Every mortgage lender and borrower knows that income and employment data are critical during the loan origination process.

But, it’s equally important to ensure this information remains accurate from start to finish. Only Argyle offers real-time data, delivered directly from the source permissioned by the borrowers, combined with all the benefits listed below.

Verify with confidence for less

The best part? There’s no additional fees to reauthenticate VOIE information, and Argyle Console (your command center for everything Argyle) continuously monitors for changes in employment and income so you can proactively reach out to the borrower. Only Argyle simultaneously offers:

Instantly authenticate with access to real-time employment and income data (over 170+ data points in total)

Data directly from the source (connected to the borrower’s payroll account) that’s not bought, sold, resold, or changed in any way

Verification for 90% of the US workforce (100% through OCR document uploads if necessary)

Fee-free reverification throughout the mortgage cycle

Notifications of changes in employment and income (so you can mitigate risk)

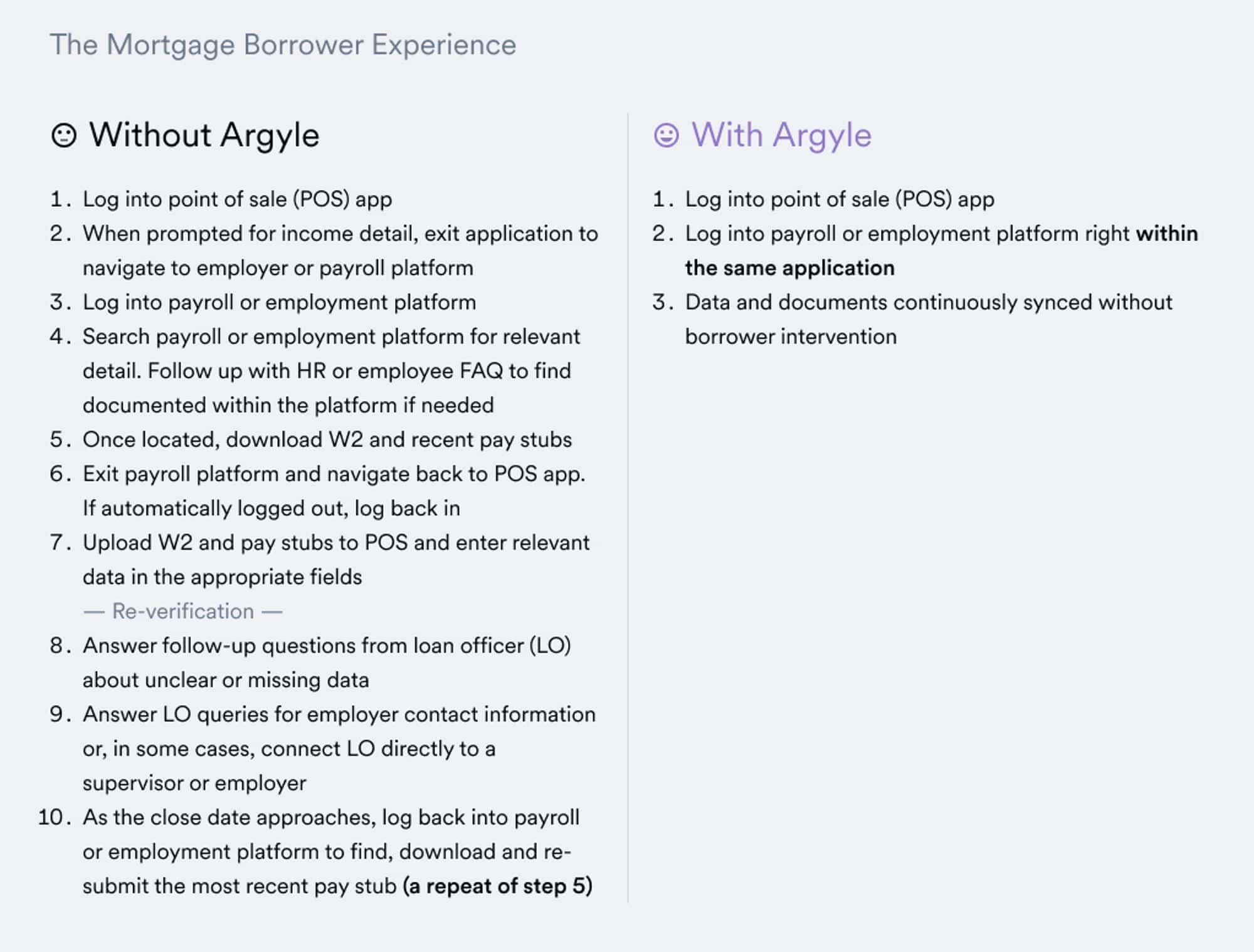

Reduce user friction and improve conversion

Our user-friendly workflows also slash the borrower journey from a daunting 10 steps down to 3, eliminating drop-off and improving overall conversion.

With Argyle, you get instant, automated income and employment verification, unlimited fee-free reverifications throughout the closing cycle, and a holistic view of applicants’ creditworthiness that creates a low-friction borrowing experience, elimination of manual touchpoints, and reduction of cycle lengths, all at less cost to you.Including Argyle in your mortgage application flow offers an immediate improvement to both your lending experience, your internal efficiencies, and your bottom line.

Want to see Argyle in action?

Reach out to our team. We are happy to walk you through a demo and answer any questions you may have.