If you’re a service provider, this should come as no surprise. Methods for collecting and verifying income and employment data are either expensive, time consuming, high friction, high risk, or unreliable (and, often, many of these things at once).

Out with the old

Income and employment verifications have an efficiency problem

In with the modern

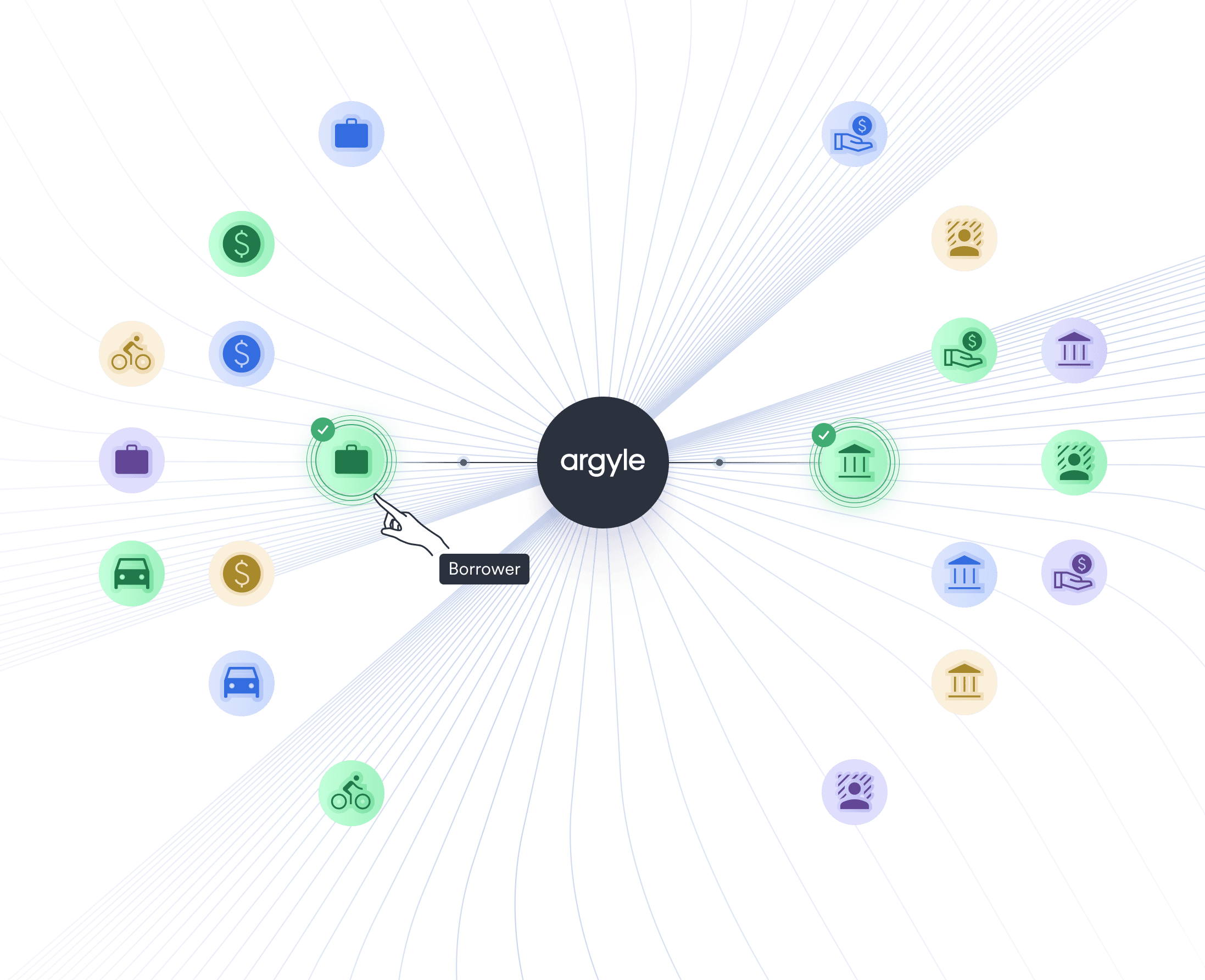

The solution is Argyle

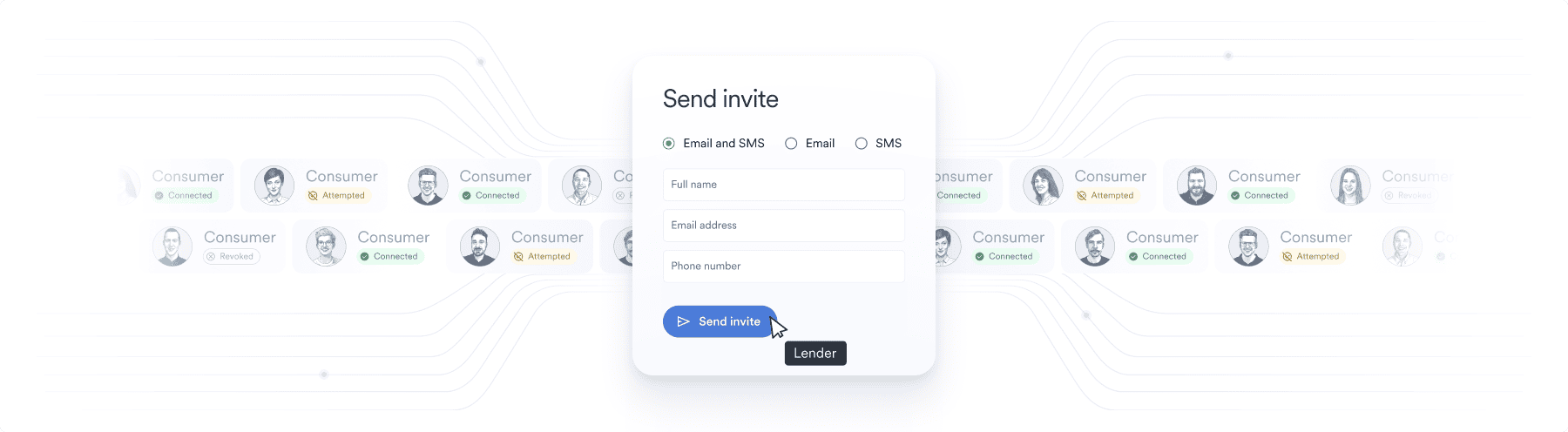

We know what you’re up against, and we’re here to fix it. We built Argyle for and with service providers like you to make inefficient verifications a thing of the past.

By connecting you with real-time income and employment data directly from the source of truth, we can help you streamline and automate workflows, save money, reduce fraud, and provide your customers with exceptional experiences.

Best of all? We’ll work hand in hand with you to optimize Argyle for your operations. Because no two Argyle customers are the same.

Our commitment to you

When you become an Argyle customer, your success becomes our success. Our entire focus is on providing the tools and support you need to get there.

We have in-house experts who know your landscape and what you’re facing.

We get to know your business and help you tailor Argyle accordingly.

We’re always working to maximize performance and your Argyle experience.

customers

Meet the businesses that trust us

Our customers range from startups to Fortune 500s, and the list is growing every day.

Read their storiesA platform changing the way money moves between employer and employee

