Insights from payroll records, bank statements, bill payments, and other alternative data sources can help lenders confidently expand their market.

One of the U.S. financial system’s main shortcomings is an over-reliance on credit history when it comes to underwriting basic financial services. Given our evolving social and economic realities, a credit report alone no longer paints a full, accurate picture of a consumer’s financial health or their ability to repay a loan.

Today, around 62 million consumers—nearly a quarter of the adult population—have a thin credit file, meaning they have fewer than five accounts on record with the three major credit bureaus. Those most likely to be “credit invisible” are recent immigrants, low-income workers, and young people who have not had sufficient time or opportunity to build a credit profile. Of course, this leads to a vicious cycle: If someone has no initial access to credit, they also have no way to prove they can afford it.

In practice, this means that almost one in four consumers struggles to qualify for essential financial services like credit cards, auto loans, mortgages, and even renting a home. Fortunately, advances in financial technology are beginning to reverse this trend.

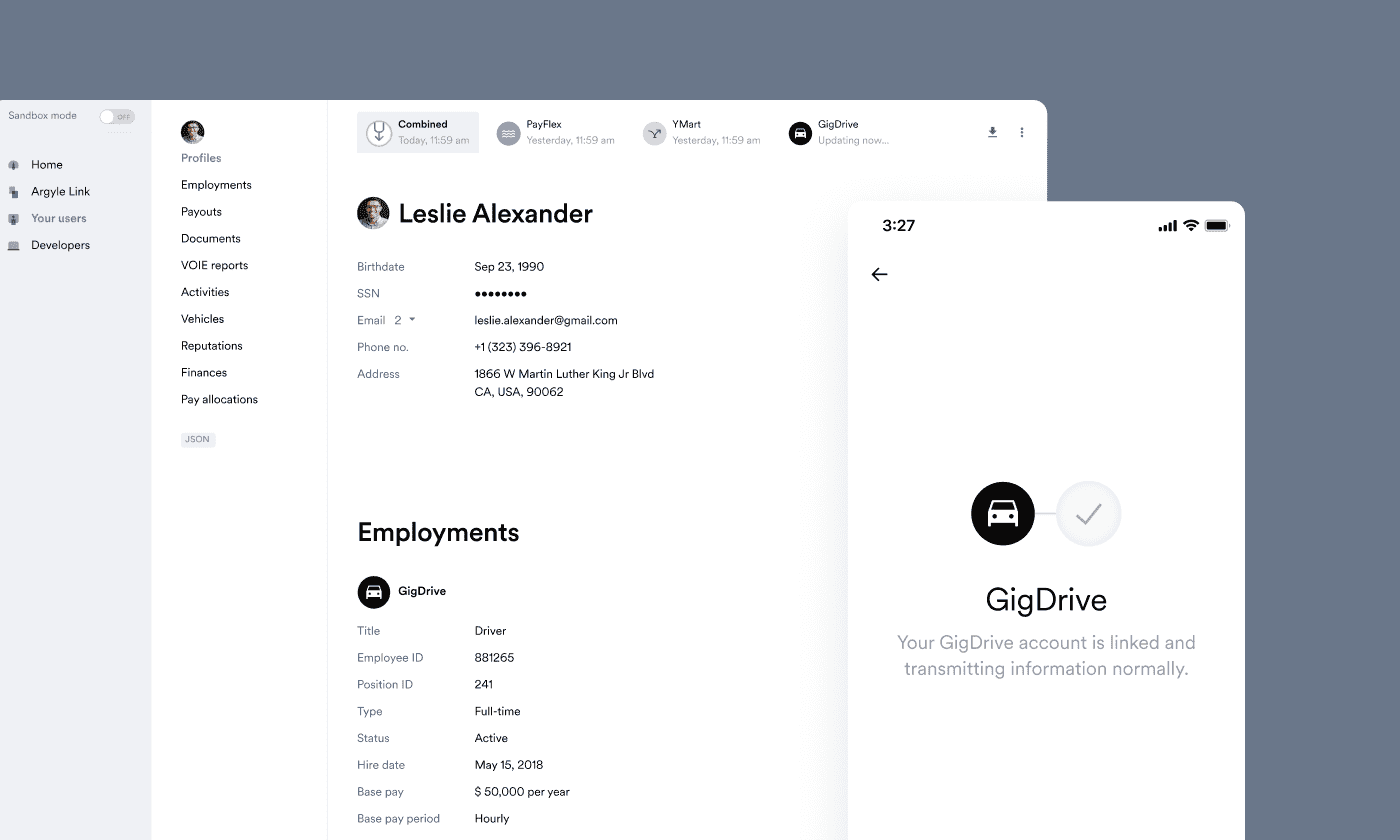

Tech-forward platforms like Argyle empower consumers to share data from alternative sources—including payroll records, bank statements, and bill payments—when traditional credit scores fall short. This not only allows lenders to evaluate financial health and credit risk on a deeper, more precise level, it also allows them to expand their addressable market to millions of consumers typically excluded from the credit system.

Below, we break down how these alternative data sources work, the questions they can answer for modern lenders, and why they offer a more promising path for our financial future.

The potential in alternative data

