Improve your portfolio performance with paycheck-linked lending solutions and deeper insights into borrowers’ income and employment.

As recent events have made all too clear, loan default rates can be unpredictable in periods of economic uncertainty. While the peak of the COVID-19 pandemic saw low delinquency, higher interest rates are projected in 2022 as the Federal Reserve works to combat inflation, leading many lenders to fear a spike in late or missed payments.

Meanwhile, according to recent reports, a majority of US adults (54%) are living paycheck to paycheck, including 36 million personal loan holders. Many of these consumers (over 40%) expect their economic circumstances to worsen in 2022 as a result of rising costs, making loan repayments even more of a financial burden.

The good news? New data solutions are automating the loan repayment process from end to end and making it easier for borrowers to meet their financial obligations.

Below, we explore three ways that real-time income and employment data can reduce your loan default risk in a fluctuating economic environment, enhance your visibility into borrowers’ pay cycles, and streamline verifications for easier, more secure underwriting.

1. Reduce uncertainty with paycheck-linked lending

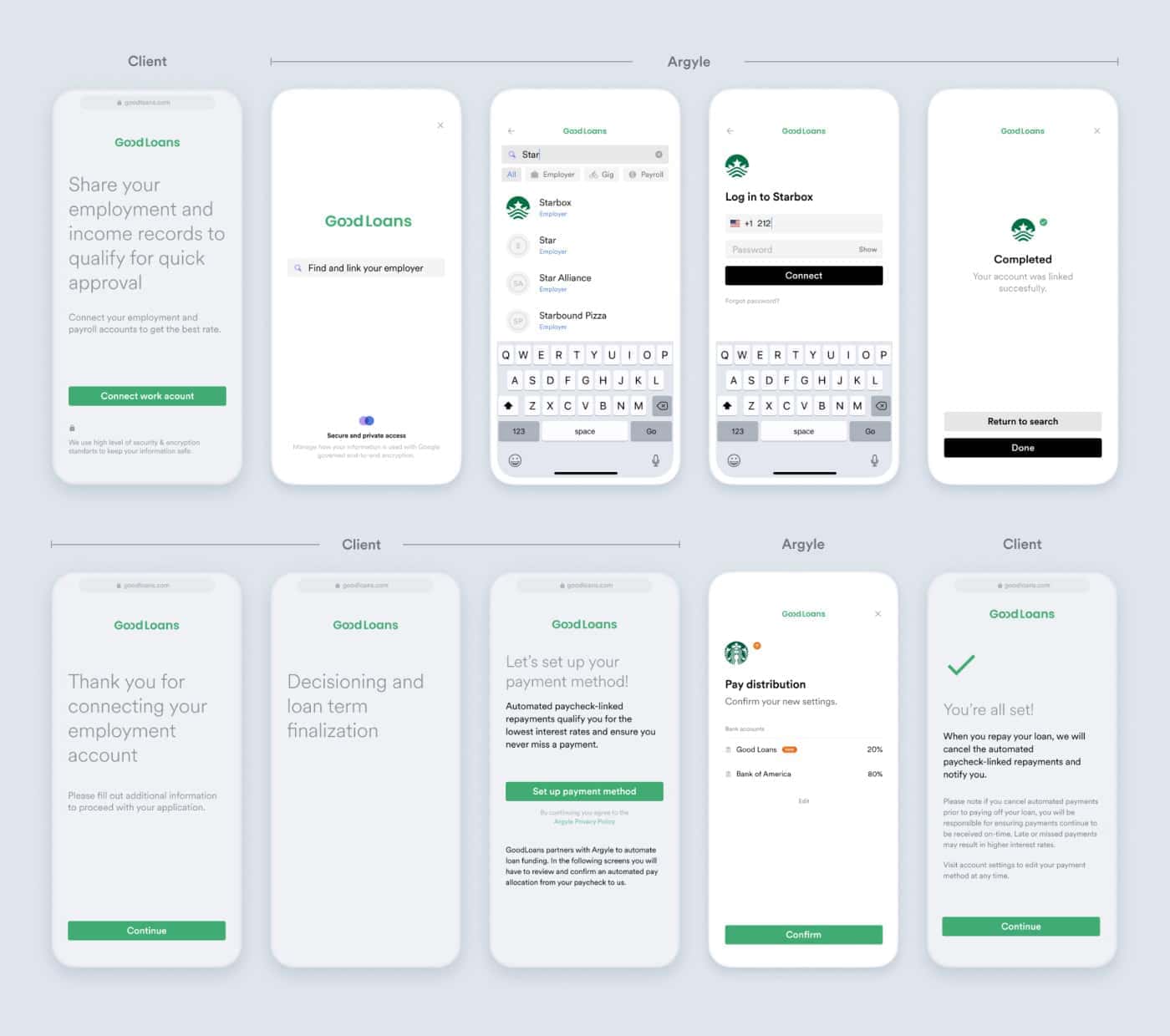

