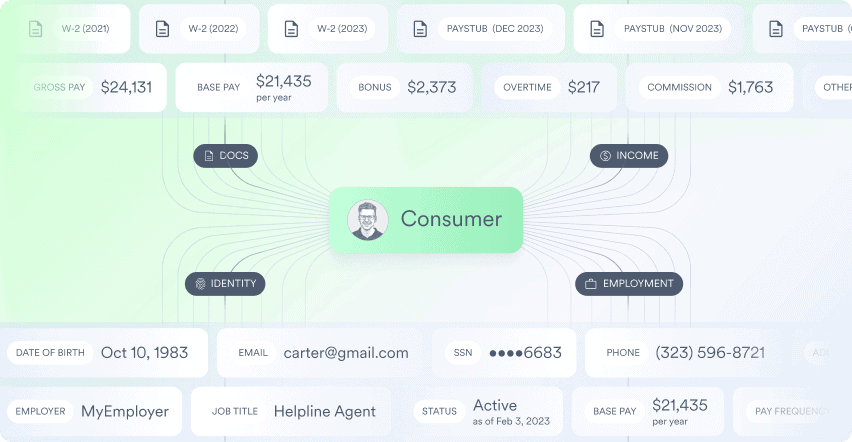

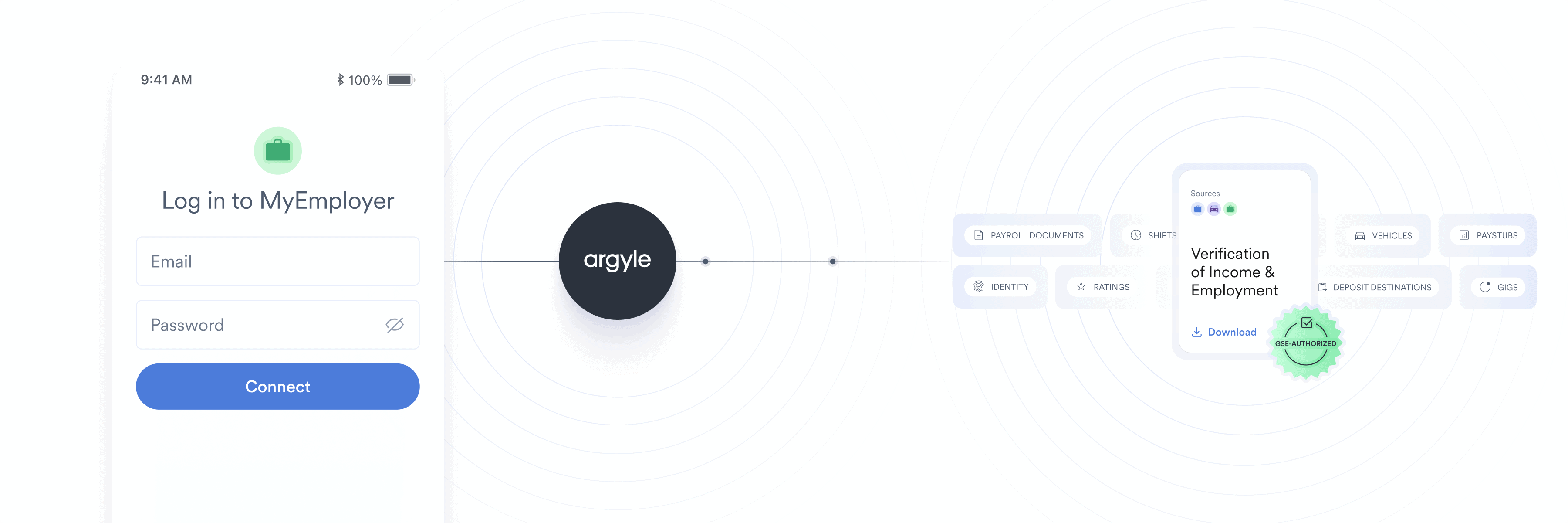

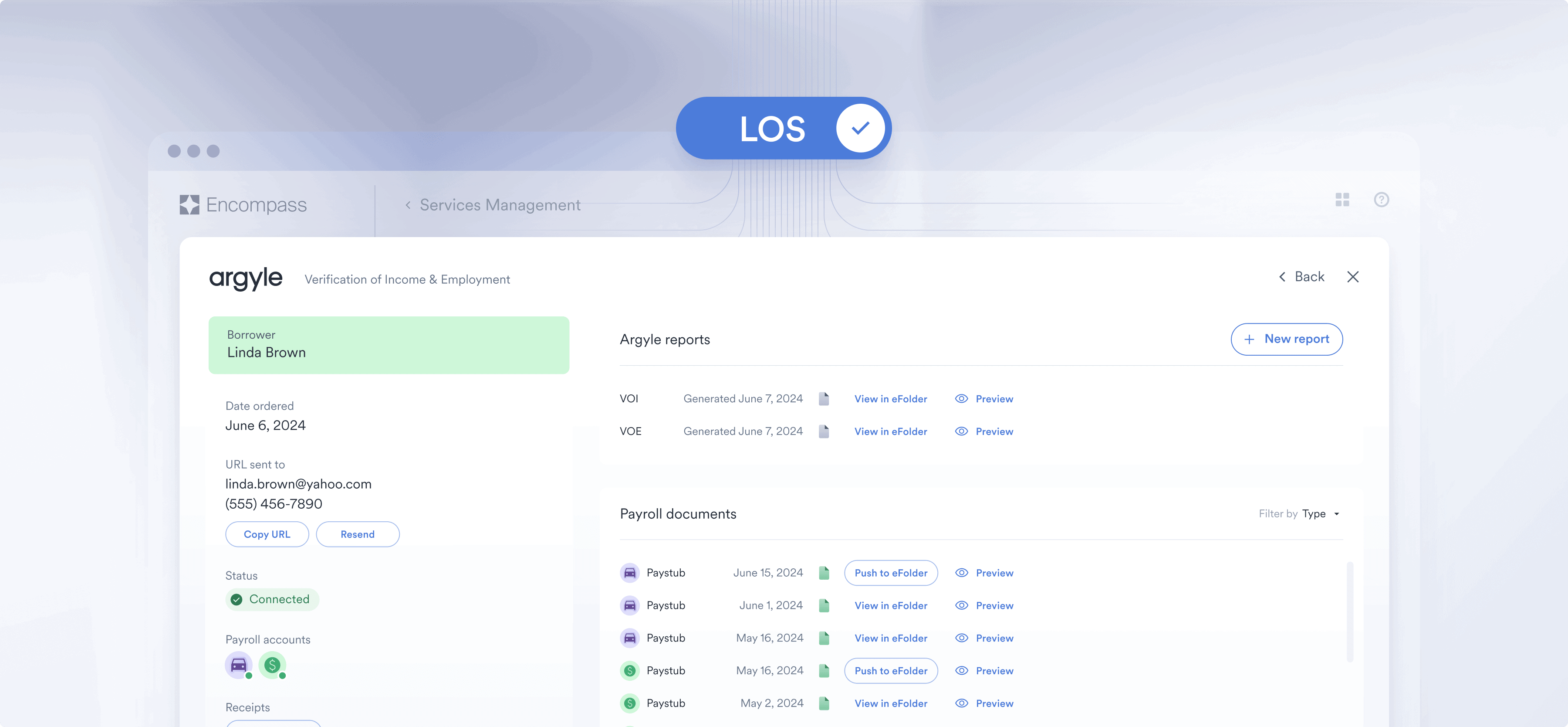

Our direct-source technology generates VOIE reports and imports paystubs, W-2s, and 1099s cost-effectively and automatically.

Trusted by

problem

The challenges you’re facing

Manual VOIE is a major labor expense, and legacy VOIE vendors keep raising their prices.

Loan repurchases are on the rise, making strict GSE compliance a top priority.

Your team spends days or weeks chasing down borrower documentation.

