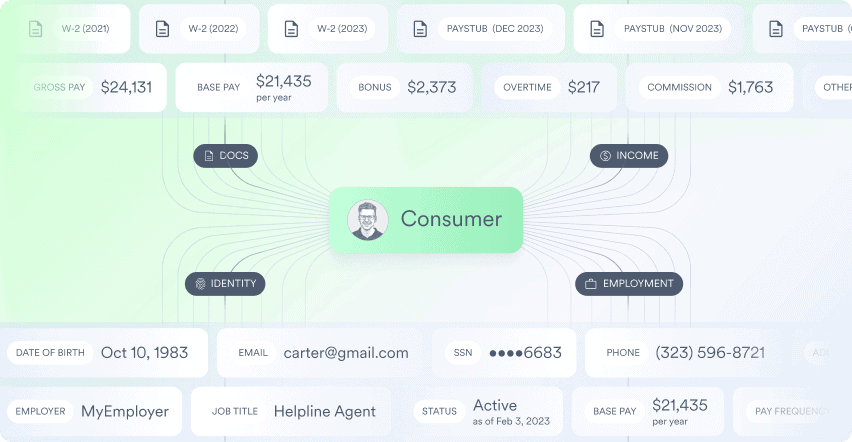

You collect excessive volumes of consumer financial data by hand, and a large percentage of your originations can’t be verified by traditional methods.

Trusted by

problem

The challenges you’re facing

The manual nature of the origination process drives operational costs. Meanwhile, the cost of legacy verification solutions like The Work Number is always rising.

Fraudsters (and the tools they use) are getting more sophisticated, making bogus paystubs and misrepresented income difficult to spot.

Manual processes make compliance controls difficult to enforce with complete consistency, putting your organization at risk of noncompliance.

