In today’s economic climate, businesses that engage in consumer underwriting are finding that access to real-time employment verification is more important than ever. Fortunately, Argyle enables a solution.

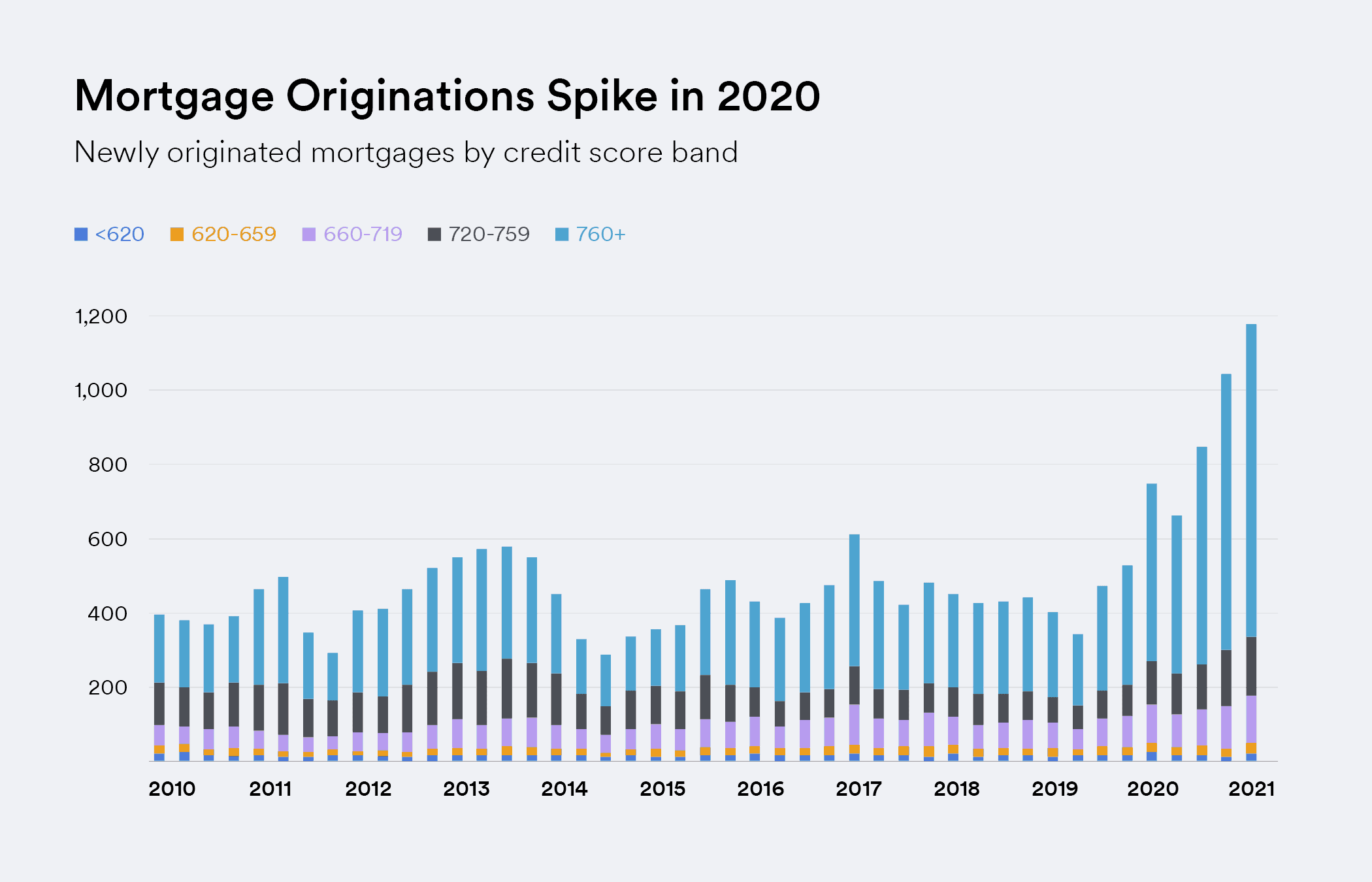

Case in point: the mortgage industry. In recent months, mortgage applications have skyrocketed as economic uncertainty surrounding the Covid-19 pandemic and policies set by the Federal Reserve hold mortgage rates at near-record lows. At the same time, U.S. unemployment numbers remain concerningly elevated, triggering higher than normal mortgage delinquency rates and threatening the financial security of homebuyers.