BENEFIT

The Argyle solution

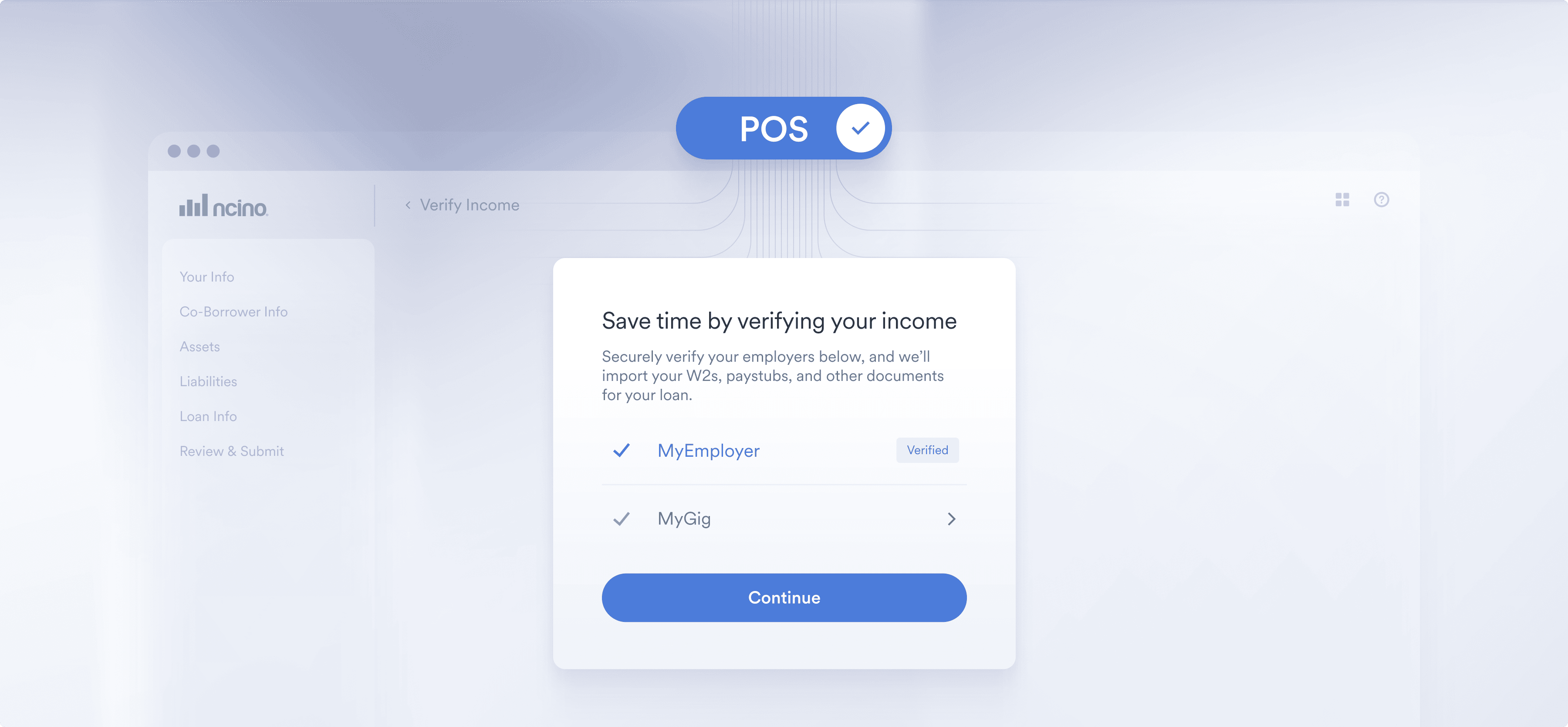

Argyle generates VOIE reports as soon as payroll connections are established.

With Argyle, there’s no risk of outdated information. What we return to you is as accurate as the source of truth.

Argyle is an authorized supplier for both Fannie Mae and Freddie Mac programs.