With Argyle, shift-level visibility into hours worked enables instant access to earned pay

Personal Lending

Earned Wage Access

Helping service people and military families become homeowners

With Argyle, VU automates parts of the origination process, for a better, more efficient experience

Mortgage

The comprehensive business app for independent workers

With Argyle, Solo tracks income from connected gig platforms for seamless dashboard management

Gig Economy

A game-changing mortgage solution for lenders serving US communities

With Argyle, Maxwell lenders auto-verify income and employment — seamlessly and at scale

Mortgage

An AI-powered decisioning platform for creditors, fintechs, and more

With Argyle, Provenir offers income data access for real-time risk decisioning in under a second

Personal Lending

Sales and marketing solutions for mortgage companies and vendors

With Argyle, SL3 helps lenders find long-term solutions to the verification challenges

Mortgage

Providing our members with honest value, superior service and trusted advice

Argyle executed a custom integration hitting on pain points so DCCU could provide an outstanding member experience

Mortgage

INVESTORS

Meet the investors that

believe in us

We’re backed by institutional investors, that have secured our runway for years to come.

Blog

Explore what’s new and our point of view

We’re always sharing product updates and insights on the issues affecting our customers.

Read our blogACCOLADES

Work with an award-winning team

careers

Join our remote global team

And help us modernize financial services

Explore open roles