From coverage to conversion rates, taking a close look at performance metrics can help you decide between competing platforms offering direct-source income and employment data.

As you navigate a down mortgage market and contend with increasing prices, you’re probably looking for smart and simple ways to cut costs. In the process, you will likely find that using a direct-source, automated data solution for your income and employment verifications, rather than a legacy database like The Work Number (TWN), is the right approach.

With several direct-source VOIE providers on the market, asking some initial, hard-hitting questions can help you vet potential vendors. But then, it’s time to dig into the metrics, so you can really compare your options and make the best possible choice for your business.

Every VOIE provider releases its own proof points and performance data, but it can be hard to know which criteria to consider (and trust) as you shop around—and which to keep an eye on after you integrate. That’s where having some inside knowledge can really make a difference.

In this post, we explain what five of the most commonly shared metrics really mean and suggest which figures to prioritize when evaluating a current or potential VOIE provider.

How VOIE providers measure success

Providers throw around many different metrics to demonstrate the strength of their automated VOIE platform. But the standards are relative.

When it comes to VOIE solutions, performance metrics only take on real meaning when compared to those of direct competitors or when measured against your actual business needs.

Metrics can take on more or less importance based on your customer traffic—because every day looks different depending on which customers are entering your flow. For example, an income and employment data provider may boast impressive coverage (say, 90% of the U.S. workforce). But if a significant part of your market comes from a specific category—like gig workers or federal employees—and that provider only connects to one or two related employer platforms, they don’t actually provide 90% coverage of your customer base.

To help you better understand these performance metrics and how they can affect your verification process, let’s break them down one by one—starting with the most impactful.

1. Net conversion rates

For VOIE providers, net conversion rates indicate how many of the consumers who begin an automated verification flow are actually verified by the end of the process. This is typically expressed as a percentage:

Net conversion rates are powerful, because they measure how effective an automated VOIE solution is from end to end.

The problem is that many data providers don’t actually track net conversions. They track a narrower range of conversions, based on just one or two steps of a much longer verification process, which artificially inflates their rates.

When it comes to automated VOIE providers, it’s important to ensure you’re looking at performance across the entire verification journey, from the initial connection to the delivery of a comprehensive data set that allows for a successful VOIE report to be run.

