In short, it’s better for business.

You may have seen headlines over the years about companies buying income and employment data in bulk, and reselling it to lenders and other financial services without consumers’ explicit consent. We call this non-permissioned consumer data, and it presents a real problem for unsuspecting users and the lenders verifying their credentials.

At Argyle, we know the importance of data and privacy, so we take a different approach. We use a strictly consumer-permissioned model and empower your customers to mobilize their data through our platform.

We’re proactive about informing users how their personal information collection will be used, and we openly seek their consent as part of our ongoing commitment to radical transparency.

It’s not just the right thing to do—it’s also better for you, our customers. Here are five ways consumer-permissioned data streamlines your verification flow and boosts your business.

1. Real-time data

Non-permissioned consumer data is a one-time deal. You get a snapshot of a user’s situation at the moment that information was collected and reported—maybe two weeks, maybe months ago—but not into anything that’s happened since.

Argyle’s consumer-permissioned data is ongoing and updated in real time, meaning you get up-to-the-minute insights into each user. Our webhook technology also alerts you right away if any relevant changes arise in their employment or income, like if they were laid off or received a raise.

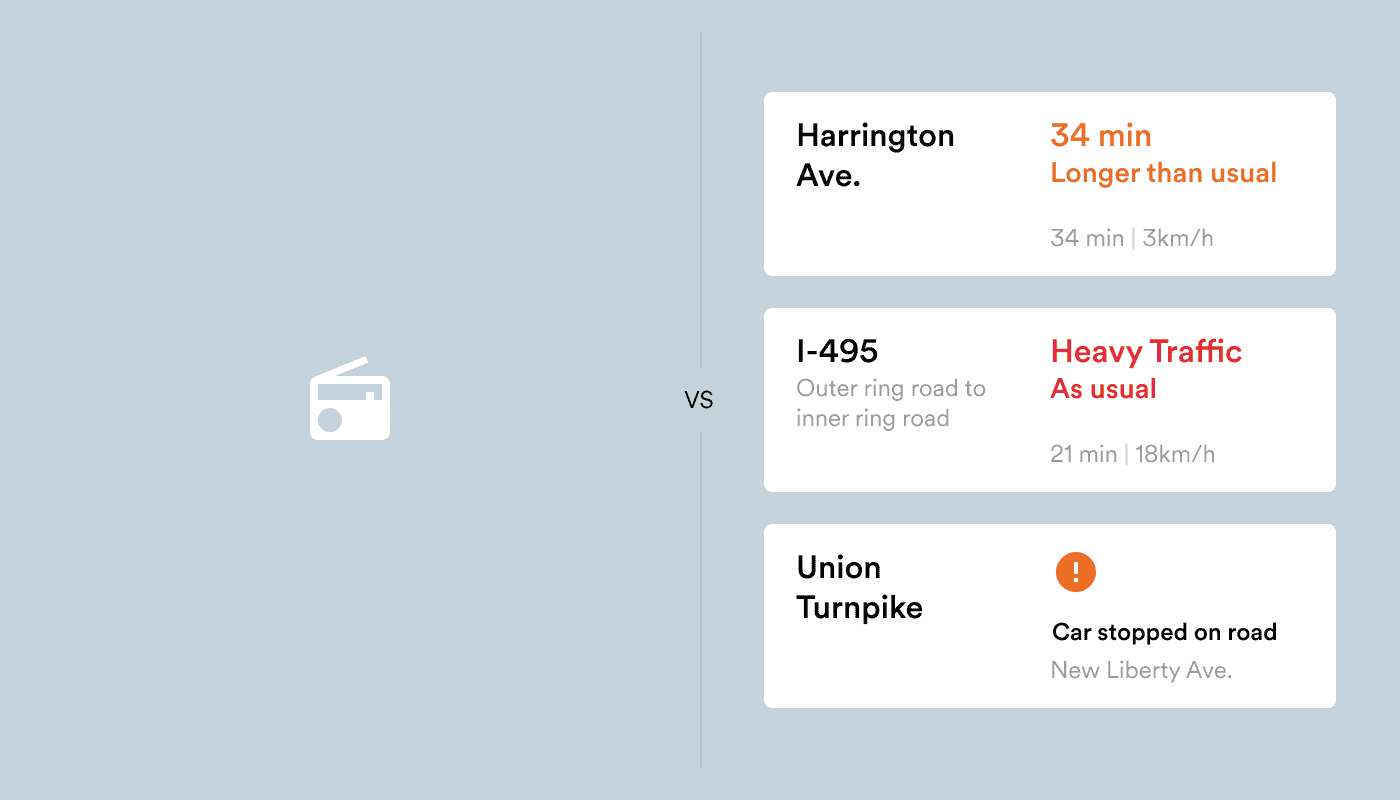

Think of it like traffic: If you’re driving somewhere in a hurry at 5 p.m., what’s more useful—the morning traffic report you heard on the radio earlier that morning or the live alerts you get through an app like Waze?

