On the heels of Argyle’s $30M fundraise, Shmulik Fishman addresses our renewed focus on the human side of digital transformation

Six years. Over $100M in total capital raised. That’s how long it has taken Argyle to build, refine, and perfect a technology that has upended an entire ecosystem. The ecosystem I’m talking about is deceptively simple, yet often misunderstood: income and employment verification.

For decades, businesses in verticals as varied as lending, mortgage, background screening, and banking have needed to be certain of a consumer’s earnings and job history to make critical decisions. The trouble has been the lack of good options for how to conduct this basic check.

In addition to being time consuming, expensive, and risky from both a compliance and credit perspective, this old-school way of doing business amounts to a tedious, negative experience for the consumer whose data is being verified. If you’ve ever bought a home, you know exactly what I’m talking about.

In 2018, I founded Argyle to radically improve this process for everyone involved. We decided to leverage principles of open finance to replace the old verification model with payroll connections that provide these very same businesses real-time access to the source of truth for consumers’ income and employment data.

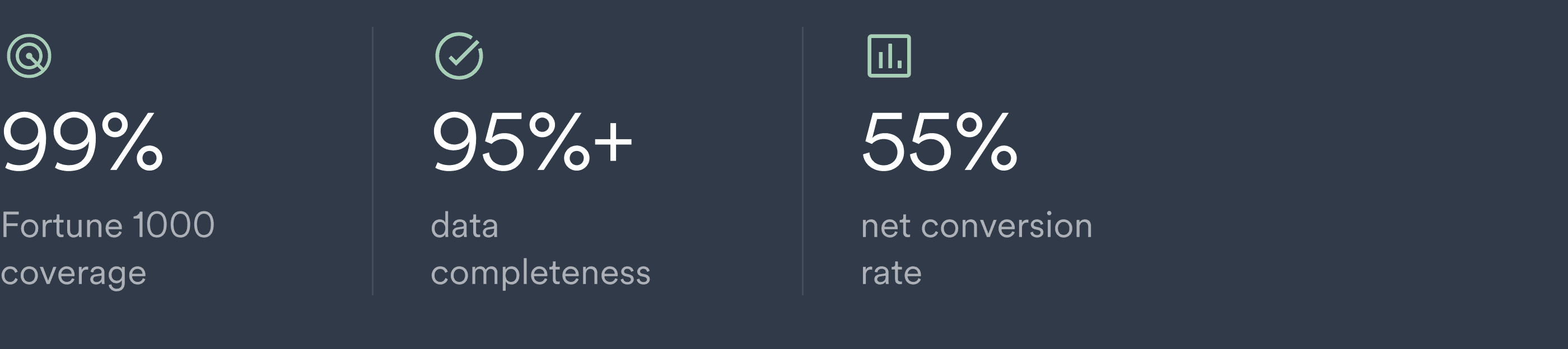

We built those connections—hundreds and hundreds of them—to payroll providers like Paychex, to proprietary workforce management systems of large employers like Target and Starbucks, and to gig platforms like Uber. Today, we cover 99% of the Fortune 1000, with market-leading conversion and data completeness rates. In effect, 220 million U.S. consumers’ income and employment data can now be verified digitally, compliantly, reliably and nearly instantly through Argyle.

But novel technology, even when it becomes more effective than the status quo, is only half of the equation. Widespread digital transformation only happens when people trust new technologies enough to change their behavior. And change is really hard—even when it’s absolutely essential.

In order for us to lead the verification transformation that is so critical to consumer finance and sectors beyond, we have started to focus on the human element of that evolution as much as the technology itself. We know that our collective progress is dependent on our customers’ openness to change and in the success of our efforts in carrying it out.

As I see it, this funding round is the culmination of our metamorphosis from a product-driven tech company to a people-driven, enterprise-grade service provider. Naturally, when we started Argyle, we had to be heads down on the challenge of building an entire infrastructure that didn’t previously exist. Once we had our bones in place, we were able to shift our focus to tailoring our technology to the verticals—mortgage, personal lending, banking, and background screening— that would benefit most from the direct-source income and employment data we make it possible to retrieve.

Argyle continues to evolve. Our product has been vetted, pressure tested, and authorized. It’s feature-rich. It has really good conversion. It does what it says it will do and what our customers need it to do, and it has proven itself viable and vital for enterprises in the verticals we target. This has put us in the position to look outward—to customer collaboration and outcomes, with an emphasis on real, human connection. In other words, Argyle has come into its own, and now we can really focus on helping our customers reach their next level.

As we enter our enterprise-adoption era, the vanguard technology we have and continue to build remains as consequential as ever, but people and process take center stage. We’ve discovered that human relationships—being onsite with our customers, providing thoughtful, hands-on training, and delivering white-glove, success-oriented customer service—are our lifeblood. We will continue to invest in developing the team that is working closely with our customers every day, so they can bring the potential of our technology to fruition within the context of our customers’ unique needs and operations.

That means continuing to hire really smart people who are experts in their fields and who genuinely care about our mission. As a business leader, there are few things that give me more pride than receiving an email from a customer lauding a member of my team for their incredible work and service. That human connection means more to our customers than any product update ever could.

Our customers aren’t the only ones noticing the difference that prioritizing people can make. Investors who have been with us since the beginning recently reaffirmed their confidence in Argyle in our latest funding round. And now, we’ve attracted the attention and dollars of institutional investors like Rockefeller Capital Management because they believe we have the track record, ethos and brainpower to fulfill our vision of transforming income and employment verifications at the enterprise level.

With this new capital at our disposal, we plan to reach another milestone—free cash flow. We expect to achieve profitability by 2026 and now have the runway we need to see us well past that point. Self-sustaining era, here we come.

In the meantime, I’m personally excited to spend my time working with our customers and the Argyle team, riffing, collaborating, and building relationships that match the strength of our product. I am reveling in our journey together and the success of everyone I work with, inside and out. Seeing other people win is my idea of fun. And it’s how we will continue to operate here at Argyle.