The mortgage origination process is generally lengthy and taxing—not only for consumers but also for processors. Financial equity analysts expect last year’s strikingly low mortgage volumes to persist into 2024, which suggests that the industry must prioritize cost-effectiveness and efficiency in the origination process now more than ever.

But the question remains: do verification databases like The Work Number (TWN) rise to meet these needs in 2024? In a recent survey by Stifel, nearly 50% of mortgage processors reported moving away from TWN to an alternative solution.

In short, mortgage processors aren’t happy with TWN. If you’re one of them and on the fence about whether the verification database should still be at the top of your verification of income and employment (VOIE) waterfall, know this: your doubts are well-founded. In this article, we’ll explain what’s likely contributing to mortgage processors’ frustrations with TWN and why using a TWN alternative is a sound decision in this and future mortgage environments.

1. The cost of TWN is simply too expensive

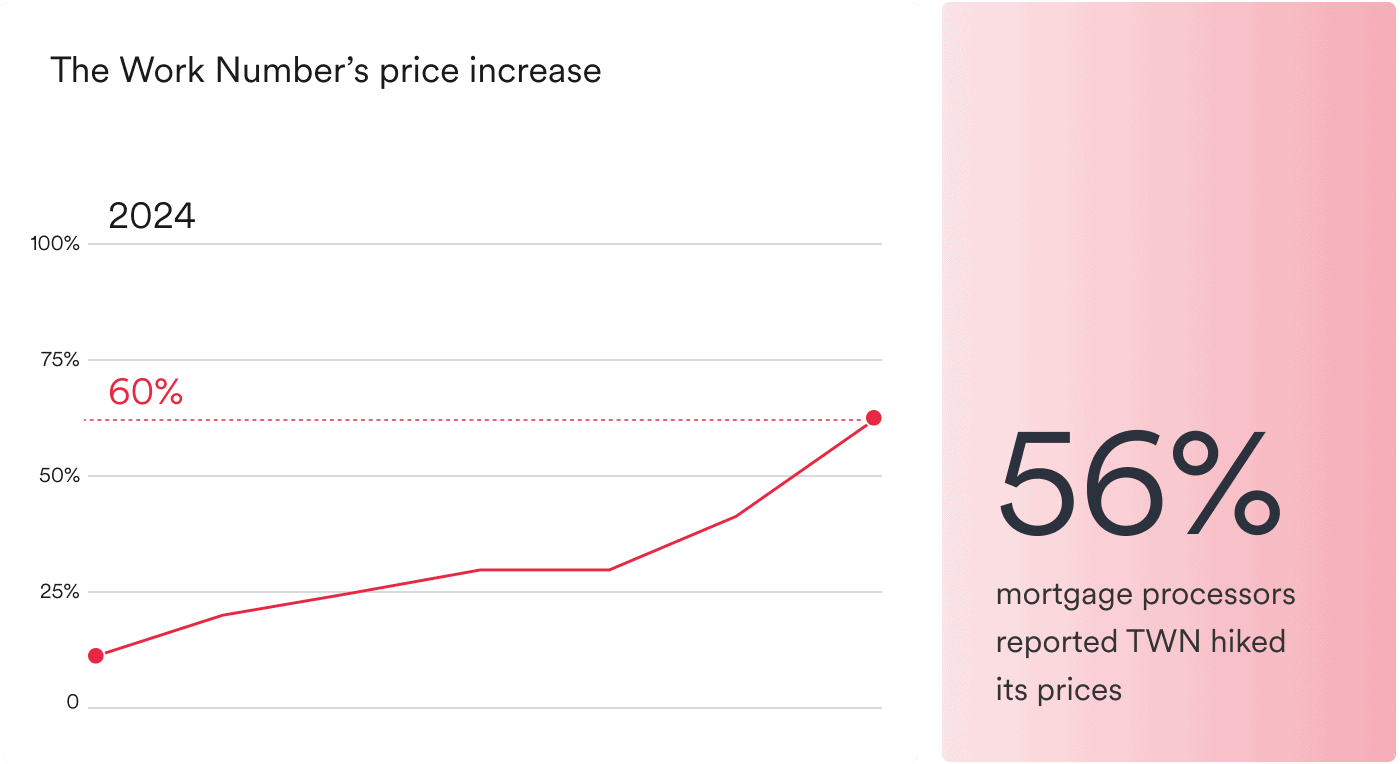

If you haven’t yet received a notice of significant price increase from TWN, you might soon. Stifel’s survey revealed that price hikes were the top reason mortgage processors sought alternative solutions. In fact, the cost of VOIE reports went up between 10% and 60% in 2024, with those processing large volumes impacted the most by these hikes.

There’s a reason TWN is so expensive—and why the price hikes will continue. TWN essentially acts as a middleman; they purchase consumer data from employers and payroll providers and resell them to mortgage lenders at a markup. So, whenever an employer or payroll provider raises their price—which can and will happen at any time since they know this data is valuable to the consumer finance economy—those costs get passed on to you.

56% of mortgage processors reported TWN hiked its prices between 10% and 60% in 2024.