For mortgage lenders, this dichotomy is posing new challenges, as it is no longer sufficient to rely on even days-old employment data to verify an applicant’s work status throughout the underwriting process. In many cases, lenders are resorting to additional layers of manual employment verification before closing to help prevent unemployed borrowers from taking on dangerous personal risk. In the process, they are layering on friction and slowing down new loan originations at a time when capacity is already strained.

A Mortgage Boom Amid a Jobs Crisis

Low mortgage rates in the wake of the pandemic have given consumers new incentive to enter the home-buying market. In turn, applications to purchase homes have seen historic gains since last spring. According to the Mortgage Bankers Association (MBA), the mortgage application rate in December 2020 was an impressive 28% higher than the previous year, closing out the mortgage industry’s best year since 2003. In light of comparably strong application numbers in the first weeks of 2021, the MBA predicts the upward trend will continue, forecasting that purchase originations will rise to $1.59 trillion in 2021.

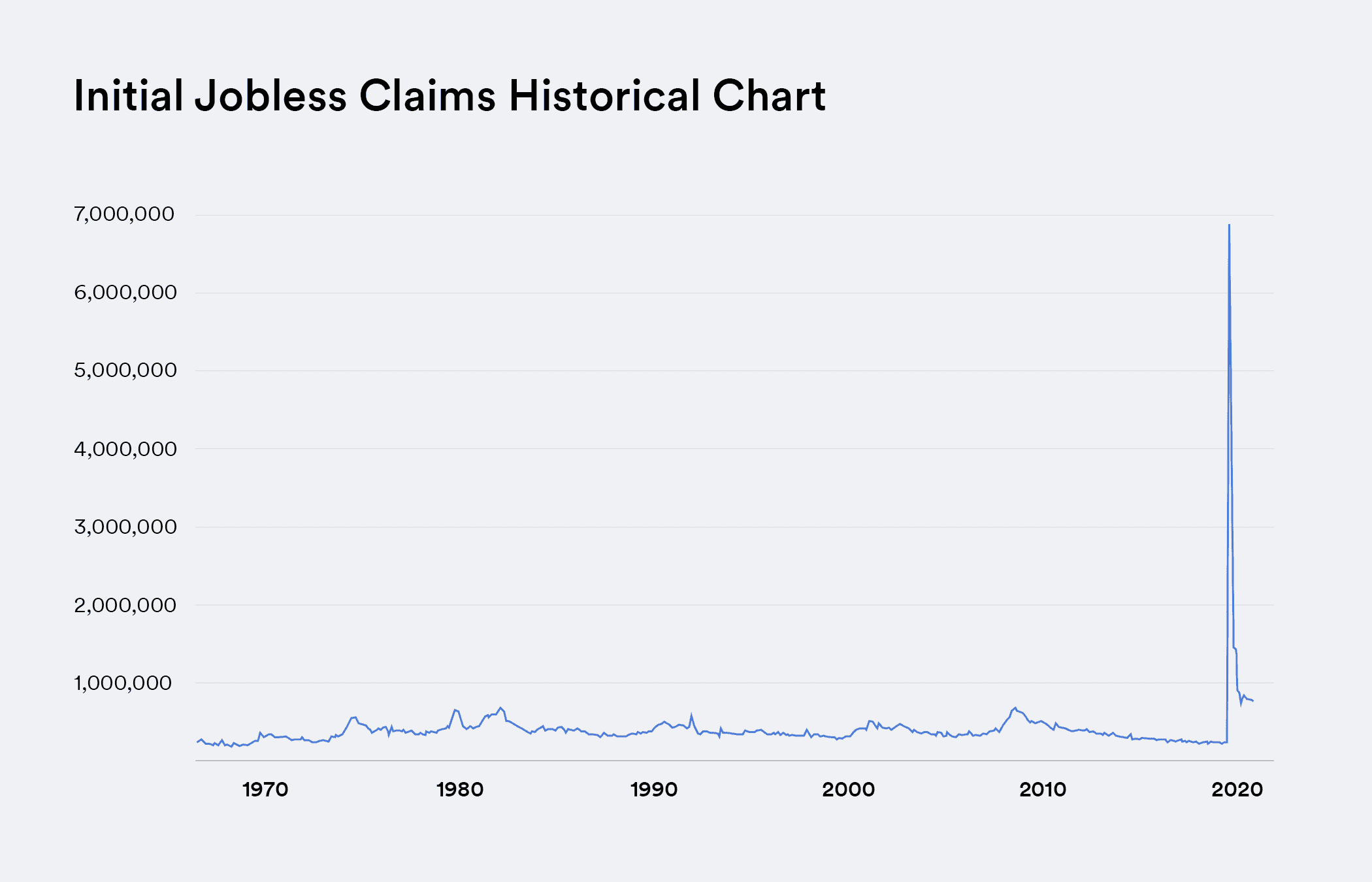

The picture is less rosy for the jobs market, which has seen unemployment rise in every state, industry, and major demographic group in the country. And while we can be thankful that the unemployment rate has declined since its unprecedented peak of 14.8% April 2020, it has remained elevated, coming in at 6.3% as recently as January 2021.

As the World Changes, so Do Lenders’ Latency Requirements

In light of these trends, mortgage lenders have grown increasingly concerned about applicants’ employment stability. Job loss is historically a strong predictor of mortgage delinquency and lenders are responsible for avoiding originating loans that borrowers may not be able to afford. Unfortunately, the vast majority of lenders’ don’t have reliable, real-time access to applicants’ employment data throughout the mortgage underwriting process, rendering it difficult to verify their work status with confidence.

That lack of transparency leads to problematic data gaps for lenders. Take, for instance, the hundreds of thousands of new unemployment insurance claims being filed each week. That equates to hundreds of thousands of potential mortgage applicants whose unemployment status wouldn’t be reflected in paystub documentation or an Equifax report, both of which pull from outdated data sets. The data gap created by paystubs and Equifax reports can mean the difference between approving a solvent applicant and an applicant who is taking on a dangerous amount of personal risk.

