How Lenders Use Real-Time Data to Reduce Credit Risk in Today’s Macroenvironment

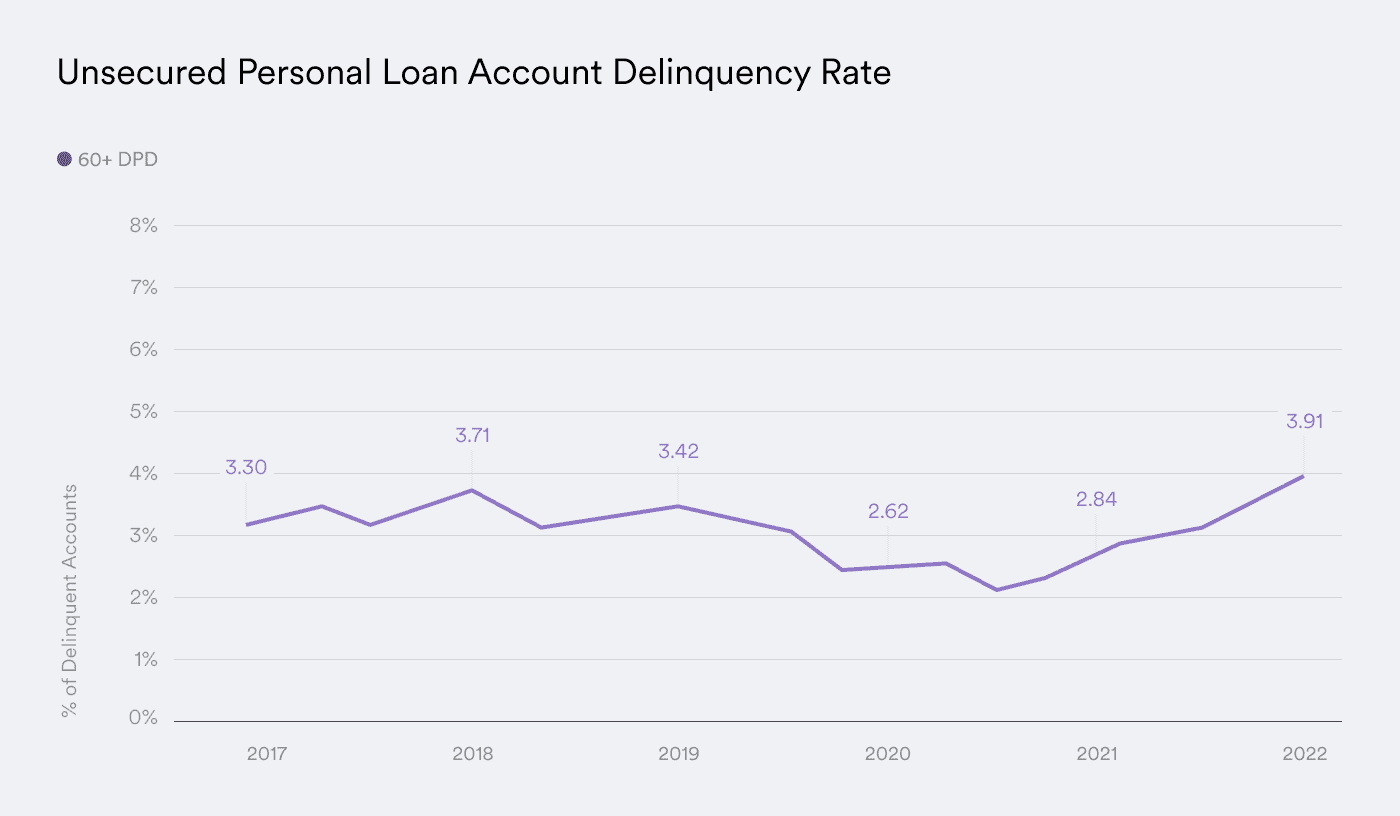

Credit performance. It’s never not on the minds of lenders, but in 2023, it’s especially pressing to take stock of. The reasons come as no surprise: delinquencies are up across most products, and experts predict they will only increase from here.

To mitigate losses, your impulse may be to tighten your credit score requirements. But sweeping changes to your risk tolerance will also cut into your addressable market. To protect your portfolio without leaving good business on the table, you need a smarter approach.

In this article, we explain how to reduce your credit risk by capitalizing on the availability of live, accurate, and granular income and employment data to add nuance to your risk matrix and paint a more dialed-in picture of consumers’ payment-to-income and debt-to-income ratios.

