatic connections to users’ payroll accounts

Autocomplete and deep-linking capabilities through a smart Employer Search bar

Automatic repayment through direct deposit switching and our paycheck-linked lending solution

But unless you see these tools at work as part of an actual loan application flow, it’s difficult to gauge what they’ll look and feel like in practice or to imagine how users might encounter them on your platform.

Our new Loan App eliminates the guesswork and paints a clear picture of how Argyle works with an interactive demo that walks you through an Argyle-powered application from end to end.

How it works

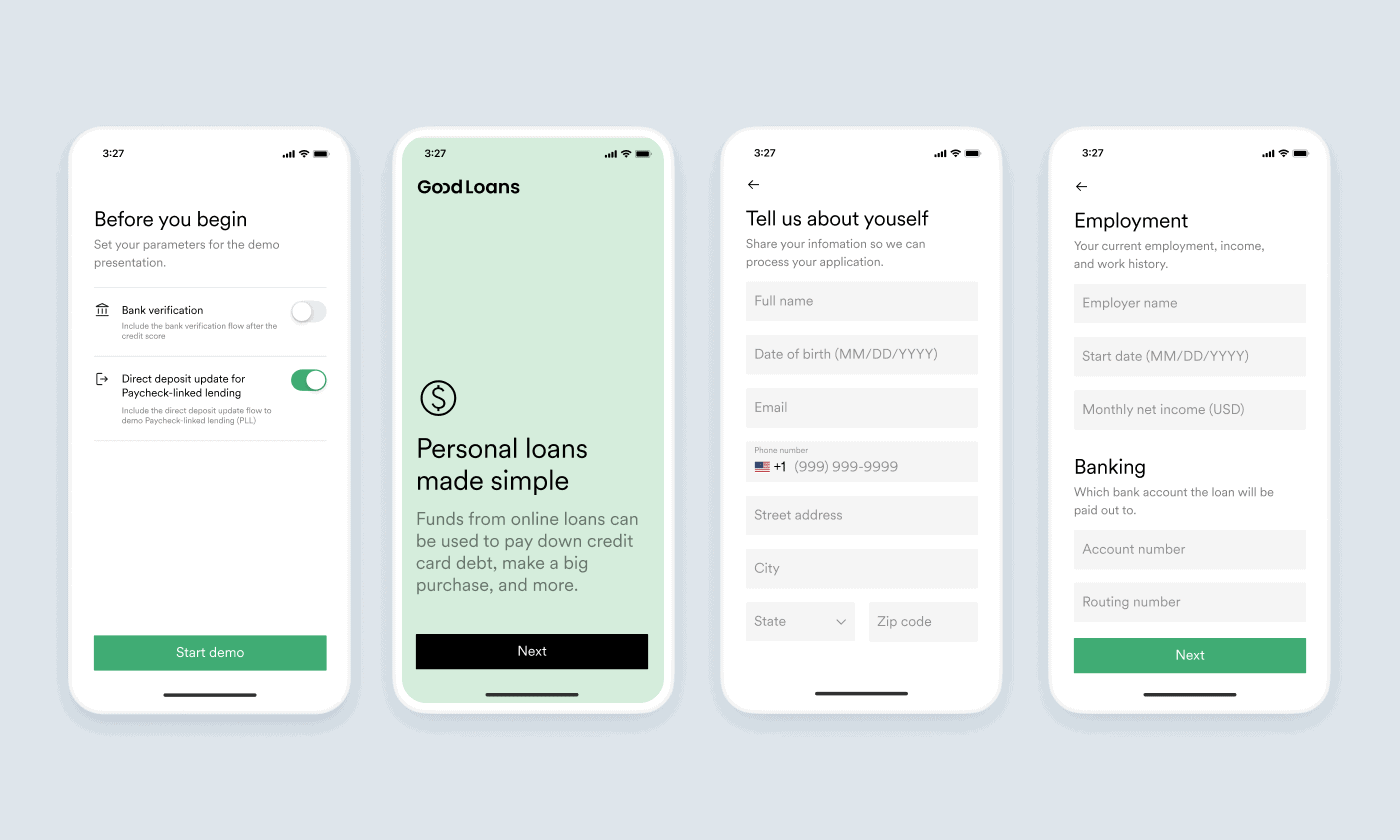

When you click into the Loan App, you start on an admin screen where you can customize your application experience.

