Seamless data access means a frictionless UX for end-users—and better business for everyone.

In an earlier post, we covered how connecting to employment and payroll platforms through Argyle is a quick, two-step process for end-users. And that’s great, obviously, but how does it translate to real results?

Here, we take a deeper look into some of the main friction points that end-users and businesses encounter using other income and employment verification methods, how Argyle is doing things differently to provide a frictionless experience, and why that matters for your organization.

Specifically, let’s dive into five key benefits your business sees from Argyle’s effortless process:

Automated verification through an instant, two-step flow that takes seconds—not days—and requires no manual tasks on either end

Continuous, real-time access that gives you ongoing, up-to-the-minute employment and payroll info and alerts you whenever there’s a change

Better customization, better relationships because our simple, highly customizable product helps you build trust and loyalty among your users and establish a stellar brand

Higher conversion rates because a frictionless UX means users can easily and securely opt to share their data without ever leaving your application, no document uploads or manual data lookup required

Comprehensive, standardized data that is easy to navigate and digest, with important computations done for you

Now, let’s break them down one by one.

Automated verification

Historically (and, too often, still today), users verify their employment and income through a high-friction, manual process.

In the best-case scenario, that means leaving your credit application or mobile app, navigating to their payroll platform, logging in, locating and downloading paystubs, and going back into your flow to upload them. In the worst case, it means filling out paper forms and scanning physical copies of their documents.

On the other end, your operations team is sorting through paystubs, W-2s, and emails and attempting to verify every employment detail by phone or email.

Whichever end you’re on, it’s a multistep process that can take hours, maybe even days or weeks, holding up important applications and business.

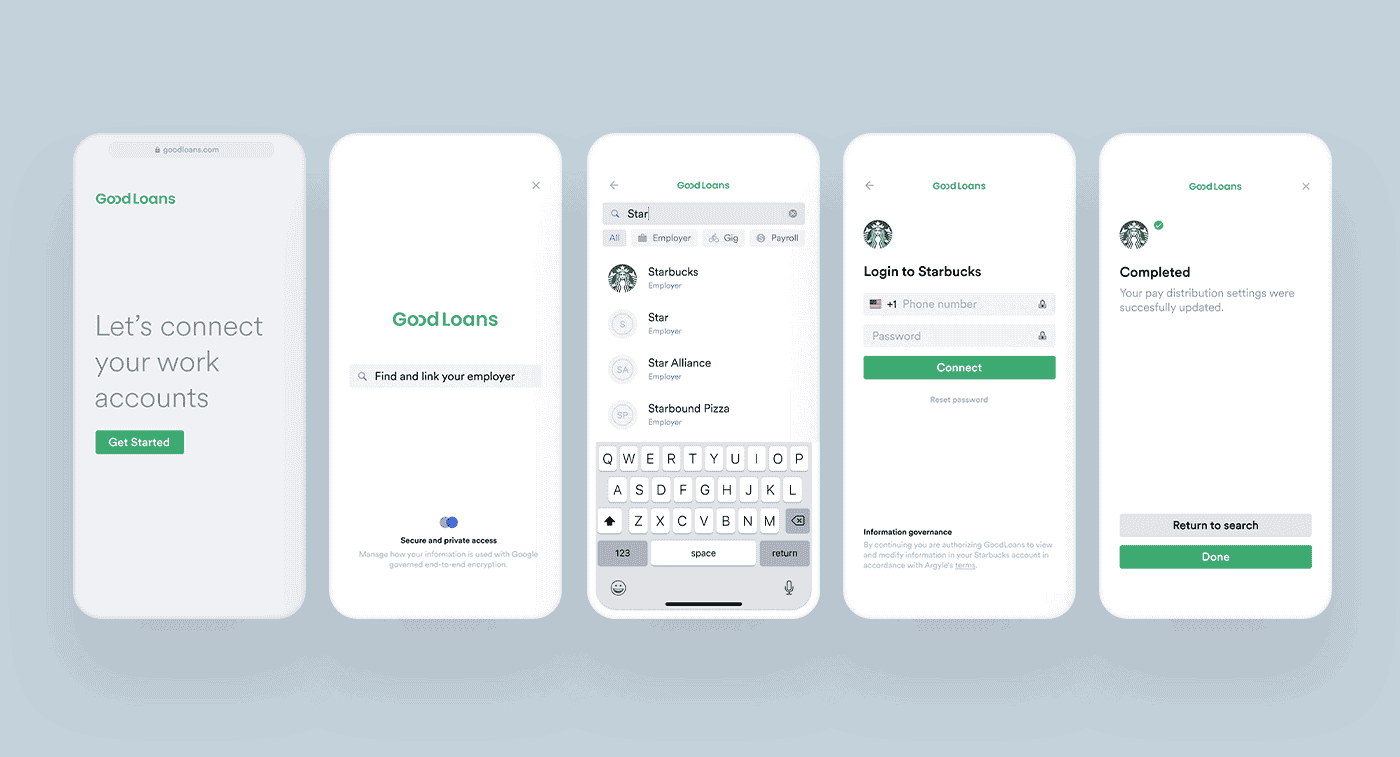

With Argyle, VoIE is a quick, two-step process, and it’s done in a matter of seconds. Users simply choose their employer or payroll provider from our comprehensive list and enter their credentials.