The economy’s perfect storm

It’s not news that serious delinquencies are up and rising across most credit products, especially unsecured personal loans. At the end of 2022, 3.91% of personal loan borrowers were 60+ days past due compared to 3.49% in the same quarter in 2019—a high not seen since 2014. And that number is expected to rise.

Experts attribute the delinquency trend to a problem of affordability resulting from rampant inflation, high interest rates, and the discontinuation of pandemic-era federal stimulus programs. Notably, although the speed at which prices are increasing has moderated since the June 2022 high of 9.1%, the annual inflation rate remains elevated and is expected to average 5% through the end of 2023.

In turn, average expenses for U.S. households have increased $370 per month, putting additional financial stress on low- and middle-income consumers and disrupting their ability to make timely loan payments. Across credit products and the risk spectrum, average minimum monthly payments have surpassed pre-pandemic levels, and considerably fewer consumers are making greater than minimum loan payments—a sign of financial struggle. Meanwhile, consumers in the below-prime space now hold a higher total share of personal loan balances—34.6% in Q4 2022 compared to 31.2% in 2021 and 32.7% just before the pandemic—suggesting that more delinquencies are to come.

The risk may be even greater if the job market doesn’t hold up. Experts warn that the effects of high federal interest rates on employment may not be fully realized until 12 to 24 months in, with some anticipating a rise in the unemployment rate later this year.

How lenders are weathering the new credit climate

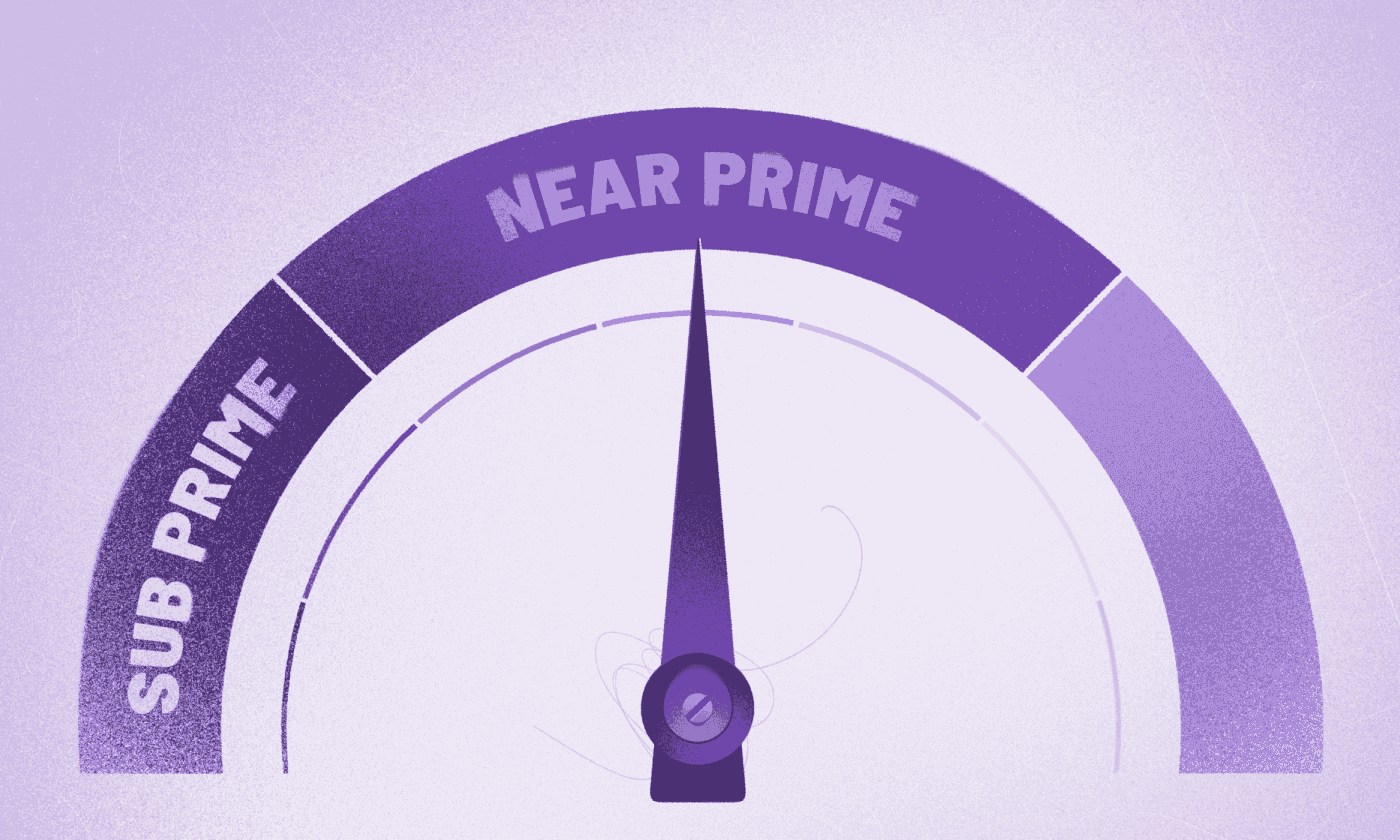

In 2022, lenders of all types, but especially fintechs and banks, drove personal loan origination volumes by tapping into the below-prime market. Now, there is evidence that they are pulling back as the risk of delinquencies comes into sharper focus.