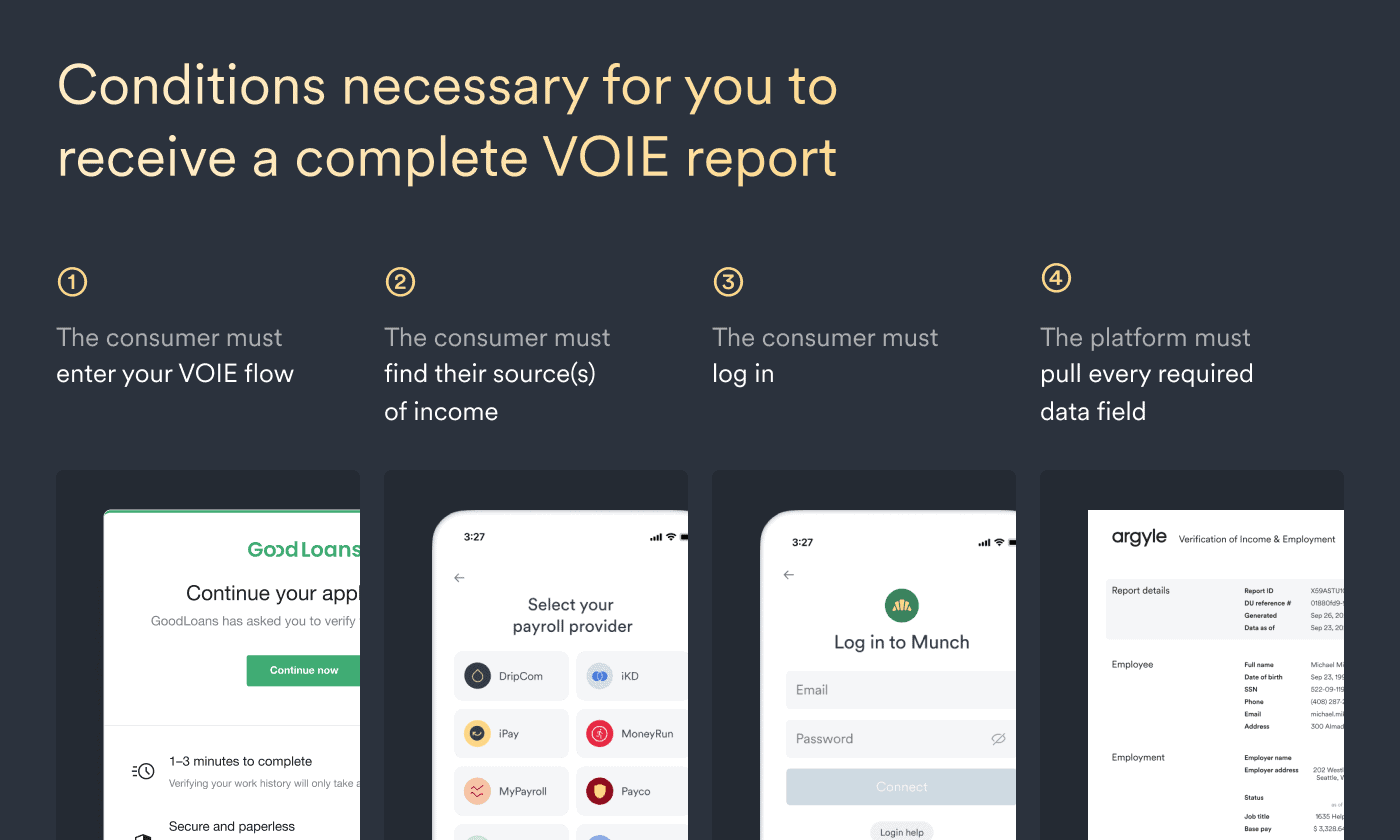

That’s because, for you to get a complete VOIE report, four things must happen—not just two:

The consumer must enter your VOIE flow, either directly through your digital offering (if you’re using an embedded API) or by clicking a link (if you’re inviting them to connect via SMS or email through a web-based tool like Argyle Console).

The consumer must find their source(s) of income in the provider’s data network, which is only possible if their employer or payroll provider is covered (see coverage, below).

The consumer must log in to their payroll provider or employer account using their existing credentials, which often hinges on a provider having a solid authentication flow in place (see authentication support, below).

The platform must pull every required data field from the consumer’s source account and deliver it to you in a usable format (see data quality, below).

There are many ways a VOIE provider can optimize this journey. They may have a frictionless user experience, an exhaustive coverage network that’s easily searchable with employers automatically matched to payroll providers, and complete data sets that retrieve and store all critical attributes. They may also think one step ahead and offer effective methods to reroute consumers who are unable to log in to their payroll accounts.

You want a provider that takes the full spectrum of net conversions into account—because each step can be optimized to enhance conversions in ways that are relevant to your customer base. Specifically, look for a vendor that offers 50% net conversions or higher, so you’ll be able to automatically verify most of the consumers who come your way.

