Why banks should revamp their mortgage and loan services software

Digital transformation in lending has undeniable benefits. As reported by McKinsey, when banks embed more digital experiences in their customer journey, they enhance customer experience, reduce cost by up to 40%, and strengthen their risk profile. Despite these clear advantages, 70% of banks have struggled to implement their digital strategies fully, and even among those who have, most failed to meet their goals.

As borrowers increasingly demand convenience, traditional banks no longer have the luxury of time to catch up. They must rethink their mortgage and personal lending tech stacks—and do it swiftly—if they want to compete with emerging market players such as fintechs and neobanks.

Fortunately, with the right mortgage and loan services software, banks can fast-track their digital lending journey—all while streamlining operations, enhancing borrower experiences, and making informed credit decisions.

The shortfalls of mortgage and personal lending

Successful mortgage and personal lending boils down to providing exceptional borrower experiences. This is key to customer acquisition, retention, and expanding market share for banks. However, the current loan application process, as it’s set up, is fundamentally flawed.

Here’s why: Despite technological advances in other areas of banking, the loan application and approval process remains complex, tedious, and time-consuming for borrowers. Challenges such as manual verifications of income and employment (VOIE) significantly impact the turnaround time, leading to frustration among borrowers who expect quicker results.

Specifically, manual verification workflows typically involve a heavy lift from borrowers to gather the necessary documents—a process not conducive to good experiences.

