Accessing real-time income and employment data can be game changing for many businesses. But knowing how to evaluate and select the provider that will best serve your business’s needs takes thoughtful consideration. This guide is designed to help you avoid potential pitfalls and set your vendor selection criteria to find the best data partner for your business.

Cutting through the noise

By reducing risk and improving user experience, employment and income data are transforming underwriting, compliance, and customer experience across financial services, and new startups are answering the call to enable access to that data.

As a result, businesses like yours are faced with a confusing number of far-from-equal choices. Between payroll APIs, VoIE services, payroll aggregators, and employment data platforms, trying to differentiate between providers and the various products and approaches they offer is a tall order.

To help you make direct comparisons between them, we put together a list of questions you can ask to help you evaluate and compare options in the income and employment data space.

1. What is your coverage, really?

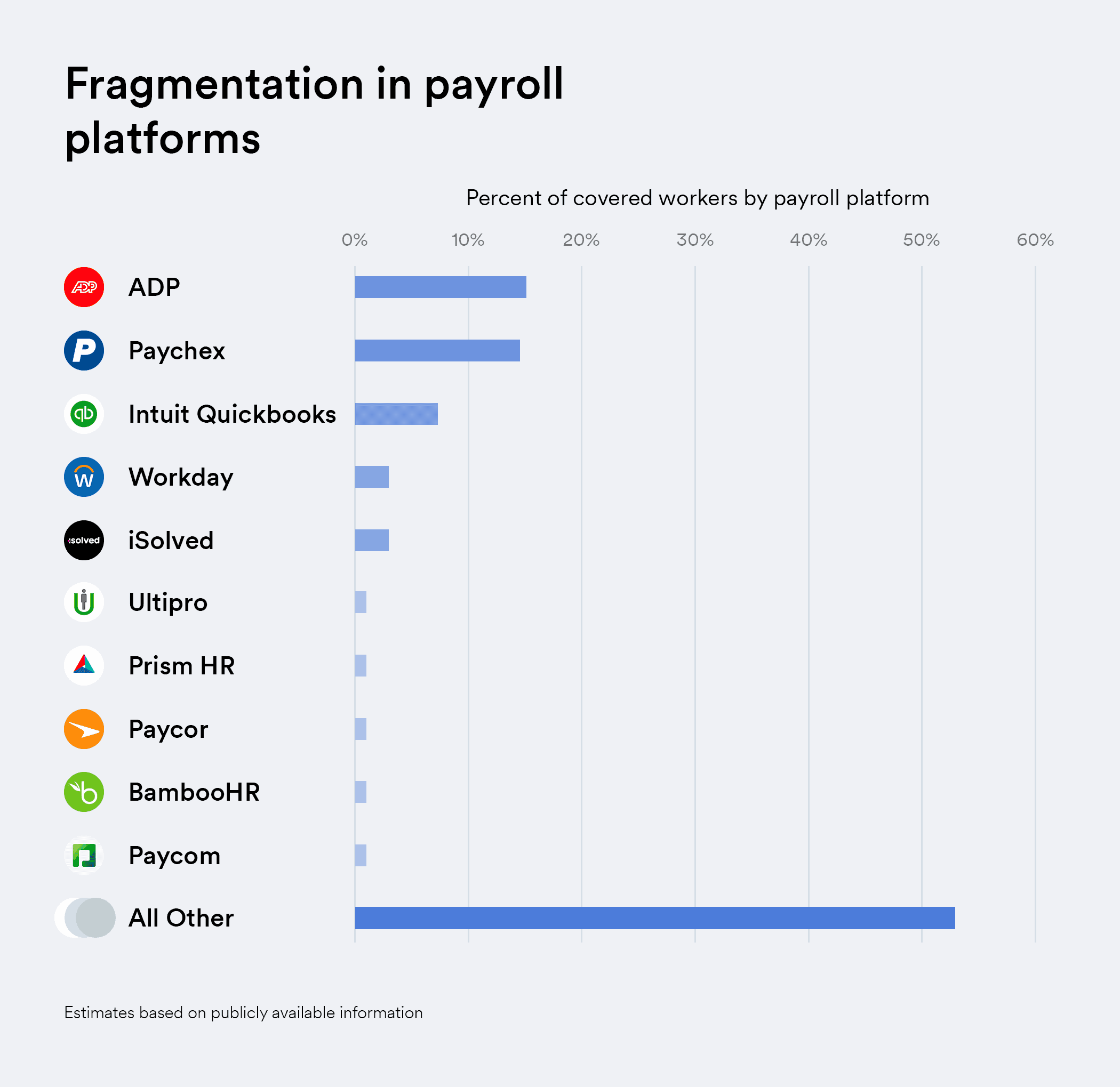

When it comes to income and employment data, coverage is defined in terms of which employers and payroll providers a data provider is compatible with and the total number of users they have the ability to retrieve data for. It is simultaneously one of the most important metrics in evaluating income and employment data partners and one of the most difficult to verify.