With paycheck-linked lending, loans are automatically repaid through preset, low-interest withholdings taken directly from a borrower’s paycheck. This instantly reduces the overall risk of default, since the onus is no longer on borrowers to keep up with their repayment schedules or to prioritize their loan debt over other financial commitments.

Paycheck-linked models mean regular, more reliable payments and quicker, more confident lending decisions than traditional payment methods like ACH and debit rails, since you’re essentially underwriting a borrower’s established income pattern.

The most innovative platforms offering paycheck-linked solutions, like Argyle, provide you with real-time, fully permissioned visibility into a borrower’s employment and payroll data—including endpoints like length and stability of employment and the amount and frequency of paychecks—so you can monitor and track their performance and keep abreast of any changes.

Argyle also makes it easy for borrowers to allocate a certain percentage of incoming paychecks to loan payments. It takes just a few minutes to authorize, as opposed to a stack of paperwork.

That means not only slashing your default rates, but being able to serve and empower a much wider swath of borrowers—without taking on additional risk.

Read more: What Is Paycheck-Linked Lending?

2. Anticipate the where and when of a borrower’s next payout

If you’re relying on traditional payment methods like ACH and debit pulls, you can use real-time income and employment data to gain greater insight into a borrower’s paycheck rhythms and predict where and when they’ll receive their next payout.

