3 Types of Employment Verification Services for Businesses

Finding the right worker is challenging for most employers. From recruiting candidates to scheduling interviews, the process involves a large investment of time, money, and effort. The last thing an employer needs is to discover that a candidate’s employment history doesn’t match their resume—and the same goes for candidates.

Sometimes, this discrepancy is the candidate’s fault, but other times, it’s because employers aren’t using a reliable employment verification service. In 2023, the Federal Trade Commission (FTC) fined two background-check companies $5.8 million for “failing to ensure the maximum possible accuracy” of their reports, among other violations of the Fair Credit Reporting Act (FCRA).

Erroneous employment verifications happen more often than they should, causing candidates and employers to miss out on potentially great professional partnerships. So, how can employers make sure they work with the right employment verification service? Below, we explore three options for verification of employment on the market.

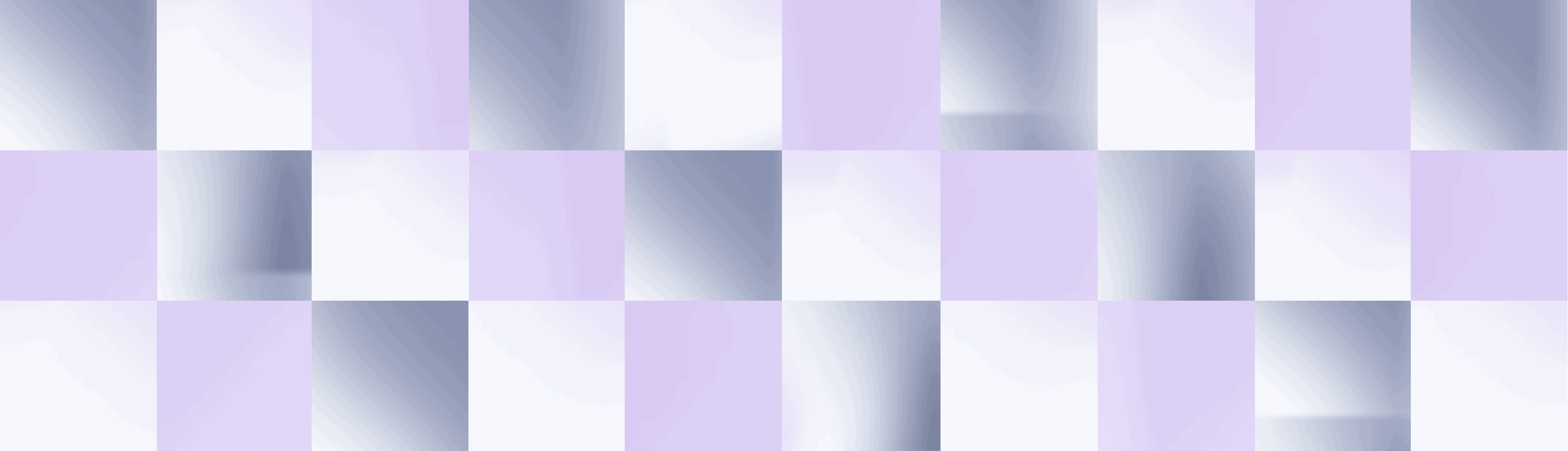

1. Credit reporting agency (CRA) or credit bureau verifications

Credit bureau employment verifications involve major credit bureaus buying candidates’ income and employment data from their former and current employers. These bureaus then maintain databases of this data. Well-known examples of CRA verification providers include Equifax’s The Work Number (TWN) and Experian’s Verify.

When an employer needs to confirm a candidate’s employment details, they submit a request to the CRA database. The CRA database then retrieves the relevant data and generates a verification report, including job titles, employment dates, income, and more.

However, there are several downsides to these services.

Lack of transparency, high costs, and static information

CRAs are notorious for incorrect results based on outdated information. Often, it takes months for these databases to update candidates’ information after a significant event like a job loss or change, and sometimes years. The CFPB and FTC cracked down on TransUnion for inaccurate data and noncompliance with FCRA in background checks, costing TransUnion approximately $23 million in penalties and fines.