Specifically, you’re asked if your platform currently runs bank verifications and whether you offer (or want to offer) paycheck-linked lending solutions. Your answers here will determine which components are included or skipped in the rest of the sample application flow.

From there, you can jump right into the demo, with a series of opening screens that introduce the lending platform and ask for basic personal and financial information.

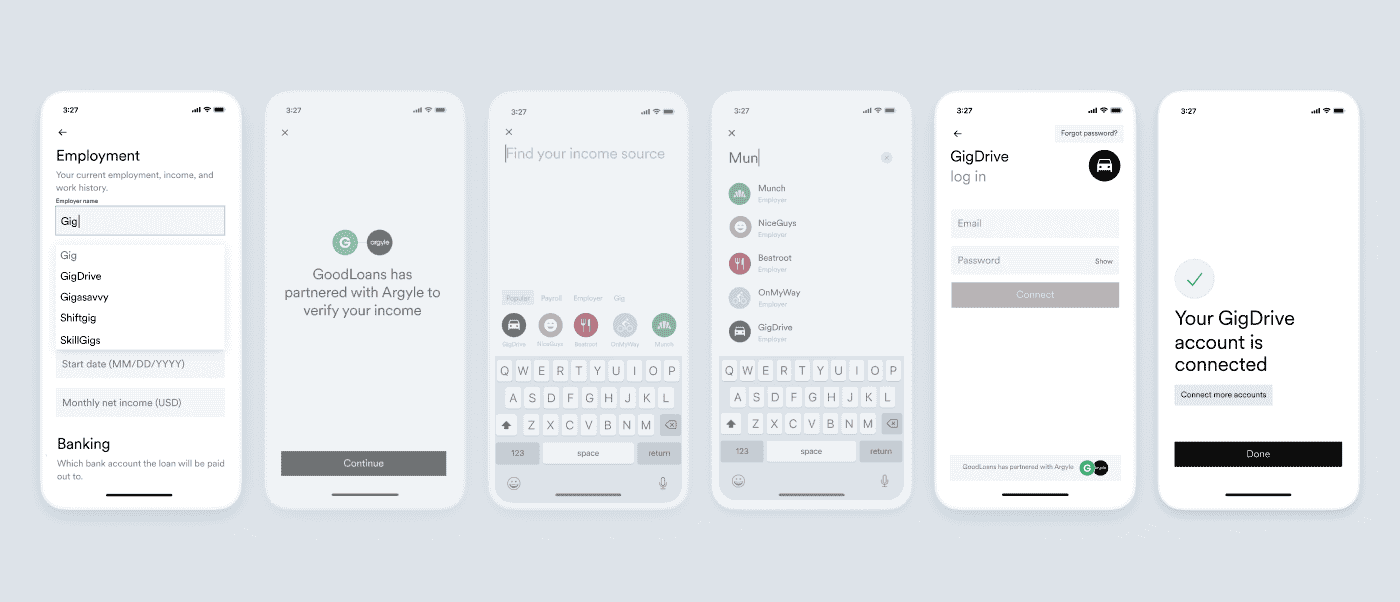

This includes an embedded Employer Search bar, which automatically completes and matches a user’s employer name as it’s typed, enabling you to deep-link directly to that employer’s login screen.From there, users can connect to their employment or payroll account and streamline their income verifications using Argyle Link’s quick, two-step process.

