Despite highly accurate, real-time data, many financial services still rely on historical information in credit decisioning

Credit scores once ushered in an era of standardization, transforming the lending industry from phone-a-friend to algorithmic probability, a mathematical and less biased method for calculating one’s likelihood of repayment. Yet, despite the technological advances in the decades that have followed its creation, traditional scoring and verification remain cumbersome, lengthy, and more importantly, vulnerable to errors that impact the lives of everyday consumers.

Credit bureaus fail to count millions of Americans and miscalculate scores for millions more

Credit reporting errors result in millions of incorrect credit scores being sent to lending institutions every year. In some cases, reported scores are so erroneous they’re practically inverted. A recent reporting blunder caused consumers with scores in the 300s (considered “bad” credit) were given scores in the 700s+ (considered “ good – excellent”), and for others, the exact opposite—those with excellent credit received poor ratings. The fallout from this failure affects not only the lending institutions that signed contracts with interest rates commensurate with credit ratings, but also everyday consumers who may be paying tens of thousands more than they should over the life of their loan—in some cases consumers may have been denied loans altogether.

The current credit system excludes roughly 26 million Americans—creating a credit invisible class. These consumers aren’t necessarily uncreditworthy; they are simply left out of the current scoring model because of thin credit—too few accounts—or no credit at all. In some cases, it’s because they are gig, freelance, or creative economy workers who represent a rapidly growing portion of labor (estimated to be 50% of the workforce by 2027). Since income and routine payments like utilities and rent don’t inform credit scoring, many thin-to-no-credit households are disadvantaged. Their financial health and ability to repay is not reflected in traditional credit modeling. Workers whose wages are untraditional (YouTube creator, DoorDash employee, Uber or Lyft driver) may be unable to furnish sufficient paperwork for legacy institutions to approve loans or credit, severely limiting financial access for millions of Americans.

Credit bureaus are the number one source of consumer complaints

The Consumer Financial Protection Bureau (CFPB) cited credit reporting errors as their number one complaint source (growing annually) and recently released a study showing that one-third of all reports contain errors. Twenty percent of errors are so egregious they could cause a consumer to be denied credit. And while the Fair Credit Reporting Act (FCRA) offers a path for redress, some consumers find that this takes months or even years to accomplish—effectively dashing the hope of obtaining a new home or vehicle within a reasonable timeframe.

In addition to being the number one source of consumer complaints, the credit bureaus have experienced data breaches, exposing the personal information and scores of millions. In 2017, a massive data breach exposed the information of 150 million Americans (that’s nearly half of the US population) and wasn’t reported to the public for over a month after the issue was discovered.

Payroll information offers better data and a real-time credit scoring alternative