BENEFIT

The Argyle solution

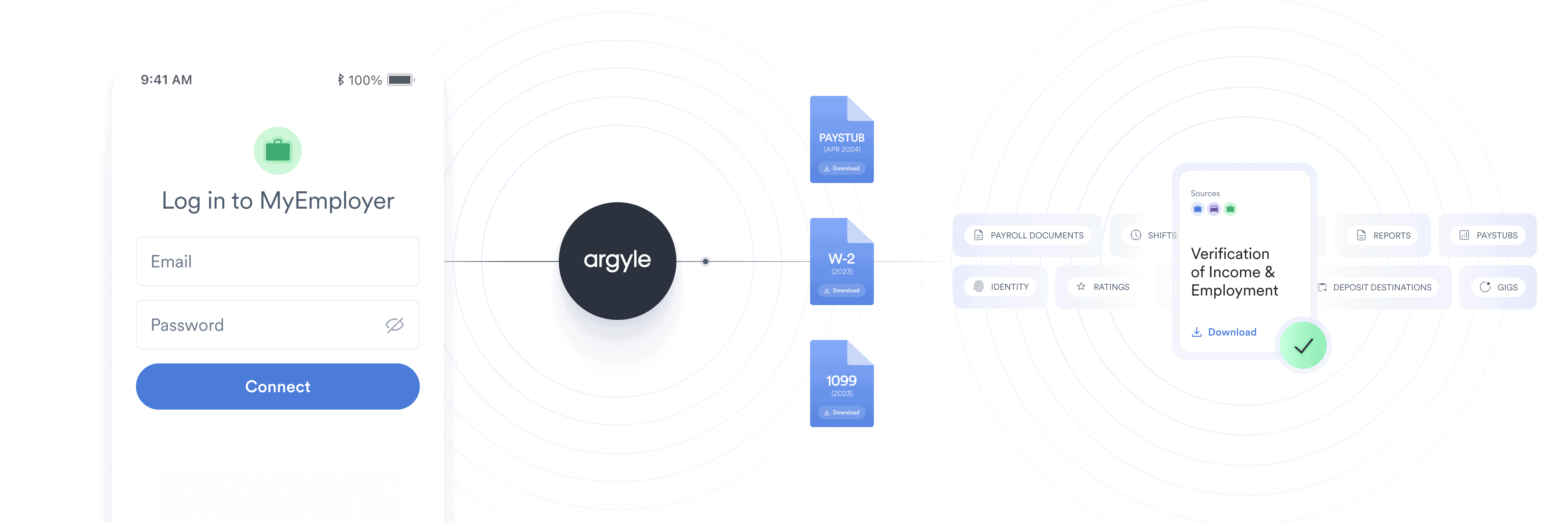

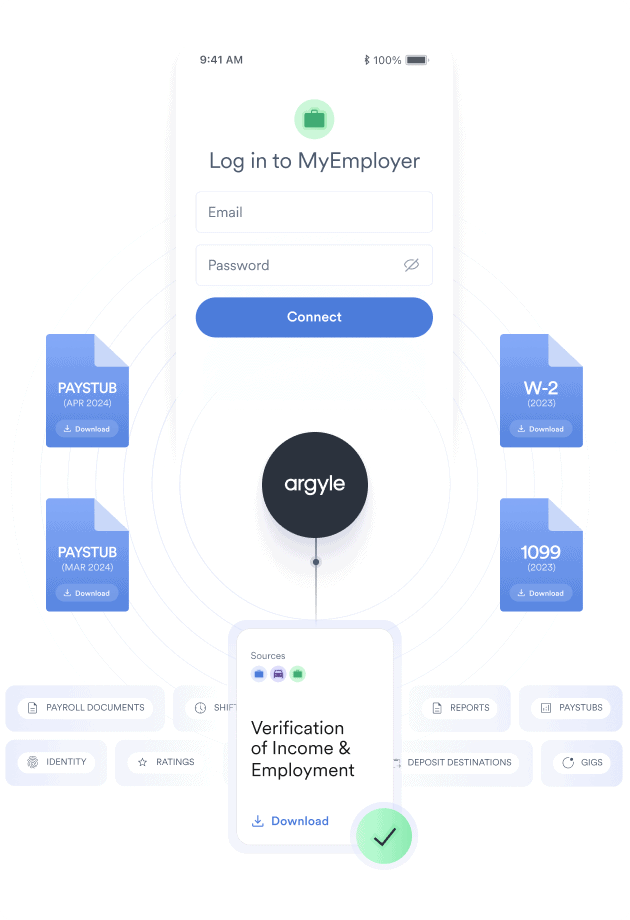

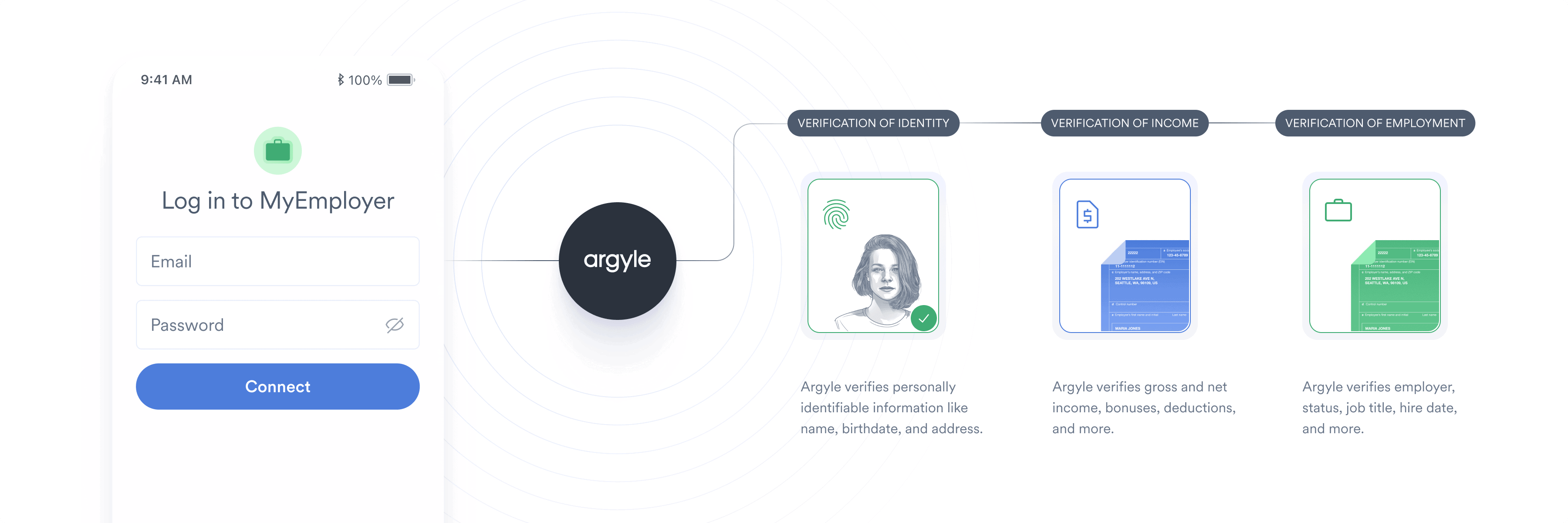

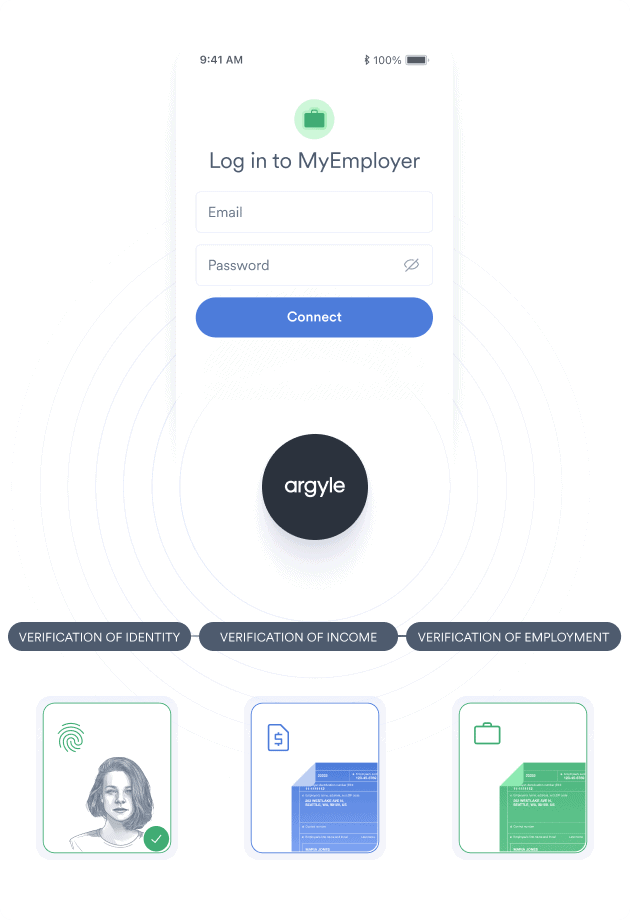

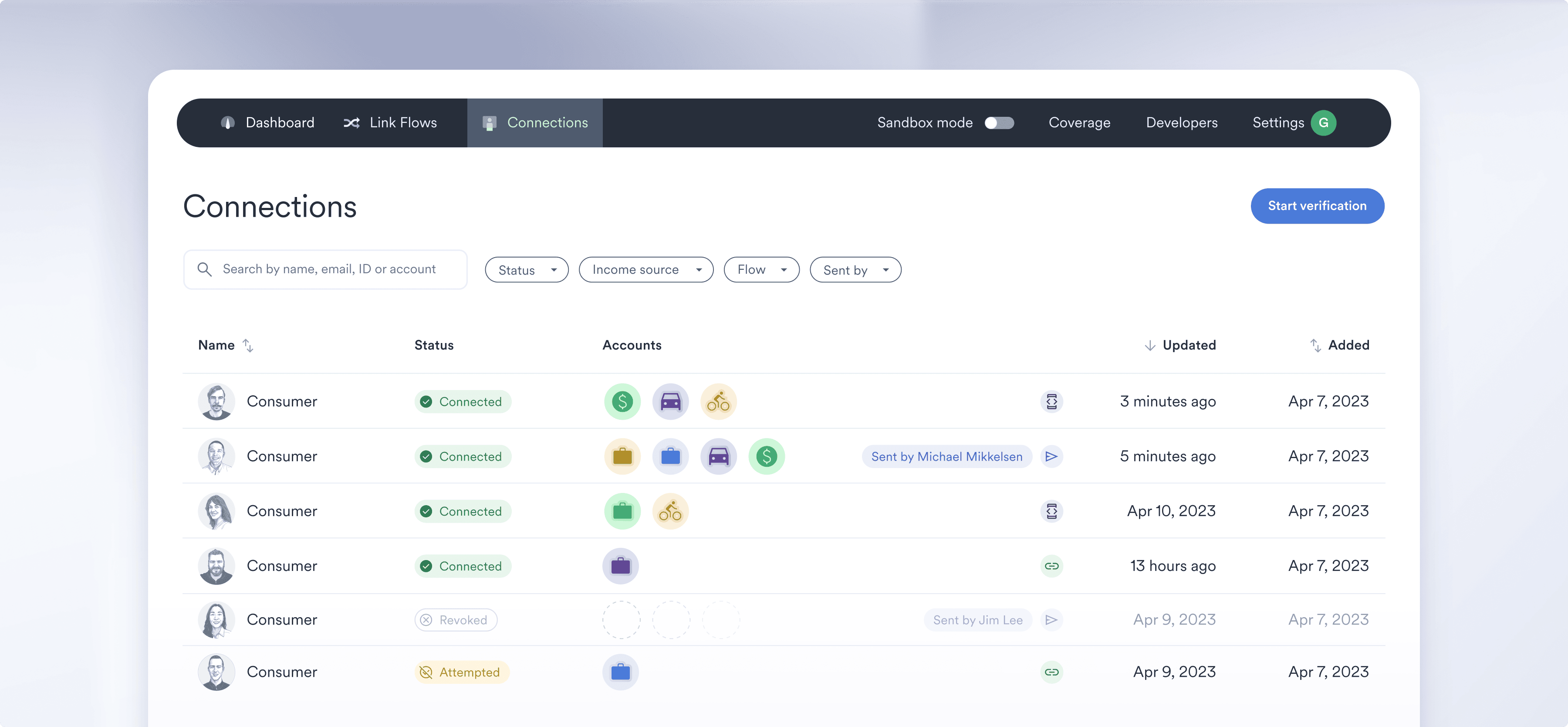

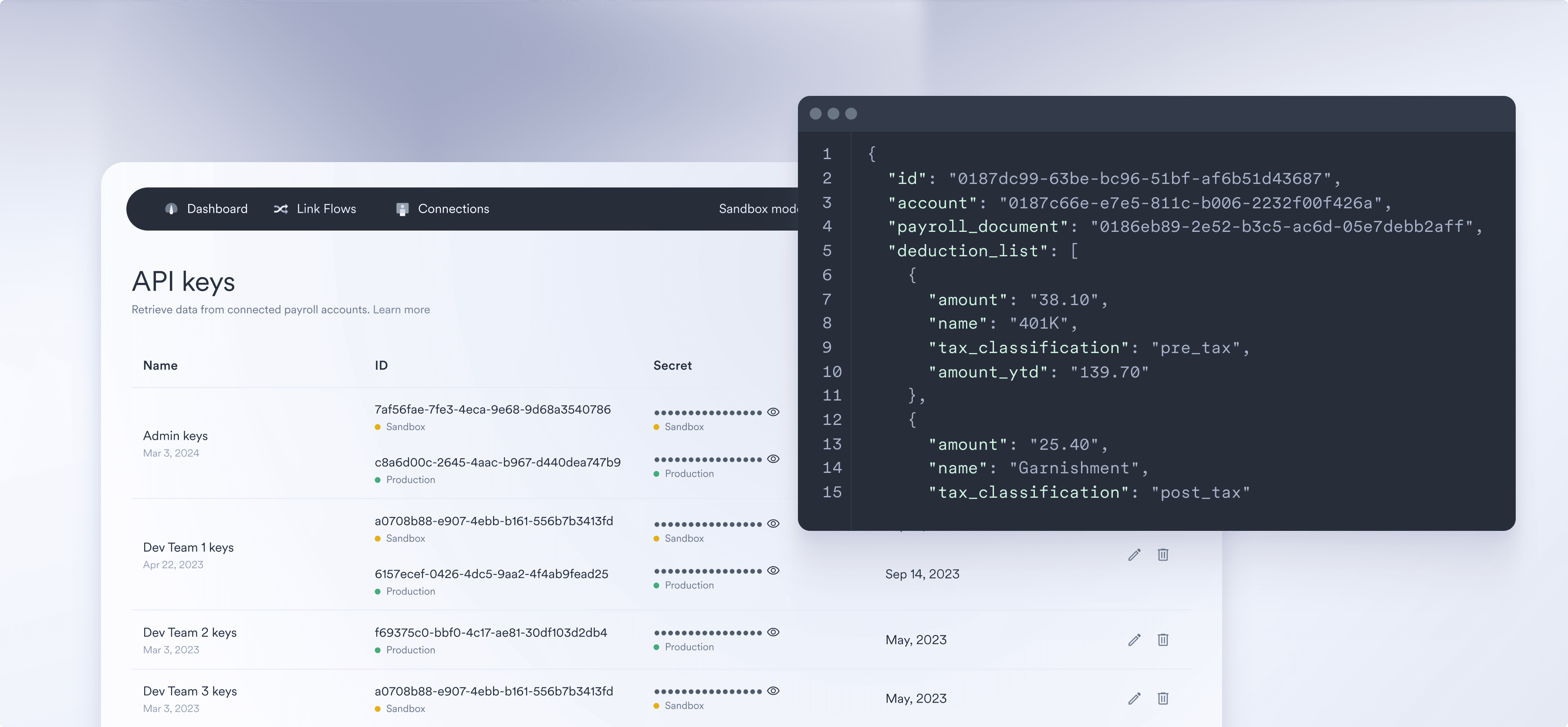

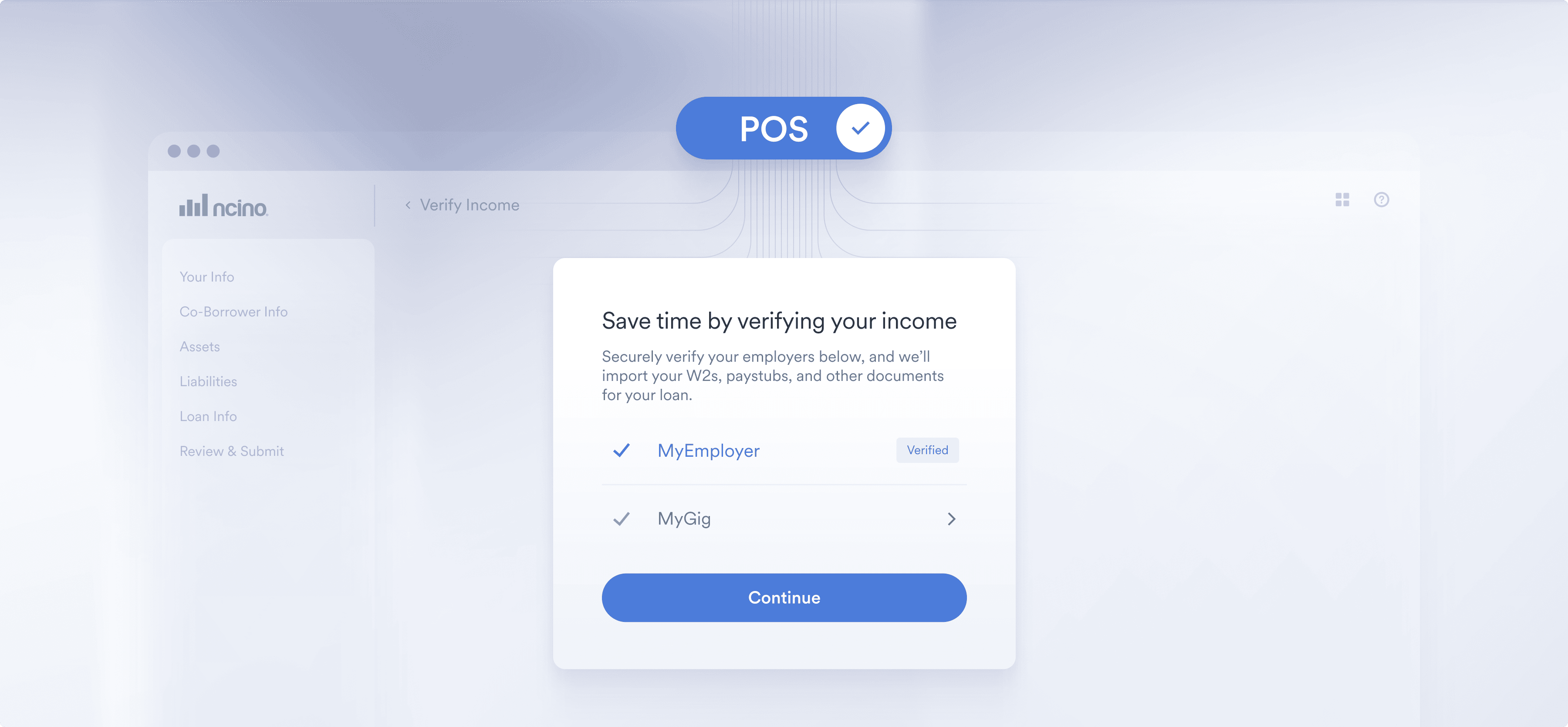

Argyle replaces manual reviews with direct-source access to real-time income and employment data, for instant