Spend less time chasing documents and more time closing loans by using live payroll connections that deliver direct-source income and employment data.

As a seasoned loan officer, you’ve witnessed profound industry change over the last few years. More loan applications than ever are being filled and submitted online, rather than on paper or over the phone, resulting in more efficient onboarding processes and shorter overall timelines.

But there’s one critical step that, for the most part, has remained stubbornly manual: verification of income (VOI) and employment (VOE).

You may have a tried-and-true method of calling or emailing employers to confirm financial details, having borrowers scan and send documents like paystubs and W-2s, and/or paying a database like The Work Number (TWN) to provide verification reports. No matter which of these methods you choose, you (and your borrowers) are pouring more time, money, and effort into the process than necessary. This comes at the expense of more profitable, “green” activities like building business relationships, attracting more applications, closing more loans, and developing expertise in more specialized products like DSCR or ITIN loans.

Below, we lay out why traditional verification processes are holding loan officers back—and how automating your VOI/VOE flows with payroll connections and direct-source data can help you take your lending practices to the next level.

What’s wrong with manual verifications?

If you’re relying on manual verifications, you’re likely spending much of your day chasing down documentation. That includes everything from asking borrowers to upload their paystubs to asking them to re-upload their paystubs when your underwriters reject their truncated or otherwise inadequate images (to name just two examples).

This not only creates busywork for you, it introduces needless points of friction for your borrowers.

Even if you’re using a database like TWN to obtain borrowers’ income and employment data, you often end up with an incomplete or inaccurate VOI/VOE report. This is especially true if borrowers are paid in less common ways, like through commissions or direct-to-card gig payouts. Plus, TWN doesn’t provide the required documents you need to satisfy internal protocols—meaning you still have to ask your borrowers to supply them.

To break it down, here’s how all of this can affect your business—and your career:

Chasing data and documentation is time-consuming.

Time you spend following up with borrowers and gathering their financial forms is time you don’t spend growing your business and earning commissions.

The quicker you can qualify a borrower, the quicker you can hand their account off to a processor and move on to other, more impactful tasks.

Inaccurate data can lead to painful buybacks.

In response to higher numbers of loan repurchases among GSEs and mounting origination costs, lending companies are implementing stricter buyback rules. In many cases, a loan officer will have to repay their entire commission if a loan they originated is bought back for any reason within six months.

That puts even more pressure on you to ensure the data, documents, and reports you’re handling are accurate.

A bumpier buyer experience means fewer closed loans.

It’s no secret that modern consumers prefer fast, frictionless, and fully digital experiences. In fact, research shows that up to 68% of potential borrowers will abandon your onboarding flow if you put too many obstacles in their way. That number will only grow as demographics shift and millennials and Gen Zers account for more and more of your customer base.

That means the more you ask borrowers to submit their own financial documents, the likelier they are to churn (and the likelier you are to lose out on a commission).

High costs are attractive to no one.

You yourself may never feel the direct monetary effects of your verification choices. The time and labor costs you incur carrying out manual VOI/VOE tasks are ultimately shouldered by your company. And the steep costs charged by databases like TWN—which charge full price for each (re-)verification—are often passed through to your borrowers.

That said, you may indirectly take a hit when your managers decide you need to be doing more to keep your operating costs down and the pricing of your services affordable.

These issues become even more of a problem in times of economic crisis, when mortgage rates are high and application volumes are low. That’s when limiting the time you spend on gruntwork can really make a difference—so you can turn your attention to creative solutions, like hosting lunch-and-learns for first-time home buyers or networking events for emerging title companies.

How does automating the verification process make a difference?

You can leverage payroll connections through a specialized direct-source data provider to automate your VOI/VOE flow from end to end.