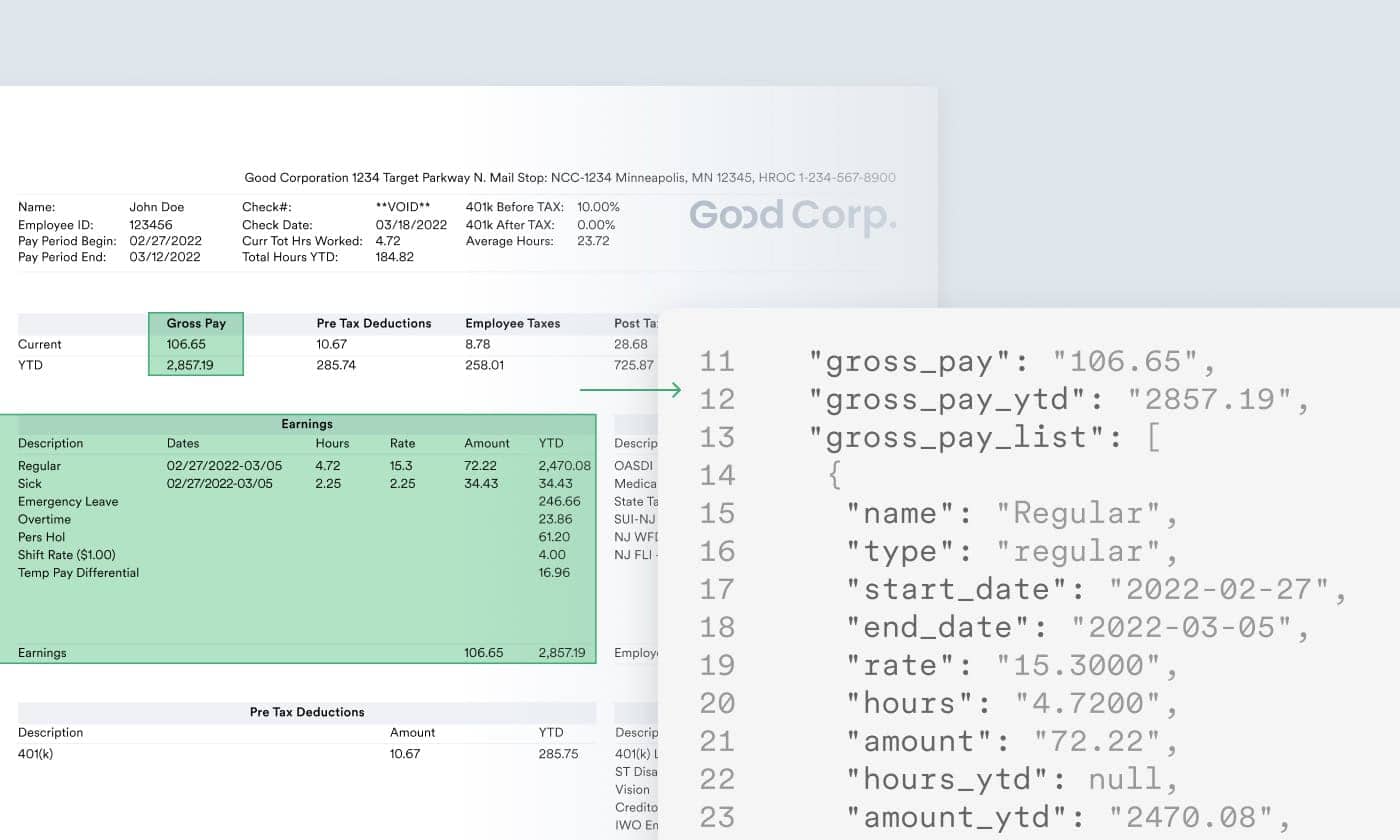

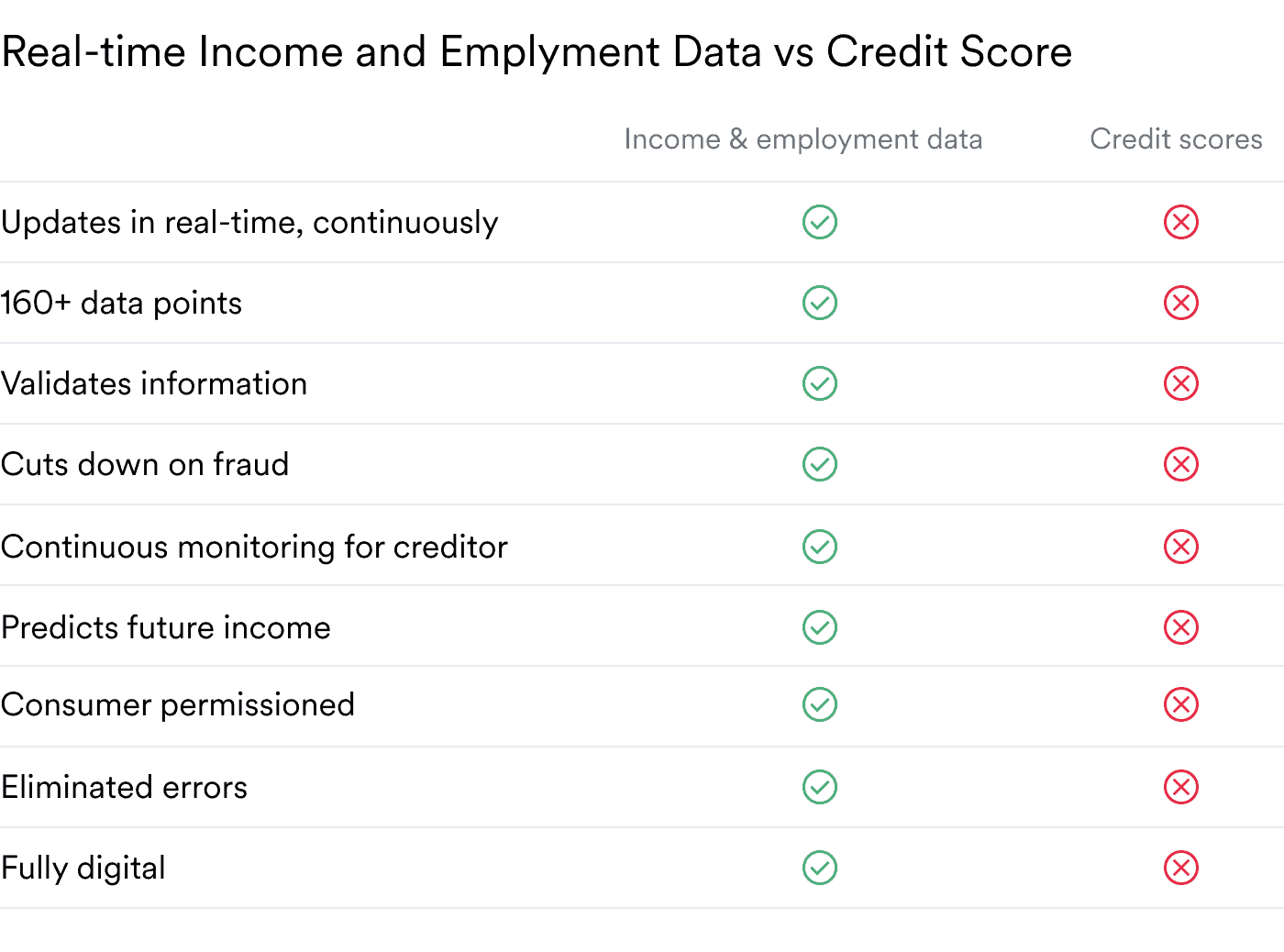

Workers generate valuable personal financial information each hour they work. Every employee in the United States has a paystub packed full of everything from how long they’ve been at their job, hourly earnings, hours worked, job title, and many more data points. This generates valuable real-time personal information that can be leveraged by decision-makers looking outside of traditional credit scoring models. Payroll data transfer agents, like Argyle, collect over 160 streaming data points using a fully transparent, consumer permission model (consumers control who has access to their financial information, unlike traditional scoring models).

Moving to payroll informed decision making reduces fraud, errors, lender-risk, and covers any and all workers, including creators, hourly, and gig workers. Once a payroll account is connected to a lender, new possibilities open for obtaining credit, and the lender has peace of mind from real-time monitoring. This approach allows lenders to be notified of major changes, affording the opportunity to contact the consumer and work out repayment options before potentially defaulting.

Employment data expands financial access

Credit scores document the past but do little to help creditors understand a consumer’s current financial status. A series of late payments three years ago can significantly harm one’s credit score, even if that individual now has three jobs and a hearty savings account. Worse, credit scores don’t consider circumstances like recessions, medical bills, or other unforeseen, unavoidable situations. Nor do they predict future earnings based on historical income and employment data such as previous or typically scheduled shifts. Companies like Argyle leverage this information to help consumers predict their potential future income while monitoring their real-time earnings. The weight of a past payment ledger (a credit report) is drastically reduced in decisioning when real-time data is available, ultimately benefiting consumers by opening up credit options and benefiting lenders by reducing defaults.