Essentially, supplementing underwriting models with alternative data acknowledges that there are many ways to demonstrate creditworthiness—and it doesn’t always come down to how much debt someone has shouldered in the past. In fact, many consumers who exhibit stable income, sensible spending habits, and timely payments can afford and keep up with loans they’re usually denied.

There are three main categories of alternative data that can give lenders a more granular and comprehensive view of a consumer’s financial health:

Income and employment data

Income and employment data from payroll records can tell lenders whether a consumer has a steady, reliable source of earnings to support ongoing loan repayments.

When tapped in real time through a platform like Argyle, income and employment data is streamed directly from a consumer’s payroll account—before it’s distributed to contributions, withholdings, and bank accounts—giving lenders a dynamic, up-to-the-minute view of the money that’s actively being made.

Among other insights, real-time income and employment data can help lenders understand:

How frequently and steadily a consumer is paid

How much of a consumer’s pay comes from variable sources like bonuses and commissions

How often a consumer changes jobs or switches primary banks/direct deposit accounts, which can indicate instability or fraud

Whether a consumer is a “diamond in the rough,” meaning they hold a highly stable role (like department manager) in a highly unstable workplace (like a supermarket)

Whether a consumer has positive factors (like high 401(k) contributions) or negative factors (like wage garnishments) in their payroll records

How regularly a consumer picks up shifts for gig platforms like Uber and DoorDash, showing consistency in a labor market that’s notoriously difficult to underwrite

Argyle’s payroll connectivity platform can answer these questions (and more) instantly and on demand, giving lenders a leg up on the competition when evaluating thin-file consumers.