What’s more, instead of the handful of consumer data fields provided by non-permissioned providers, Argyle gets granular with over 160 data points, and our bi-directional integrations enable both read and write functionality. All of this together means you get a more holistic and continuously updated understanding of your users’ employment and income status and can tailor (and cross-sell) your products and services to match their needs.

2. Rapid coverage expansion

Argyle’s platform is built to easily map and integrate new payroll integrations, allowing us to rapidly expand our coverage of information collecting.

That’s why we have two to three times the coverage of non-permissioned platforms—or 65 to 70% of employers, compared to the 25 to 30% seen by non-permissioned sources—and why our reach is growing exponentially. Over the past year, we’ve doubled our coverage, and we’re still gaining steam.

The flexibility of our modern platform also allows us to quickly adapt to new worker categories. That’s why only Argyle has close to 100% coverage of workers in the gig economy.

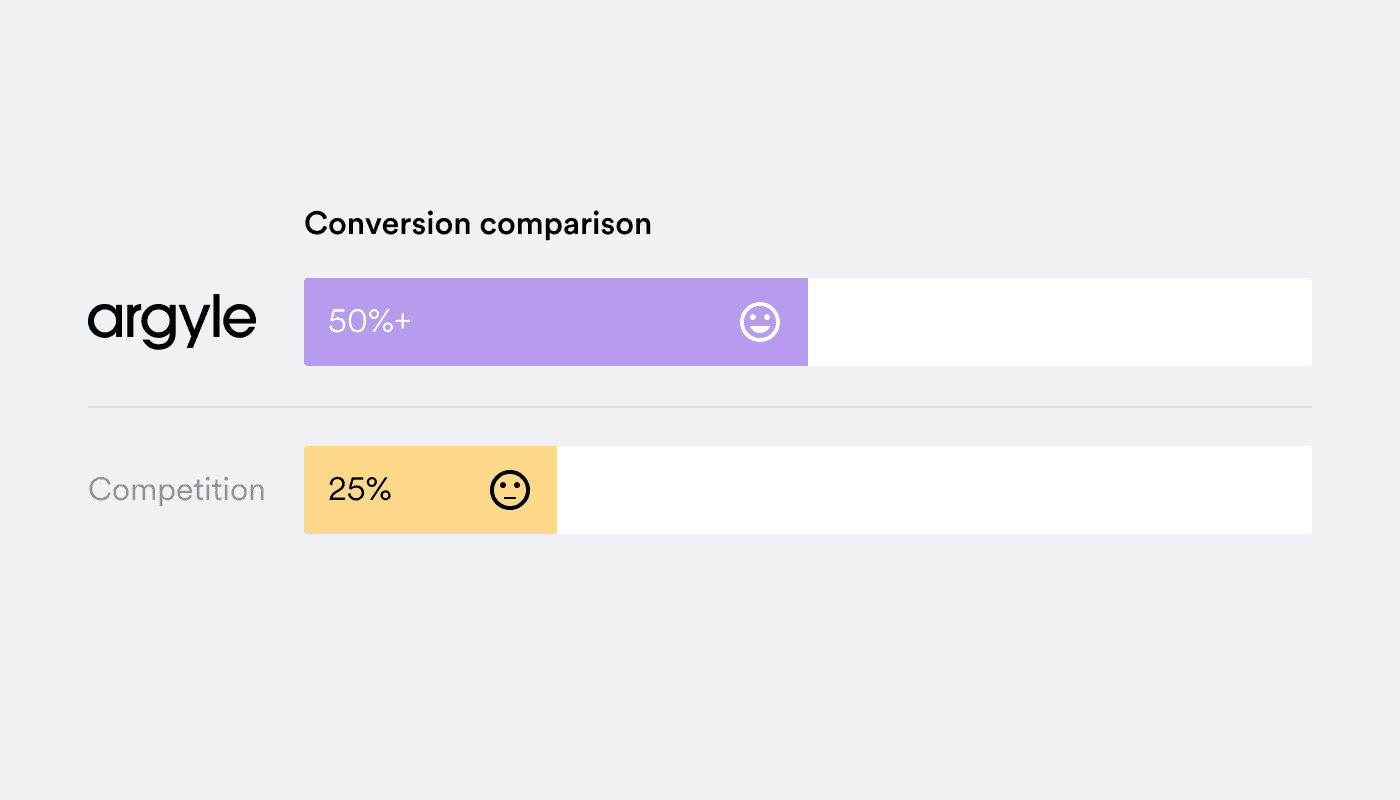

3. High conversion

If you’re hesitant to let users take the lead on the verification process, our results may surprise you. We’ve consistently found that 65 to 75% of covered users successfully login and connect to their employment and payroll system through Argyle, meaning they’re more motivated (and better at remembering their passwords) than you might think.

Doing a quick bit of math, that means Argyle roughly doubles the number of users who can be swiftly and automatically verified using our platform. That’s up to 70% coverage, multiplied by up to 75% completion, equaling an end-to-end conversion rate of 50%+ —compared to the static 25% you get by using non-permissioned sources.

But don’t just take our word for it—we make our results readily available to any customer upon request and are open about our coverage, console, and endpoints for each product.