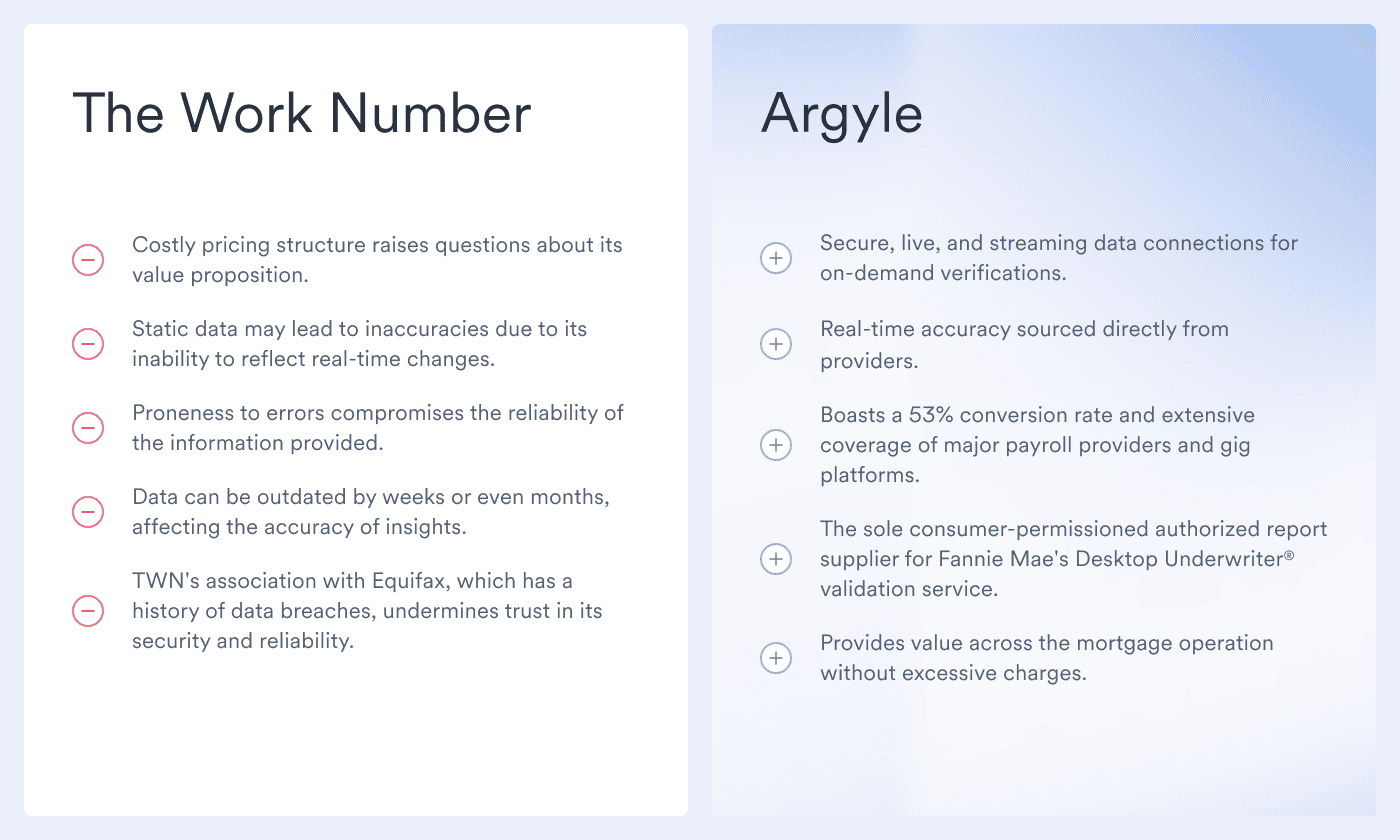

At the same time, lenders struggle just as much as they attempt to process loans quickly while adhering to compliance requirements. In short, manual processes will never be efficient. Meanwhile, popular verification databases like Equifax’s The Work Number (TWN), which many lenders rely on for over 60% of loans, are also imperfect—they are static, prone to errors, and very expensive.