2. Coverage

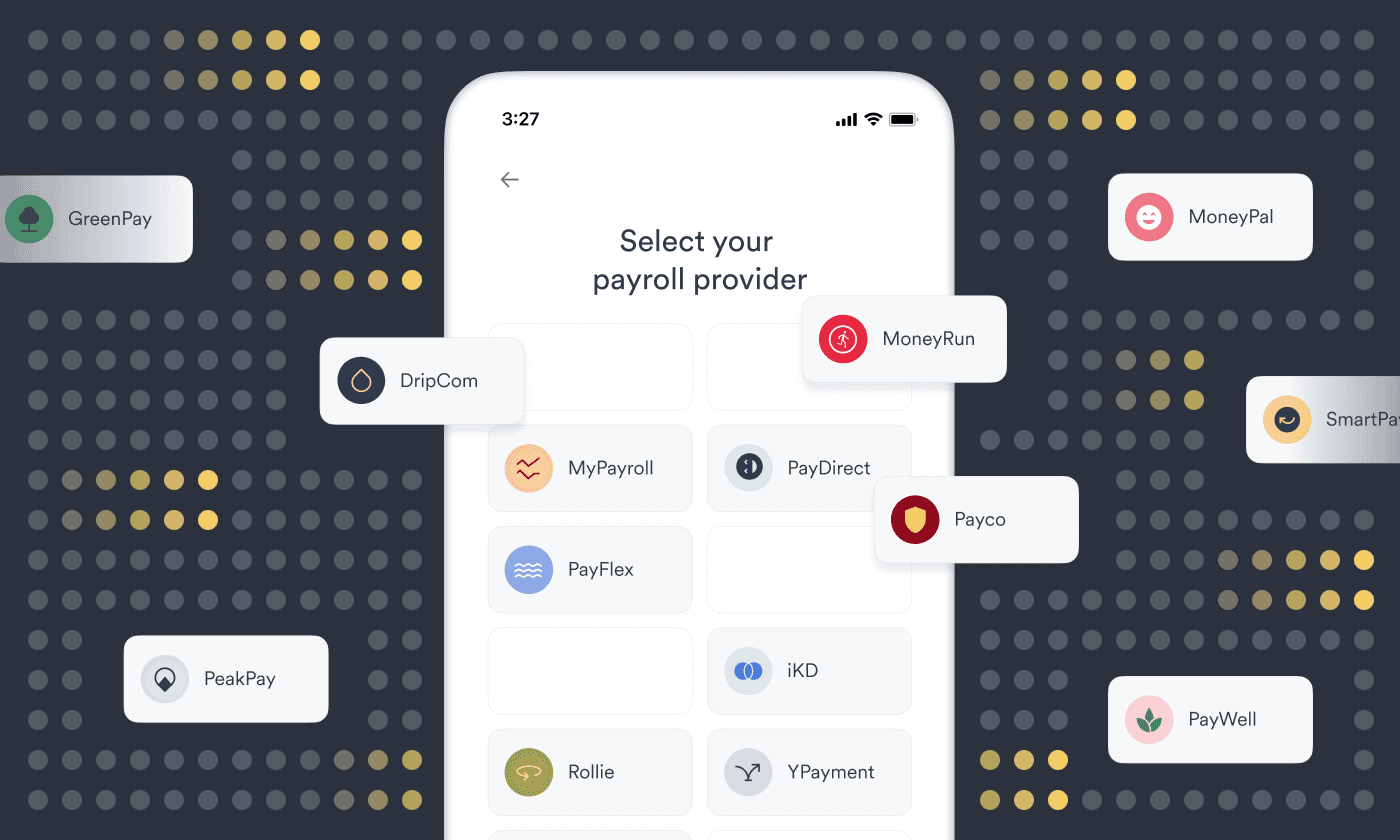

Coverage is usually one of the first metrics a VOIE provider will use to display their value. In the world of income and employment verifications, coverage can refer to either:

The total number of consumers who have an income source represented in the provider’s data network, sometimes expressed as a percentage of the U.S. workforce

The total number of payroll platforms or employers the provider integrates with and counts as part of their data network

Generally, the broader a provider’s coverage, the likelier it is consumers will be able to use their network to connect you to their payroll account(s) and share their income and employment data. Ideally, a provider can also prove they’re adding new integrations month over month to expand their reach.

Keep in mind that, if a provider advertises 90% coverage, that doesn’t necessarily mean 90% coverage for you. You need to conduct additional investigations to cross-check their network against your customer base.

There are a few other potential snags to consider, as well:

Coverage claims are difficult to corroborate.

There are around 5,700 payroll providers and over six million employers in the U.S. The only real way to confirm a provider’s stated coverage would be to manually verify that each of the integrations listed in their data network is indeed up and running—and then check their numbers against the figures above to arrive at a rough percentage.

Just because a provider has high coverage doesn’t mean they have the coverage you need.

As in the example above, your customer base may be heavily concentrated among a certain type of consumer (like gig workers or independent contractors) or a handful of specific employers. If they’re all in the 10% of consumers excluded from a provider’s 90% workforce coverage, you’ll be left high and dry.

Coverage terms can mean different things to different providers.

When a provider says they cover 90% of the U.S. workforce, do they just mean traditional, W-2 employees or 1099 workers and freelancers as well? Do they count gig platforms and creator-economy platforms among their employer network? Do they account for non-traditional forms of income, like government benefits?

Best practice is to compare a potential vendor’s live integrations against the 100 or so most common income sources reported by your customers. That way, you can be sure a substantial proportion of your customer base will be covered.

3. Data quality

Since automated VOIE solutions pull income and employment data directly from the source of truth—that is, straight from a consumer’s payroll provider or employer account—accuracy should never be an issue. But what is at question is the depth and accessibility of that data.

Measuring data quality and completeness means taking a close look at:

How often the solution delivers all of the data points and documents required by outside entities like GSEs—or what percentage of these data points it consistently returns

Whether data is organized in an intuitive way and presented in a simple, standardized format

How many total data fields the VOIE platform is able to provide

Whether these data fields transcend basic information like a consumer’s name and net pay and include granular details like shift hours, tax withholdings, and commission rates

Any VOIE provider should be able to give you a firm number (as well as an itemized list) of available fields by data source, plus the average percent of VOI/VOE reports they’re able to complete. For insights into their data structure, you may want to consider diving into their docs—or requesting a sample data set.

4. Customer experience

BOD As mentioned above, an integral part of an automated VOI or VOE flow is ensuring consumers can quickly and easily log in to their payroll or employer account to support conversions.