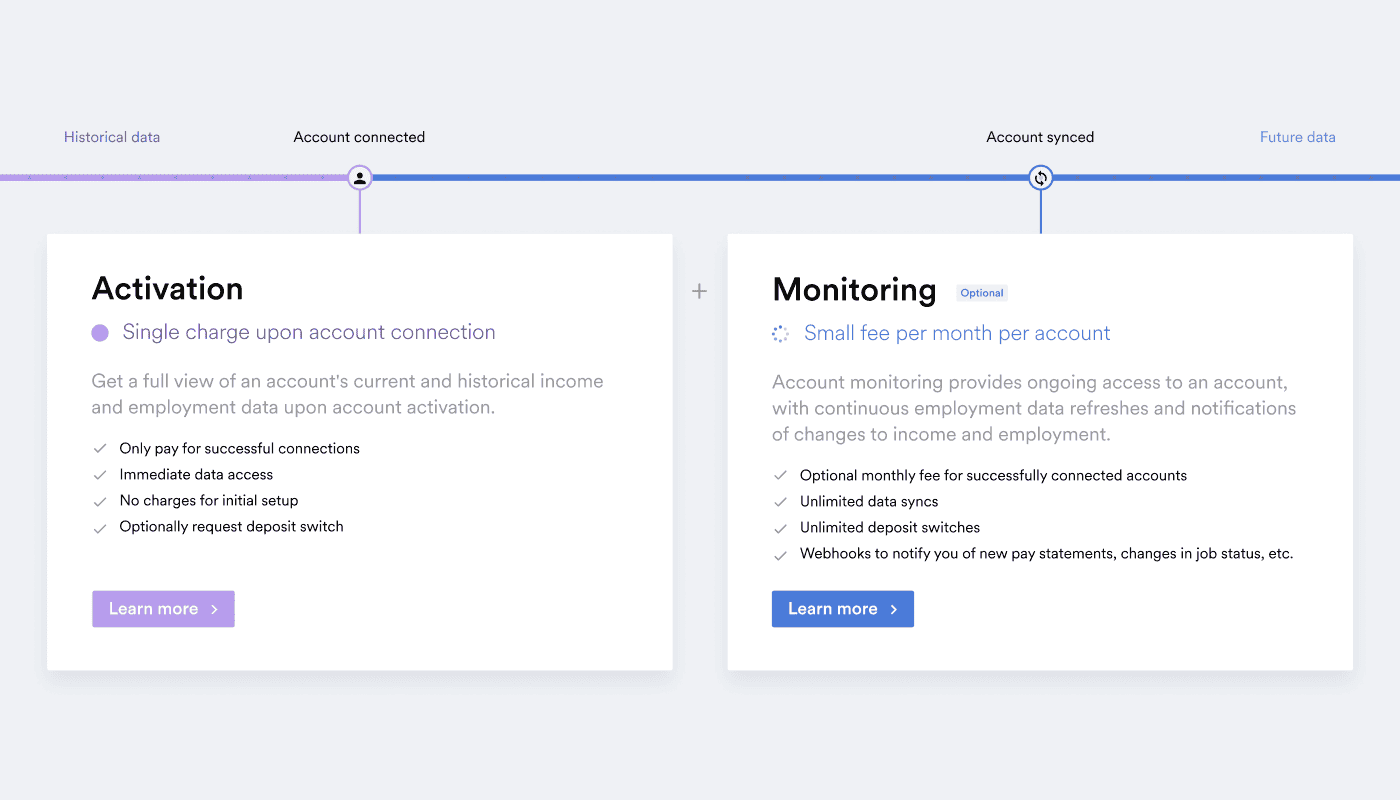

4. Better value

With Argyle’s pay-per-use policy, you’re charged only for the data you’re able to access—with no charges for interrupted or unsuccessful connections.

More importantly, your spend goes further. With our consumer-permissioned data model, you get continuous, real-time access to all consumer data with a nominal monthly fee. If you want freshly collected information from non-permissioned sources, you’ll have to purchase additional reports and reverifications, or ask your users to fill in gaps themselves in order to stay current.

5. It’s more ethical—and more secure

This one’s easy. Users deserve to know what data of theirs is being shared, where it’s going, how it’s being used, and who’s profiting from it. And, as a recent survey has shown, consumers really care about their privacy.

Offering information upfront gives your users peace of mind and lets them know you’re looking out for their best interests—ultimately instilling greater trust in your brand and enabling better business relationships.

In recent years, legislation like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have shown that the world is moving toward tighter user data and privacy protections. You don’t want your organization to fall behind the times or be associated with unethical practices as they’re brought to light.

Not only that—you don’t want to put your customers at risk. Non-permissioned sources sit on mountains of sensitive consumer information (with mixed security results) whether or not it’s being used. Argyle accesses only the employment data that users explicitly authorize, and we keep their privacy and security top of mind.

Want to see Argyle in action?

Sign up for a corporate account to use our sandbox for free or contact our team to learn more about our consumer-permissioned payroll and employment data.