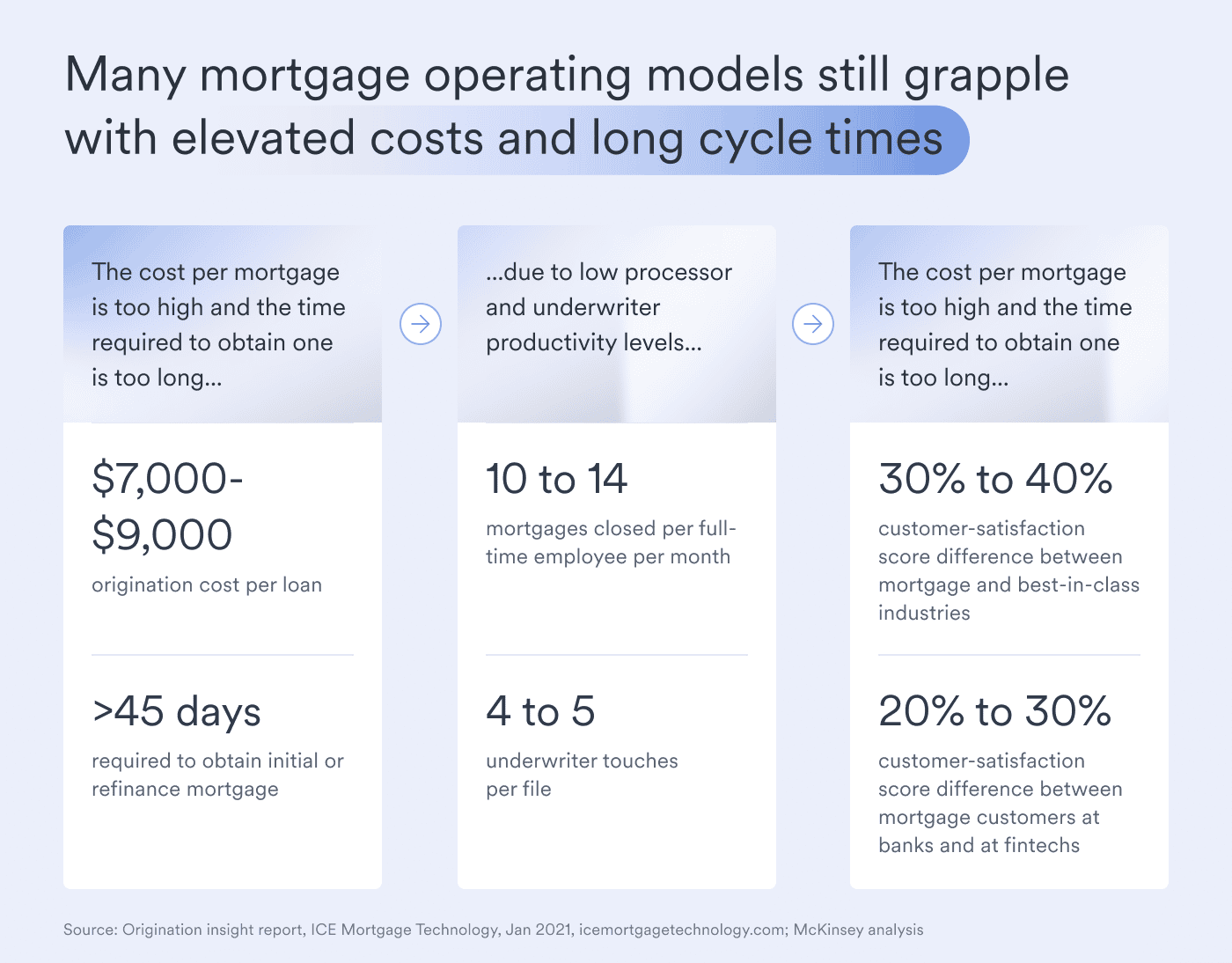

Many mortgage operating models, especially at loan origination, cost mortgage lenders anywhere from $7,000 to $9,000 per loan and involve lengthy processing times.

Even more concerning is that the burden of this inefficiency is passed onto borrowers. As a result, there’s a 30% to 40% difference in customer satisfaction scores between the mortgage industry and other best-in-class industries. This endless cycle negatively impacts borrowers and lenders alike.

Revamp the lending tech stack, starting with verifications

Luckily, the right mortgage and loan services software can streamline the lending process and set the right tone for borrowers, beginning with verifications. Below, we explain three benefits of embracing a modern VOIE solution in your tech stack to help traditional banks gain—and keep—a competitive edge and offer a better borrower experience.

Automated, affordable verifications

VOIE costs via TWN for an application involving two borrowers can be around $280—and potentially higher when reverifications at closing are considered—which can eat into financial institutions’ profitability. In fact, the Community Home Lenders of America (CHLA) recently submitted a letter to the Federal Housing Administration (FHA) and the Federal Housing Finance Agency (FHFA) urging them to scrutinize TWN’s pricing practices.

That’s why an increasing number of lenders are adding alternatives like Argyle’s Income & Employment Verification solution to the top of their verification waterfall as they revamp their tech stack. Through Argyle’s VOIE automation, lenders—from loan officers to underwriters—benefit from faster loan cycles at lower costs.

Argyle’s Income & Employment Verification solution enables direct payroll connections with over 210 million US consumers, allowing lenders to view and verify borrowers’ data instantly, and the VOIE reports are GSE compliant. Plus, there are no added costs for reverifications, so it is a more affordable, sustainable solution in the long run.

