As AI tools still can’t tell fact from fiction, the ability to stream financial data straight from the source provides much-needed accuracy and assurance.

It’s safe to assume that all agree: Manual data collection and analysis is not only slow and time-consuming, but vulnerable to unintentional oversights and intentional fraud. So, it’s no surprise that many banks, lenders, fintechs, and other financial service providers are turning to innovative technologies that use generative artificial intelligence (AI) to automate data collection and decision-making processes from end to end.

But, in many ways, AI can’t be trusted any more than humans. It’s trained on human-generated material—with all of the mistakes and biases that entails—and it has significant trouble separating what is true from what is not.

For those seeking a process that’s both fast and reliable, direct-source data—or data that comes straight from the platform that produced it—offers a more practical solution.

Read on to discover the gaps that direct-source data can fill in modern technology, how financial service providers can use it to ensure accuracy and authenticity, and how it could suggest a promising path forward for the future of AI.

Where AI falls short

If you think about it, deciding what’s true versus false isn’t black and white. What’s true—or what someone perceives to be true—changes over time, and it often comes down to interpretation.

That’s why many argue that identifying ”truth” is a question of semantics over simple math. This is bad news for generative AI tools trained on binary systems and limited data sets, and they’ll likely always require human assistance when rooting out false information.

Determining what’s true becomes especially murky when it comes to financial data. Information from a consumer’s bank account, payroll records, or credit file that was true months, weeks, or even days ago may no longer paint an accurate picture of their finances today. Any shift in employment, income, debt, or investment performance can have an immediate impact on their financial health and alter their ability to open a new account or take on a new financial service.

Generative AI tools lack ongoing, real-time access to the latest data, as they are generally fed static, pre-existing material to build their algorithms. That means that the freshness and quality of the insights they produce—especially if financial in nature—should always be called into question. If there’s flawed data going in, there’s almost certainly flawed data coming out.

The advantages of direct-source data

By cutting out any middlemen (human or otherwise), direct-source data offers an exact, one-to-one reproduction of whatever records it represents in real time.

In most cases, it travels via an API integration, or underlying infrastructure that connects the originating system (like a payroll provider, employer, or bank account) to the delivery system (a data provider like Argyle or Plaid). You can think of it like a pipeline or aqueduct that transports water from a lake or river directly to a city’s central water supply.