CRA databases like TWN and Verify are also expensive, with each report costing anywhere between $50 and $80. These expenses can add up quickly, particularly for employers with many verification requests. From a cost perspective, it’s simply not sustainable at scale.

However, the most concerning issue is that these verification practices aren’t necessarily ethical, as databases like TWN purchase candidates’ data directly from employers and resell this information to employers and other companies seeking verifications. Essentially, these agencies monopolize the market, creating barriers for newer, better verification solutions entering the industry.

Shmulik Fishman, CEO of Argyle, said the following in a letter to the FTC:

“The nation’s largest credit reporting agencies have used their historically dominant positions to collect payroll records on millions of Americans without their consent, which they then sell to lenders, landlords, debt collectors, and other customers as part of their workforce verification services. As a result, consumers’ data is constantly bought, moved, stored, and re-sold without their knowledge or any meaningful consent, and the dominant players in a concentrated market give workers little to no choice in what happens to their personal data.”

While Equifax, Experian, and TransUnion may seem like credible verification services, the data is often unreliable, and the reports are more expensive than they’re worth.

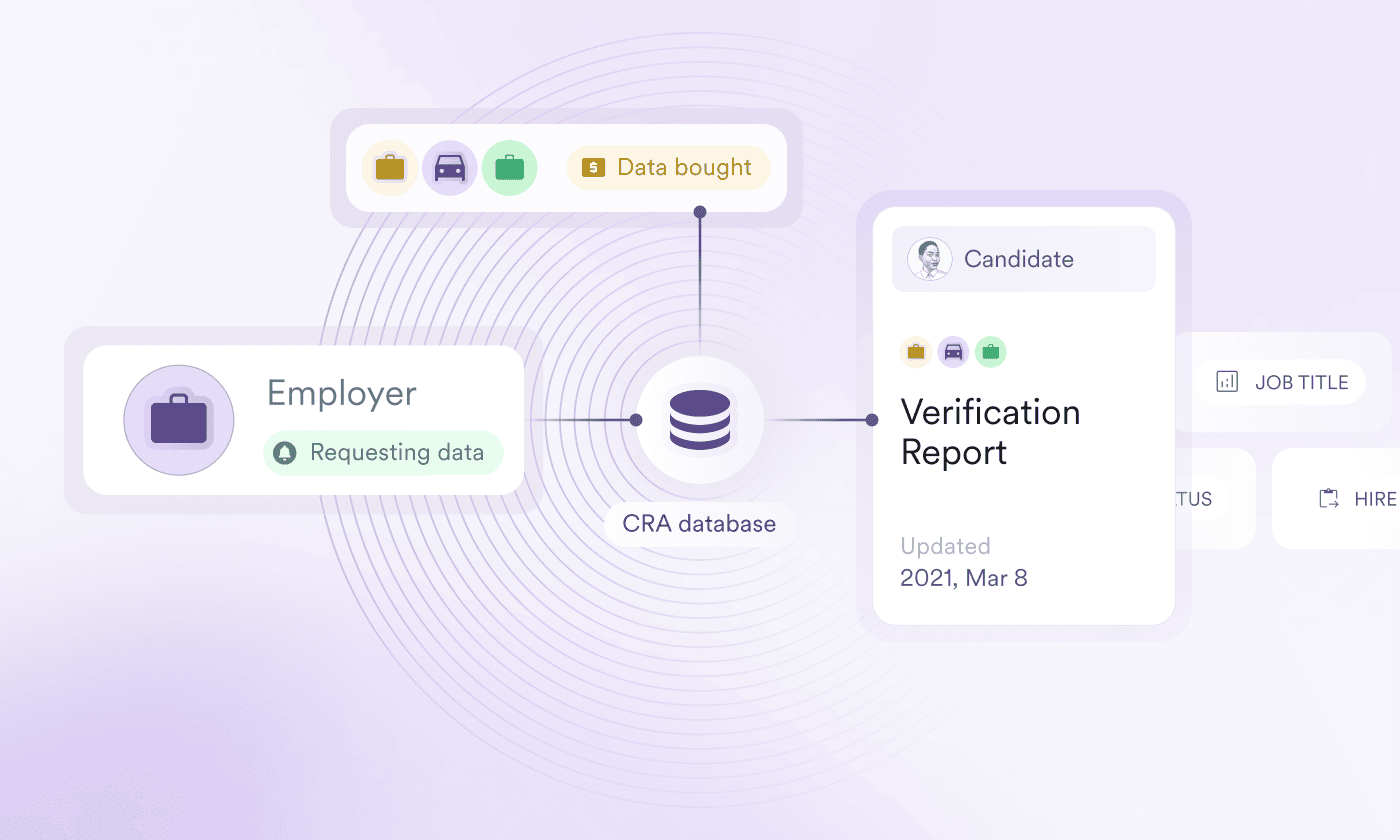

2. Third-party background check service providers

Third-party background check service providers offer another type of employment verification services. These providers verify the employment history, income, dates of employment, and other job-related details of candidates, along with education verification, on behalf of employers—either manually or through a CRA like The Work Number.