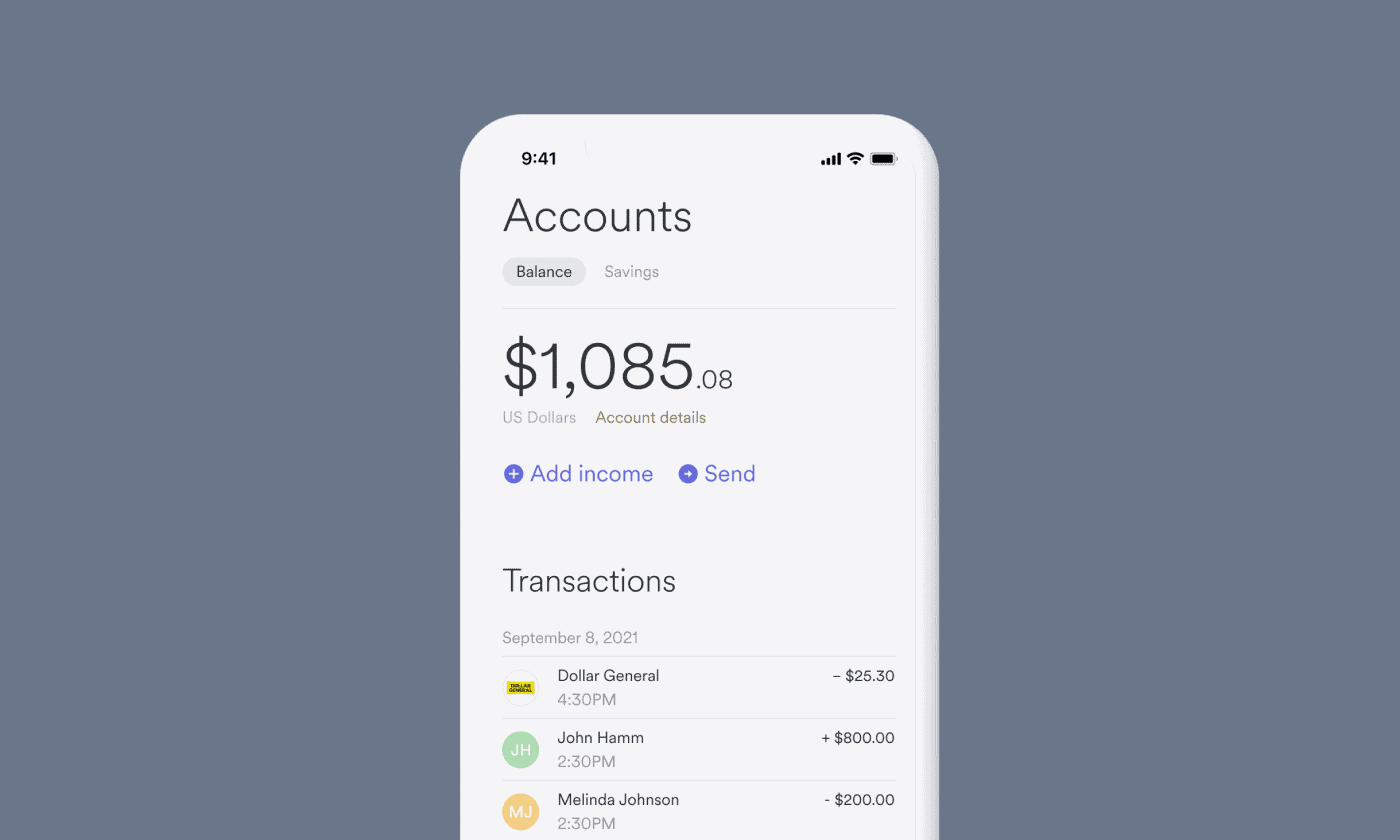

Bank account data

Beyond income and employment data, lenders can leverage bank data to round out a consumer’s financial profile.

For instance, lenders can use bank account activity and transaction data to assess:

How often a consumer incurs fees for overdrafts or non-sufficient funds

Whether a consumer spends a significant portion of their month-to-month income on risky behaviors like large cash withdrawals at casinos or bets on online gambling sites

Whether a consumer’s average balance is trending up or down over time

This not only allows lenders to gauge how much money a consumer has at their disposal, but to ensure they’re managing their liquidity in a responsible way.

Bill payments

Finally, lenders can access alternative payment records—including monthly rental payments, utility bills, cell phone and cable plans, and more—as a proxy for an official credit file. While such payments aren’t typically reported to credit bureaus, they still speak to a consumer’s ability to stay on top of their financial debts.

Utility bills and other non-credit payment data can help lenders measure:

How promptly a consumer meets payment deadlines and whether they pay amounts in full

Whether a consumer has a history of late or missing payments

Whether a consumer has ever been referred to a collection agency for unsettled bills

Observing how a consumer has managed prior financial obligations can give lenders a good idea of how they’ll handle the burden of a new loan.

The bottom line

Alternative data sources—like Argyle’s real-time income and employment data, along with bank data and bill-pay records—can work together to help lenders build a more complete picture of a consumer’s financial health and overall credit risk.

Not only can this help lenders expand their total addressable market into new arenas, it can help level the playing field for the 62 million U.S. consumers historically excluded from financial services.

Interested in the promise of alternative lending data?

Reach out to an Argyle data expert to learn more about our powerful payroll connections—and discover what real-time income and employment data can do for you.