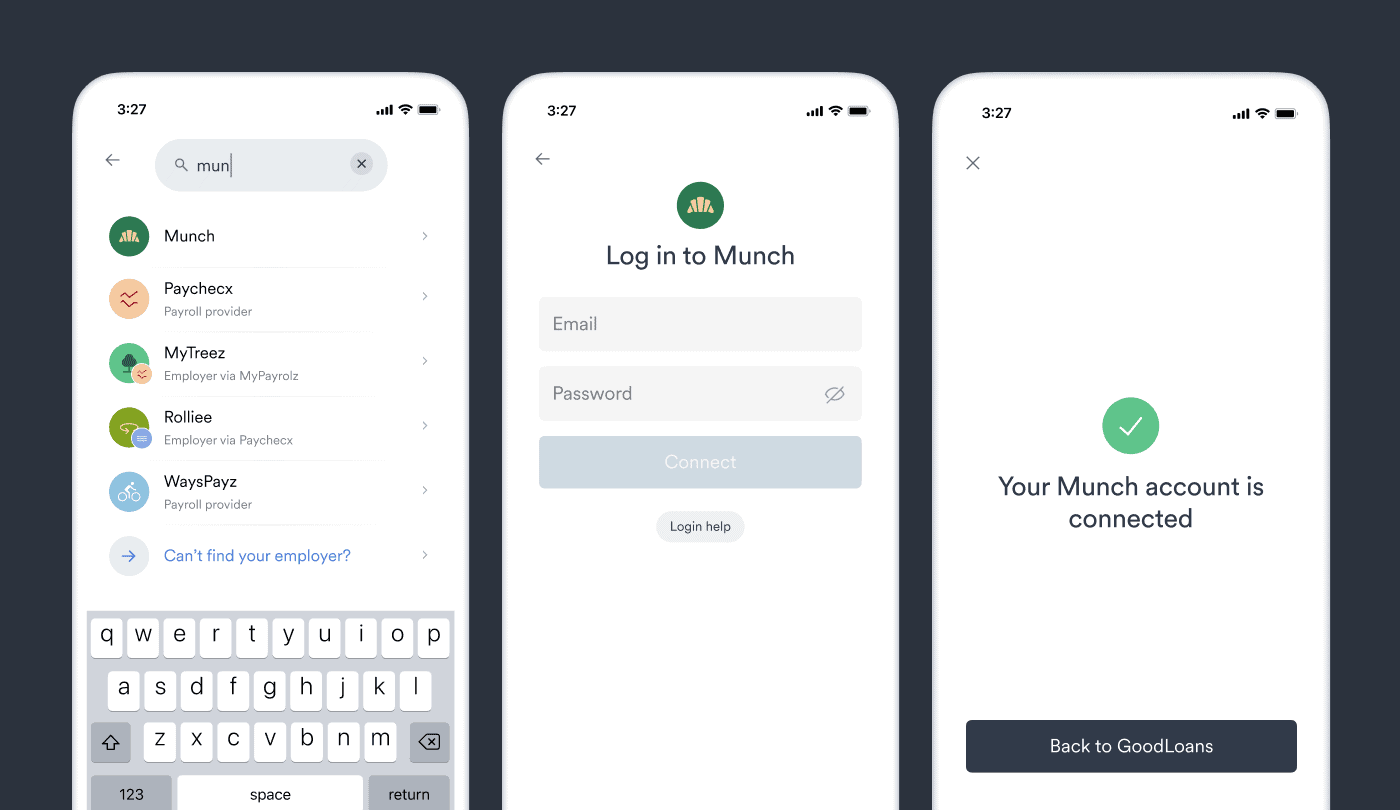

It’s typically a quick, two-step process that can be carried out with just a few clicks: Borrowers simply find their source(s) of income in the provider’s data network and enter their credentials. Once they connect, you get real-time, ongoing access to their income and employment data, which can often be streamed directly into your point-of-sale (POS) or loan origination system (LOS).

Verifying your borrowers’ income and employment via live payroll connections and direct-source data has several immediate benefits:

The entire VOI/VOE process can be completed in minutes—or less.

After a borrower connects their payroll account, their income and employment data is instantly and automatically streamed to your platform. Some lenders report this has reduced their verification timelines from three weeks to under a minute.

That means you can stop spending your time on endless back-and-forths chasing down documents and start focusing on the initiatives you care about.

Borrowers never have to leave your application.

An automated verification flow results in a much more seamless borrower experience. With a single connection, borrowers supply all of the income and employment data you need to process and assess their application, so you won’t have to trouble (and re-trouble) them for their financial documents.

Lenders have found that most borrowers are able to locate their income source(s) and log in to their accounts without difficulty, eliminating hassles on both sides of the exchange.

You get ongoing access to the documents you need, when you need them.

Once a payroll connection is established, you have continuous and unlimited access to a borrower’s granular income and employment details—plus key documents like paystubs and W-2s—without any need for additional logins.

Better still, their data is automatically refreshed as soon as new information becomes available. In some cases, you can even set up webhooks to notify you if there’s any significant change to a borrower’s financial status.

Accuracy is built into the process.

With a direct-source data solution, income and employment information is tapped straight from the system of record. That means it’s a reliable, one-to-one copy of what’s in a borrower’s payroll account, with no opportunity for mediating databases or error-prone manual processes to introduce inaccuracies.

It’s one reason why payroll connectivity providers like Argyle are approved as authorized report suppliers for Fannie Mae’s Desktop Underwriter® (DU®) validation service, which dramatically limits buyback risk for partnering lenders.

Your operational costs will plummet.

With the price of a single VOI/VOE report running $100 or more with TWN, you can expect to see your costs go down by 60% to 80% with an automated verification solution.

These savings can then be passed on to your borrowers, giving you a significant competitive advantage in the marketplace.

As an added bonus, using financial data that is actively permissioned and shared by consumers (rather than bought and sold behind their backs) can help you earn your borrowers’ trust—and establish better, stronger relationships that drive your business forward.

Ready to take your VOI/VOE flows to the next level?

Check out our guide to identifying a best-in-class direct-source data provider, complete with eight hard-hitting questions you can ask potential vendors to ensure they’re a good fit for your business.

If you have questions about what live payroll connections can do for you, reach out to a member of our team to schedule a call—or register for a free Argyle account to explore our platform and see what an automated Income & Employment Verification solution looks like firsthand.