Consumer lenders can either catch up to the data revolution—or fall behind and accept the shortcomings of the status quo.

We live in an era of unprecedented data quality and availability, but much of the consumer lending industry is falling behind. Lenders are still verifying tremendous loan volumes by hand and relying too heavily on credit scores and other old school data sources to assess borrowers’ creditworthiness. In turn, their operational costs are bloated, their capacity to process loans is throttled, and they’re heavily restricting their addressable market.

In this article, we explore the current realities of consumer lending and what some lenders are doing to solve the problems of the status quo.

Visibility is in reach

As recently as a decade ago, it was practically impossible to paint an intricate picture of a consumer’s financial circumstances, because the details of their finances—from how reliably they pay their bills to their present and historic cash flow—were locked up in siloed data sets. And even if you were able to get those details through phone calls, emails, and paper forms, the data would come to you outdated and possibly fraudulent, making it difficult to trust.

The API boom of the past 5 years has upended this once-accepted reality by making it possible for lenders to access verified, real-time consumer data directly from sources of truth.

But consumer lending is slow to adapt

Despite the advances in API technology, the consumer lending industry operates much the same way it has for decades. Which is to say, lenders continue to collect excessive volumes of consumer financial data by way of manual entry and email, and they’re spending countless hours and millions of dollars, compromising their ability to efficiently scale.

Correcting these issues is critical. Outstanding personal loan balances in the U.S. amounted to $245 billion in Q1 2024—an increase of more than 10% compared to the previous year and the highest amount of personal loan debt ever recorded. And there is good reason to believe it will only go up: credit card debt and delinquencies are growing, too, and managing credit card debt is the top reason consumers take out personal loans.

So, aside from the sheer number of hours and dollars lost to manual verifications, there is also the opportunity cost of throttled origination capacity. The more verifications lenders complete by hand, the fewer loans they can process, and that’s akin to leaving money on the table.

Then there’s the problem with credit scores

Compounding their challenges is lenders’ overreliance on credit scores. No doubt, credit scores are useful, but they are only reflective of how a consumer has managed debt in the past, which is just one piece of their financial puzzle. Perhaps most problematically, credit scores operate on a significant delay (events that affect credit scores aren’t reported to credit bureaus in real time) and have been found to contain significant inaccuracies that can be difficult for consumers to correct.

As a result, credit scores can be misleading indicators of creditworthiness. Case in point: a 2023 survey revealed that 40% of consumers living paycheck to paycheck have super-prime credit scores. Meanwhile, around half (50.7%) of consumers living paycheck to paycheck with issues paying their bills report having super-prime or prime credit scores. That’s an astonishing number of “good” credit risks who are one unexpected cost or life event away from default. At the same time, “bad” credit can belie a good credit risk, as many thin-file consumers are actually in sound financial standing. They are simply victims of having little to no credit activity to report.

To remedy these limitations of credit scores, some lenders supplement their understanding of consumers’ finances with banking data. But that, too, poses issues, as it takes extensive modeling to turn net deposit values into an even halfway reliable indicator of income.

At best, this puts lenders at a competitive disadvantage. At worst, it puts lenders at risk

Adhering to an underwriting model based primarily on outmoded credit scores compromises lenders’ market share. Without proper visibility into a consumer’s income, many resort to setting conservative credit score thresholds that exclude significant consumer segments from their addressable market. This is particularly true in a challenging credit environment.