verifications, faster credit decisions, and better visibility into creditworthiness.

Automating VOIE amounts to big savings.

Argyle improves borrower pull-through.

Better data + fewer interventions = tighter controls and smarter decisions.

Automations get you to decisioning faster.

It’s easy for borrowers to provide supplementary or fallback files.

With Argyle, consumer lending is fundamentally more efficient—and less risky

When borrowers connect your platform directly to their payroll accounts via Argyle, it unlocks incredible solutions like Income and Employment Verifications and a host of benefits for you.

KEY FEATURES

Why lenders love Argyle

Lower verification costs

Turnaround time

Data on demand

Argyle’s value will be felt

across your organization

Borrowers

Value our speed and simplicity. Argyle gets them to funding faster.

Loan officers

Value our accuracy. A clear view of income helps maximize loan size.

Executives

Value the cost savings. Argyle is less expensive than manual and TWN.

Internal auditors

Value the risk reduction. Real-time, direct-source data and documents thwart fraud.

Marketers

Value the effect on spend. A higher app-to-funded ratio creates marketing efficiencies.

IMPLEMENTATION IS EASY

Get to market quickly

Invite borrowers to connect via custom landing pages.

Invite borrowers to connect via custom landing pages.

why Argyle

Find out why lenders trust Argyle to power their credit decisions

Broader coverage

Higher conversion rate

Better quality

Ready to see what Argyle can do for you?

Get in touch to learn more about our verification solutions for the mortgage, personal lending, and background check industries, and more.

Contact sales