Argyle’s automated verification process does the rest—giving both your users and your team back valuable time and energy.

Continuous, real-time access

With both paystub uploads and non-permissioned data sources (like Equifax’s The Work Number), you get a one-time, static glimpse into your users’ income and employment info.

Any recent changes won’t be reflected in last period’s paystub or last month’s data dump. And if you want information that’s up to date, you have to purchase additional reports, leading to an even larger investment of time and resources.

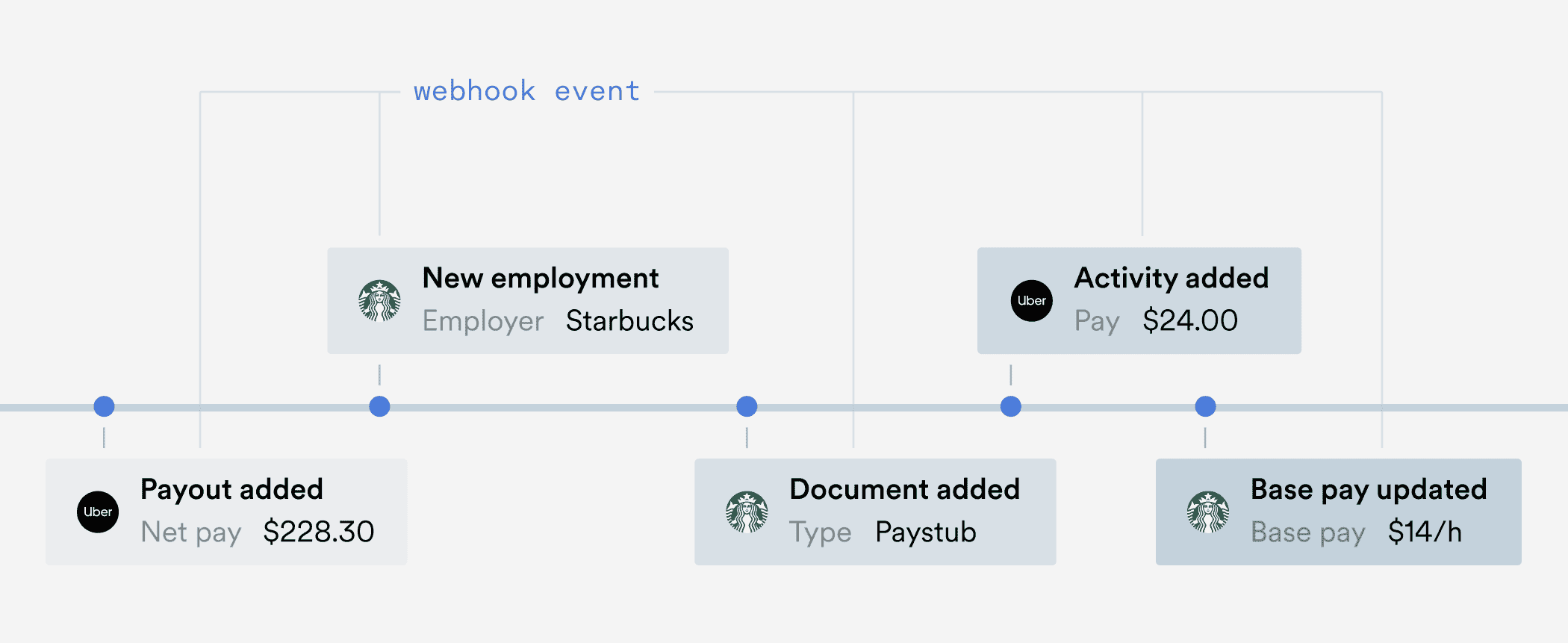

Argyle is proudly low-maintenance. Once a user provides direct, permissioned access to their data, you get real-time access that’s up to the minute. Plus, our webhook technology alerts you instantly if a user’s status changes—for instance, if their income suddenly drops or they lose their job.

With a single, upfront connection, you can skip the extra cost and effort of staying current and tap into a frictionless flow of user data.

Better customization, better relationships

When users submit their personal data, they don’t want to feel like they’re being bounced around to outside platforms. They’ve signed on to interact with your brand, not some third party. Our embedded interfaces can be fully customized to match your brand, so users won’t miss a beat while navigating your app’s VoIE flow. In fact, they won’t even know we’re there.

Additionally, we make it really easy for you to customize this experience for your users with the Link Customizer tab in the Console. In Customizer, you can customize all sorts of things without any code required, such as how Link appears in your application or what employers, payroll providers, and gig platforms are available to your users. With Link Analytics, you can also track and monitor how your users are interacting with the flow so that you can keep offering the best experience for your users.

In other words, we make the process quick and easy, and you get all the credit. It’s win-win, really.

Higher conversion rates

Current forms and options for sharing income and employment data with a third party are incredibly cumbersome. Sometimes, that looks like leaving an application to find, download and re-upload pdf statements. Sometimes it’s even worse, with certain processes requiring individuals to get a physical copy of an employment verification signed by their boss! With Argyle, users never leave the application experience they’re already in, and all required data is transmitted instantly and seamlessly.

