How looking beyond borrowers’ credit scores helps lenders enhance their underwriting models, expand their market share, and support all types of workers

Lending decisions can determine consumers’ ability to access critical resources like housing, vehicles, and insurance, not to mention personal loans in times of financial hardship. Historically, these decisions have hinged on a limited set of criteria, including a borrower’s credit score and their ability to demonstrate consistent employment.

But economic paradigms are changing

One study found freelance work is expanding at a rate 3x faster than general employment in the United States, with the number of gig workers reaching 59 million people, or 36% of the workforce, in 2020. Meanwhile, reports estimate 45 million US adults (over 15%) have a thin or no credit file, meaning traditional underwriting fails to account for a substantial portion of the population and alternatives to credit scores are needed.

Below, we break down how alternative data — like employment and payroll accounts or shift reports — can paint a fuller picture of workers’ financial health and creditworthiness, fuel better lending decisions, and allow lenders to serve more consumers at more competitive rates.

Why traditional data is insufficient

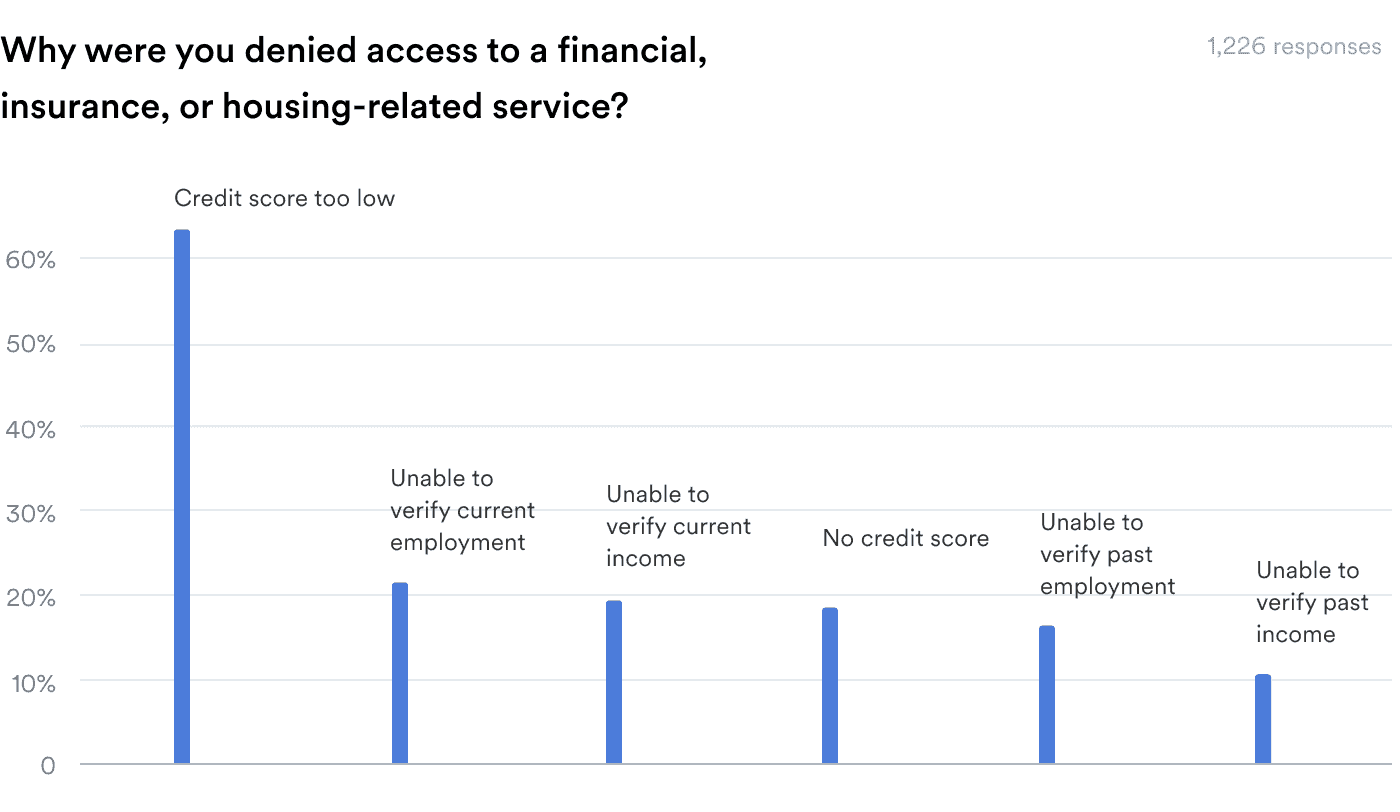

Typically, lending decisions are heavily based on a single factor: the borrower’s credit history. In a survey conducted by Argyle, the vast majority (nearly 82%) of workers who’d been denied access to financial services had been rejected because of a low or nonexistent credit score.

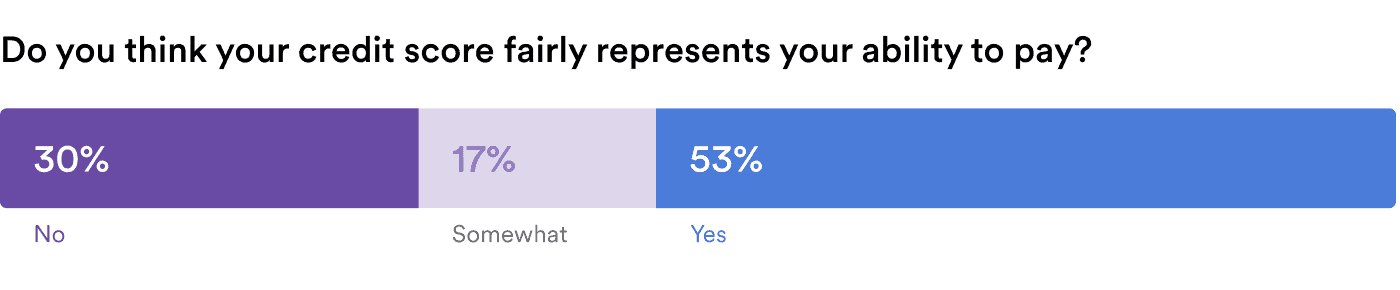

And yet, almost half of respondents (46%) felt that credit scoring doesn’t accurately reflect (or only partially reflects) their actual ability to repay a loan.

The second most reported reason for denial (in 68% of cases) was an inability to verify current or past income or employment in the manner required by a financial institution. That’s because lenders tend to rely on verification methods — like employment letters, phone calls to supervisors, and Social Security numbers — that assume workers have access to an HR department or receive conventional paychecks.

Gig workers often work and earn just as much as (if not more) their W2 counterparts; it’s just that traditional underwriting models don’t take their financial strengths into account. That’s why turning to alternative data points can fill the substantial gaps in credit and employment records and offer a much fairer assessment of workers’ overall financial health.