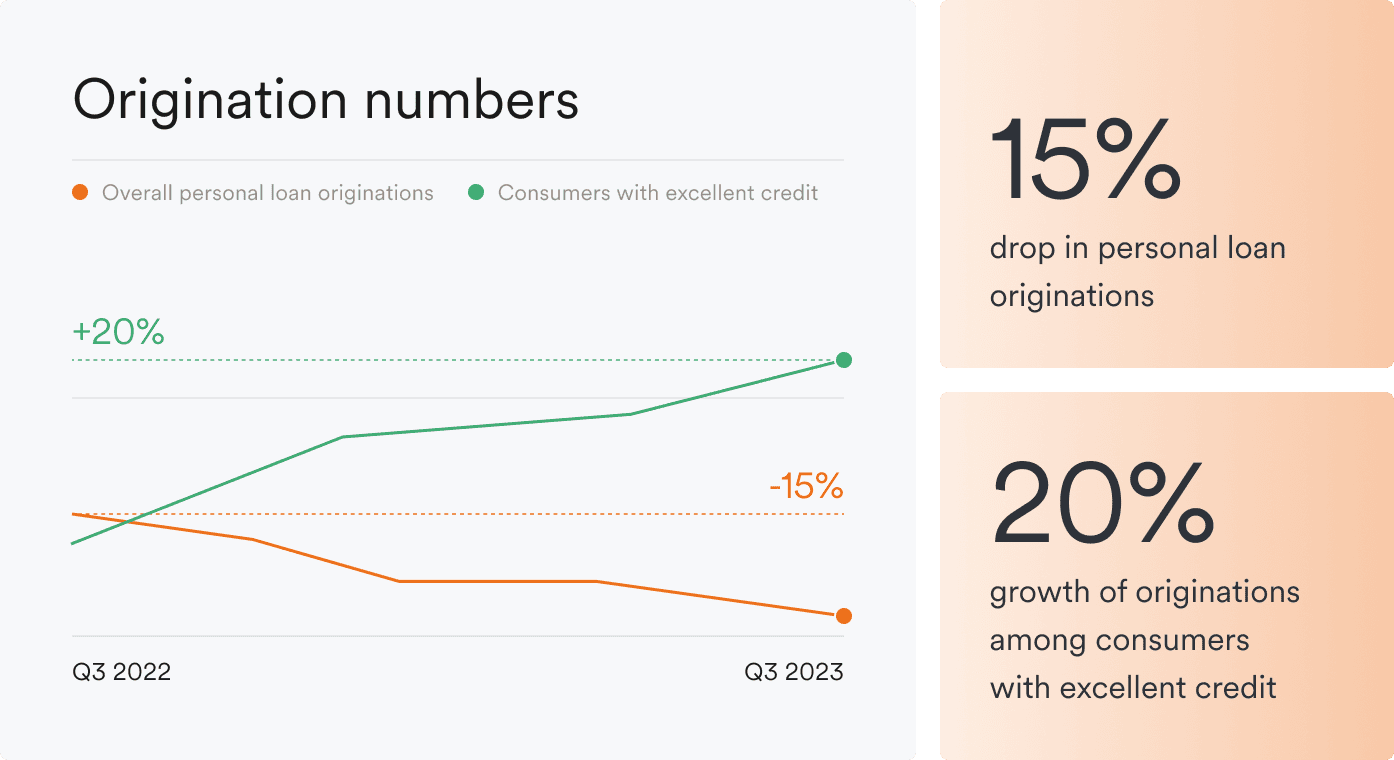

That appears to be what’s happening when we look at origination numbers. Q3 2023 showed a 15% year-over-year drop in personal loan originations. At the same time, originations among consumers with excellent credit grew by 20% YoY, indicating lenders may be tightening their credit criteria overall and focusing their efforts on super-prime borrowers.

In other words, without better data, it’s simply too difficult for lenders to properly identify quality, low-risk borrowers and weed out the higher risks.

Then there’s the matters of credit and regulatory risk. When you are making credit decisions based on inaccurate, outdated, or speculative data, you are more likely to approve borrowers who will default. Not to mention the fact that when you have hundreds of loan officers making very sensitive decisions by hand, thousands of times per year, you are at elevated risk of security breaches and running afoul of federal fair lending laws. If you get either wrong, you could face heavy fines and take a major hit to your reputation.

The answer is payroll connections

There is a way lenders can significantly lower their verification costs, expand their TAM, and reduce their credit and regulatory risks: payroll connectivity. When lenders deploy payroll connectivity to verify income and employment and underwrite personal loans, they gain access to the extensive set of consumer data locked in the country’s vast payroll market and open up incredible advantages in the process.

With payroll connectivity, invaluable data like borrowers’ real-time employment status, pay frequency, gross and net income, job tenure, the length of each direct deposit allocation, and more are at lenders’ disposal. What’s more, they can aggregate and verify these data points instantly and automatically across borrowers’ income streams—whether they work traditional W-2 or contract-based 1099 jobs—giving them a complete picture of their financial circumstances.

The benefits are significant:

More automation Lenders replace hours of manual reviews with instant verifications and faster credit decisions.

Lower cost per funded loan Automations maximize processing volumes and lenders’ submitted-to-funded ratio.

Reduced risk exposure Fewer manual interventions amounts to tighter privacy controls and smarter, unbiased credit decisions.

Simply powerful payroll connections

Payroll connectivity is not the future of consumer lending. It is increasingly the present. And making it all possible is Argyle, the leading provider of direct-source income and employment verifications and the most established and reliable payroll connections platform available.

Since 2018, we’ve brought together hundreds of the brightest minds in the game to build fast, cost-effective, consumer-permissioned connections between payroll processors and lenders of all kinds. Today, lenders that use Argyle benefit from 60 to 80% lower verification costs, our market-leading 55% conversion rate, and superlative data completeness and quality capable of powering the most sophisticated credit models. It’s why lenders like BMG Money and Regional Finance rely on Argyle to help process and underwrite loans.

Get started with your first verification report, or contact sales to see how Argyle can best support your organization.