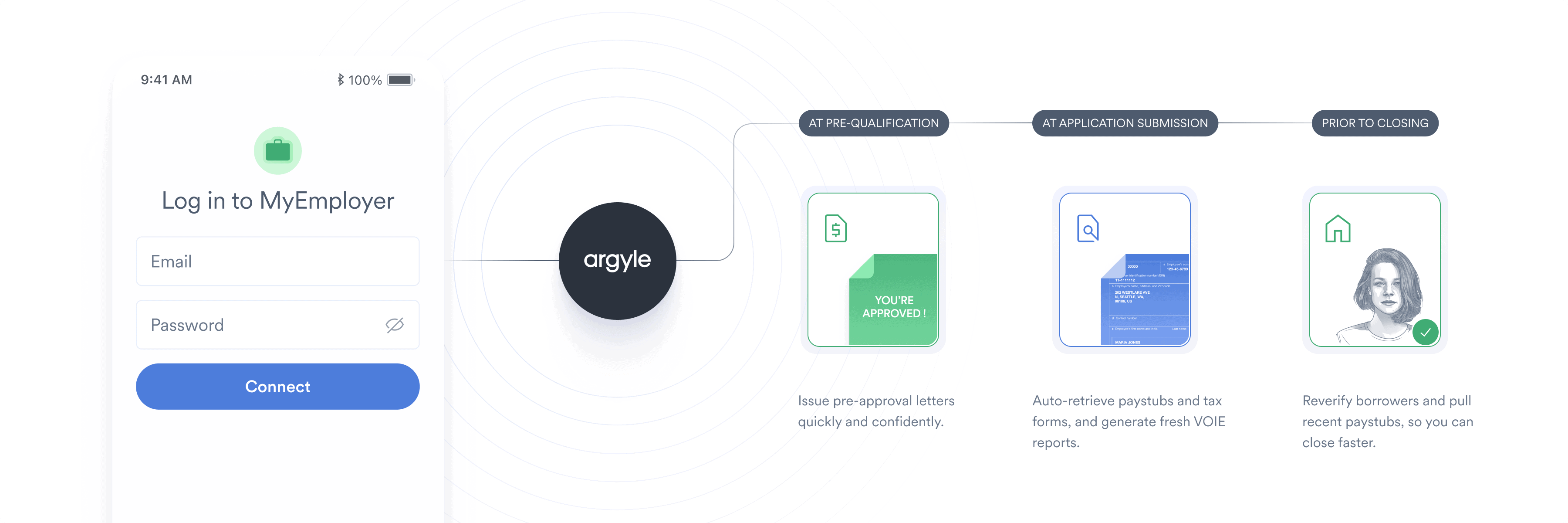

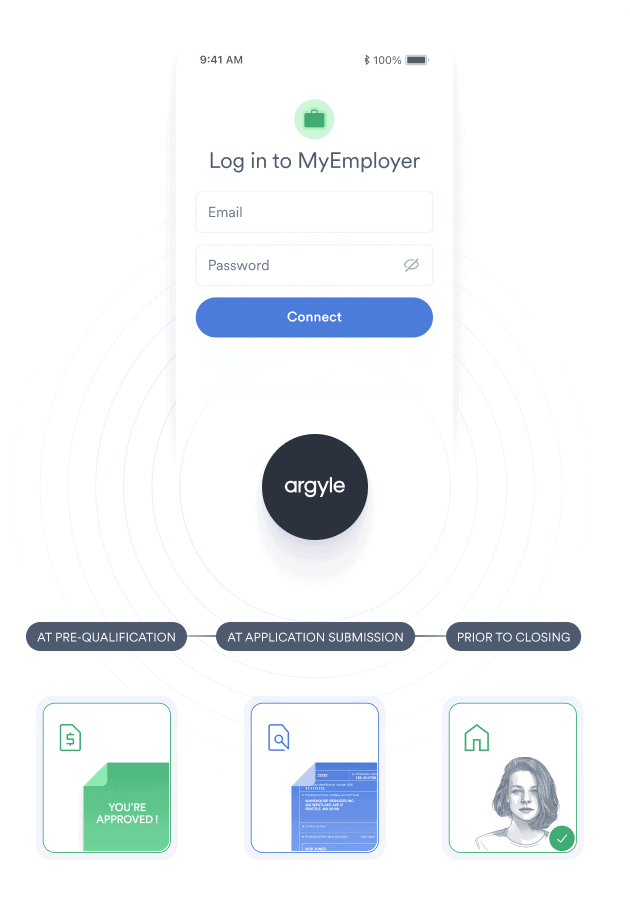

One authentication,

multiple verifications

With Argyle, you can verify income and employment on demand and throughout the loan cycle.