When an employer needs to verify a candidate’s employment details, it submits a request to the third-party provider, often through an online portal or API integration. The provider retrieves the relevant employment data from a CRA’s database based on the individual’s information. Alternatively, they complete these verifications manually by calling the candidate’s previous hiring managers. It’s a time-consuming and expensive process.

There’s still work to be done

In many ways, third-party providers streamline the employment verification process for employers by assuming the burdens of the process on their behalf. But if the third-party provider is totally reliant on CRAs like TWN and manual verifications, it’s still a lengthy process riddled with risks. For instance, the accuracy of the verification reports they generate depends on the quality and timeliness of their data. Too often, outdated, incomplete, or incorrect information leads to inaccurate verifications.

As a result, employers might unknowingly hire workers without the right experience due to inaccurate reports, or candidates may lose out on great opportunities. For instance, a job candidate in Birmingham, Alabama, was denied a $75,000 job as a mortgage banker after one third-party provider classified him as “high risk” due to an error. They had mistakenly reported that he lived in a rooming or boarding house when it was actually a regular apartment.

As one 2020 class action settlement shows, there are numerous cases of workers losing job offers due to verification errors. To add to that problem, working with third-party providers involves sharing sensitive information such as Social Security numbers, which can raise privacy concerns and lead to unauthorized data disclosure, specifically noncompliance with FCRA.

But there are proactive providers that are set up to tackle these challenges head on, as you’ll learn in the next section.