Moreover, considering that VOIE reports must be pulled at least twice, both during origination and at closing, this price point puts you between a rock and a hard place, especially amid inflation and an already low volume of applications that make cost-effectiveness a priority.

That’s why alternative VOIE solutions like Argyle are the future of mortgage technology. Argyle’s direct-source, consumer-permissioned Income & Employment Solution circumvents all of these issues by streaming data to mortgage processors in real time, directly from the source of truth: consumers’ payroll accounts.

With Argyle, mortgage lenders don’t have to deal with erratic pricing based on the whims of employers or payroll providers—that’s one of the key advantages of a consumer-permissioned solution.

2. TWN is not worth the price tag

TWN is costly, but more importantly, is this price tag justified?

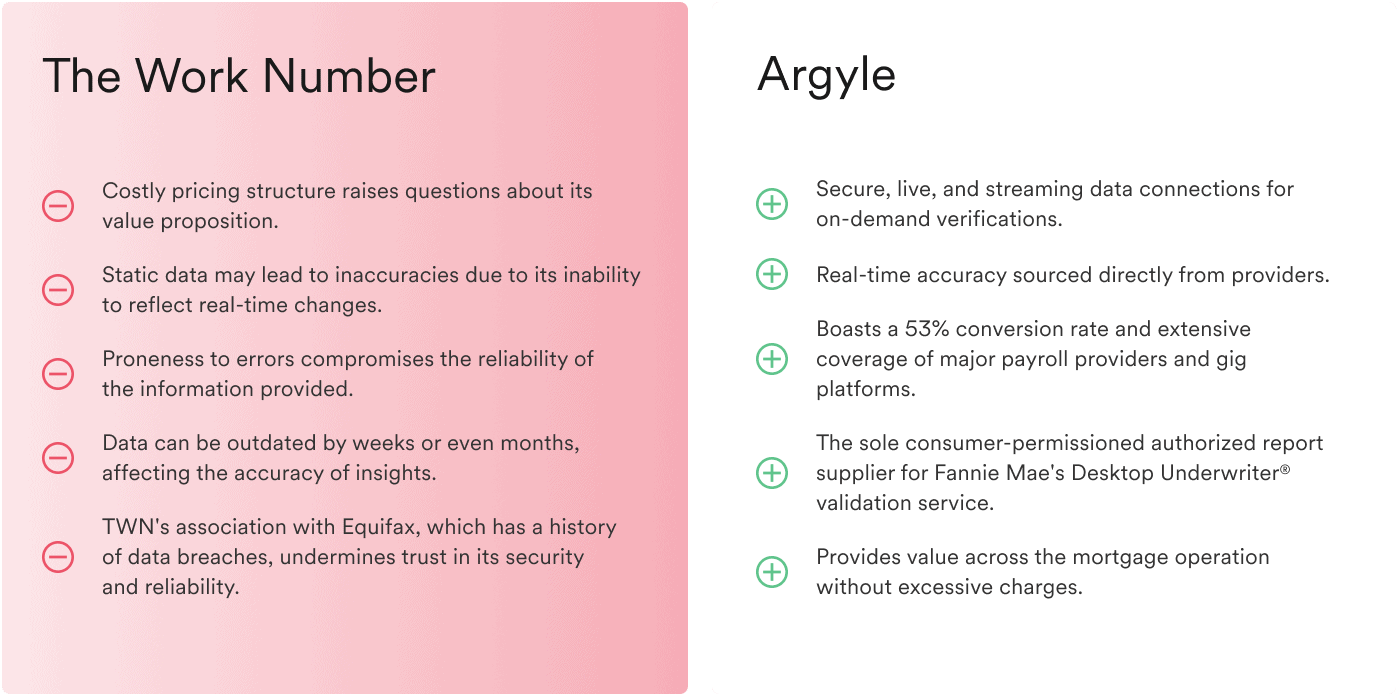

As a credit bureau-owned verification database, TWN—at best—offers access to data from a breadth of employers and payroll providers. However, this data has its downsides: It’s static, prone to errors, and up to weeks or months out of date at any given time.

Consequently, you might not always get accurate insight into a consumer’s employment or income. For example, a consumer may have applied for a mortgage a month before they quit or lost their job, and at closing, the VOIE report might still show them as employed.

Additionally, TWN doesn’t have the best reputation, and its parent company, Equifax, has experienced multiple data breaches over the past few decades.