It’s easy for a provider to toss out big coverage numbers, because coverage as a percentage of workers is difficult to confirm. But the truth is, the top 20 income and employment data platforms do not provide meaningful coverage of the U.S. workforce. That’s because the payroll systems the U.S. workforce depends on are extremely fragmented, and there is no silver bullet for universal coverage.

So, if a vendor promises 80% coverage of your customer base, how do you substantiate that claim apart from running a side-by-side, multi-month pilot? Getting below the high-level numbers is key to comparing coverage across vendors. That means asking vendors for:

A full list of live, integrated payroll and employment data networks

A cross-reference of their live covered employers to the top 100 employers of your users

Their pace of new integrations: How many new platforms were added last month? Over the last six months?

A summary of their recent live production data: What percentage of their users found, selected, or entered a covered employer or platform?

A summary of their proprietary employment platform handling (i.e., platforms with a custom URL and/or a custom implementation). Most Fortune 100 companies have a complex payroll implementation; what is the standard operating practice for managing these custom implementations? What tooling is available for you to manage variable data field availability across employers on the same platform?

For more, check out our cross-provider coverage comparison at http://oeds.org/.

2. What is your user conversion rate?

Even when users can find their payroll or employer platform, not all will result in successful authentication. There are many opportunities for failure along the way, whether due to a user’s lack of trust, confusion, missing credentials, or backend system failures.

For radical transparency, you should require vendors to share specific, demonstrated metrics around the percentage of attempts that successfully convert for covered employers in prior implementations of your specific use case. Keep in mind that conversion varies by use case (e.g., direct deposit switching versus verification of income and employment) and by vertical (e.g., personal loans versus mortgage lending), so you’ll want to ask for the data most pertinent to your situation.

With such an important metric at stake, you’ll want to consider follow-up questions, too. For example:

How does the provider handle multi-factor authentication, and which types do they use: SMS and email one-time passcodes, security questions, confirmation SMS and emails (i.e., magic links), and/or time-based one-time-passcodes (e.g., Google Authenticator)?

Does the provider support authentication via single sign-on (e.g., Okta, OneID, Microsoft SSO)?

How does the product assist users who have forgotten their password?

How does conversion vary across payroll providers and employers? Can the provider share demonstrated data to support those assertions?

3. What depth of data can I access through your platform?

The depth of data availability is another important vendor selection criteria in which data providers differ dramatically. Consider both current and potential future use cases as you evaluate the depth of data availability across vendors.

To get into specifics on data coverage, ask for:

A complete list of covered data fields, if not available via public documentation

A summary of total coverage by specific critical fields: For how many platforms is direct deposit switching supported? What about document downloads? Do they have summarized documentation on data field availability by platform?

Their frequency of data refresh (e.g., every hour, every day, or only as often as partners share data)?

An overview of calculation handling like annual income. Does the platform provide access to raw data or only calculations? Are there tools for summarizing the raw data?

The provider’s ability to provide continuous access

4. How well does your infrastructure function?

Income and employment data is a technically complex category. To ensure your chosen data partner has the proper infrastructure in place to handle the demands placed on it, you’ll want details around how well their systems are functioning as well as the tooling available to monitor system performance.

To that end, you’ll want to ask for:

Their average and 90th percentile response times

How many requests they handle daily and weekly

Their historical uptime and number of API errors

Whether or not they employ humans to retrieve data under any circumstances

The supporting tooling they make available to you to see platform data limitations, track sync times, review uptime, etc.

5. How easily and flexibly can I implement?

Fitting a new feature into your product roadmap can be a difficult trade-off, which makes the ease of product implementation a critical evaluation criterion. Relatedly, the ability to adapt the product to your specific user flow, brand visuals and voice, and backend data requirements impacts your timeline to integrate. To better understand what your own roadmap might look like, consider asking vendors to describe a typical implementation process.

Make sure to request:

Their average implementation timeline

Public documentation for your engineering team to review

A summary of the configurability of widgets and reports

Different options for implementation (e.g., deep-link directly to employer login screen, API, console, no-code with email/sms-based delivery, etc.)

A preview of available implementation guides and technical support resources

6. What does the client-provider relationship look like post implementation?

Equally important to evaluating the technical aspects of a solution is evaluating what kind of a partner the provider will be. Having a good partner post implementation is critical to getting the most out of the product.

To determine the probable nature of your potential future data partnership, consider asking:

If the provider has expertise in your industry to offer you guidance on how to leverage the product and provide you with best practices pertinent to your particular needs

How the provider plans to offer technical support on an ongoing basis

How the provider uses client feedback to inform their product roadmap

An apples-to-apples analysis

By asking the candidates on your short list of employment and income data providers these six questions (and pushing them to fulfill the detailed requests that come with them), you’ll be in a much better position to make direct comparisons between vendors and come to an informed decision for your business.

If you need more information on any of these vendor selection criteria or want to pose these questions to our own sales team, please don’t hesitate to reach out.