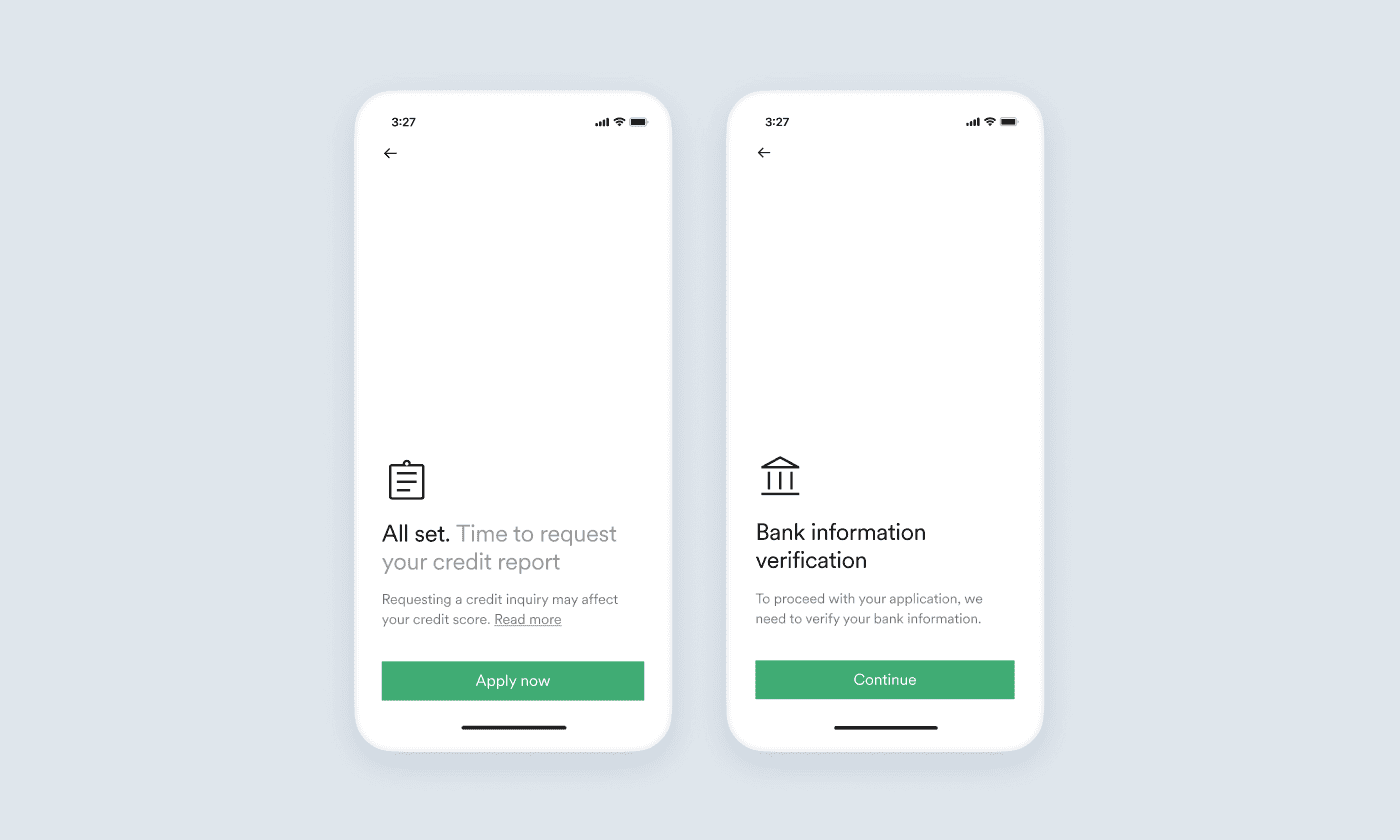

You’ll also find placeholders for key external flows—like credit checks and bank verifications—that you may or may not include in your loan application.