Even compared to banking aggregator conversion rates, Argyle has a clear advantage. Users prefer sharing less sensitive payroll logins over the banking credentials and personal information required by other third-party data providers. In fact, they strongly prefer it—which is why Argyle sees a 70 to 75% total conversion rate, compared to the 25 to 30% rate reported by other platforms.

Opting for a more secure, comfortable method demonstrates to users that you care about their experience and are building your business relationship on trust and accountability.

Comprehensive, standardized data

When users submit their own payroll records, data can come in a variety of different formats, and important figures like income are often reported in intervals or as a lump sum. That means someone from your team has to comb through forms to locate relevant information and independently calculate a user’s financial details (and not always correctly).

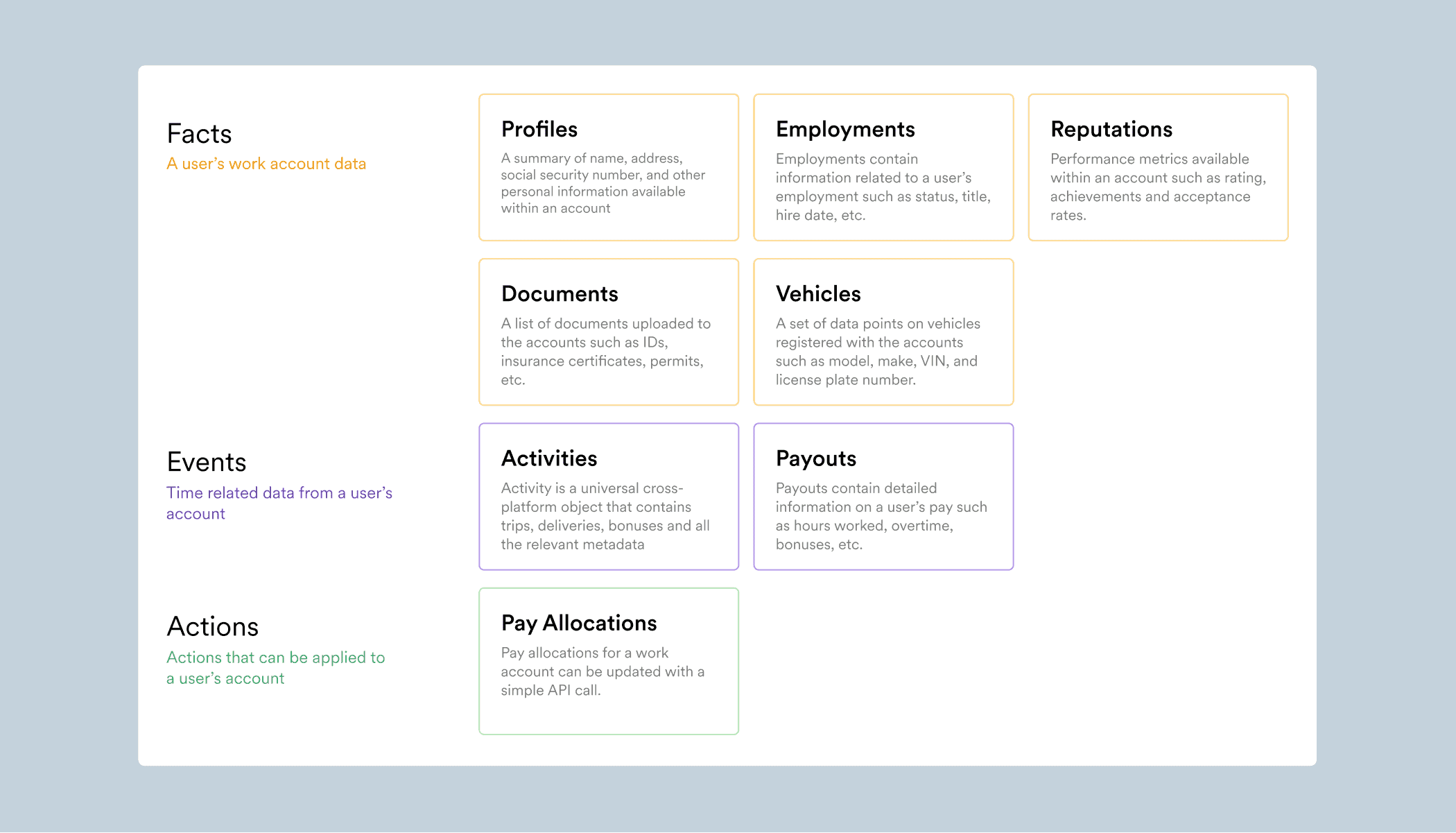

Argyle provides intuitive, standardized data sets that clearly communicate over 160 endpoints in an easy-to-navigate bundle—so you never have to hunt down information, run your own computations, or worry about your math.

Give the Argyle experience a try

Contact our team to learn more about our consent-based payroll and employment data or to request a demo of the frictionless UX experience you can have with Argyle.