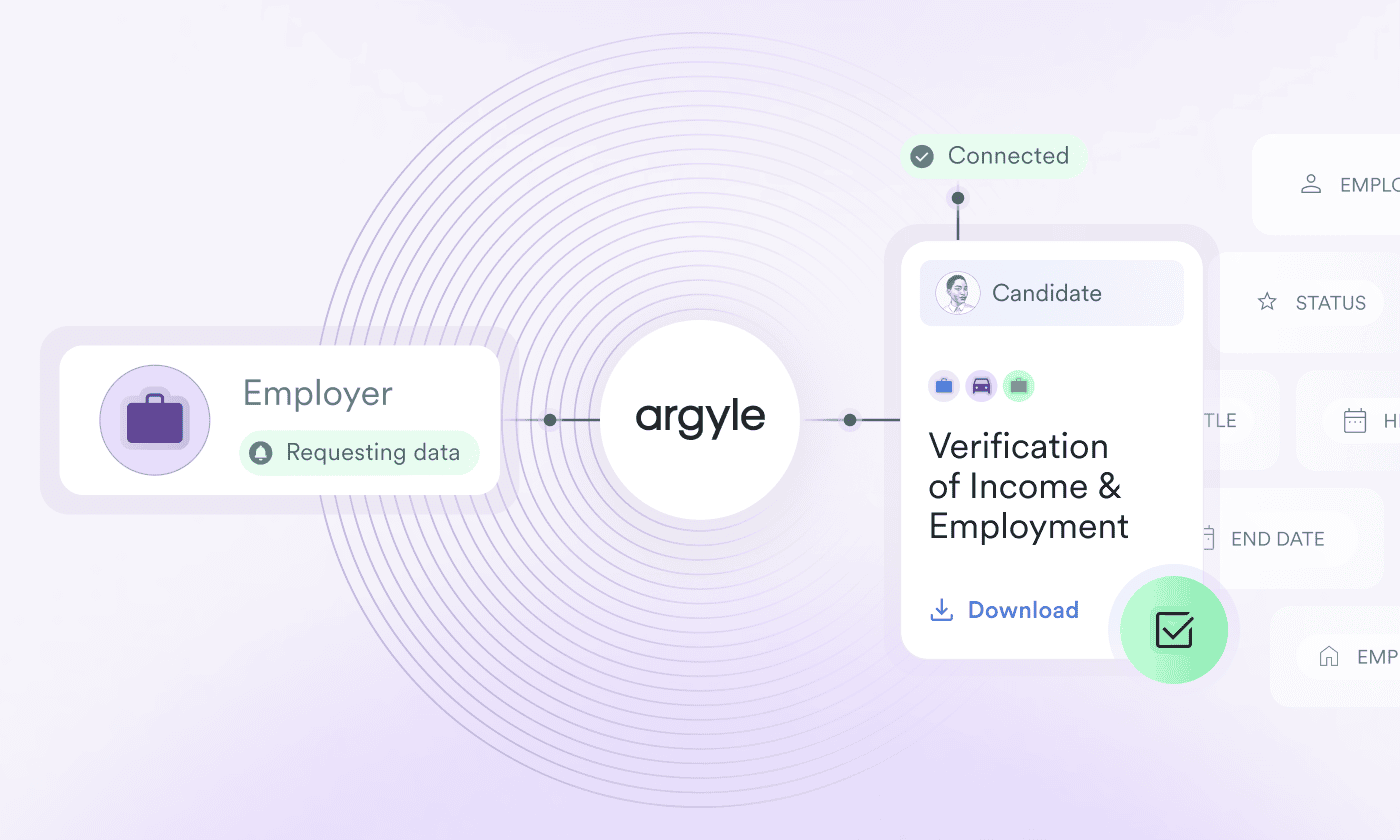

3. Real-time verifications through payroll connections

As employment screenings become more commonplace in the US economy, it’s also important to note that candidates aren’t willing to wait forever. Specifically, 41 percent of adults in the US are only willing to wait between one week and ten days for a background check to be completed before moving on to other job opportunities.

That’s where consumer-permissioned payroll connections come in. Forward-thinking third-party background check service providers leverage payroll connectivity from Argyle to make their background check services better for everyone involved.

The future of background checks

Payroll connections allow third-party providers to securely access employment and income data directly from candidates’ payroll accounts or their employers’ human resource (HR) systems by obtaining the candidate’s consent.

Here’s how it works: With candidates’ permission, Argyle establishes direct connections with their payroll providers or employer platforms to verify their multi-year employment history in real time. These payroll connections are continuous, allowing third-party background check service providers to get the most recent, accurate information straight from the source for their customers (i.e., employers). Candidates share this information willingly, and most importantly, they are in complete control of their data; they can end the connections at any time through Argyle Passport.

And the benefits are plenty.

Argyle connects to over 90% of the US workforce, including demographics credit bureau reports often miss, such as gig workers and federal employees.

With employment verifications from Argyle’s payroll connections, third-party providers like Checkr, and the employers they serve, can benefit from:

Automated and streamlined verification process that reduces manual effort and costs

Accurate, up-to-date employment and income data directly from the source

Less reliance on TWN

Greater data security and data privacy, proven by SOC 2 certification

Faster background checks and hiring decisions

Broader coverage, including coverage of candidates employed by government agencies and gig platforms (two segments not covered by TWN)

Complete candidate privacy, since their current and past employers are never made aware that they are searching for new work

Simply put, in an era where speed and accuracy are increasingly important, consumer-permissioned solutions like Argyle meet providers’, consumers’, and employers’ present and future needs for background checks and employment verifications.

The best employment verification service works long term

In the end, when choosing an employment verification service, background check providers should think long and hard about what will work for now and in the future. Regardless of whether you’re catering to a small business or a large enterprise, the best service offers a sustainable solution that will work for all your customers.

See Argyle in action. Sign up for an account.