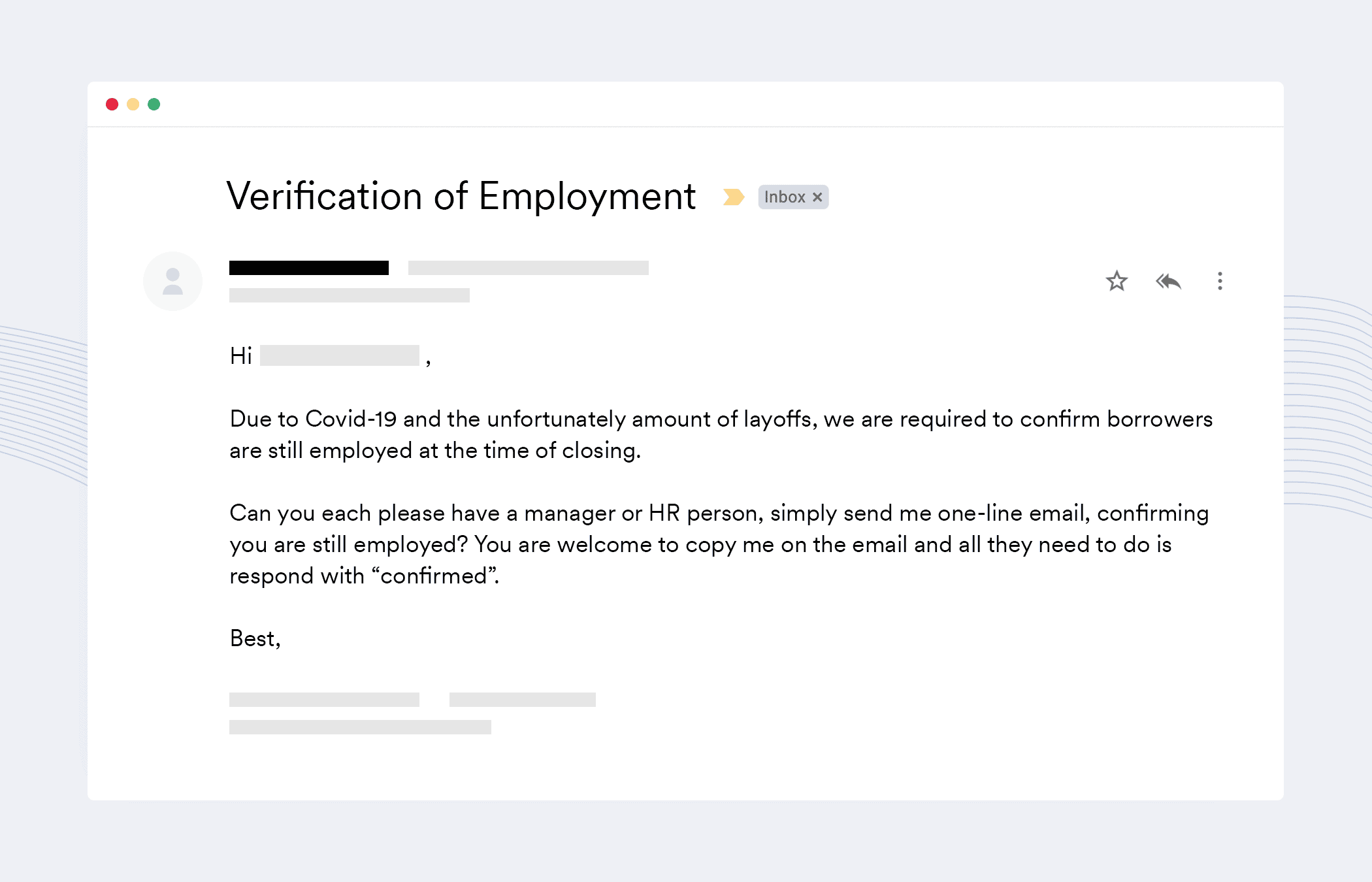

To compensate for their lack of visibility throughout the mortgage underwriting process, many lenders have been forced to take additional measures to ensure the validity of applicants’ employment status before closing on a loan. In practice, this often takes the form of an email chain, with the lending agent contacting applicants to request email verification from their HR department, which applicants then have to forward to their lending agent for manual review. It’s a cumbersome, friction-filled exchange that can add days to the mortgage underwriting and closing processes.

Lenders Seek Out Real-Time Data Solutions

Mortgage lenders looking to close the data gap, eliminate manual workarounds, reduce delinquency risks, and bolster mortgage approval rates are turning to Argyle—a digital gateway to real-time employment records that enables better lending decisions.

Argyle works by way of API technology that links lenders’ business systems to the data stored in applicants’ online employer or payroll platforms—all with the explicit consent of the applicant. Applicants simply sign in to their employer or payroll platform like they would at work, and Argyle makes the connection instantly for the simplest verification of employment for mortgage approvals.

From there, lenders have access to up to 120 fields of high-fidelity, accurate-to-the-second employment data, ensuring confidence in the fidelity of the data used to underwrite each loan.

Truthfully, the world has always been in an unpredictable state of flux; the pandemic has only made the precariousness of it all more apparent. As we continue to navigate our ever-changing economic landscape, not only mortgage underwriters and lenders but financial services providers of all kinds are sure to find value in instant, real-time employment verification solutions like Argyle.