Seamless borrower experiences

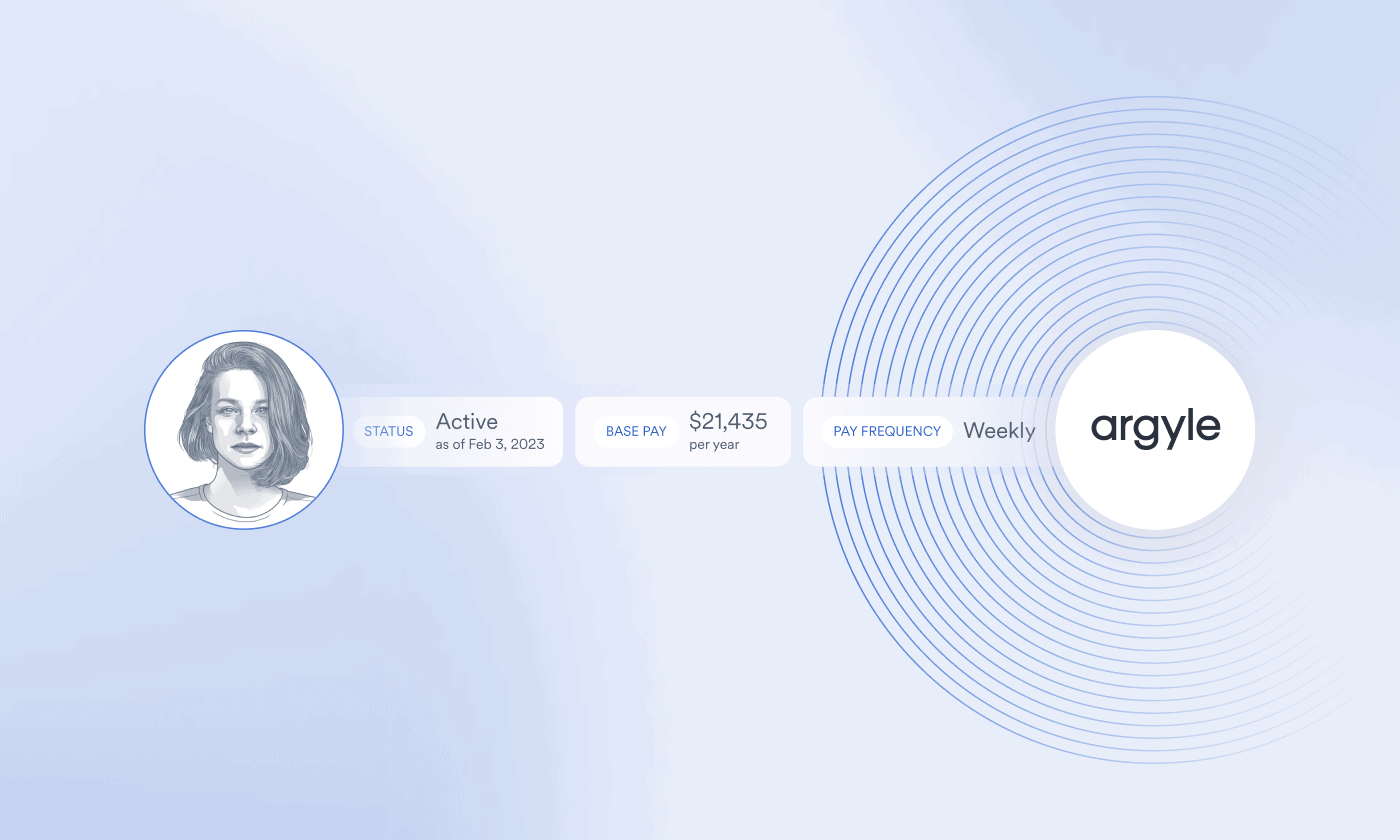

Automated verification solutions like Argyle are designed with borrower experiences in mind.

Here’s how: Borrowers only have to connect their payroll account via Argyle once to give lenders the information they need. As you can imagine, fewer manual touchpoints mean a smoother borrowing experience—while simultaneously speeding up the loan process, ensuring compliance, and cutting costs for lenders.

Ultimately, Argyle creates cutting-edge digital experiences that ensure lenders remain not just relevant but competitive now and into the future. Argyle’s real-time, detailed data makes it possible to create a tailored, seamless home-buying journey for borrowers—from pre-approval to refinancing—with little to no need for manual input from them or your team.

Better credit decisions

Argyle streamlines the retrieval of paystubs and tax forms, generates instant, GSE-compliant verification reports, offers unlimited fee-free reverifications throughout the mortgage loan cycle, and gives lenders a comprehensive view of borrowers’ creditworthiness.

Here’s how: With Argyle, borrowers provide their income and employment data in real-time directly from the source. This continuous access allows lenders to refresh customer data on demand, supporting decision-making through greater financial visibility that goes beyond credit scores. As a result, lenders:

Lower credit risks

Reduce the potential for fraud

Accelerate underwriting and credit decisioning

Speed up time to funding

Because Argyle connections are direct-source, real-time live, the income and employment data they stream is more accurate—so lenders are set up to make well-informed credit decisions with insight into borrowers’ ability to repay the debt.

Ambitious lenders don’t rest on their laurels

While legacy systems have served their purpose, an innovative mortgage technology solution makes all the difference between good and great loan experiences—especially for banks that want to remain competitive in the rapidly evolving personal and mortgage lending industry. The good news? Argyle already bridges that gap for banks across the US—and it can for you, too.

Streamline your personal lending and mortgage processes. Reach out to our team to see Argyle in action firsthand.