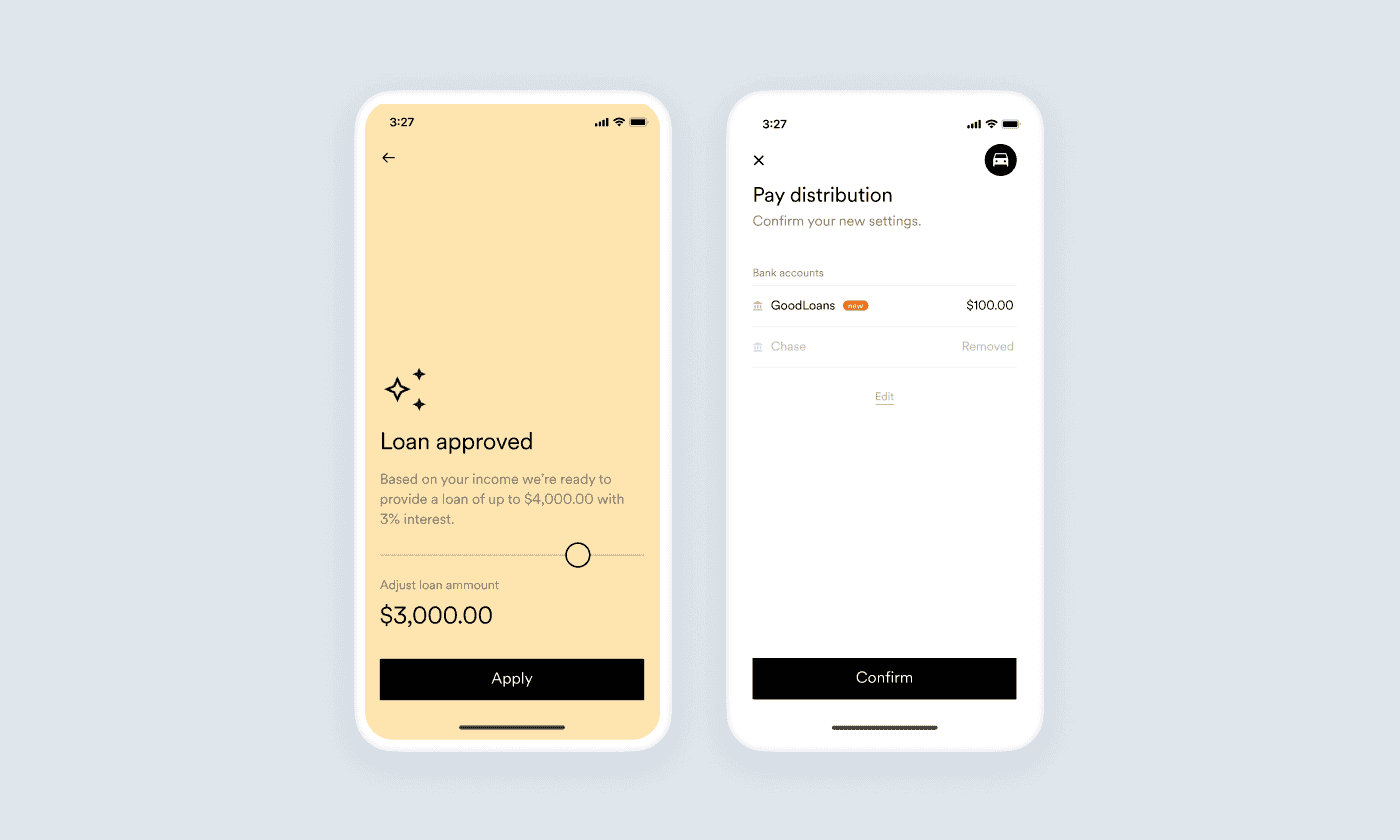

Once the sample loan is approved—if you’ve opted to include PLL capabilities—you’ll move on to Argyle’s pay distribution feature. There, users can automatically allocate a portion of each incoming paycheck to their loan obligation, rather than planning out and submitting each repayment manually.