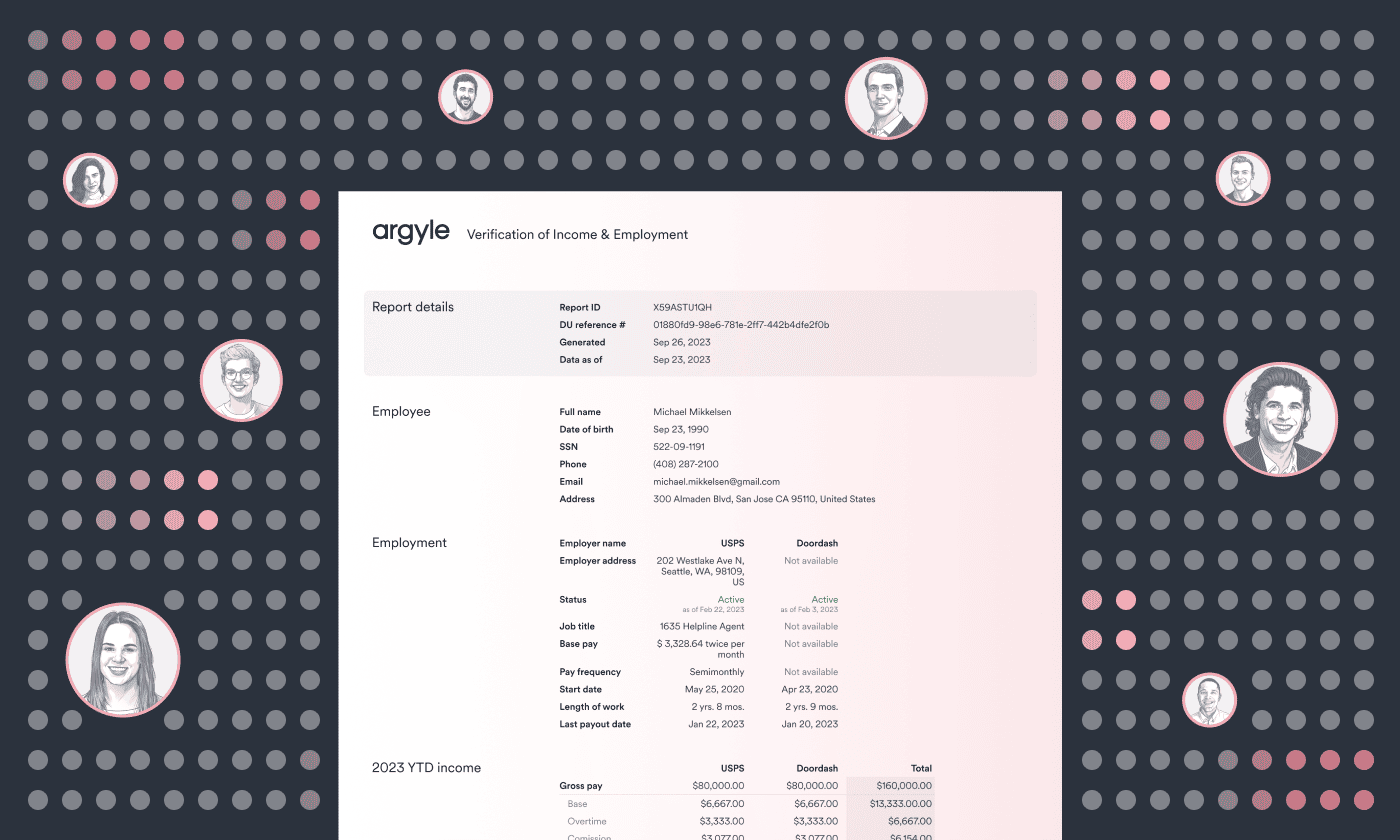

On the other hand, data connections with Argyle are secure, live, and streaming, so you’ll benefit from on-demand income and employment verifications throughout the loan cycle—without having to pay reverification costs. And because the data is coming straight from the source, you can be confident that it’s accurate in real time.

Moreover, Argyle boasts a 53% conversion rate, extensive coverage to major payroll providers and gig platforms, and is the only consumer-permissioned authorized report supplier for Fannie Mae’s Desktop Underwriter® validation service—a component of Day 1 Certainty®.

In essence, Argyle delivers value across your entire mortgage operation—without overcharging you.

3. TWN customer service is a hassle

Credit bureaus like Equifax, which owns TWN, are notorious for their less-than-ideal customer support. Consumers have been affected for years, as evidenced by the 604,221 complaints tied to three credit bureaus in 2022, including Equifax. The process of getting these mistakes corrected is aggravating for consumers, to say the least.

Mortgage professionals have not been exempt from this type of experience. According to the Stifel survey, the second reason mortgage processors switched from TWN was—you guessed it—customer service.

TWN has monopolized VOIE reports for decades, so perhaps it isn’t equipped to handle the volume of support tickets that come in. Or, more skeptically, perhaps its grip on the industry has meant it has never had to. Whatever the reason, as a mortgage processor, you may not receive the level of service or attention you need.

That said, if you want to be price-conscious and not have to compromise on customer service, an alternative VOIE provider can provide the experience you’re looking for.

At Argyle, we don’t just provide training and adoption collateral for our customers; we go a step beyond and offer you a dedicated account team of industry experts who will work alongside you through setup and provide ongoing support to accelerate your time to value and ensure your continued success with our product. That involves conducting regular check-ins and guiding you through tailored reports to understand how your customers are using Argyle and what you can do to maximize conversion.

Take it from Steve Flatt, VP of operations at Acopia and a customer of Argyle:

If you want to know how other mortgage lenders feel about Argyle, read some of our case studies.

Mortgage lenders love Argyle, and you will too

Argyle is rapidly transforming the mortgage industry, and lenders like NFM Lending, Acopia, and LMCU love our solutions. Get started with your first verification report, or contact sales to see how Argyle can best support you.