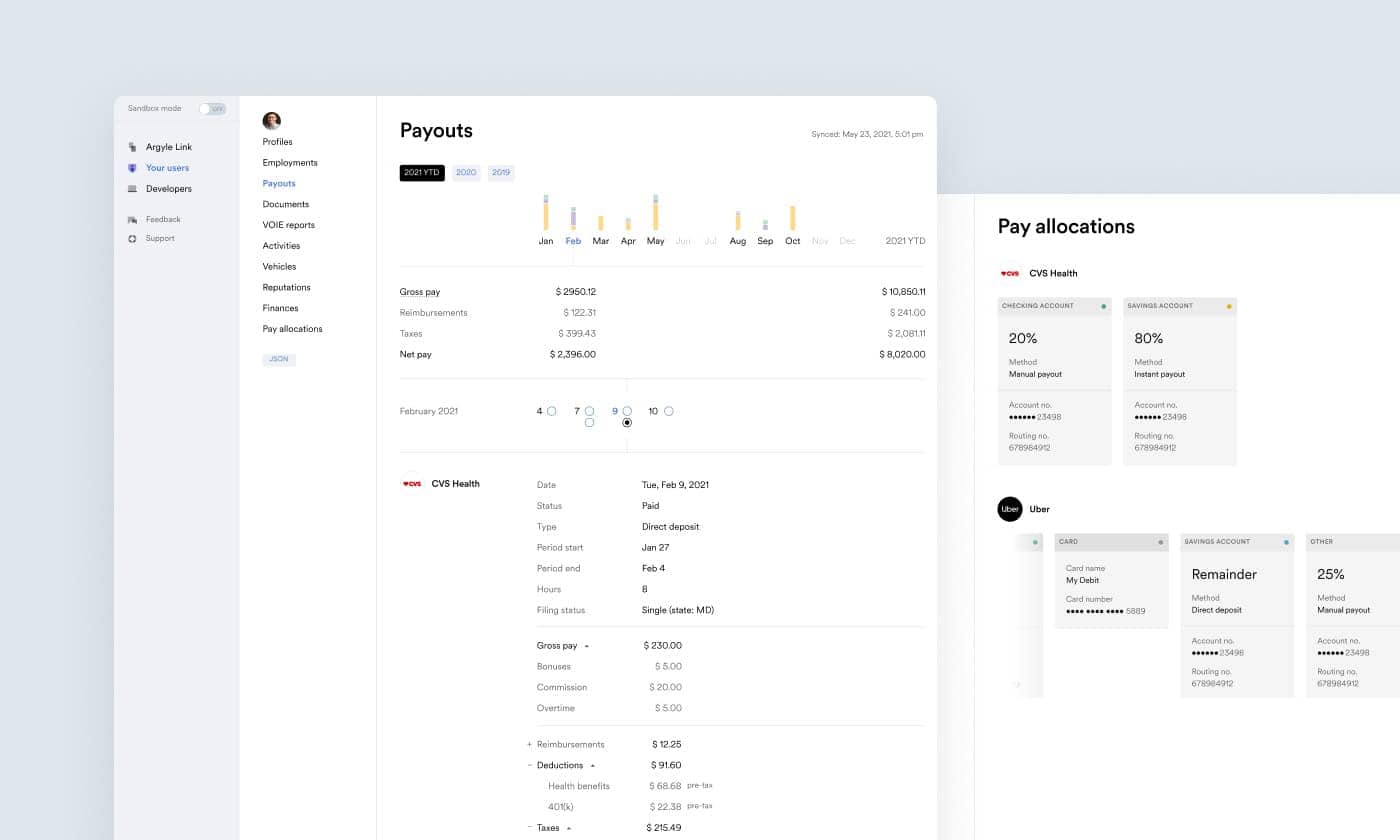

For instance, Argyle’s platform provides full transparency into a user’s pay cycle and track record, so you know precisely when their next paycheck will land. Through webhooks, you can also be alerted as soon as their next payout is scheduled and posted, typically two to three days before payday.

Getting even more granular, Argyle’s payroll data shows what amount or percent of each paycheck is deposited into each of a user’s bank accounts, so you can easily identify their primary account.