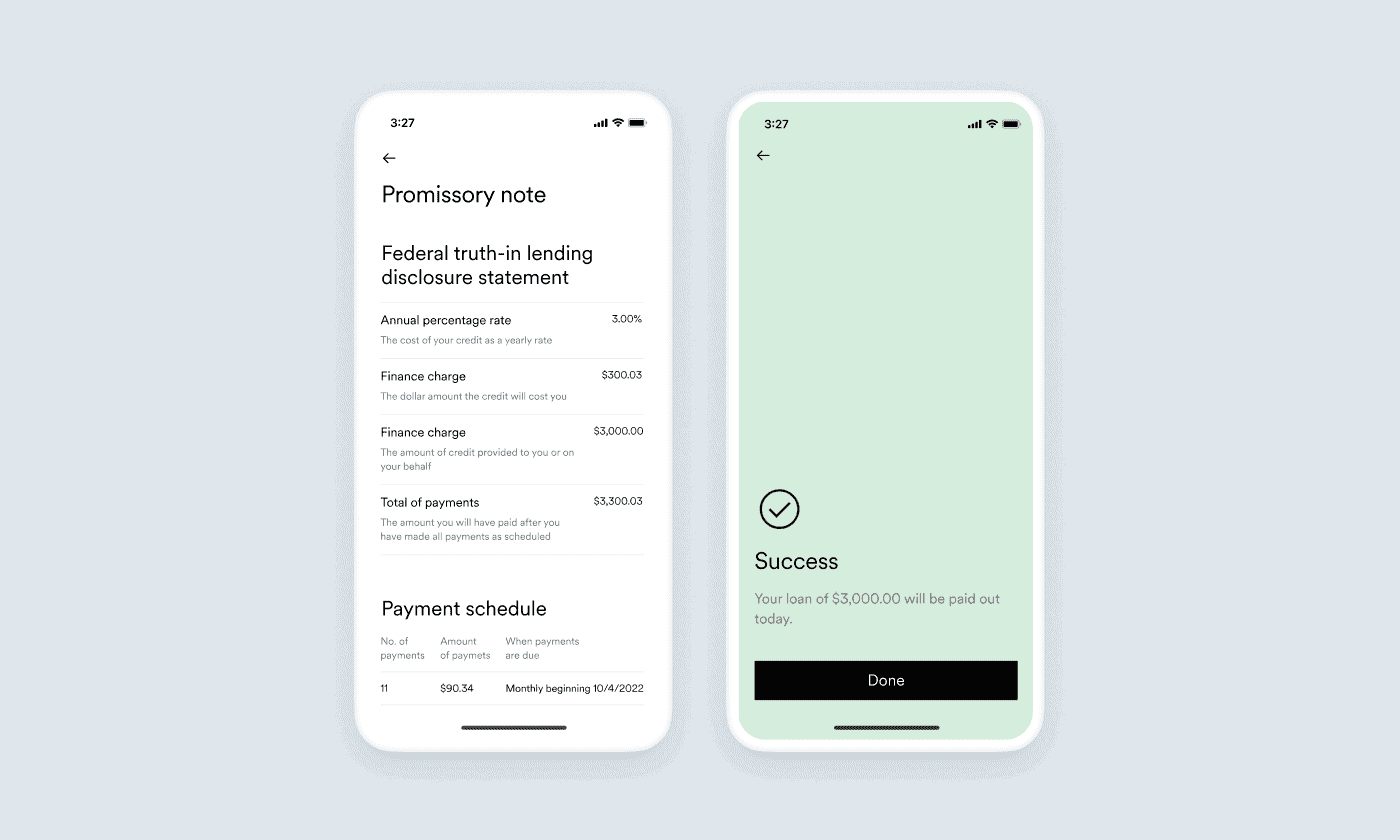

Finally, you’ll pass through a standard contract page and success screen—and voilà, the loan application is complete.

Why you’ll love it

It’s one thing to read about the benefits of Argyle’s income data solutions—but it’s quite another to see them in action.

With our new Loan App, you get a full working model of an Argyle-powered application flow, so you can experience the simplicity and seamlessness of our products first-hand and use them to inform and inspire the foundations of your next build.

Ready to enhance your loan application?

Reach out to an Argyle account executive to learn more about our Loan App—or check it out for yourself in our Sample Apps library.