Income and employment data helps consumers and financial services with:

Paycheck-linked lending, which has been shown to lower default by two-thirds, helping creditors feel confident and aiding consumers in meeting their financial obligations (plus the added benefit of always paying on time and avoiding late fees and penalties)

Earned wage access—payouts daily or even ahead of scheduled shifts—changing the way workers get paid and eliminating the need for predatory payday loans

Greater financial access with real-time insight creditors can rely on

Deposit switching—consumers can easily transport their information between financial institutions

Data portability and access—when your data belongs to you, there should always be the option to move it or revoke access to it at any time

Real-time insight into financial changes

Upending the credit score will transform financial services

Modern financial services across the country are offering consumers flexible options, helping eliminate paydays loans and giving workers access to the wages earned as they earn them. The more consumers that choose these options, the more legacy institution will move in this direction. This transformation, while initially costly for legacy institutions built on layer after layer of outdated technology, will ultimately make the industry consumer-centric, more efficient, and more effective for decades to come.

If you’re ready for a world where credit reports, pay stubs, W2s, direct deposit change forms, and all other forms of fixed, opaque, and reductive financial documentation are rendered obsolete, start choosing to work with companies that are embracing new lending models. Supporting these companies helps build a new network of continuous, comprehensive, and cross-functional income data streams—owned and permissioned by consumers and leveraged by institutions to transform financial services in ways that meaningfully change lives.

Learn more about how income data is changing the future of finance