Today, developers use a variety of authentication methods (or factors) beyond simple username-and-password credentials to secure those accounts and verify a consumer’s identity. Often, two or more factors are stacked together for extra protection in what’s known as a multi-factor authentication (MFA) flow. These can include:

Security questions

Email- and SMS-based one-time passcodes or magic links

Authenticator apps such as Google Authenticator, Authy, or Duo Mobile

Biometrics like fingerprint scans and facial recognition

Increasingly, developers are simplifying authentication with single sign-on (SSO), which allows consumers to sign in using an active, already logged-in account—through a platform like Google, Facebook, or Microsoft.

So, how does this affect your VOI/VOE flow? In short, if a VOIE solution doesn’t support a given auth factor, consumers won’t be able to log in to their payroll account—or they’ll be bounced around to external security sites, leading to greater friction and churn.

In other words, the more flexible a vendor can be—and the more authentication factors, MFA configurations, and SSO platforms they can support—the likelier it is that consumers will be able to make it seamlessly through your verification flow.

5. Reliability and scale

A VOIE provider’s reliability first comes down to their uptime, or the percentage of time their platform is available and functioning as it should. In other words, uptime speaks to how reliably their system operates and whether you can count on it to pull and return the data you need, when you need it. This statistic is usually included in a provider’s service level agreement (SLA).

An uptime of 100% is nearly impossible to achieve, as system updates and maintenance—not to mention any unforeseen errors—will cause it to occasionally go offline.

Generally, an uptime of 99.9% or higher is considered good, which means that a provider’s system is down for less than 1.44 minutes per day (or around 8.76 hours per year).

You can also look at other metrics when assessing a provider’s reliability and overall system quality. Consider, for instance:

Call volumes: How many API calls does the system generally field per day? How many requests per minute (RPM) can it handle? These figures will give you an idea not only of the vendor’s level of experience, but also its ability to perform under pressure.

Latency: How long does it take the platform to pull consumer data from the source (a payroll or employer account) and deliver it to the destination (your platform)? This should be a question of milliseconds. Obviously, the quicker, the better.

Documents processed: You need access not only to a consumer’s income and employment data, but also to essential documents like paystubs and W-2s. How skilled is a provider at pulling these forms and presenting them in a readable structure?

Error handling: How often does the provider conduct internal audits, run routine maintenance checks, and implement necessary updates? Do they have policies and procedures in place for identifying and responding to system errors and technical issues?

In addition, you want to make sure a VOIE provider has a dedicated team at the ready to get you up and running quickly. This includes tailoring your integration to your business needs. Having a superior VOIE product won’t mean superior results if you can’t properly implement and scale your flow.

Ultimately, you’re out to save time and money on your verifications—and you want to be sure that what you are spending is going toward the best possible data and service.

Beware of vendors that promise savings based on the surface cost of requesting a single VOIE report. There may be hidden terms behind the scenes that will drive up costs over time—like charging per connection attempt (versus only for successful connections), charging full price for reverifications, or charging a flat rate instead of pro-rating for the features you actually use.

It’s always a red flag if a vendor doesn’t make their pricing model fully transparent. Make sure you ask for a breakdown of all costs and that you understand which features are and are not included in your preferred plan.

Our suggestion? Check out a provider’s case studies, so you get a sense of what their actual customers have experienced in the past.

