Integration with nCino Mortgage Suite (formerly SimpleNexus) represents a win for mortgage companies looking to radically streamline operations and upgrade the borrower experience.

We’re thrilled to announce that Argyle, the most trusted network for income and employment data, has integrated with nCino to make automated, fully digital income and employment verification a seamless addition to the homeownership platform’s point-of-sale (POS) workflow.

For the more than 300 mortgage companies and 42,000 loan officers using the nCino Mortgage Suite to manage their loan application process, the implications of our no-code integration are powerful—fewer touchpoints, less friction, and higher conversions at up to 80% cost savings compared to other verification providers.

How it works

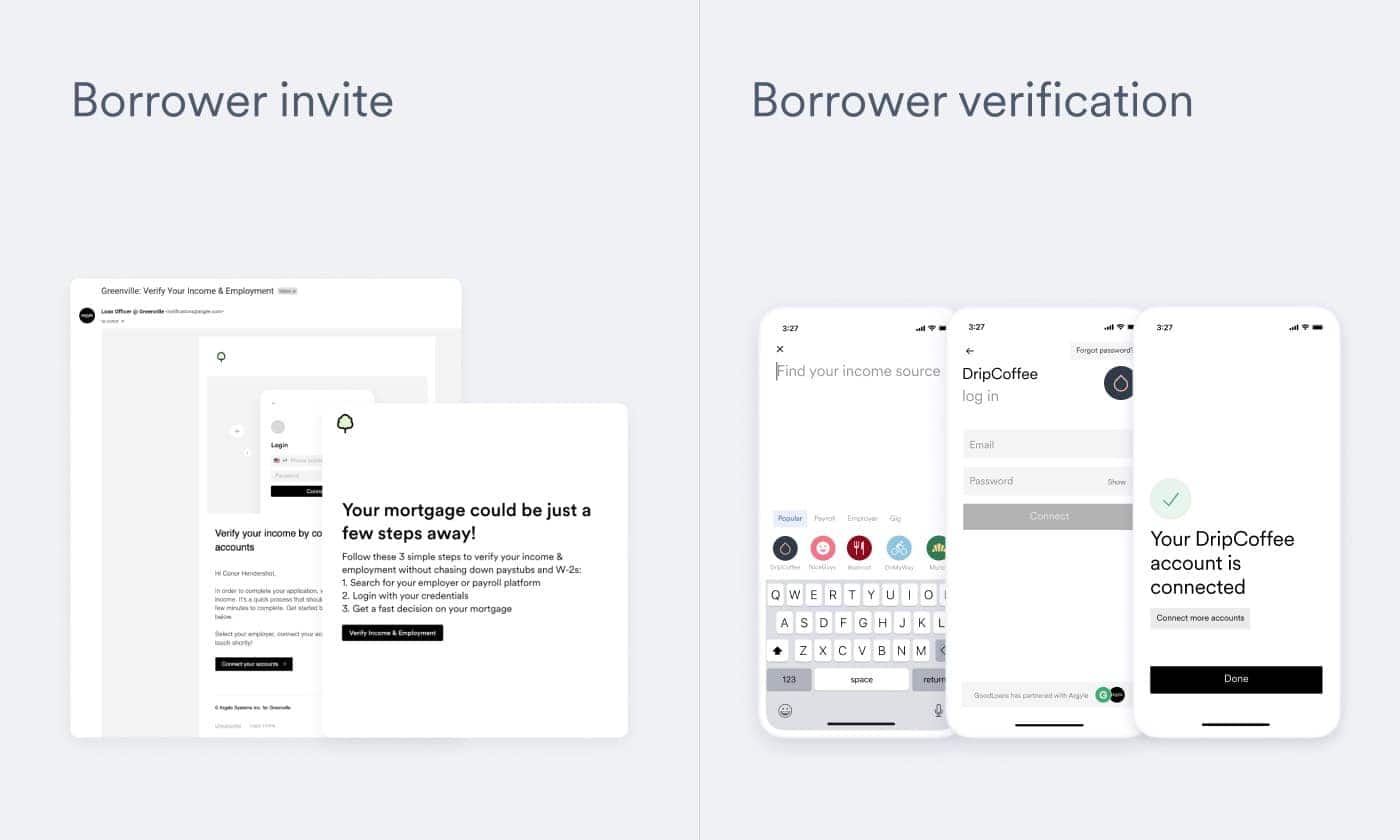

For nCino lenders who also use Argyle as their income and employment verification solution, the process couldn’t be simpler:

A borrower submits their nCino Mortgage Suite loan application, triggering a custom email or SMS invitation to connect their payroll account in seconds from any computer or mobile device.

The borrower logs into their payroll account and authorizes the connection, establishing a continuous stream of direct-source income and employment data.

Argyle sends verification of income (VOI) / verification of employment (VOE) reports plus digital paystubs and W-2s to the lender’s nCino account for centralized document access.

If the lender’s LOS is integrated with nCino, the LOS receives copies as well.

Mortgage lenders avoid the hassles and tedium of borrower outreach and admin, and borrowers no longer have to jump through hurdles to track down and upload their financial documents. Meanwhile, lenders benefit from Argyle’s market-leading coverage, with hit rates 4x to 5x higher than other verification providers at a fraction of the cost.

“Our integration with the nCino Mortgage Suite is a slam dunk for our mutual customers,” said Shmulik Fishman, CEO and co-founder of Argyle. “In addition to the efficiencies nCino affords them across the loan life cycle, lenders now have access to a completely automated verification workflow that marries seamlessly with their POS and LOS to push loans through the pipeline with exceptional efficiency. At scale, that’s transformative.”

Want to see Argyle in action?

Create a free Argyle Console account to access demos and sandbox tools. Or reach out to our team! We are happy to answer any questions you may have.

Safe Harbor Statement

This blog publication contains forward-looking statements within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or “continues” or similar expressions. Any forward-looking statements contained in this blog publication are based upon nCino’s historical performance and its current plans, estimates, and expectations, and are not a representation that such plans, estimates, or expectations will be achieved. These forward-looking statements represent nCino’s expectations as of the date of this blog publication. Subsequent events may cause these expectations to change and, except as may be required by law, nCino does not undertake any obligation to update or revise these forward-looking statements. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially including, among others, risks and uncertainties relating to the market adoption of our solution and privacy and data security matters. Additional risks and uncertainties that could affect nCino’s business and financial results are included in reports filed by nCino with the U.S. Securities and Exchange Commission (available on our web site at www.ncino.com or the SEC’s web site at www.sec.gov). Further information on potential risks that could affect actual results will be included in other filings nCino makes with the SEC from time to time.