At the same time, more consumers may soon be slipping into below-prime territory, with gains in credit scores realized over the course of the pandemic coming to a standstill thanks to higher account balances, delinquencies, and credit utilization rates. The median VantageScore declined in Q4 2022, while the average FICO score leveled off in 2022, representing the first time since the Great Recession that the average FICO score saw no year-over-year gain.

Should consumers lose their credit standing, a greater share of the total loan balance will fall into higher-risk categories. Meanwhile, lenders who choose to tighten their lending standards by a single, broad measure—aka, credit score – find themselves with far fewer lending opportunities at a time when origination volumes are already decreasing due to contractions in the economy.

“If credit score is the only measure you’re looking at, you’re probably eliminating 20 to 40% of the originations you could be capturing,” said Matthew Gomes, general manager of consumer lending and banking at Argyle.

Getting wind of payroll connectivity

To mitigate credit risk without eliminating huge swaths of consumers, innovative lenders are turning to the granular, verifiable income and employment data afforded to them by payroll connectivity.

Payroll connectivity is the integration of your POS and LOS with consumers’ payroll accounts. By establishing a direct, live, and continuous payroll connection, you can retrieve and verify dozens of real-time data points relative to your borrowers’ pay, earnings, and employment status—straight from the system of record.

You can use this new-found visibility to inform and power a more nuanced risk matrix that supports strong credit performance without making sweeping cuts to your addressable market.

With payroll connectivity, valuable data like consumers’ real-time employment status, pay frequency, gross and net income, job tenure, the length of each direct deposit allocation, and so much more are at your disposal. And you can verify these data points instantly and automatically across income streams—from traditional salaried and hourly jobs to contract-based 1099 sources—giving you a complete picture of their financial circumstances.

Unlike credit reports and even banking data, income and employment data derived from payroll connectivity can tell you:

How frequently and regularly a consumer is paid

How much of their wages come from variable sources (e.g., bonuses or commissions)

How often they change jobs or switch primary banks or direct deposit accounts

Whether they hold a highly stable role in a highly unstable industry

Whether they have positive factors [like 401(k) contribution] or negative factors [like wage garnishments] in their payroll records

When and how often they pick up shifts for gig platforms

In turn, you can leverage more accurate payment-to-income or debt-to-income ratios to reduce credit risk or add completely new indicators of creditworthiness to your underwriting model. So, instead of approving or denying a borrower based on credit score alone, you can confidently consider credit score in tandem with other factors that demonstrate their ability to repay.

This will help you identify below-prime or near-prime consumers who are actually lower risk than their credit score suggests. It will also help you identify consumers with fair or good credit scores who might struggle to make minimum payments, either because they are living paycheck to paycheck or because of a recent job loss—neither of which can be adequately captured by a credit report. Both scenarios protect you against losses and are a boon to your credit performance.

Lightning-quick verification

Of course, payroll connectivity isn’t required to deploy a more nuanced risk matrix. But without payroll connectivity, verifying these granular income and employment data points is a highly manual, time-consuming process involving tremendous back-and-forth between you, your borrowers, and their employers. Not only would your borrowers need to come up with documented proof for every factor and submit that proof via digital upload or in-person exchange, your loan officers have to manually review each one.

In addition to adding days or weeks to your origination cycle, manual verification introduces considerable friction for your borrowers that undermines conversion. In contrast, borrowers can permission real-time payroll connectivity in moments with a single sign-in. Then, just as quickly, your LOS can retrieve the data it needs to verify income and employment—no human intervention required.

Simply powerful payroll connections

In short, payroll connectivity makes it easy to establish smarter credit tightening measures and optimize credit performance in light of rising delinquencies in an uncertain economy.

To put payroll connectivity to work for you, make like innovative lenders and turn to Argyle. Argyle is a payroll connectivity platform that provides lenders with fast, cost-effective, consumer-permissioned access to the most trusted network for real-time income and employment data.

Get in touch with our team to learn how real-time payroll connections can reduce your lending risk—or sign up for a free account to try Argyle out for yourself.