What alternative data does better

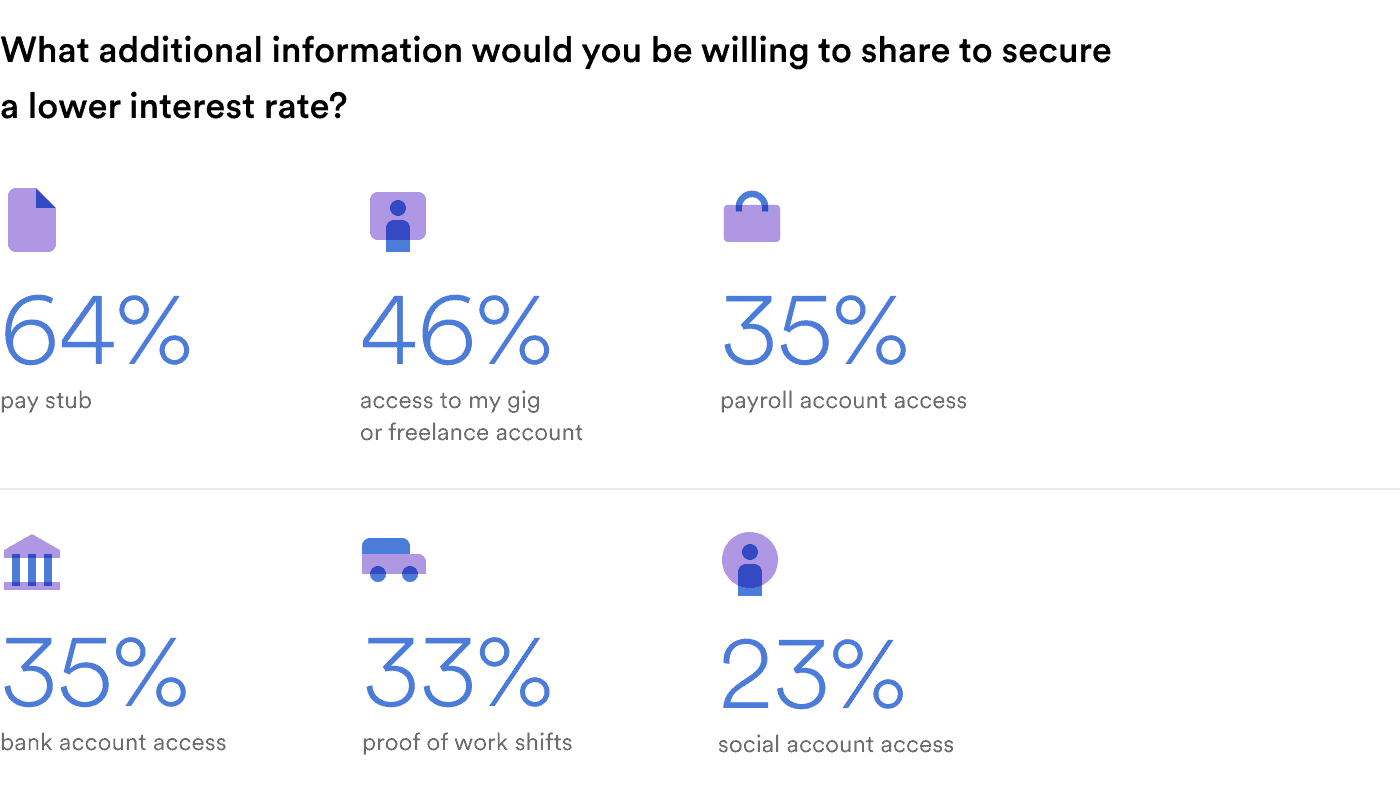

When asked what additional information they’d be willing to share to boost their loan chances or secure a lower interest rate, surveyed workers offered a range of options, with income and employment data topping the list:

In recent years, Argyle has allowed lenders to access alternative lending data in order to meet these needs and provide a more equitable, holistic view of workers’ creditworthiness.

Argyle lets borrowers connect directly to their source(s) of income during the loan application process, whether that’s a gig platform like Uber or a creative channel like YouTube. From there, lenders get permissioned access to employment data in real time, with webhooks notifying them any time there’s a significant change.

What’s more, Argyle can be embedded seamlessly into an existing application flow. That means borrowers can provide additional data points without encountering extra friction, without ever leaving the lender’s application.

Key takeaways

In short, more data means more confident, precise lending decisions — and more support for every kind of worker.

When included in a credit risk analysis, alternative sources like real-time income and employment data offer a truer, more comprehensive view of borrowers’ finances. By taking advantage of these solutions, lenders can not only unlock access to affordable credit for millions of overlooked workers but also tap into new markets and new business opportunities.