3. Invest in better data for better underwriting

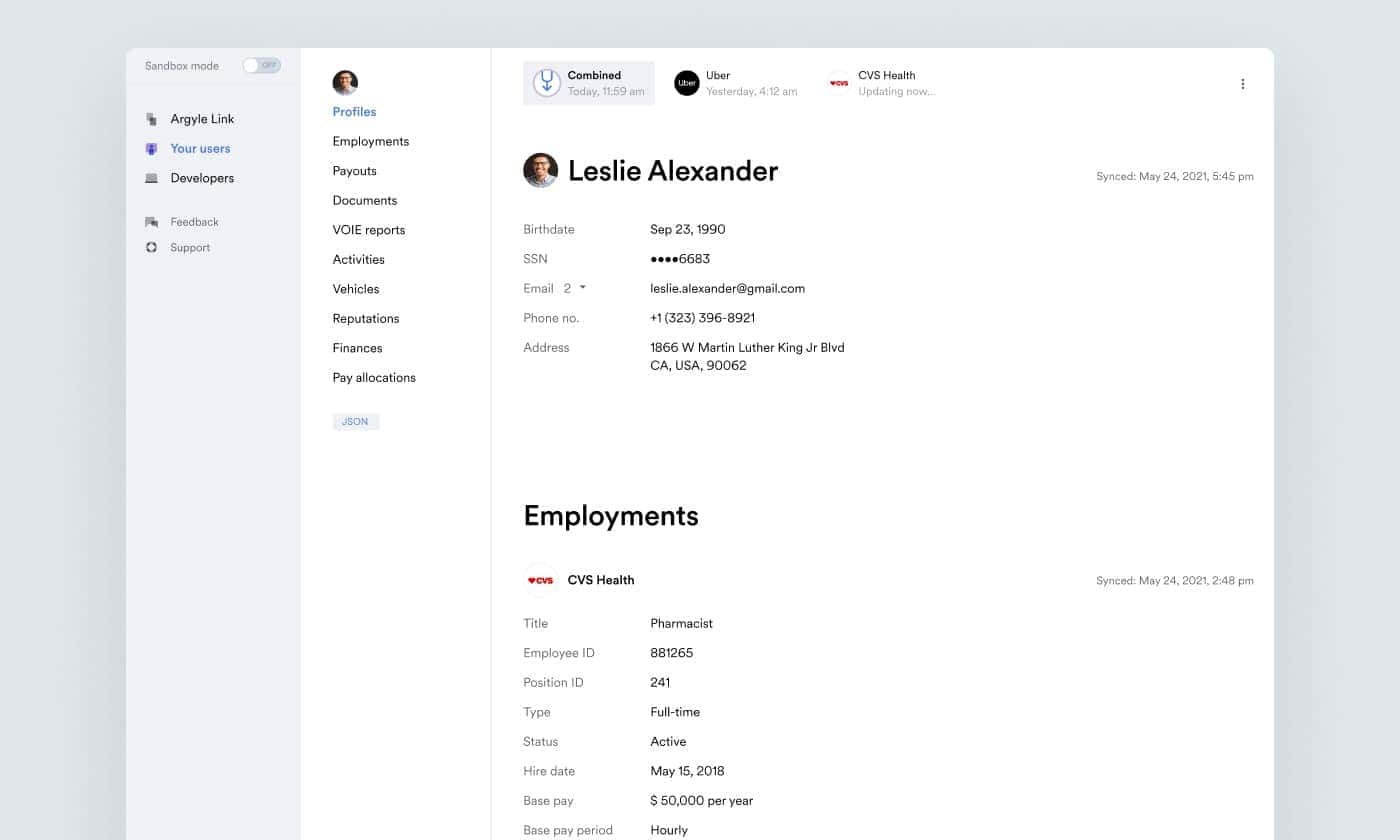

The more you know about a borrower upfront, the better. And, increasingly, lenders are finding that tapping into live income and employment data offers a much fuller picture of potential borrowers than their bank account balance while instantly verifying their ability to pay. In many cases, that means lower overall risk and a frictionless onboarding experience that allows everyone involved to avoid paper paystubs, paystub uploads, and manual data entry.

With Argyle, verifying income and employment is a quick, two-step process for borrowers. They simply select their employer or payroll provider from our vast network and enter the same credentials they use regularly at work to log in—without ever leaving your platform.

From there, you get continuous access to real-time, verified employment data straight from the source, with live notifications any time there’s a significant event, like if a borrower gets a new job or receives a raise.

Key takeaways

Going into 2022, you can’t know what shifts and surprises lie in store for our economy. But you can get a handle on your default risk by switching to smart, alternative data solutions that automate loan repayments and provide a sounder assessment of borrowers’ ability to repay.

Ultimately, that means not only protecting your business interests but offering safer, lower-cost loan options for your borrowers—boosting both your brand and your bottom line.

Ready to lower your default risk?

The Argyle team is always on hand to help you learn more about our real-time income and employment data and give you a quick tour of our solutions.

Reach out to schedule a consultation, or sign up for a free account to try out our sandbox.