KEY FEATURES

Why mortgage lenders love Argyle

Lower verification costs

Relief from reps and warranties

Faster loan cycles

White-glove service and support

Argyle’s value will be felt

across your organization

Loan officers

Value our efficiencies. Fewer touch points mean fewer steps to close.

Executives

Value our cost-savings. Direct-source data is less expensive.

Underwriters

Value our precision. Calculated, compliant data makes for clearer credit decisions.

Processors

Value our speed. Files flow through the pipeline faster.

Closers

Value our reverifications. Real-time reports offer the best protection from buybacks.

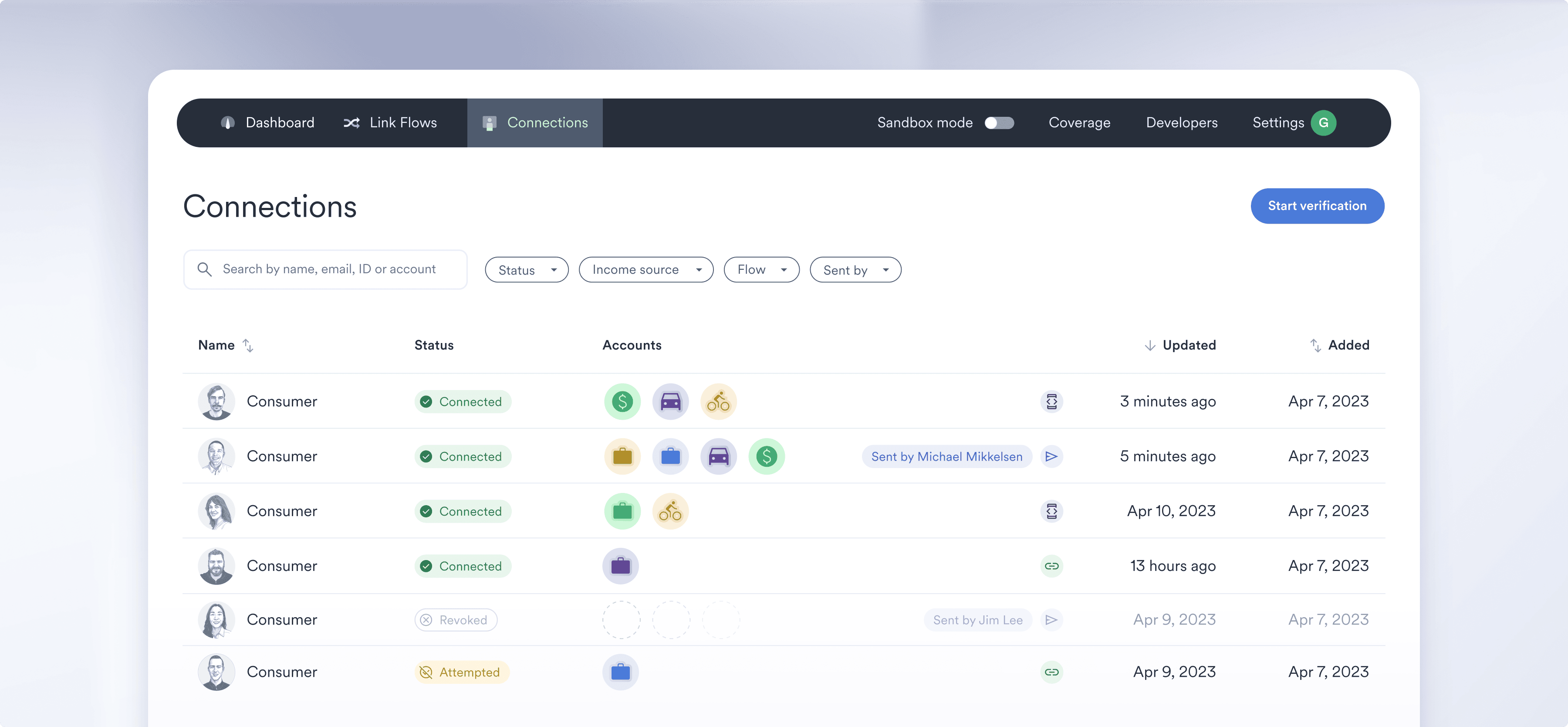

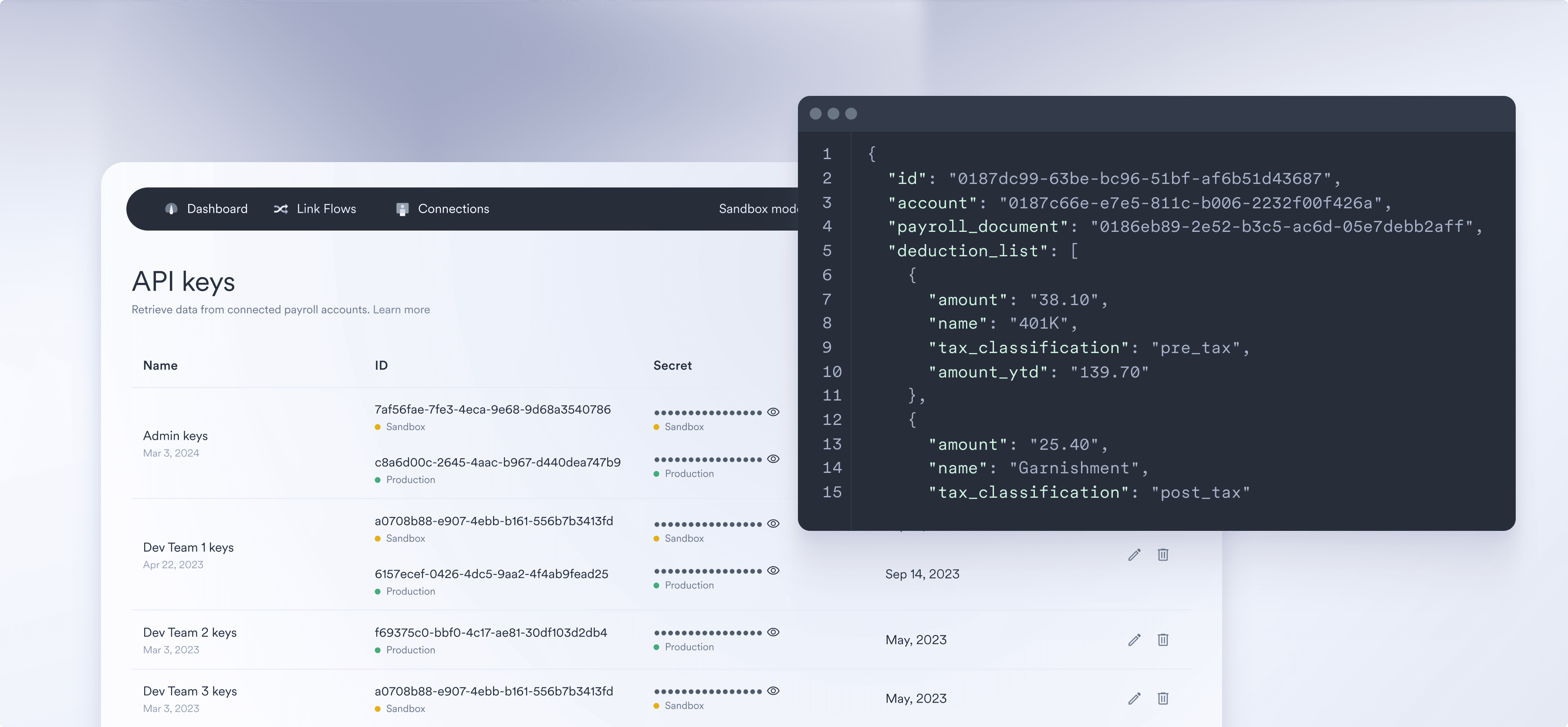

IMPLEMENTATION IS EASY

Get to market quickly

Choose from simple methods to start using Argyle.

why Argyle

The Argyle difference

Find out why mortgage lenders trust Argyle to supercharge their verification waterfall.

Broader coverage

Higher conversion rate

Better quality

Ready to see what Argyle can do for you?

Get in touch to learn more about our verification solutions for the mortgage, personal lending, and background check industries, and more.

Contact sales