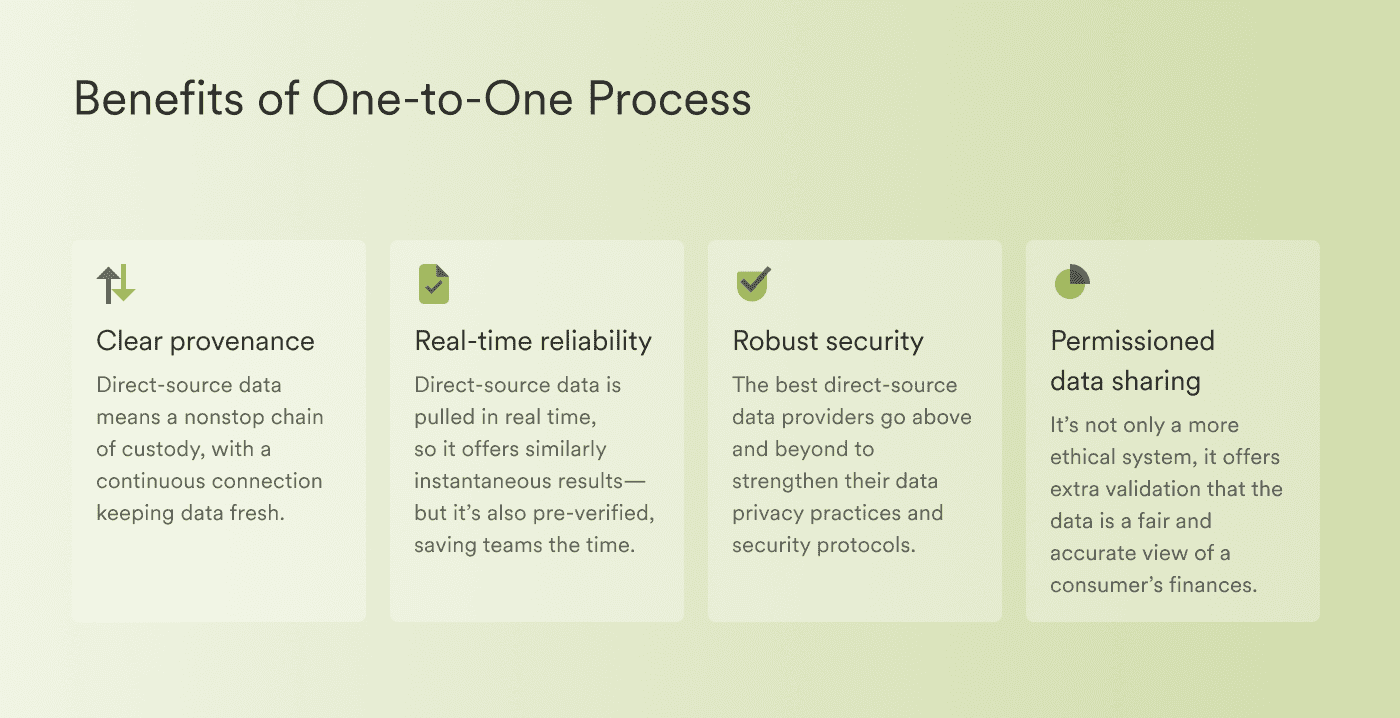

This one-to-one process offers several benefits:

Clear provenance

Provenance, sometimes called lineage, is a documented trail that tells you how something arrived at its present location. In other words, it’s a way of charting an item’s journey from its original source and identifying every stop along the way.

When it comes to financial data, the transporting infrastructure or API captures not only where that data originated, but when it was last updated. Direct-source data means a nonstop chain of custody, with a continuous connection keeping data fresh.

Real-time reliability

One of the main reasons generative AI tools are so attractive is their efficiency. They can not only compile large amounts of financial data, but process it, analyze it, recognize complex trends and patterns, and pull out critical insights in a matter of seconds.

The problem is, if humans then need to jump in and verify that the data these insights are based on is correct, they’ll use up many of the hours saved by AI in the first place.

This can be avoided by using direct-source data at the start of the process. Direct-source data is pulled in real time, so it offers similarly instantaneous results—but it’s also pre-verified, saving teams the time and headaches of inspecting output down the line.

Robust security

Debates are still ongoing as to who is responsible for regulating AI—or whether it can be effectively regulated at all. There is no question that increased AI adoption introduces certain privacy and security risks for businesses and consumers, as without the proper oversight, any sensitive data shared with an AI system could be compromised through a cyberattack or an accidental leak.

Direct-source data providers, on the other hand, are often established data transfer agents or data stewards, subject to industry standards set by the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB), among other regulatory bodies.

The best direct-source data providers go above and beyond to strengthen their data privacy practices and security protocols, and they make their policies transparent.

Permissioned data sharing

With direct-source data, technology and humans actually work together to enable faster, smarter data sharing.

Unlike other financial data sources, direct-source models are consumer-permissioned. That means consumers must actively participate in connecting their payroll or other accounts by providing their credentials, and their financial data is only accessed with their fully informed consent.

It’s not only a more ethical system, it offers extra validation that the data being furnished by a third-party payroll provider, employer, bank, or other institution is a fair and accurate view of a consumer’s finances.

Leveraging direct-source solutions for better data

Direct-source data not only offers immediate business benefits for financial service providers—with greater coverage, cost savings, conversion rates, and access compared to legacy data reporting models—it also offers a promising path forward for generative AI tools looking to boost their accuracy and reliability.

The more decision-makers lean into direct-source, consumer-permissioned data, the more it can be used to train emerging AI tools and make verified, real-time financial data the industry standard. Only then can AI play a central role in shaping the future of finance and presenting powerful new insights that businesses—and consumers—can trust.

Discover direct-source payroll connections with Argyle

Argyle is the leading network for income and employment data, giving businesses easy, real-time access to the financial data and documents they need to run verifications, conduct background checks, fund accounts, switch direct deposits, calculate premiums, and more.

To learn more about our solutions, reach out to a member of our team—or register for a free account to explore our platform for yourself.