Our latest partnership enables lenders who use Encompass to unlock the efficiencies and cost-savings of direct-source income and employment verifications.

Fresh on the heels of our approval as a Day 1 Certainty authorized vendor, we’re thrilled to announce that we’re fully integrated with Encompass® by ICE Mortgage Technology®, a leading loan origination system (LOS) for mortgage lenders.

Through our formal partnership with ICE, we’ve made our direct-source Income & Employment Verification solution available within the Encompass platform, so mortgage lenders don’t have to leave the Encompass software environment to leverage the benefits of the most trusted network for income and employment data.

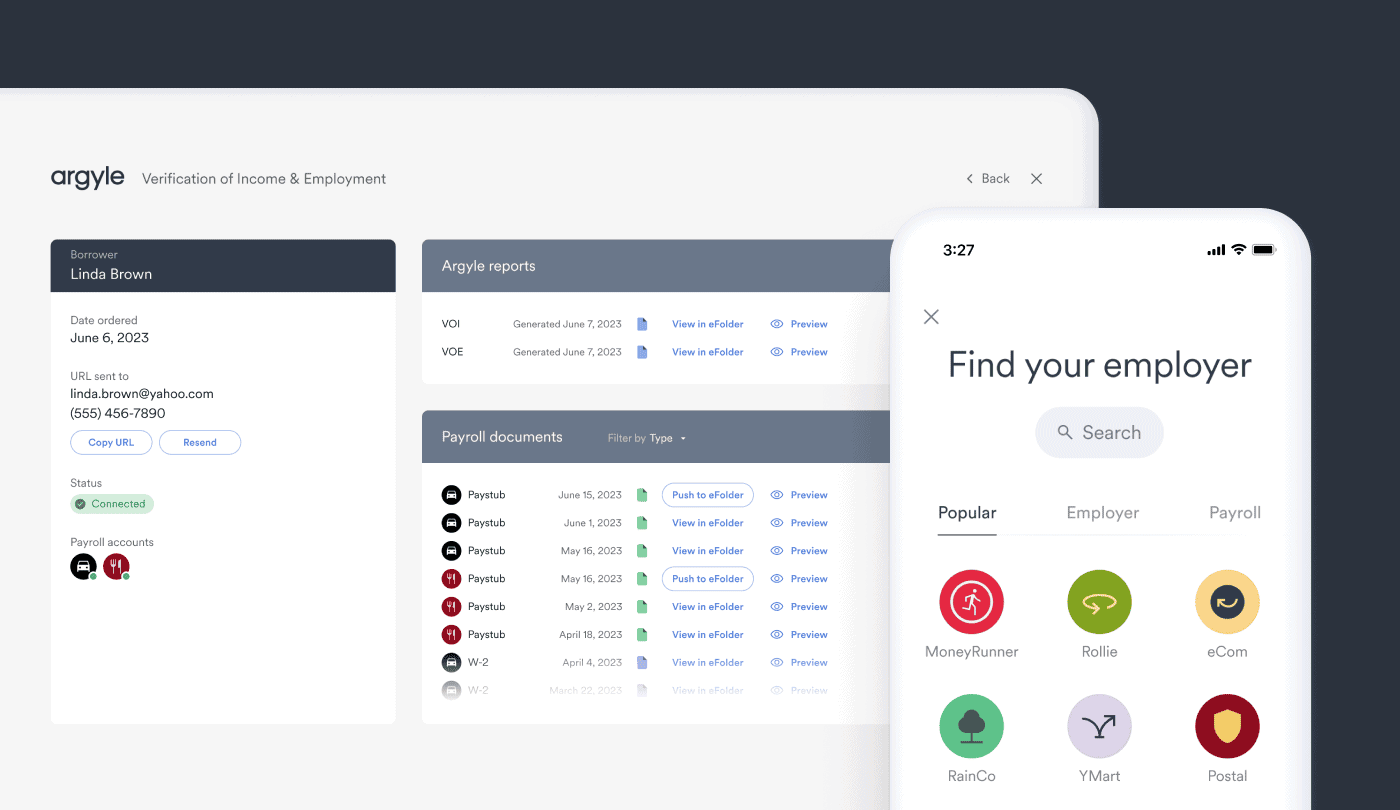

Argyle’s integration with Encompass gives lenders continuous access to real-time VOI and VOE reports and borrower documentation throughout the mortgage loan cycle. As a result, lenders gain significant production efficiencies at a much lower cost.

What lenders can expect from our Encompass software integration

As a result of our ICE partnership, lenders using Encompass have in-platform access to consumer-permissioned income and employment data via Argyle’s secure connections to borrowers’ payroll records. Best of all, lenders receive the data in a format they are familiar with and can trust: VOI and VOE reports that meet Day 1 Certainty requirements.

Because Argyle connects directly with borrowers’ payroll source, our technology also allows lenders to auto-retrieve borrowers’ paystubs, W-2s, 1099s—eliminating the need for lenders to ask borrowers to collect and send payroll documentation themselves. For many lenders, this shaves days off of loan origination and processing times.

Best of all, Argyle’s payroll connections are streaming, which means:

Borrowers’ accounts are continuously monitored.

Lenders receive notification when a borrower experiences a significant change in income and employment status.

Lenders have ongoing access to borrowers’ most current payroll documents.

Lenders can instantly generate real-time verification reports throughout the mortgage loan cycle at no additional cost.

In other words, Argyle ensures lenders have fast, accurate, and reliable data from application to closing.

Lenders can begin using Argyle as soon as today

Accessing Argyle within the Encompass platform is quick, easy, and requires no technical resources. You simply need an Encompass administrative account and credentials from Argyle to complete setup in a few steps.

Contact our team today to get your company’s unique credentials so you can start testing and connecting with Argyle via your Encompass mortgage software. You can find complete setup instructions in our Argyle + Encompass® user guide.