How Argyle’s metrics stack up

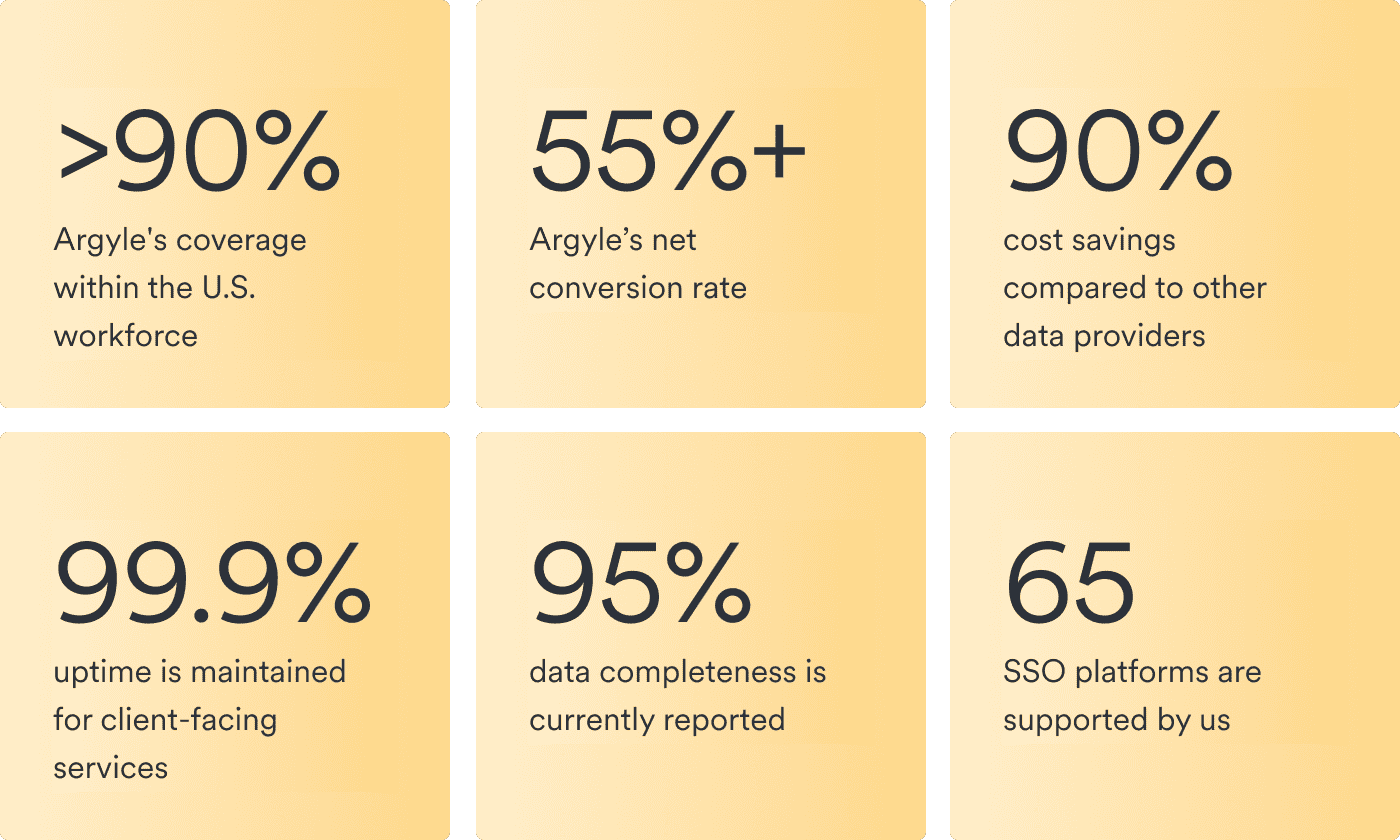

To give you a starting point and some key benchmarks for comparison, consider how Argyle performs in each of the above categories:

Argyle’s coverage spans 90% of the U.S. workforce (and counting).

That number represents 220M+ consumers, 570+ payroll and gig platforms, and 1.7M+ employers—including 99% of the Fortune 1000. And our coverage is growing at an average of 4M+ consumers per month.

A complete, transparent list of live integrations is always accessible on our website.

Our net conversion rate is 55%+.

This includes the entire customer journey, from the moment you invite a consumer to connect to the moment you receive their VOI or VOE report. Conversion rates are even higher once consumers actually enter Argyle’s flow.

Additionally, eight out of 10 login attempts succeed through our platform, and that rises to nine out of 10 when consumers use our login help to reset lost or forgotten credentials. All told, ours is the highest-converting income and employment data network on the market.

We only charge for successfully connected accounts.

At Argyle, you pay only for the features and data you actually use. You can also access continuous account monitoring, unlimited data sets, and automated webhook alerts through a low monthly fee—which means $0 reverifications.

All in all, our customers report up to 90% cost savings, compared to other data providers they’ve used.

Argyle operates at 99.9% uptime for client-facing services.

Plus, we handle 90k+ account connections per month and around 8M calls per day. To date, we’ve processed and standardized around 14.3M+ essential payroll documents like paystubs and W-2s, which we make available for all connected accounts.

If you want to check on our system status at any time, you can find a live log here.

Our data completeness rates are near perfect.

We’re currently reporting 95% data completeness, which means we deliver every data field required by GSEs and 1003/1005 forms at a very high rate.

In total, we return 170+ income and employment data attributes—including granular details like gross, net, and base pay, hire dates, shift-level hours and wages, tax withholdings, bonus and commission rates, contributions, and wage garnishments. You can get a closer look at our data sets and sample reports over in our Docs.

We support over 65 SSO platforms.

We also make login experiences simple by offering passcode pre-fill features, streamlined password-reset flows, and deep-linking options.

Learn more

If you want to dive deeper into the performance metrics you should consider when evaluating an automated VOIE provider—or you’re looking for more details on Argyle’s platform—reach out to our team to set up a quick call.